The Hilton Honors American Express Aspire Card and the Hilton Honors American Express Ascend Card were just released and so a lot of folks are going to be wondering which credit card they should apply for. Each card has its pros and cons and so I’m going to run through the major perks of each card to help you determine which card is better. So here’s a Hilton card showdown: the Aspire vs Ascend.

Update: Some offers are no longer available — click here for the latest deals!

Aspire vs. Ascend: Benefits

The Hilton Aspire is a premium credit card that offers a ton of value in the form of several benefits.

This is key to understand because if you have little to no use for these benefits, then the Aspire’s $450 annual fee becomes much more difficult to justify. On the other hand, if the opposite is true, then the Aspire card quickly becomes almost a no-brainer.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Hilton Aspire airline credit

There are a lot of credit cards offering airline credits these days. You need to think about what other airline credits you already are using (or not using).

Remember, a credit is not actually “saving” you money unless you were already going to spend that money. Some folks forget to consider the cumulative value of their travel credits and end up being enticed by big $200+ credits that they would ordinarily have no use for.

But remember, you’ll probably be able to get away with buying gift cards with this airline credit and that opens up greater opportunities to recoup your value and essentially lower the annual fee by approximately $250.

Hilton Aspire resort credit

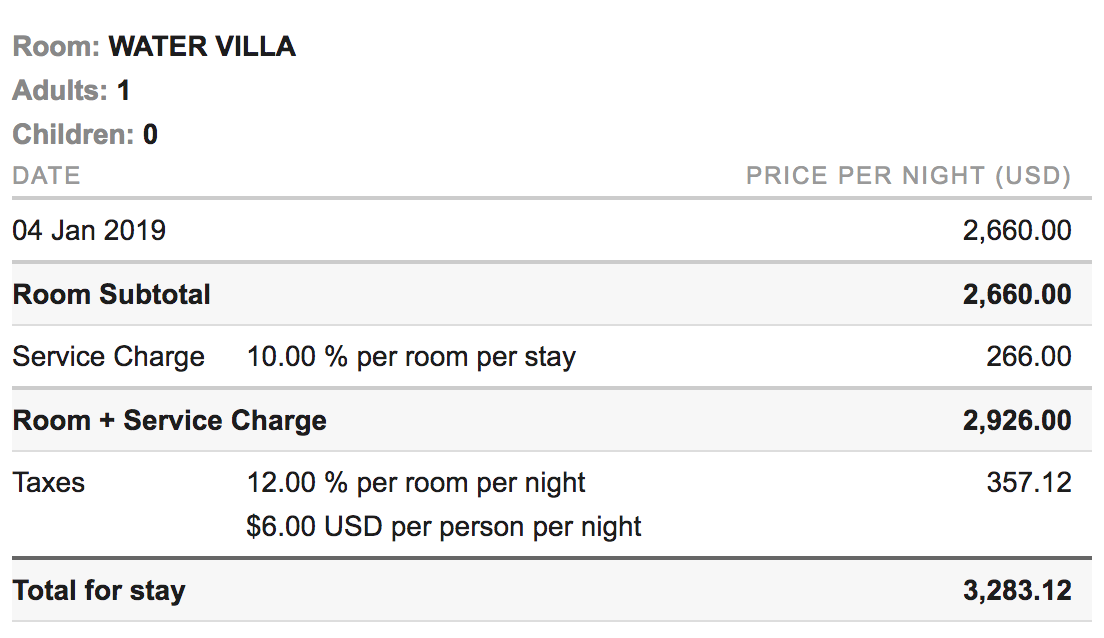

The $250 resort credit is absolutely huge if you had plans to stay at any of the eligible resorts.

This resort credit can come in handy even if you booked your hotels with rewards. For example, if you stayed at the Conrad Maldives and you wanted to have lunch in their famous underwater restaurant, you’re looking at over $200 per person!

So this credit can help cover those nice meals, bar visits, and spa treatments that will usually come from out of your pocket.

If you know you’d usually spend $250 at a Hilton resort a year and $250 on airline incidentals (or some airline gift cards), then you probably should get the Aspire card because you’ll be profiting at least $50 a year from this card.

$100 Conrad/Waldorf credit

When you use your Hilton Honors American Express Aspire Card to book through HiltonHonors.com/aspirecard for a two-night minimum stay at Waldorf Astoria and Conrad Hotels & Resorts, you will be eligible to receive a property credit of up to $100 per booking.

Again, think about the value of these credits in terms of what you’d normally be spending your money on.

Aspire vs. Ascend: Priority Pass perks

The Hilton Aspire Priority Pass benefit gives you unlimited access to Priority Pass lounges for yourself and up to two guests.

The Hilton Ascend Priority Pass benefit offers 10 complimentary lounge visits every calendar year.

Once your 10 complimentary lounge visits are used, all subsequent lounge visits during the remainder of the same calendar year will cost $27 per person per visit. (You can use your your 10 complimentary lounge visits to cover guests.)

The value of unlimited Priority Pass is always questionable for those who don’t travel often. But now the Ascend offers an alternative where you don’t have to shell out several hundred dollars for an annual fee to enjoy airport lounges.

If you think you’ll only visit a Priority Pass airport lounge a hand full of times each year the Ascend Card might be the better option for obtaining Priority Pass. But if you know you’ll be frequenting these lounges quite often, the better value might be with the Hilton Aspire.

Personally, I’d rather go with the Platinum Card from American Express for my lounge access but that’s because I’m a huge fan of Centurion Lounges.

Diamond status

Hilton Honors Diamond Status is going to offer you some solid perks like better upgrades to suites, free breakfast, lounge access, free premium internet, and a few other perks.

The thing is, Hilton Honors Gold Status may be all you really need. It gives you free internet (not high speed), a chance for upgrades (not quite as good), and usually gets you free breakfast (sometimes you can even get lounge access).

A lot of folks only want a breakfast, free wifi, and a shot at an upgrade, so Diamond Status may not be so valuable. In that case you might want to go with the latter when you’re choosing the Aspire vs Ascend.

Aspire vs. Ascend: Bonus earning potential

Hilton purchases

The Hilton Ascend earns 12X on Hilton purchases while the Hilton Aspire earns a whopping 14X. I used to value Honors points at .4 cents per point but now I’m starting to value them at .5 cents based on my personal redemptions.

At .5 cents per point, the Ascend earns 6% back on Hilton purchases while the Aspire earns 7% back.

The Hilton Aspire also comes with Diamond status that will earn you 20 points per dollar. So in total, the Hilton Aspire card will earn 34X or 17% back. Once the new Hilton changes come into effect in April 2018, Gold members will earn 18X (or 9% back) so the Ascend would earn you a total of 30X or 15% back.

So the difference in bonus earning on Hilton purchases between these cards isn’t that huge. For that reason, I would not let the bonus earning rate on Hilton purchases be the determining factor when choosing between the Aspire vs Ascend in most cases.

Other bonus categories

These cards have different types of bonus categories.

The Hilton Aspire earns the following rates:

- 7X Hilton Honors Bonus Points on flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and at U.S. restaurants

The Hilton Ascend earns the following rates

- 6X Hilton Honors Bonus Points at U.S. restaurants, U.S supermarkets, and U.S. gas stations.

Both cards earn 3 Hilton Honors Bonus Points for all other eligible purchases.

The Hilton Aspire bonus categories are geared more towards travel expenses like flights and car rentals though it also earns that at US restaurants. At 7X, that’s 3.5% back which is actually pretty good and could make sense if you prioritize earning Hilton points.

The Hilton Ascend earns a lower 6X (3% back) but it earns that on U.S. restaurants, U.S supermarkets, and U.S. gas stations. So if you’re looking for a good card to earn bonus on groceries and gas, the Ascend can be a decent option since it offers 3% back.

Aspire vs Ascend: Sign-up bonus

Some people have knocked the Aspire sign-up bonus but I think they are off base with the criticism.

The Aspire comes with 100K Hilton points + 1 free weekend night. That free night certificate can be used any Hilton property — even the Conrad Maldives which can go for over $3,000 a night!

Imagine if you used 95,000 points plus one free weekend night to cover two stays at the Conrad Maldives during peak season — that’d be $6,500 worth of value from the Aspire sign-up bonus alone! That. Is. Straight-up ridiculous.

Admittedly, that’s a very extreme example but the point is that this sign-up bonus has potential for insane value.

Meanwhile, the Ascend offers 100K in the form of 75K when you spend $2,000 or more in purchases within the first 3 months and an additional 25,000 Hilton Honors Bonus Points after you make an additional $1,000 in purchases within your first 6 months.

The Aspire bonus is essentially 195,000 Hilton Honors points. Considering all of the other benefits that the Aspire comes with, I find this sign-up bonus to be pretty generous.

If you really want to be able to cover a couple of free nights at a top-tier property like a Waldorf or Conrad then the Aspire is for your you. But if you’d rather stretch your points while staying at lower-tier or mid-tier properties, you’ll be well-served by the Ascend’s 100K bonus.

Aspire vs Ascend: Spend for free nights

One major advantage that the Ascend has is that you can earn a free night certificate after only spending $15,000 in a year.

Compare that to the the Aspire which requires $60,000 worth of spend for a free night! So if you and your partner each had the Ascend, you could spend half of the money needed for an Aspire free night and receive twice the number of free nights!

Aspire vs Ascend: Annual free nights

The Aspire has a huge advantage in that it comes with an annual free weekend night. So while you have to spend a lot more to earn an additional free night, you automatically get one each year on your account anniversary.

So this is another benefit that makes it that much easier to justify the annual fee of the Aspire. Even if you only used half of all your available travel credits ($300 worth), you’d still only be paying $150 for a free weekend night, Diamond status, the ability to earn 14X on Hilton purchases, and Priority Pass. That is a an absolute bargain.

Have you had or do you have Hilton Surpass?

If you had the Hilton Surpass you likely won’t be eligible for the sign-up bonus of the Hilton Ascend. So if you’re hoping to earn a lot of Hilton points with the aid of a sign-up bonus, you might need to consider the Aspire or another Hilton credit card offered by American Express.

Final word

When it comes down to choosing a winner for the Aspire vs Ascend, I personally prefer the Aspire over the Ascend. That’s largely because I know I can make use of at least $500 of the $600 in total travel credits that it offers. The 14X on Hilton purchases, Diamond status, and free anniversary night are just gravy on top of everything else.

But if I wasn’t sure that I would make proper use of those credits, the Ascend would still offer me a lot of value with a good sign-up bonus, great bonus earning rates, free Priority Pass access, and chance for a free night after only $15 in spend. So while the winner depends on your own spending and traveling habits, the Aspire is just a more valuable card to me.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I believe I was given the bonus point option when my card converted from Surpass to Ascend.

Did you see that in writing?