A couple of weeks ago I wrote about how US consumers preferred credit card usage over debit card usage for the first time in recent history (and perhaps all of history). Not only that, but the rate of acceleration of credit card usage is far outpacing debit cards as well. The reason for this has to do with the better state of the economy combined with banks providing more and more rewards for consumers. Now, I’ve just come across even more data on credit card usage that I thought was interesting and shed more light on the state of credit cards in the US.

One of the reasons why we’ve seen an increase in credit card usage is that issuers are ramping up their incentives. This was well apparent with the release of the Chase Sapphire Reserve and, the US Bank Altitude Reserve, and the revamping of the The Platinum Card® from American Express. But I didn’t realize how much more spending these big issuers are doing to attract consumers to their credit cards.

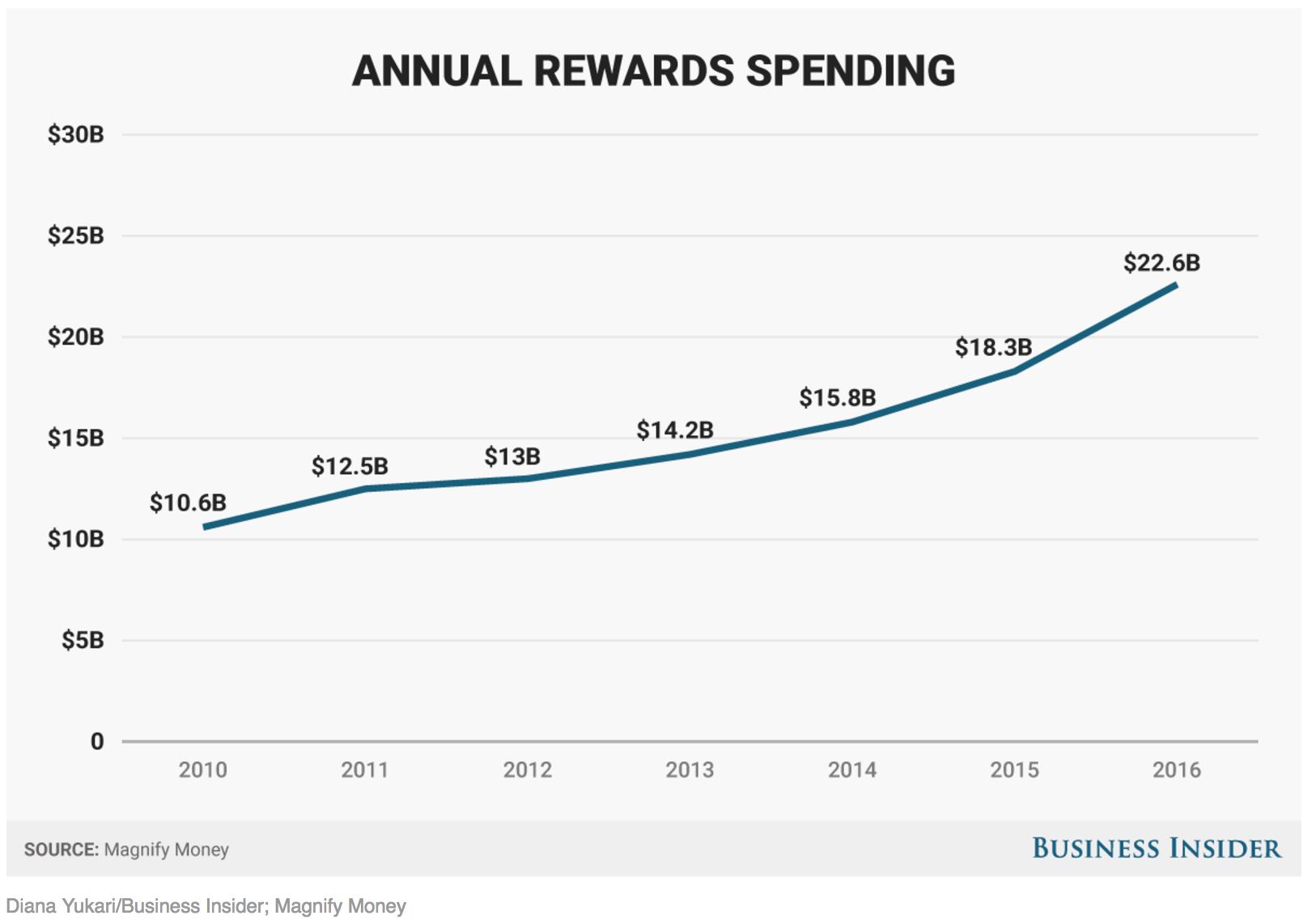

Magnify Money, via Business Insider, is reporting an increase over 100% in annual rewards spending since 2010 among the six largest issuers, as seen in the graph below. These issuers include JPMorgan Chase, American Express, Capital One, Citigroup, Bank of America, and Discover. These costs include things like sign-up bonuses, cash back, and other rewards and travel perks.

That’s an enormous uptick in credit card rewards spending. The uptick coincided with an amendment, known as the Durbin Amendment, to the Dodd-Rank bill which lowered the interchange fee on debit card transactions and ended up costing the banks an estimated $14 billion a year. This loss led to an average increase of 3%-5% in fees to bank accounts connected to debit cards for things like monthly maintenance fees, inactivity fees, and overdraft fees. And it also could have provided an impetus for issuers to start incentivizing more credit card usage.

This focus of issuers to provide more lucrative credit card rewards is obviously fantastic for miles and points folks. The more competition, the more options we have and the more competitive these cards get. For example, we saw the Platinum Card from American Express launch a host of new perks and benefits right after the Chase Sapphire Reserve was launched, even though Amex staunchly denies this was in response to the Reserve (right….). We’re also hearing rumors about new benefits coming to the Citi Prestige, which I suspect is in response to heightened competition.

This all should make us very optimistic about rewards in the near future, since we are in my opinion in a bit of a golden age for lucrative credit cards (notwithstanding more credit card restrictions). But one thing that’s a bit scary is that US credit card debt is on the rise and the highest it’s been since the Great Recession. And more specifically, more defaults have spiked despite the fact that unemployment has been relatively low. The Federal Reserve projected in its annual stress tests of banks last week that losses could hit $100 billion if the US entered a severe recession.

These are indicators that there’s a bubble on its way to busting. Approvals might be harder to get pretty soon, so if your credit score is on the cusp, things might be tougher for you to get approved in the future. Interestingly, credit card rewards are historically known to get better during tougher economic times, so it will be interesting to see how things will play out.

I think it’s still too early to really tell how much longer this credit card rewards competition is going to be on the rise but for now I think it’s just important that we all focus on responsibly using our credit cards and just enjoy the shower of benefits that we’re experiencing, because it may not last for a long time.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.