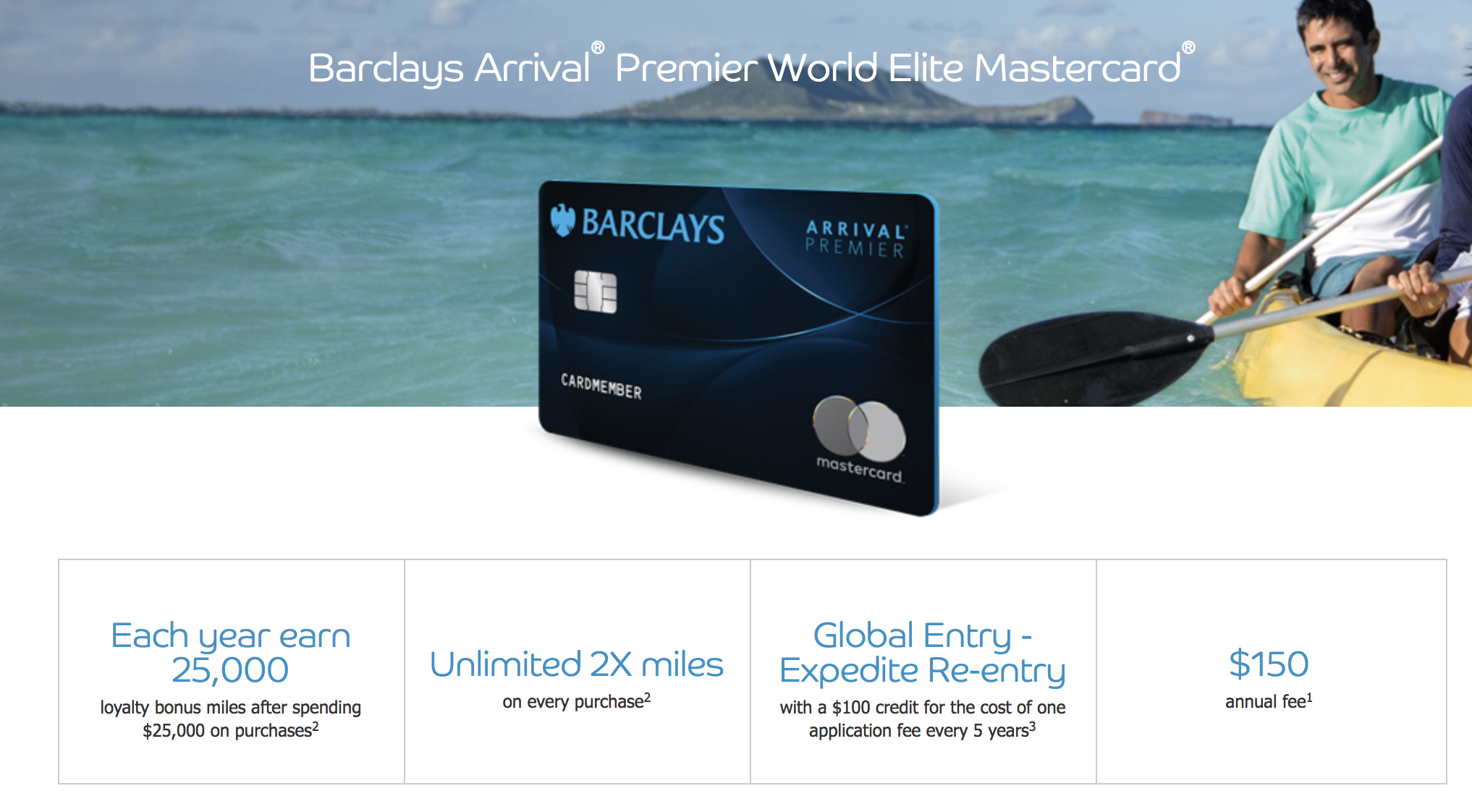

The Barclays Arrival Premier debuted today and we finally got to see all of the card’s details, which also include transfer partners. So far the general response to the card has been overwhelmingly negative, so I’m going to take a look at the card and see if that’s justified. Here’s my full Barclays Arrival Premier review.

Update: Some offers are no longer available — click here for the latest deals!

The Barclays Arrival Premier review

- Sign-up bonus: None

- 2X miles on every purchase

- Spend $15,000 on purchases, get 15,000 miles.

- Spend an additional $10,000 on purchases, get an additional 10,000 miles, for a total of 25,000 miles after $25,000 in purchases.

- $100 Global Entry credit

- Priority Pass (still must pay for each visit)

- No foreign transaction fees

- Ability to transfer to travel partners (more on that below)

- Annual fee: $150

No sign-up bonus

The lack of sign-up bonus is a huge turn off to any credit card, let alone a card with a high annual fee of $150. If you’re not going to utilize the Global Entry credit then this $150 fee is very hard to justify, especially because the Priority Pass benefit requires you to pay for each visit!

Bonus earning potential

The card will be like the Arrival Plus, which earned 2% back on all purchases when redeemed for a travel credit. But this version is improved if you spend $25,000 on the card because for that $25K worth of spend, you’ll be rewarded with an extra 25,000 miles. This amounts to 3% back towards travel on all purchases for $25,000 worth of spend.

That’s not bad.

However, that $150 annual fee cuts into those earnings.

3% of $25,000 is worth $750 but factoring in the annual fee, that’s only $600 worth of travel. If you spent $25,000 on the Amex Blue Business Plus, you’d earn 2X Membership Rewards on all purchases for a total of 50,000 Membership Rewards. If you value those at 1.5 cents per point, that’s still $750 worth of travel, which out earns the Arrival Premier by a lot.

Other cards from Chase, Citi, and Amex will often earn you more in travel because they offer 2X, 3X, or even 5X on bonus categories that would end up netting you more than $600 on $25,000 worth of spend. So don’t get too excited about the 3%.

The Barclays Arrival Premier transfer partners

The Barclays Arrival Premier having transfer partners was a very exciting development. Nobody quite knew what to expect but I think Barclays delivered an okay list of transfer partners (considering this is their first dive into the transfer partner game).

These partners include:

- Aeromexico

- Air France/KLM Flying Blue

- China Eastern

- Etihad

- EVA Air

- Japan Airlines

- Jet Airways

- Malaysia Airlines

- Qantas

Thoughts on the Barclays Arrival Premier transfer partners

This line-up of travel partners isn’t as good as Chase, Amex, or Citi. There’s no domestic carrier and many of the partners don’t have great award charts and/or require you to pay high fees. However, there’s definitely some potential for Flying Blue, Etihad, and Japan Airlines (JAL).

JAL catches my attention the most as it offers some of the best sweet spots out of any airline with its distance-based awards. They were one of the best ways to book Emirates first class until recently when they tacked on huge fees to those awards and made those less attractive.

Still, JAL is only a transfer partner to SPG so the fact that it’s a partner with Barclays is pretty exciting.

Barclays Arrival Premier transfer ratios

What’s not exciting is that all of the transfer partners except for JAL will transfer at a 1:4 to 1 ratio. JAL will transfer at a 1.7 to 1 ratio. This means for every 1.4 Barclays miles you have, you’ll receive only 1 mile for most travel partners.

So for most partners it’s like earning 1.43 miles per dollar spent on everyday spend. Not a horrible rate but it gets beat out by no annual fee cards like the Freedom Unlimited (1.5x) or Amex Blue Business Plus (2X on the first $50,000 spent).

And if you look at the Chase Sapphire Reserve (a card with an effective annual fee of $150), the earning potential is far better with the Reserve than the Barclays Arrival Premier if you think you utilize the 3X on dining and travel. And that’s not even to mention the other benefits that the Sapphire Reserve offers like unlimited lounge access.

The sweet spot: spending $25,000

If you spend $25,000 you’ll be earning at 2.14 miles per dollar spent for the majority of the travel partners and 1.76 miles per dollar spent for JAL.

These ratios for spending $25,000 are somewhat compelling.

Earning 2.14 miles per dollar is great. And while the earning ratio is lower for JAL at 1.76, it’s still better than what you would get for the same spend on the SPG card so that’s worth noting since JAL is only a transfer partner of SPG.

But once again, that high annual fee cuts into these earnings so always you have to factor that in.

For example, if you were going to spend $25,000 in one year, the Barclays Arrival Premier could earn you 52,500 miles to transfer to Flying Blue while the Amex Blue Business Plus would only net you 50,000 miles. However, you’d be paying $150 extra for only earning 2,500 more miles for that spend. That’s clearly not worth it.

In other situations it will be less clear. If you spent $25,000 on the SPG card you’d earn 30,000 miles (with the automatic 20% SPG transfer bonus factored in) and those could go out to a number of programs like JAL. If you spent $25,000, on the Premier you’d net 42,613 JAL miles.

The SPG card comes with a $95 annual fee so it’d be like paying $55 for the extra 12,600 miles after the first year. That’s a deal a lot of people would be willing to take if they’re trying to build up a JAL balance. So there are some instances where the Arrival Premier can serve a purpose.

However, overall that purpose is for those want a simple way use rewards and aren’t looking to transfer points.

Final word on the Barclays Arrival Premier

While these earning rates for the Arrival Premier appear attractive, make sure you think about how much that high $150 annual fee is going to cut into your earnings. In some situations where you’re after JAL miles, I think this card could definitely make sense. However, the high annual fee and lack of sign-up bonus, make it a tough sell when there’s so many other cards out there that also come with better transfer partners.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

One comment