The Hilton Honors American Express Ascend Card is the replacement to the Hilton Honors Surpass Credit Card. The Ascend is similar to the Surpass but offers a host of upgraded features that make this credit card a bit more exciting than it was before. But… the Ascend also comes with a higher annual fee of $95. So here’s my Amex Hilton Ascend Card review with a detailed look at all of the benefits it has to offer.

Update: Some offers are no longer available — click here for the latest deals!

- You can click HERE to learn more about this card and compare it others.

Amex Hilton Ascend Card features

- 75,000 Hilton Honors points when you spend $2,000 or more in purchases within the first 3 months

- An additional 25,000 Hilton Honors Bonus Points after you make an additional $1,000 in purchases within your first 6 months

- 12X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 6X Hilton Honors Bonus Points at U.S. supermarkets, U.S. restaurants, and U.S. gas stations

- 3X Hilton Honors Bonus Points on all other eligible purchases

- 10 free priority pass lounge passes

- One Weekend Night Reward at a hotel or resort in the Hilton portfolio after spending $15,000 in purchases in a calendar year

- Automatic Hilton Honors Gold status

- No foreign transaction fees

- $95 annual fee

Eligibility

Unfortunately, if you had the Surpass before you won’t be eligible for the sign-up bonus for the Ascend since this is not considered a “new product” by American Express. Amex generally only allows you to earn one sign-up bonus per lifetime (though sometimes just 7 years).

- If you don’t know how Amex application rules work, I highly suggest you click here to find out more on them.

Hilton Ascend sign-up bonus

- 75,000 Hilton Honors points when you spend $2,000 or more in purchases within the first 3 months

- An additional 25,000 Hilton Honors Bonus Points after you make an additional $1,000 in purchases within your first 6 months

The sign-up bonus is essentially a 100,000 points bonus for $3,000 spend with the caveat that you have 6 months to meet that last $1,000 worth of spend for the final 25,000 points.

Historically, a 100,000 point offer for the old Surpass was thought to be a very strong offer so this is a pretty solid sign-up bonus. Don’t be surprised to see it drop down to 75,000 points in a matter of months, though.

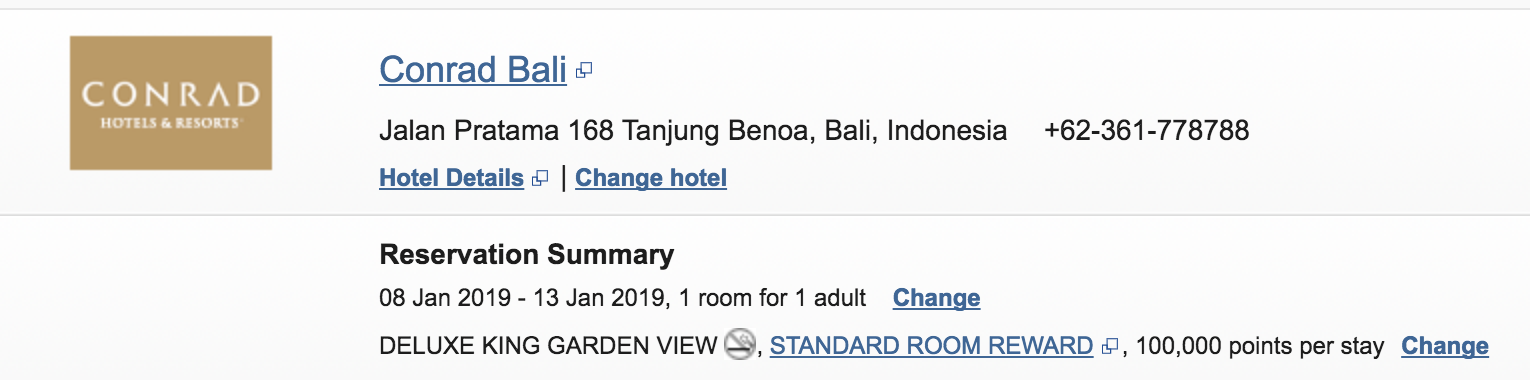

100,000 Honors points will cover one to two nights at a top/solid hotel in a major city most of the time but you can definitely stretch these points in some parts of the world. And by “stretch” I don’t mean staying in undesirable properties. For example, I found a Conrad in Bali that went for 20,000 per night. With the 5th night free benefit factored in, you could stay there for five nights for 100,000 points.

Bonus earning potential

- 12X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 6X Hilton Honors Bonus Points at U.S. supermarkets, U.S. restaurants, and U.S. gas stations

- 3X Hilton Honors Bonus Points on all other eligible purchases

The bonus earning on the Ascend is pretty solid.

If you value Hilton Honors points at .5 cents per point, then you’re getting a 6% return on Hilton purchases and 3% return at U.S. supermarkets, U.S. restaurants, and U.S. gas stations, which is actually very good. The only slight bummer is that the categories are restricted to US establishments.

Hilton is known for running promotions that allow you to earn a lot of points. If you jump on some of those offers with the Hilton Ascend, you might find yourself earning close to 20% back at times, which is excellent.

Hilton Gold Status

Hilton Gold status is one of my favorite mid-tier statuses.

That’s because it gives you everything you need and then some. You get free internet, breakfasts, late check-out, eligibility for upgrades and sometimes even find yourself with executive lounge access. (Read more about Hilton Gold status here.)

While Hilton Diamond status offers better upgrades and lounge access, for most people, Hilton Gold is more than sufficient.

Hilton Gold status will also allow you to earn a 25% bonus on all the Honors Base Points. Compared to other major hotel loyalty programs, this 25% bonus for mid-tier status amounts to a 7% to 9% return based on how you value Hilton points.

Upgrade to Hilton Diamond status

You can upgrade to Hilton Honors Diamond status if the total eligible purchases on your card during a calendar year reach $40,000. (Your Diamond status is valid for the calendar year in which it was earned and the subsequent calendar year.)

Diamond status can also be obtained via a status match, so consider that route (which can be very easy with cards like the IHG credit card).

Alternatively, since the Hilton Aspire grants automatic Diamond status, you should consider going for that card rather than spending $40,000 in a year for Diamond status.

- For more on the comparison between the Aspire vs the Ascend, click here.

Amex Hilton Ascend free weekend night

The Hilton Ascend offers you a free night after you spend $15,000 in a calendar year. Compare this to the Aspire which requires $60,000 worth of spend for its free night (though it also offers a free night each year).

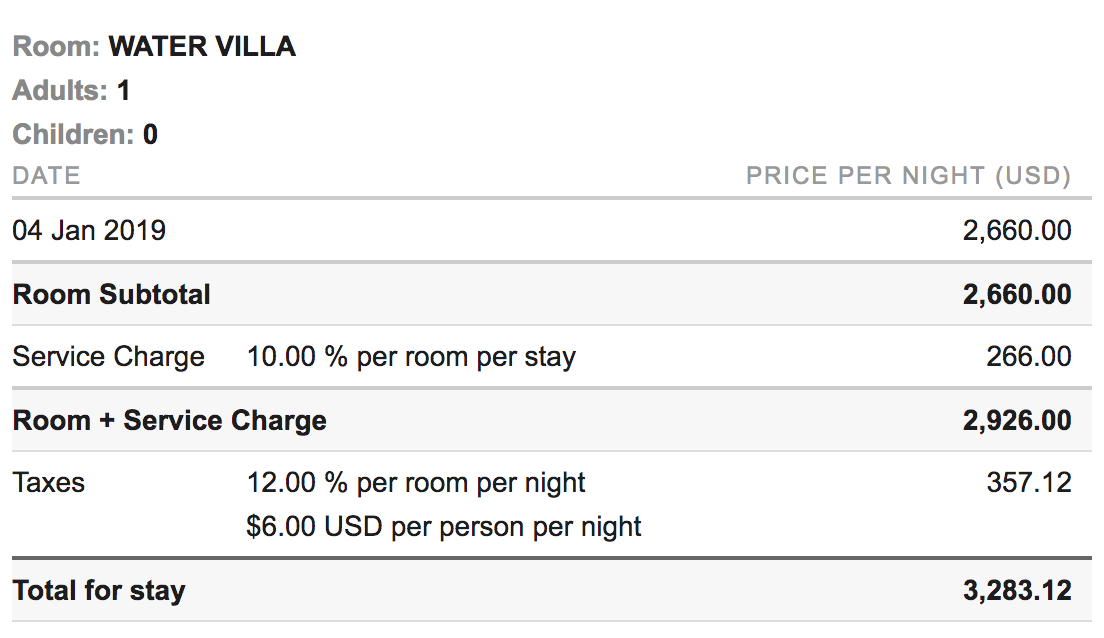

These free weekend nights can be used on Friday, Saturday, and Sunday and they can offer you some outrageous value. For example, you could use one at the Conrad Maldives where an award night can go for as much as $3,283!

So these certificates can offer extremely lucrative redemption opportunities.

If earning Hilton points with everyday spend is something you’re very interested in, then hitting that $15,000 worth of spend should be very obtainable, since that’s just $1,250 of spend each month.

If you’ve got the patience to pull it off, you could always save your sign-up bonus until you’ve had the card for one year. If you ended up spending $15,000, you’d then have at least 150,000 Honors points plus a free night coming your way. That could get you two to three nights at some pretty amazing Conrad, Waldorf, and Curio properties.

I really like the idea of combining the Ascend with the Aspire. If you put $15K worth of spend on the Ascend each year, you’d be getting two free weekend nights each year between those two cards. Combine those earnings with a spouse, and you’ll be set to have a couple of very luxurious weekend get-a-ways each year. (For more on credit cards that are great for couples click here.)

Amex Hilton Ascend Priority Pass

The Ascend offers Priority Pass for up to 10 entries in a year.

Priority Pass grants you lounge access to over 1,000 lounges around the world. In these lounges, you can enjoy comfy seating, free wifi, and often complimentary drinks (alcohol included) and food. Some will even have showers and nap rooms!

A lot of people don’t need the full Priority Pass membership with unlimited access because they don’t travel enough to really take advantage of the value.

But if you think you’ll just be heading through airports a hand full of times each year then this type of Priority Pass could really work in your favor. This pass also adds a lot of value to the card since each entry into a lounge would cost you $27.

No foreign transaction fees

Believe it or not, the Hilton Surpass came with foreign transaction fees, so this was a much-needed upgrade for the Hilton Ascend card.

500 points

You will receive 500 Hilton Honors points for each qualifying stay at any of the participating hotels and resorts when the stay is booked online at any Hilton website and paid for with your Hilton Honors Card.

Amex Hilton Ascend travel insurance & other protections

The Hilton Ascend also comes with some pretty good travel insurance and other protections like extended warranty, rental car coverage (not primary) purchase protection, return protection, and baggage insurance (among others).

- You can read more about these in the official terms and conditions.

Final word on the Amex Hilton Ascend card

I think this is a great card for anybody interested in staying at Hilton properties. It can be used in conjunction with the Aspire card to accumulate more sign-up bonus points and/or free nights. But the card can also stand alone given that you’ll get automatic Hilton Gold status, great bonus earning rates, and a free weekend night after only spending $15,000. Since this sign-up bonus will eventually fall down to somewhere around 70K to 80K, I think it makes a lot of sense to consider applying for the Ascend now rather than later.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I just received the AMEX card and the problem for me is the 15,000 spend in a ‘calendar year’ clause. So, even if I put 1250 on my card for every month starting now (Aug.2018) I will not earn that 2nd night 12 months from now, but rather not until after Jan 2020! Disappointed I didnt catch that before I applied. The value per point is just too low also in my opinion. Will stick with Chase and URs for everyday spend.