A few weeks ago I wrote about the new Uber credit card issued by Barclaycard that was expected to hit the market this fall. Well, now the card has been officially revealed and it’s actually one of the best cash back credit cards we’ve seen to day. Here’s the full Uber credit card review.

Update: Some offers are no longer available — click here for the latest deals!

Uber credit card review

- Earn $100 after spending $500 on purchases in the first 90 days

- 4% back on restaurants, takeout and bars, including UberEATS

- 3% back on airfare, hotels and vacation home rentals

- 2% back on online purchases including Uber, online shopping, and video and music streaming services

- 1% back on all other purchases

- Up to $50 credit for online subscription services after spending $5,000 on the card per year

- Receive invites to exclusive events and offers in select U.S. cities.

- Up to $600 mobile phone insurance for damage and theft when the card is used to pay the monthly mobile phone bill

- Redeem points for Uber credits, gift cards, or cash back with a simple tap

- $0 fraud liability protection

- Free FICO Score

- No foreign transaction fee

- No annual fee

Uber credit card sign-up bonus

- Earn $100 after spending $500 on purchases in the first 90 days

The $100 comes in the form of 10,000 bonus points which represent $100 in Uber credits (minimum redemptions will be $5 or 500 points).

I don’t like that Uber credits can only be used in the US but it’s great that you can also use your points earned for other redemptions, such as gift cards, statement credits, or bank deposits in $25 increments and at a 1 cent per point rate. The fact that this card is not limited to Uber credits is a huge win in my book.

$100 is not a super-valuable sign-up bonus but for a no annual fee credit card that’s packed with bonus earning potential it’s not that bad.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

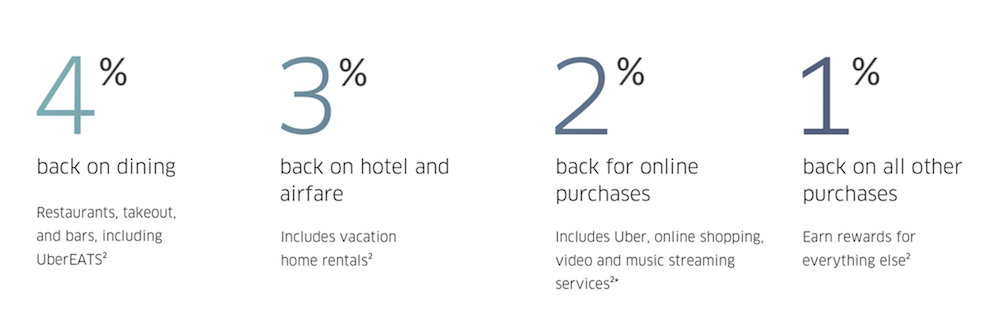

Uber credit card bonus categories

- 4% back on restaurants, takeout and bars, including UberEATS

- 3% back on airfare, hotels and vacation home rentals

- 2% back on online purchases including Uber, online shopping, and video and music streaming services

- 1% back on all other purchases

This card is a powerhouse for bonus earning potential. You just don’t often see a true no annual fee card (open to the public) without foreign transaction fees that offers such good bonus earning potential.

4% back on dining

4% back on dining is fantastic and even beats out the 3% on the no annual fee Capital One® SavorOne® Cash Rewards Credit Card that was just released. You’ll get 4% back on an array of dining purchases including fast food joints and bars.

This will absolutely be one of the best credit cards for dining so if earning points for dining expenses is a priority then this card might be made just for you. I also love that it’s a Visa card with no foreign transaction fees, so it’s great for travel dining.

3% back on some travel

The 3% back on airfare, hotels, and vacation rental homes is fantastic as well. (Vacation rental homes include things like Airbnb if you’re wondering.)

2% back on Uber and online purchases

The 2% back on Uber purchases is a bit odd since this is an Uber co-branded credit card and you’d think Uber would earn the most points back.

However, earning 2% back for online purchases is huge because so much of what we purchase now-a-days is found online (even when we pick it up in the store). Some merchants included here include: Amazon, Wal-Mart, and Best Buy among what I’m sure is a long list of many others.

There is some fine print to be aware of for the online purchases category, however.

First, the good news is that Online Purchases that are also Restaurant Purchases will earn 4% Back/4 Points and Online Purchases that are also Travel Purchases will earn 3% Back/3 Points.

Uber card online merchants excluded

However, there are many merchants that are excluded from the online category. These include:

- Utilities (such as cable, satellite, telecommunications, gas, water, and electric)

- Contracted Services (such as landscaping, general contractors, plumbing, heating/air conditioning, roofing, siding, carpentry, electrical, masonry, and concrete, and certain special trade contractors)

- Government Services (such as court costs, alimony, child support, fines, bail and bond payments, and tax payments)

- Professional Services (such as doctors, therapists, dentists, opticians, nursing care facilities, hospitals, attorneys, child care services, accounting, and architectural services).

2% back on streaming services

Then, there’s also the 2% back on streaming services.

These include the following:

- Video and music streaming services (including Netflix, Pandora, HBO Now, and Apple Music)

- Certain online services (including Instacart, Shyp, Angie’s List, Handy, Thumbtack, FlyCleaners and TaskRabbit)

- Digital purchases of mobile applications and media on platforms (including iTunes and Google Play).

But keep in mind that any Online Purchases using third party payment methods including PayPal, Venmo, Apple Pay, Samsung Pay and Android Pay are excluded.

$50 Digital subscription benefit

After spending $5,000 in an anniversary year, you may earn up to a $50 credit for Net Purchases from the following eligible digital music, video and shopping subscription services:

- Apple Music

- Pandora

- Spotify

- Amazon Music

- Google Music

- Audible

- Sirius XM

- Netflix

- Hulu

- HBO NOW

- DirecTV NOW

- Amazon Prime

- Shoprunner

When you meet the $5,000 spend threshold, statement credits will be automatically applied for up to $50 worth of Net Purchases of Eligible Digital Subscription Services that have posted during that Cardmembership Year.

So each 12 months any eligible purchases within that timeframe will be credited up to $50, whether they occur before or after you hit the $5,000 spend. Barclaycard will also provide a tracker so you can keep tabs on how close you are to meeting the threshold.

This is a nice little perk that isn’t to difficult to meet, requiring only $5,000 worth of spend. If you put $5,000 worth of restaurant spend on your card, that would be a nice way to be rewarded on top of the 4% you’d be getting back.

$600 Mobile phone insurance

When you charge your total monthly wireless telephone bill to your Uber Visa Card, the phone lines listed on your wireless account are automatically covered beginning the calendar month after your wireless telephone bill was charged to your Uber Visa Card.

You’ll be covered for stolen and damaged cell phones as well as involuntary and accidental parting of your cell phone.

Once all other available insurance has been utilized, the insurance will provide coverage up to $600 per claim after the $25.00 deductible, with a maximum of two (2) claims and $1,200.00 per twelve (12) month period. (This is very similar to the Wells Fargo Propel cell phone insurance).

This is a terrific benefit that could end up saving you hundreds if something happened to your phone. I think that protections like these are very underrated and now there are a few credit cards starting to offer this. Since there’s no annual fee, this essentially like free cell-phone insurance.

Exclusive access to events

It’s not clear what type of events these will be but they will be focused in major cities like Chicago, NYC, Los Angeles, San Francisco, and DC.

Points don’t expire

As long as the Program continues and the Account is open, active and in Good Standing, there is no limit to the total Points you can earn and your Points will not expire

Final word

It’s a bit odd to me that this is an Uber card. I think that’s because this seems really more like a very strong cash back card that just happens to have some Uber branding on it. The “millennial” focus is obvious with the dining and Uber perks, but without a doubt this is one of the top no annual fee credit cards and one of the best new cash back credit cards that we’ve seen. Uber controversies aside, this card definitely exceeded my expectations. Well done, Barclaycard.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.