Offers contained within this article maybe expired.

American Express purchase protection is one of the strongest benefits offered by American Express credit cards and it can end up saving you hundreds (or even thousands) of dollars.

But what exactly does this benefit offer protection for?

I’ll show what Amex purchase protection is and how it works with different Amex credit cards. I”ll also show you how to file a claim and what to expect when it comes to things like submitting forms and proof of loss during that process.

Table of Contents

What is American Express purchase protection?

American Express purchase protection will protect your purchases when they are accidentally damaged or stolen for up to 90 days from the date of purchase (for most states).

The reimbursement will be for the lesser of:

- the cost to repair the item;

- the cost to replace the item; or

- reimbursement for the item.

The limit of your coverage will depend on the type of American Express card that you used for the purchase.

Tip: Check out the Amex Gold Card for purchase protection — it’s one of the most rewarding travel rewards cards and the card I use the for most purchases.

American Express purchase protection filing deadlines

The first thing that you need to be aware of is that the purchase protection claims have explicit deadlines. Missing these could be the difference between getting coverage and getting denied.

90 days from purchase

For your item to be eligible for coverage, you must have purchased it with your Card within 90 days.

Note that some states like Arizona and Texas are given protection up to 120 days from the time of purchase.

The 90 day period is a little bit of a bummer because some cards like those premium cards issued by Chase provide coverage for up to 120 days.

30 days to file

You must file a claim within 30 days from the date your item is stolen or accidentally damaged.

If you have a good excuse as to why you were not able to file your claim within 30 days, Amex may still allow you to file your claim.

American Express purchase protection limits

The total amount that you’ll be covered for your purchase protection depends on the American Express card that you used for your purchase.

Here are some examples of the different limits imposed for different cards. Notice the big difference between the premium cards like the Platinum Card with limits of $10,000 per item and the other basic cards with much lower limits of $1,000.

Amex EveryDay

- The Plan will pay a benefit for an item up to $1,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Amex EveryDay Preferred Credit Card

- The Plan will pay a benefit for an item up to $1,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Gold Delta SkyMiles Credit Card

- The Plan will pay a benefit for an item up to $1,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Amex Gold Card ($10,000)

- The Plan will pay a benefit for an item up to $10,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Platinum Card from American Express ($10,000)

- The Plan will pay a benefit for an item up to $10,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Delta Reserve Credit Card ($10,000)

- The Plan will pay a benefit for an item up to $10,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Hilton Aspire ($10,000)

- The Plan will pay a benefit for an item up to $10,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Blue Cash from American Express

- The Plan will pay a benefit for an item up to $1,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

American Express Business Gold Card

- The Plan will pay a benefit for an item up to $1,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

Blue Business Plus Credit Card

- The Plan will pay a benefit for an item up to $1,000 for any one Covered Incident and up to $50,000 for all Covered Incidents per Card Member Account during a calendar year

The $1,000 limit on some of these no annual fee cards might seem a little low but it’s actually pretty competitive. For example, the Chase Freedom cards only offer protection up to $500 per item.

Even the Chase Sapphire Preferred only offers protection up to $500 (though the Chase Sapphire Reserve offers a $10,000 limit for its protection).

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How to file an American Express purchase protection claim

In order to receive your coverage, you must provide both Notice of Claim and Proof of Loss.

Notice of Claim

As stated, Notice of Claim should be provided to Amex within 30 days of the incident.

To provide notice you can call Amex at the following phone number: 1-800-322-1277 or, if from overseas, by calling collect 1-303-273- 6498.

You can also mail them at:

- Purchase Protection Claims Unit,

- PO Box 981553

- El Paso TX 79998- 9920.

If for some reason you don’t file within 30 days note that you can still submit your claim so long as it can be shown that Notice of Claim was provided as soon as reasonably possible.

Once you file your notice, Amex will assist you with that additional documents might be necessary.

Proof of Loss

If you have to show proof of loss, a claim form will be sent to you after Amex receives your notice of loss.

Written proof of loss, which includes the signed claim form and all other requested documentation, must be received within 60 days after they provide you with a response to your claim.

Proof of Loss may require documentation consisting of, but not necessarily limited to, the following:

- Purchase Protection claim form;

- The original itemized store receipt with applicable sales tax included;

- The insurance declaration forms for your other sources of primary insurance policies or indemnity (e.g., homeowner’s or renter’s insurance policies);

- A photograph of and/or repair estimate for the damaged item by an authorized repair facility or other professional repair facility as outlined in the manufacturer’s warranty; and

- For theft and vandalism claims, a report regarding the stolen or vandalized item that has been filed with the appropriate authority. You must file such report before you call to file a claim under Purchase Protection.

Note that if your item is damaged you might be required to send in the damaged item to Amex at their expense for further evaluation of your claim. If requested, you must send in the damaged item within 60 days from the date of their request to remain eligible for coverage

Once you file your claim, Amex will decide whether to do one of the following:

- Have the product repaired

- Have the product replaced

- Reimburse you up to the amount of the item purchased on your card

When will the payment be made?

If your claim is accepted by Amex, it will be paid within 30 days upon them receiving all the necessary documentation needed for your claim.

Exclusions

Note that if the loss is brought about by one of the conditions below, you won’t be able to get coverage.

Benefits are not payable if the incident for which coverage is sought was directly or indirectly, wholly or partially, contributed to or caused by:

- war or acts of war

- participation in a felony, riot, civil disturbance, protest or insurrections

- any activity directly related to and occurring while in the service of any armed military force of any nation state recognized by the United Nations;

- violation of a criminal law, offense or infraction

- fraud or abuse or illegal activity of any kind by the Card Member

- confiscation by any governmental authority, public authority, or customs official

- damage or theft while under the care and control of any third party

- item not being reasonably safeguarded

- theft from baggage not carried by hand and under Your personal supervision

- damage through alteration

- normal wear and tear of any kind

- Damage or theft while under the care and control of a common carrier

- Leaving the purchased item at an unoccupied

- Fraudulent, dishonest, or criminal acts or omissions

Note: This is a non-exhaustive list.; see the official terms for more.

Purchases not covered

There are several types of purchases which are simply not covered by this protection.

These include:

- Consumable or perishable items with extended or limited life spans (including, but not limited to: food, perfume, light bulbs, batteries)

- Lost, stolen or damaged items consisting of articles in a pair or set. Coverage will be limited to no more than the value of any particular part or parts, unless the articles are unusable individually and cannot be replaced individually, regardless of any special value they may have had as part of a set or collection;

- Travelers checks, tickets of any kind, negotiable instruments (including but not limited to gift certificates, gift cards and gift checks), cash or its equivalent, rare stamps or coins;

- Animals or living plants;

- One-of-a-kind, antique or previously owned and used items. Items refurbished by the manufacturer are not considered previously owned or used;

- Motorized vehicles, scooters, golf carts, etc.

- Items rented, leased or borrowed;

- Permanent household fixtures unless they can be removed without causing damage to the structure;

- Items purchased for use as inventory, resale, professional, or commercial use (including but not limited to professional education, training or skills, or to be used in professional competition);

- Business fixtures, including, but not limited to, air conditioners, refrigerators, heaters and/or any item that cannot be removed without causing damage to the structure; and

- Hospital, medical and dental equipment and devices

Note: This is a non-exhaustive list.; see the official terms for more.

American Express purchase protection FAQ

Approximately 50 Amex cards have purchase protection but some of the most popular cards include:

Amex EveryDay

Amex EveryDay Preferred Credit Card

Gold Delta SkyMiles Credit Card

Gold Card

Platinum Card from American Express

Delta Reserve Credit Card

Blue Business Plus Credit Card

Premium cards issued by American Express will have the highest purchase protection limits that go up to $10,000. These cards include the following:

Gold Card

Platinum Card

Delta Reserve Credit Card

Hilton Aspire

You can find the purchase protection limits that apply to you your card in your state by checking the American Express website here.

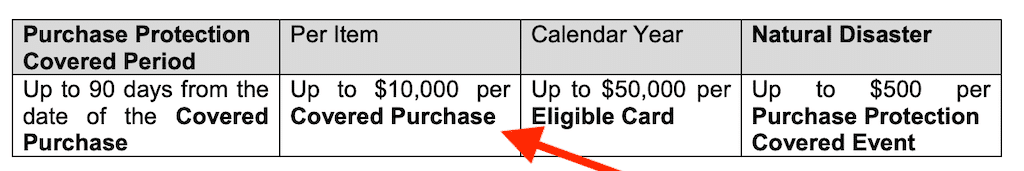

Click on your card and then make sure you are reviewing the terms for your specific state. You should see a table showing you the breakdown of elements such as the one pictured below.

Amex states that purchases that are lost and/or irretrievable (i.e. item is neither stolen nor damaged), misplaced, or “Mysteriously Disappeared” are excluded.

Mysteriously Disappeared means “the vanishing of an item in an unexplained manner when there is an absence of evidence of a wrongful act by a person or persons.”

So lost items won’t be covered and unless you have evidence of a wrongdoing there’s a chance that your loss may be classified as a mysterious disappearance.

Yes, as long as the item was refurbished by the manufacturer the items is not considered previously owned or used

Typically, you can get coverage from stores like these but you need to make that you’re purchasing new and not used items.

Coverage is secondary and Amex states that “This Plan is secondary to all other valid and collectible insurance or other sources of indemnity and shall apply only when such other benefits are exhausted.”

So if you have something like renter’s insurance, that will probably take precedent over the purchase protection offered by Amex.

If you’ve damaged your iPhone or Android, you should be able to get coverage for your loss. Keep in mind that Amex also offers a great extended warranty program that can provide some great cell phone protection too.

Also, other credit cards like the Chase Ink Preferred provide cell phone protection on an ongoing basis so long as you pay your cell phone bill with the credit cards. Read more about that here.

There’s a good chance that your drone might be considered an aircraft and will NOT be covered.

If you paid for the product with Membership Rewards you’ll still be able to get coverage as Amex states, an item is eligible for coverage under this Plan if it was purchased through the redemption of Membership Rewards Points and/or Pay with Points.

If a natural disaster is to blame for the damage, note that there will be a maximum per occurrence limit of $500 for any one Covered Incident.

You should always check the terms and conditions for your specific Amex card because there can be very different rules based on the state that you reside in.

For example, some states get coverage for up to 120 days from the date of purchase instead of 90 days.

Yes, the terms and conditions state that gifts are considered a “covered incident.”

Final word

The protection offered by premium Amex cards like the Platinum Card and the Gold Card are top notch with coverage up to $10,000. However, it’s a good idea to make sure you keep track of all of the required documents and make an effort to submit for your claim forms in a timely fashion.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Does Amex Gold purchase protection cover things you purchase for someone else as a gift? For example, if I buy my fiancé a wedding ring with my card and then she loses the ring, is that covered? Thank you!

Yes, gifts count as covered incidents so you’d be good. 👍

I see that the Amex Gold and Platinum cards cover “lost” items. Are there any restrictions with what is considered lost? I lost my watch while swimming in the ocean. How do i prove it was lost if there is obviously no evidence? Will is be covered?