United just released its new MileagePlus® GO Visa® Prepaid Card but it doesn’t look like it’s going to be a clear winner. There might be some potential for some people to come out on top with it but for the most part, it doesn’t look like anything special.

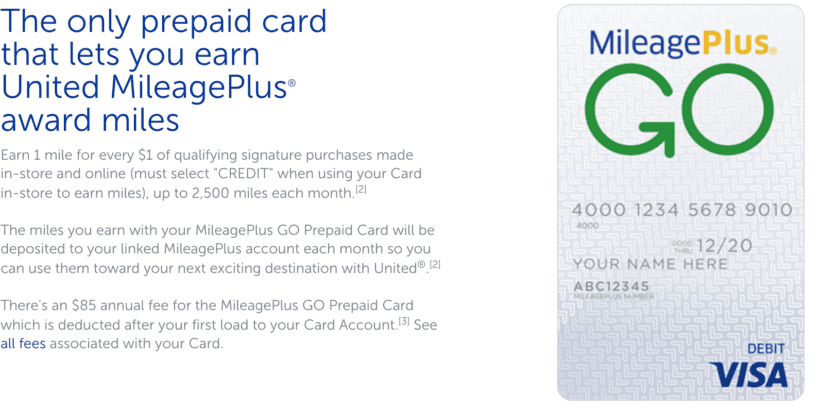

The offer

- No credit check

- No sign-up bonus

- Earns 1X United miles per dollar spent but with a monthly cap of 2,500 miles

- $85 annual fee

- Loading fees vary

- 3.5% foreign transaction fees

- Lots of potential fees

No credit check

- As is customary with prepaid debit cards, there is no credit check to open up the card.

This is good because it means easy or virtually automatic approval for most but it also means that this card will not help you improve your credit by building up your credit history.

Sign-up bonus

- There is no sign-up bonus for this pre-paid card (which is not surprising)

Since this is a prepaid card, this isn’t a major strike.

Bonus earning

- Earns 1X United miles per dollar spent but with a monthly cap of 2,500 miles

There are two major drawbacks to the bonus earning potential of this card.

The first is that there is a monthly cap of 2,500 miles earned so this isn’t going to benefit heavy spenders who spend over $2,500 a month, which isn’t surprising since this card is definitely not targeted to those individuals.

The other drawback is that only purchases processed as a credit transaction (asking for a signature) will earn miles. This means that if you have to enter in your pin-number you will not earn miles on the purchase.

Both of these factors could potentially limit the use of this card greatly but we’ll have to see how it actually plays out in the real world. This card could come in handy for certain purchases, such as paying taxes or possibly even rent, where transactions fees are greatly diminished or nonexistent for debit cards. For those, it’s possible that you could end up saving enough by using the prepaid card that it would make sense to use it over a credit card. But again, that hinges on the transaction actually earning miles and what the fees would be. I think it’s something worth keeping your eye on, at the very least.

$85 Annual fee

The initial fee is assessed on the date of the first funding of the card, regardless of funding amount and the fee deducted after first load. The annual fee will then hit each year on the anniversary of the first funding of the card.

This annual fee is a bummer but as mentioned, the math could still work in your favor depending on that transactions earn miles.

Loading fees

There is no fee for direct deposits but there’s still a lot of unknown about other fees. For example, for fees related to cash value loads it states:

Fee may be assessed by reload location and may vary from location to location.

For fees related to bank account transfers it states:

Depending on the transfer service you select, a fee may be assessed to your Card Account or to the transferor. The fee may be determined by a variety of factors set by the service provider, such as speed, amount, or destination. Some of the fees are assessed by third-parties or the originating bank.

For mobile check load fees it states:

Fees are determined and may be assessed by the mobile check load service provider and are not assessed by us.

Thus, I think fees will apply for the majority of these loading techniques and assuming there’s a way to load these cards with gift cards, I think there will definitely be a fee imposed on that. This means that using these cards to liquidate funds may end up being a fairly costly option that won’t be worth it, considering the annual fee.

Foreign transaction fees

- 3.5% of the U.S. Dollar amount of the purchase transaction

Again, it’s no surprise to see a foreign transaction fee imposed on a prepaid card.

No late fees or interest payments

Since your funds are pre-paid and thus there is no possibility for running up a balance, there is no late fees or interest payments.

Is this a good deal?

For the majority of people who already have a United or Chase Ultimate Rewards earning credit card, I don’t think it will make a lot of sense to use this card. The major possibility I see is using this card for up to $2,500 in purchases a month that would otherwise incur a substantial transaction fee, such as paying rent, loans, or maybe taxes.

It’s possible that the math could work in your favor so that it would make sense to pay the $85 annual fee and earn miles with this card, but I’d need to see how everything plays out before arriving at that conclusion.

Who is this card for?

Prepaid debit cards are generally for people who don’t have bank accounts, usually because they can’t get approved for them or for some other reason they just don’t have one. Thus, it’s no surprise that the earnings are capped at a pretty low amount each month, since these people aren’t typically big spenders.

This card will offer people who can’t get approved for rewards credit cards an opportunity to earn rewards so this card is in many ways a step above some of the other prepaid cards. But getting this card will not improve your credit like getting a secured credit card or retail credit card would, so it’s not exactly a solution to helping to fix your credit.

So while I find the card interesting, I don’t think it’s much of a winner for a lot of people but we’ll see what the data points will show in the future.

H/T: Points Fitness

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.