The Amex Platinum Card is making a lot of noise recently. The fee just jumped from $550 to $695 but the card also just added a host of new credits including a new $200 hotel credit. In this article, I’ll break down everything you need to know about the Amex Platinum $200 hotel credit.

Table of Contents

What is the Amex Platinum $200 Hotel Credit?

The hotel credit is a special perk that offers you $200 back in statement credits each year on prepaid Fine Hotels + Resorts (FHR) or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card.

This is one of the more straightforward credits offered by the Platinum Card since you do not have to enroll or keep up with monthly limits for your credit. Other credits like the entertainment credit are issued on a monthly basis so you have to keep close tabs on them.

Tip: Use WalletFlo to help you keep track of all of your monthly credits! It’s free and is one of the best ways to manage all your credit cards and promotions!

How can you use the $200 Hotel Credit?

To use the credit you need to make a booking through through amextravel.com, the Amex App, or by calling the phone number on the back of your Platinum Card. I would recommend doing it online or in the app since the search filters are pretty handy.

Factors to consider

Stacked benefits

The FHR comes with a number of benefits which include:

- Noon check-in, when available

- Guaranteed 4pm late check-out

- Room upgrade upon arrival, when available

- Daily breakfast for two people

- Complimentary Wi-Fi

- Special amenity unique to each property

Your $200 hotel credit will stack on top of these benefits which includes the property credit that you may receive. You can already get several hundred dollars from the FHR even from a short stay. So this credit adds $200 to the mix which makes the FHR just that much more attractive.

Prepaid

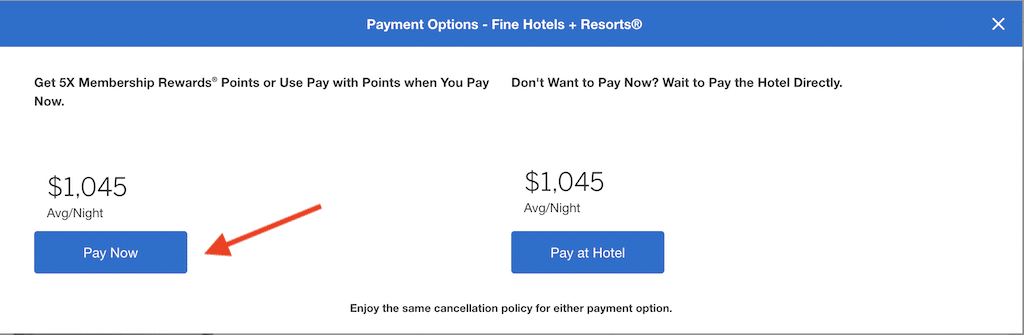

When making your booking you need to make sure that you are booking a prepaid rate. When you are on amextravel.com or on the AMEX app you will see “pay now” after you click “Book” and that means that you are looking at a prepaid rate that will be eligible.

Keep in mind that these prepaid rates do not work like traditional prepaid rates. Traditionally a prepaid rate does not offer you flexible cancellation but with these type of prepaid rates you can still get the same cancellation policy as if you paid at the hotel.

Tip: You should also be able to earn 5X on these purchases with your Platinum Card, although I don’t think you will earn 5X on the $200 credit portion of your purchase.

Related: Amex Travel: Everything You Need to Know

Hotel Collection

The Hotel Collection benefits include:

- $100 property credit

- Room upgrade at check-in if available

- Gold Card members receive 2X (on prepaid stays)

- Platinum Card members receive 5X (on prepaid stays)

- Ability to pay with points

If you are booking a stay for the Hotel Collection keep in mind that they require you to book a minimum of two nights. Hotel Collection rates are cheaper than FHR but the two night minimum makes it a little bit more difficult to offset your purchase with the $200 hotel credit.

Calendar year

This credit will be issued every calendar year meaning that you will need to use it by December 31 (11:59 PM Central Time) of a given year and it will reset on January 1.

This means that in some instances you might be able to combine your $200 credit on multiple hotel stays on New Year’s. You would need to check out on December 31 and then once again after the new year but it could be done. If you were staying at FHR properties this would allow you to also receive double the perks on things like the $100 property credits.

So in 48 hours you could squeeze out $600 in value plus all of the additional value you would get from FHR upgrades, free breakfast, late check out, etc.

The hardest part would be making a last-second booking at New Year’s since you would have to make your second booking January one for that same night (remember the rate must be prepaid).

Also, be aware that if you are checking out and then checking right back in to the same hotel things can get tricky with these type of perks so I would generally recommend not doing that (but if you do it at least be smart about it).

Authorized user

Authorized users can trigger this credit. However, they do not receive their own $200 credit. Instead, the primary cardmember and all authorized users will utilize the same $200 annual credit.

Delta SkyMiles® Platinum Card

Delta SkyMiles® Platinum Card Members do not get this benefit for their Delta card.

Fees may not qualify

Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise).

90 day waiting period

Sometimes your Amex statement credits will post very soon after you make your purchase but other times credits can take a while to post.

American Express states for you to wait up to 90 days after a charge is posted to your account for the statement credit to apply. I have a feeling that you will not have to wait nearly that long to see your statement credit but if it does not appear after 90 days than simply call the number on the back of your Platinum Card to inquire about the credit.

Your transaction will not be eligible if it is a booking:

- (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs

- (ii) not made through American Express Travel, or

- (iii) not made with an eligible Platinum Card.

Is the credit worth it?

The upside to this credit is that it is extremely easy to use. There is no enrollment required and it is an annual credit so you don’t have to keep close tabs on it every month or every few months.

The downside is that on some prepaid bookings you may not receive your elite benefits and you may also not receive elite credits. For some people, that takes a lot of the fun out of staying at big brands like Hyatt, Marriott, and Hilton.

In my experience, if you call the hotel ahead of time and add your loyalty number to your reservation you can still receive many of your elite benefits so it is not a total loss. Also, if you are booking through FHR you typically have a better experience when it comes to retaining elite perks.

The other factor about this credit is that the luxury properties included in these programs typically go for a few hundred dollars per night.

For FHR, you might be able to cover a single night with a $200 credit by booking off-season but for the most part you will be spending more than that for a one night stay and definitely a two night stay.

It will be easier to find cheaper hotels in the Hotel Collection but you have to book a minimum of two nights with that program so it will still be very difficult to remain at or under $200 total.

So this credit could incentivize you to spend money in a way that you normally would not which is not usually a great thing for a credit.

Final word

I like the $200 hotel credit because it is so easy to use. My only problem with it is that it is limited to prepaid hotels and that many of those hotels are going to be quite pricey so that it might be difficult to cover one night with your credit. Still, if you are somebody who likes to take a weekend getaway here and there this could be a great way to cover a stay at a hotel, especially a boutique property where you don’t have elite status and where you won’t be missing out on elite benefits.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

So if i have the amex paltinum card and delta platinum card then i cant get the $200 hotel credit?

Hey Scott, No you will still be eligible. I just re-worded the terms so that it will be more clear.

If you have multiple Amex Platinum cards, can you use this multiple times per year?

Yes, you can!