Advertiser Disclosure: UponArriving has partnered with affiliate partners and may receive a commission from card issuers. UponArriving does not display all credit card offers and affiliate relationships may impact how offers are presented.

How do you know when a credit card welcome bonus is a good option for you?

What factors do you look at when evaluating a bonus?

These are common questions a lot of people have and in this article I’ll provide some insight into different factors you want to consider when thinking about jumping on an offer.

1. Is it one of the best offers?

The first consideration I think about when applying for a credit card is: “is this one of the highest offers available for this card?” You can easily miss out on tens of thousands of points ($100s in value) by timing your application poorly.

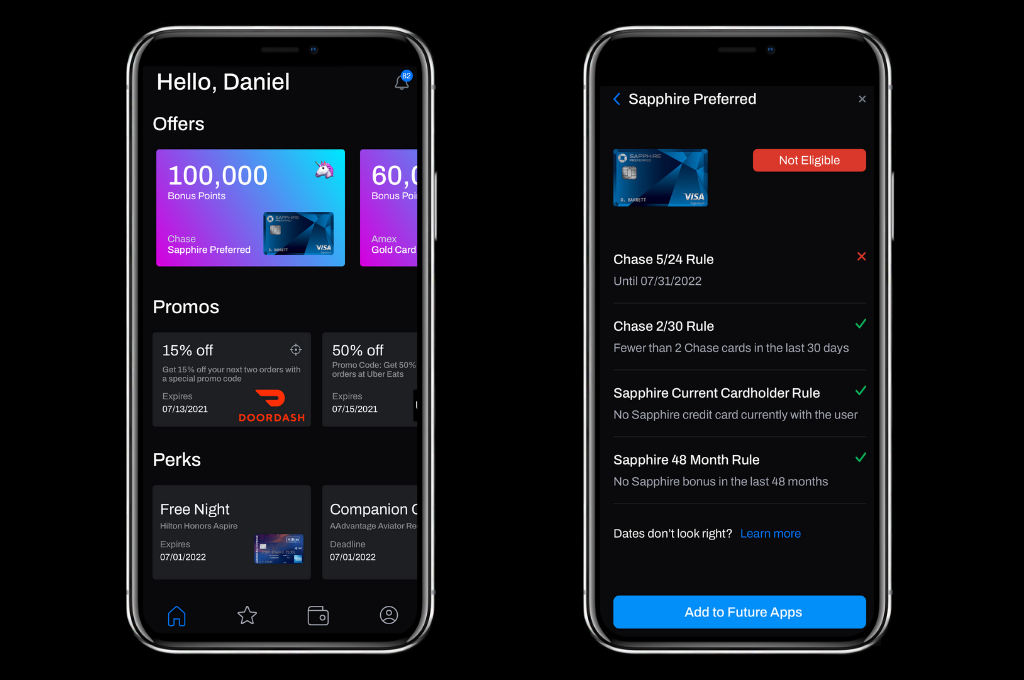

This is why in the mobile app, WalletFlo shows you icons for each offer: unicorn 🦄, diamond 💎, fire 🔥.

Typically, I would try to shoot for only unicorn and diamond offers since those are the rarest and best value offers.

A great unicorn offer right now is the welcome bonus for the Citi Premier® Card:

- Earn 80,000 ThankYou Points after you spend $4,000 in within the first 3 months

The only time I would go for a lower offer is if I really needed the points to top off the required points for an upcoming trip, strategy called for it (see below), or I had a specific use in mind for some of the valuable credit card perks.

Tip: Don’t forget to see if you have referral link options for big bonuses.

2. Can you meet the minimum spend?

If you can’t meet the minimum spend then you won’t earn the bonus. And if you are struggling to meet a minimum spend you might be incentivized to spend carelessly.

So you really need to make sure that you have a solid plan for meeting the minimum spend. Sometimes that might mean putting rent on your card, purchasing gift cards, or getting creative.

But I would avoid applying for credit cards without putting serious thought into exactly how you will meet that minimum spend within the needed timeframe.

3. Do you have a plan to use the points?

Some people believe that you should never apply for a credit card unless you have a specific use for those points in mind.

I’m not one of those people.

Don’t get me wrong — I would not recommend applying for niche airline or hotel program credit cards if you don’t have use for those miles. For example, applying for a Korean Air credit card on a whim is probably not a good idea.

But when it comes to transferable points programs like Chase and Citi, you’ll have so many options to use those points that rarely (if ever) do you need to have an exact plan in mind.

While you may not have a specific redemption in mind, you probably want to have an exit strategy in mind when you apply, especially if you are applying for a card with a very high annual fee.

In that case, you just want to at least know the cheapest way to park your points if you want to end up canceling that card and avoid getting hit with a big fee.

4. Are you eligible?

Most bonuses worth picking up have some type of eligibility language tied to them. And sometimes that language can be confusing or it can just be difficult to keep track of things.

For example, sometimes you might be eligible to get approved for the card but NOT eligible for the bonus.

The best way to keep track of your eligibility is to use the eligibility checker in WalletFlo. As long as you have accurately input your open dates, it can help guide you so that you can always see if you’re eligible to apply or not.

Tip: If you’re not eligible just add the card to your “future apps” and you can receive a notification when you become eligible.

5. Is it strategic?

Even if the bonus is great, you can meet the minimum spend, and you are eligible, you still may want to hold off for strategic reasons.

For example, right now I would recommend some people to apply for the Chase Sapphire Preferred® Card instead of the Citi Premier if they are under 5/24.

That’s because even though the Chase Sapphire Preferred® Card bonus is not a unicorn level bonus, you can still pick it up and then get the Citi Premier later.

But if you were to go over 5/24 by going for the Citi Premier and a couple of other cards down the road, you may have to miss out on the Sapphire Preferred (and other valuable Chase cards) for another couple of years.

6. Is there a risk?

Every now and again an offer comes around that may get you into trouble.

Perhaps there is a way to take advantage of certain referral loopholes or leaked links. Jumping on these could be tempting but you could be jeopardizing your points or even your good standing with the bank.

Sometimes these “too good to be true” offers can come back to bite you in the rear end so proceed with caution when you encounter these.

7. Credit score

And finally you obviously want to be aware of the effects the application will have on your credit score.

A typical hard inquiry will drop your credit score temporarily anywhere from 2 to 5 points on average. But sometimes opening up new accounts can cause a further drop.

On average, to protect your credit score, I would recommend waiting three months between credit card applications with the occasional one-two (maybe 3) punch happening to quickly boost your earnings.

Final word

If you take into consideration all of the factors above, you should be able to make smart decisions when going for credit card welcome bonuses.

Advertiser Disclosure: UponArriving has partnered with affiliate partners and may receive a commission from card issuers. UponArriving does not display all credit card offers and affiliate relationships may impact how offers are presented.

Editorial Disclosure: Opinions, reviews, analysis & recommendations are UponArriving’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.