A lot of people are wondering if the new “Apple Card,” which will run on the MasterCard network, is worth it. In this article, I will show you everything you need to know about the Apple Credit Card in order for you to make an informed decision on whether or not it is worth it for you. I’ll cover things like the bonuses, fees, and special privacy and rewards features.

Table of Contents

Sign up bonus

- There will initially be no sign-up bonus offered by the Apple Card.

Although this was expected, it is still a bummer to not have any upfront value with a credit card. Many other cash back credit cards offer something like $150 cash back or more so this puts this card behind those in terms of its upfront value proposition.

Bonus earning

The Apple Card will earn the following rates:

- 3% on Apple purchases

- 2% on Apple Pay purchases

- 1% back on all other purchases

3% back on Apple purchases

You will get 3 percent Daily Cash on all purchases made directly with Apple, including at Apple Stores, on the App Store, and for Apple services. That includes games, in‑app purchases, and services like your Apple Music subscription and iCloud storage plan.

Getting 3% back on Apple purchases is okay but not super exciting. I have used the Chase Shopping Portal and Chase Freedom Unlimited to net 3.5X Ultimate Rewards on Apple purchases in the past (and gotten purchase protections). Some have even had iTunes code as entertainment for Citi.

Cards like the US Bank Cash+ card allow you to earn 5% back (up to $2,000) at the Apple Store each quarter, as well. And there are also options for purchasing Apple Gift Cards at discounts or with bonus categories triggered.

2% back on Apple Pay

If you aren’t familiar with cash back credit cards, you know that there are a few options like the Citi DoubleCash and Fidelity Card that allow you to earn 2% back on all purchases. So getting 2% back on only Apple Pay purchases is not industry-leading, especially when there’s the Altitude Reserve which earns 3X on mobile wallet payments beyond just Apple Pay.

But it’s not all about every bonus category being maximized with a single card. The Apple Card offers other benefits and features that when considered in conjunction with its bonus categories, make it a pretty appealing option to many.

Daily Cash

One thing that this card does that most others don’t do, is that you will be given your “Daily Cash” each day. It can then be used right away for purchases using Apple Pay, put toward your Apple Card balance, sent to your bank account, or sent to friends and family in Messages. The money on your Apple Cash card can be spent using your iPhone, iPad, Apple Watch, and Mac.

This is a departure from most other issuers that require you to wait about a month to get your cash back. This will be a nice feature for many people, but I am curious to see how it plays out when it comes to returns. That could get messy.

Apple Credit Card Fees

One of the unique features of this credit card is that there are going to be zero fees. This means that you will see:

- No annual fee

- No cash advance fee

- No late fee (no penalty interest rates)

- No foreign transaction fees

- No over-the-limit fees

- No express delivery fee

Not a lot of no annual fee cards offer no foreign transaction fees so that is a plus for the card. Having no fees for cash advances and late fees can be good for some people but I am pretty sure that interest will start to accrue on those so I wouldn’t count on using them. Overall, it is refreshing to see a lack of so many fees and hopefully other issuers will follow suit in the future.

Security and privacy

The Apple Credit Card is taking privacy to the next level in a few ways.

First, the physical credit card will not have any information on it other than your name, which will be laser-etched into a titanium card. There’ll be no credit card number, no security code, and no signature. Many have considered those “security features” obsolete and so it is good to see an issuer taking the next step forward.

Your credit card number will be stored in your Apple Wallet, so you can still use it on online purchases. Also, there will be a dynamic security code that changes with each transaction.

Every time a purchase is made you will receive a notification which will help with fraud prevention.

Apple, or more accurately Goldman Sachs, will not sell your data to third-party businesses. Most other major issuers do this so this is a nice new trend that will hopefully continue. Apple also states that it does not even have access to the transaction data that Goldman Sachs has.

Regardless of how these privacy efforts play out, it is refreshing to see a bank and tech company come together to emphasize security and privacy.

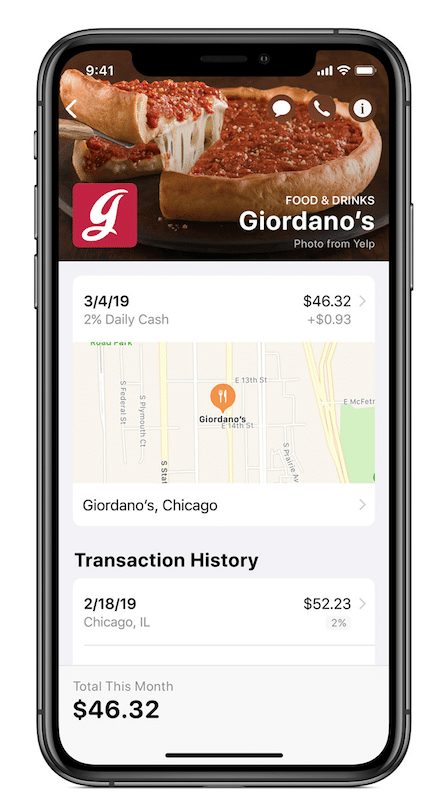

Tracking expenses

With the Apple Credit Card, it will be easy to track your expenses. You’ll have access to a color-coded graph that will breakdown all of your expenses. Purchases are automatically totaled and organized by color-coded categories such as Food and Drinks, Shopping, and Entertainment with weekly and monthly spending summaries.

Those analytics should be really helpful for a lot of people and could help many budget better on a weekly basis. And the information is not stored on Apple servers but instead is stored locally on your device.

You can also get a map view so you can view merchants where purchases were made. This would have been a very handy feature in my younger days when I would go bar hopping in cities and not recall where I stopped at. But this still could be very useful for a traveler or just someone who enjoys viewing data on map views since it will often be clearer where exactly that transaction is coming from.

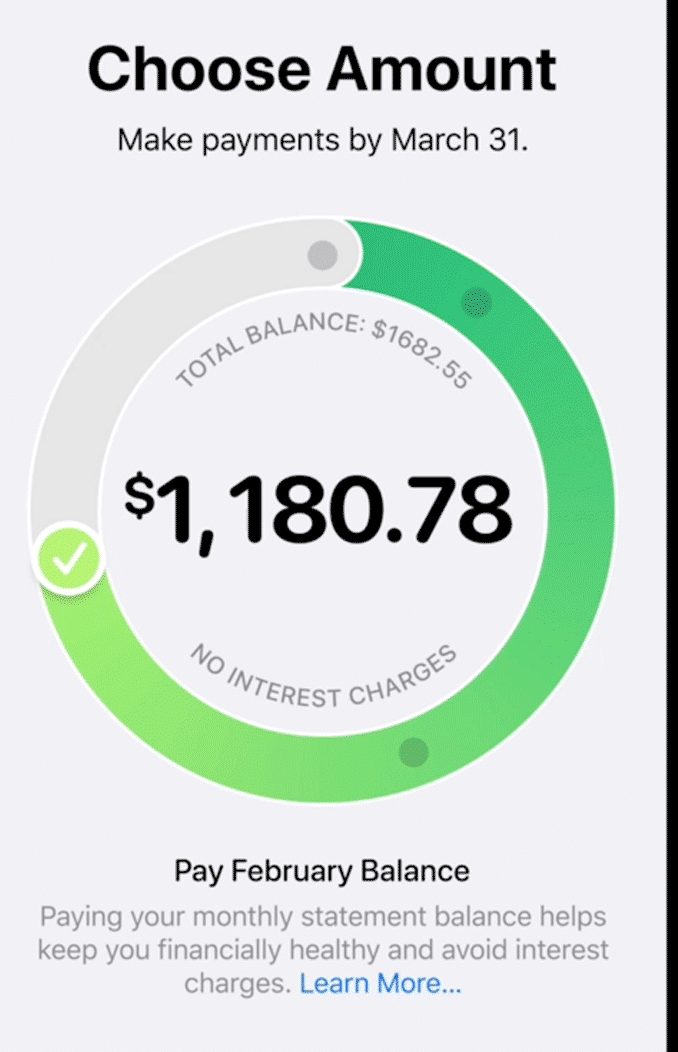

They also have a graphics feature that we’ll show you how much interest you will be paying based on your proposed payment. You’ll also have the flexibility to schedule more frequent payments. One thing that Apple has done is set the due date to always be the last day of the month. I actually really like this feature because it just simplifies the process.

Text support

Apple has been raving about the ability to get instant support via text messages. For a lot of inquiries I don’t see myself wanting to use text message to resolve them. However, I could see in some cases where it could be convenient to accomplish a simple task like placing travel alerts and you can do it discretely.

One cool feature is that there will be a number that you can access via your Apple Wallet where you can call in for customer service. This is nice because even if you don’t have your card on you you can easily access the customer service phone number.

Instantly available

You will be able to apply for the card be at your Wallet App and once you are approved your card will be instantly available. It should be noted that the Apple Credit Card will not be compatible with all phones. You’ll need to use an iPhone that supports Apple Pay, including iPhone 6 and later and iPhone SE. Also, other platforms like Android won’t be compatible.

Special protections?

One of the great benefits of using other cards like the DoubleCash is that you can take advantage of perks like price protection. So if you purchase an item and then the price drops within a certain time, you can get refunded for that amount. Other cards also offer special features like extended warranties, cell phone insurance, etc.

The Apple Credit Card will not have any type of special protections built into the card but we’ll see what kind of MasterCard benefits it has.

No authorized users

You will not be able to add authorized users to the Apple Credit Card. This could actually be a deal breaker for some people who are heavily reliant on authorized users in their financial eco-system.

Safari auto-fill

When using Safari it looks like your credit card details will be automatically filled out which can save you some time. This won’t be available for other browsers (unless people create a workaround).

Interest rates

Apple expects Apple Card interest rates to range from 13.24 percent to 24.24 percent.

Final word

Overall, this is an interesting (and innovative) product but not something that offers unparalleled value for credit card rewards. I think Apple has done a fantastic job in simplifying a lot of things like: fees, payments, rewards, customer service, and security in a way that others will probably follow.

It has managed to offer some decent rewards for those who are heavy into Apple Pay but beyond that there’s nothing very special. There are no special protections built into the card and no sign-up bonus available.

I see this as a great product for Apple users who value simplicity, integration, increased security, and aren’t overly concerned with optimizing their credit card rewards. But for those who truly want to maximize cash back earnings this is not the best product available and likely wouldn’t be the best daily driver.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.