Barclaycard is now offering a new 60,000 miles sign-up bonus for the AAdvantage® Aviator™ Red World Elite Mastercard® (up from the previous 50,000 offer). This is one of the best sign-up bonuses available due to how easy it is to obtain because all you have to do is make a single purchase on your credit card. Here’s a review of the Aviator Red Card and closer look a the offer.

Update: Some offers are no longer available — click here for the latest deals!

The offer

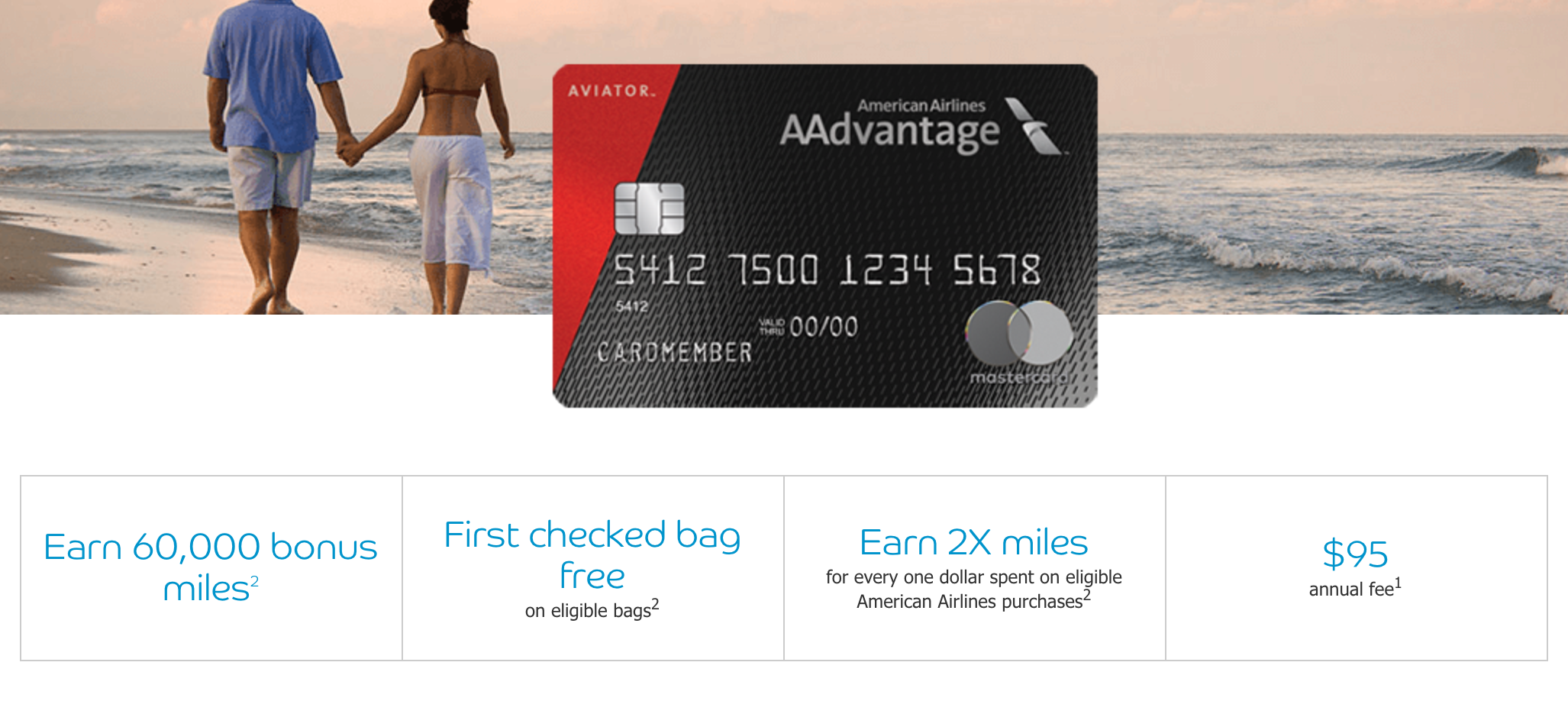

- Earn 60,000 AAdvantage miles after your first purchase.

- Annual fee $95 (not waived)

- First checked bag free for the primary cardmember and up to 4 companions on eligible bags when traveling on domestic itineraries operated by American Airlines.

- Group 1 boarding for the primary cardmember on domestic flights operated by American

- 25% inflight savings on food, beverages, and headsets on American Airlines-operated flights

- 10% of your redeemed miles back on redemptions (up to 10,000 miles per calendar year)

- No foreign transaction fees

- Expires November 30, 2017

Sign-up bonus

The standard offer for this card is 40,000 though the most recent offer has been for 50,000 miles. Not many cards offer a sign-up bonus for simply making a purchase and for those that do, it’s rarer to find such a lucrative sign-up bonus at 60,000 miles. For that reason alone, I think this card is a no-brainer for many.

Things can get really lucrative when you combine the earnings from this sign-up bonus with other cards.

With the Citi® / AAdvantage® Platinum Select® World Elite MasterCard® offering 50,000 miles for its sign up bonus, you have the potential to rack up 110,000 AAdvantage miles for only about $3,000 worth of spend. That’s only 5,000 miles short of having enough miles for a roundtrip business class trip to Europe or a one way on the Etihad First Class Apartment to or from the Middle East.

Bonus category earning potential

- 2X for every one dollar you spend on eligible American Airlines purchases

- 1X on all other purchases

Bonus earning is pretty standard for a co-branded card — nothing special here.

Additional perks

- First checked bag free for the primary cardmember and up to 4 companions on eligible bags when traveling on domestic itineraries operated by American Airlines.

- Group 1 boarding for the primary cardmember on domestic flights operated by American

- 25% inflight savings on food, beverages, and headsets on American Airlines-operated flights

- 10% of your redeemed miles back on redemptions (up to 10,000 miles per calendar year)

- No foreign transaction fees

These perks are very similar to the Citi Platinum Select and are nice additions if you fly American domestically. For the casual traveler who only takes a couple of international trips a year, these perks don’t do you too much good since they are limited to domestic flights.

Tip: Many Barclaycards come equipped with true “chip and pin” technology making them very useful to have when traveling to places like Europe.

Annual fee

- $95

This annual fee is not waived unlike the Citi Platinum Select which waives its $95 annual fee the first year. So you’re essentially paying $95 for 50,000 AAdvantage miles, which is a deal that I would take any day.

Hard pull

- Barclaycard sometimes only pulls from Transunion (although not always) so this is a great way to give your Experian and/or Equifax credit report (just remember YMMV).

Barclaycard can combine inquiries but your second application may go to pending and you will probably have to recon on that app, so if you don’t want to deal with a reconsideration call then maybe consider waiting a few days to a week to apply for a second card and missing out on the combined hard pull. Otherwise, give it a shot.

Final word

At 60,000 miles for making a single purchase this is one of the best credit card offers available. If you’re under 5/24 you might want to still hold off from applying for this credit card since it’s not hard to accumulate AAdvantage miles with the different credit card options. I’m still waiting for the business version of this card to come out which would open the door for even more earnings.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.