The new World of Hyatt Credit Card and the new Marriott Rewards Premier Plus are two of the most popular hotel credit cards on the market. They both offer some solid perks and unique benefits but there are several key differences between these cards. Here’s my full review of the Hyatt credit card vs Marriott credit card.

Update: Some offers are no longer available — click here for the latest deals!

1. 5/24 Rule

The World of Hyatt credit card is not subject to the Chase 5/24 rule but the Marriott Rewards Premier Plus is subject to 5/24.

What does this mean?

It means that if you’ve opened up five or more accounts in the last 24 months you’re not eligible for the Marriott Rewards Premier Plus but you are still eligible for the World of Hyatt credit card.

However, we recently learned that Chase is planning on implementing the 5/24 rule for all of its cards including the World of Hyatt credit card. So if you’ve been busy opening up new credit cards, then you might want to jump on the World of Hyatt credit card pretty quickly before the new rule goes into effect.

You can read more about 5/24 here and read on more about other Chase application rules here.

2. Sign-up bonus

The World of Hyatt Card

- Earn 40,000 points after you spend $3,000 on purchases within the first 3 months of account opening

- Plus, earn an additional 20,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months of account opening.

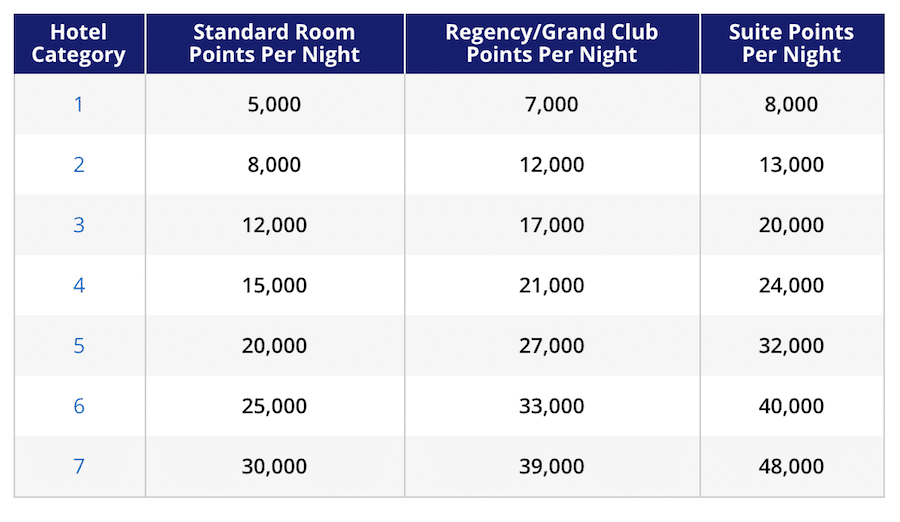

The Hyatt credit card used to offer 2 free night certificates that could be used at even the top Hyatt properties. This new 60,000 point sign-up bonus offers that same ability to cover two nights at a top-tier Hyatt property as shown by the Hyatt award chart below.

The big difference is that these points won’t expire after one year (though they do expire) and now you have the option to stretch those points very far by going with cheaper properties in the hotel category 1 through 4 range. For example, you could cover 12 nights at a hotel 1 category room.

At a valuation of 1.5 cents per point, 60,000 Hyatt points is worth $900. Many value Hyatt points closer to 2 cents per point, so there’s potential for even more value.

Although it does require more spending to hit the 60,000 bonus, that spend requirement is only $1,000 more than the Marriott offer.

Marriott Rewards Premier Plus Credit Card

- 75K after you spend $3,000 on purchases in the first 3 months from account opening.

Marriott is getting ready to officially introduce its new award chart but you can already price out what to expect with the new award prices. Keep in mind that Marriott will also introduce off-peak and peak pricing.

Marriott properties will require more points than Hyatt (the highest category during peak time will require 100,000 points per night!). However, Marriott points are easier to accumulate and Marriott has a much wider network of properties, especially since they have now merged with SPG.

So it’s much easier to find Marriott/SPG properties.

With the new award chart, you should expect to pay around 50,000 points per night for a resort like the Aruba Marriott Resort & Stellaris Casino pictured below.

Take-a-way

If I had to choose one sign-up bonus over the other, I’m going with the 60,000 offer from the Hyatt credit card.

It’s nice to know that you can cover the most expensive properties for two nights with 60,000 points and I just feel there’s more value to be had with the Hyatt card.

3. Bonus earnings

The World of Hyatt Card

- 4X spent with your card at Hyatt hotels, including participating restaurants and spas

- 2X on local transit and commuting, including taxis, mass transit, tolls and ride-share services

- 2X at restaurants, cafes and coffee shops

- 2X on airline tickets purchased directly from the airline

- 2X spent on fitness club and gym memberships

The big change to the new Hyatt card’s bonus earning was the ability to earn 4X at Hyatt stays. That allows you to rack up points much quicker and is a huge positive for Hyatt loyalists. At a valuation of 1.5 cents per point, that’s 6% back on all Hyatt purchases.

This change was also significant because it means that you’ll now earn more Hyatt points with this card than you would by putting your Hyatt purchases on the Chase Sapphire Reserve, which would earn 3X on travel purchases.

Getting 2X on the additional dining and travel categories is nice but if you have the Sapphire Preferred you might just want to use that and you’d definitely use the Chase Sapphire Reserve over this card for those purchases since it earns 3X on those categories.

They also added a bonus category to gym memberships which is not very common to find.

Marriott Rewards Premier Plus Credit Card

- 6X Marriott Rewards and SPG hotels

- 2X on all other purchases

The Marriott credit card earns 6X and with a .8 cent valuation that’s 4.8% back, which is not as good as the Hyatt card.

But the Marriott card earns 2X on all non-bonuses spend. This isn’t as good as the SPG card that essentially earned 3X Marriott points on all purchases but it’s better than the 1X offered by the Hyatt card.

Take-a-way

So the Marriott Rewards Premier Plus isn’t as good as the SPG card for everyday spend but it’s still better than the Hyatt card. But when it comes to earning points for purchases at their respective properties, the Hyatt is going to give you more value per dollar spent.

4. Free nights

The World of Hyatt Card

- Receive one free night at any Category 1-4 Hyatt hotel or resort every year after your cardmember anniversary

- Earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year

The new Hyatt card offers the potential to earn two free nights.

The first free night is automatically given to you each year just by paying your annual fee and waiting for your cardmember birthday. It’s similar to the IHG card’s free night which is also limited by mid-tier hotel categories.

You can use your free night certificates on some pretty decent hotels like the Hyatt Regency Dallas. Overall, though, I’m not a huge fan of the category 1-4 free night since I often have difficulty finding an eligible Hyatt property.

To receive the second free night, you’ll have to spend $15,000 in one year. $15,000 worth of spend in one year isn’t that hard to do for many people and could definitely be worth it when you consider the benefits below.

Keep in mind that the Hilton Honors Ascend card will give you a free weekend night when you spend $15,000 and that can be used on any Hilton properties.

Marriott Rewards Premier Plus Credit Card

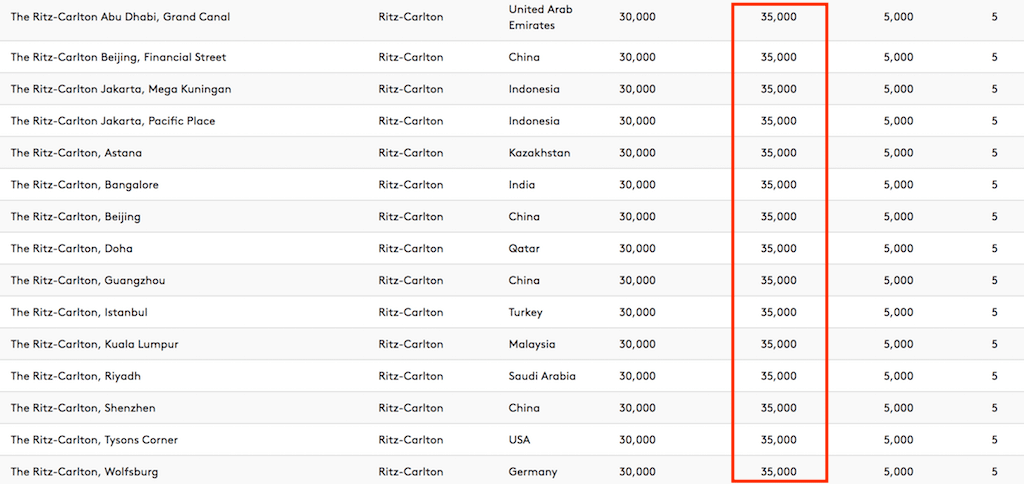

- Free Night Award every year after your account anniversary, valid for a one night hotel stay at a property with a redemption level up to 35,000 points

The free night with the new card is potentially very valuable. You’ll be able to use it at a property that would cost up to 35,000 points! You’ll be able to choose from over 6,000 properties, including some Ritz-Carlton and St. Regis properties.

That’s pretty impressive considering you’ll get this perk just for not closing your card.

5. Elite status

The World of Hyatt Card

The World of Hyatt Card comes with Hyatt Discoverist status.

That is the bottom tier status that doesn’t offer you a whole lot but it can get you a ten percent point bonus on the Base Points, upgrades, premium in-room internet access, late check-out, and discounts on purchases.

The real elite perks of this card come in two forms:

- Receive 5 qualifying night credits toward your next tier status every yea

- Earn 2 additional qualifying night credits toward your next tier status every time you spend $5,000 on your card

So with the Hyatt card you can more easily qualify for elite status with five qualifying night credits. Explorist requires 30 qualifying nights while Globalist requires 60 qualifying nights.

And what’s even sweeter is that you can continue to climb the elite status ladder with your spend. For every $5,000 you spend, you’ll get two elite credits which is fantastic for big-spenders. If you’re a high spender and Hyatt loyalist then the new Hyatt card is very tempting.

Marriott Rewards Premier Plus Credit Card

This card will get you Marriott Silver elite status. Silver status is going to be even more worthless after the new program changes and will only get you a 10% bonus on base points, late check out, and not much else.

If you spend $35,000 or more you will qualify for Gold Elite Status but considering the downgrade Marriott Gold status received, this is not an attractive perk to me. $35,000 is way too high of an opportunity cost for Marriott Gold so I don’t care too much for this perk.

In 2019, each calendar year you’ll receive a maximum of 15 Elite Night credits, which can help you reach Gold (25 nights), Platinum (50 nights), Platinum Premier (75 nights), or Platinum Premier 100K (100 nights).

Unlike, Hyatt, however, there’s no way to spend your way to the top.

The World of Hyatt Card strengths

- Great sign-up bonus

- Strong bonus spend for hotel stays

- Good way to earn elite credits

Marriott Rewards Premier Plus Credit Card strengths

- Bigger hotel network (easier to use points)

- Better annual free night

- Good bonus spend for everyday purchases

Final Word

Overall, if I had to choose one of these two cards, I’m probably going to go for the World of Hyatt.

I like the sign-up bonus a lot more and like the possibility of climbing elite status with spend. I do think that the Marriott Rewards Premier Plus is a great card, though. It’s got a great free night perk and it can be a great way to rack up Marriott points on everyday spend if you don’t have the SPG card.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.