Knowing how to navigate credit card application rules is extremely important for optimizing your credit card rewards. If you don’t know what you’re doing or you simply are not aware of the rules, you could be costing yourself thousands of dollars in value.

One of the most important rules to be aware of is the Chase Sapphire 48 month rule. The Chase Sapphire 48 month rule was a pretty big blow when it was unveiled a couple of years ago because it cut down on the bonuses available to people. But if you’re patient enough, this rule doesn’t have to limit you so much.

Table of Contents

What is the Chase Sapphire 48 month rule?

The Sapphire 48 month rule means that you cannot receive a bonus or even get approved for a Sapphire card within 48 months of receiving a bonus from another Sapphire card.

Below, I will go into detail about the Sapphire 48 month rule.

But I would strongly recommend that you look into downloading the free app WalletFlo that calculates your eligibility for cards like this. Not only does it calculate the Sapphire 48 month rule but it also calculates eligibility for other major banks like American Express, Citibank, Discover, etc. You won’t have to worry about calculating these things yourself and can simply automate your credit card strategy.

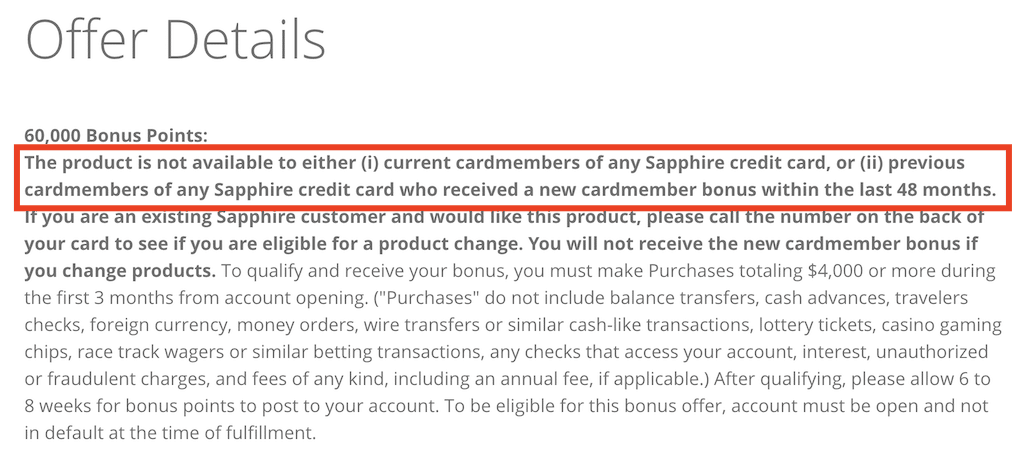

The actual text of the rule

You can find the text of this rule by clicking on “offer details” on the main application page for the credit card.

The actual text of the full Sapphire eligibility rule states the following:

The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months.

So there are basically two parts to this rule.

The first is that you cannot be a current card member of any Sapphire credit card.

So let’s say that you have the Chase Sapphire Reserve and you are trying to apply for the Sapphire Preferred. Even if you received your bonus for the Sapphire Reserve five years ago, you would still not be eligible for the Sapphire Preferred until you close or product change your card.

Many people choose to downgrade their Sapphire cards to one of the Chase Freedom cards so that they can retain some decent rewards while also avoiding an annual fee. Typically, I would advise to wait at least 30 days after closing or product changing a card to re-apply. Others may only wait one week but I like to play things safe.

The second part of the rule is the actual 48 month rule. This simply means that you have to wait 48 months (or four years) from receiving a bonus to be eligible for the card/bonus again. (Again, notice that the rule applies to any Sapphire credit card.)

The big question is when do they consider your bonus received?

How the 48 months is calculated

I think one of the most common questions I see is how is the 48 months calculated?

Does it start from the date that you meet your minimum spend, received your bonus, or when your statement closes? Does it occur on an exact date or is it rounded to the end or beginning of a month?

It’s hard to get a straight answer on questions like this but the general consensus seems to be that the 48 month clock starts to run from the statement close date of the statement that contains the arrival of your bonus points.

So let’s say that you received your bonus points on March 23, 2020.

Now let’s assume that your statement ran from the period of March 12 through April 11. Many people would state that your 48 month clock would reset on April 12, 2024. I would agree with this.

It can sometimes be difficult to track down when exactly you received your points or what statement they came in. And that is why WalletFlo can be so helpful.

The app conservatively estimates when you would receive your bonus so that you can guarantee you’ll be eligible whenever you receive your notification.

I prefer to go with a very conservative method when calculating eligibility because of a few reasons.

First, we don’t always know exactly how these rules are calculated.

For example, I have seen data points where the 5/24 rule is calculated in different ways based on the type of credit reports that were pulled. So there is not always an exact science to how these eligibility rules are done. But if you go conservative then you can almost guarantee that you won’t be surprised by anything.

The other thing to consider is that these type of things can change. So just because something was calculated one way three years ago, that does not mean it will be the same this year.

Authorized users

It’s important to remember that an authorized user is not affected by this rule because they do not receive a bonus. Chase also does not consider you to be a current cardmember if you are only an authorized user.

Final word

The Sapphire 48 month rule requires you to be pretty patient when applying for a new Sapphire card. You typically would calculate your 48 month period by finding the statement close date of the statement in which your points arrived. Then just count four years from that date. But one very easy way to keep tabs on your eligibility for this card and for many others is to simply use WalletFlo.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.