In my personal experience, Barclays has been one of the more reliable banks when it comes to offering retention offers so you should always check in for retention offers before you cancel one of their cards, as some of these offers can be pretty lucrative.

In this article, I’ll talk about what kind of retention offers you can expect to receive from Barclays for cards like the Arrival Plus and the Aviator Red and give you some tips for handling your retention call.

What are retention offers?

Retention offers are special offers that credit card issuers make to customers in order to prevent them from cancelling their credit cards.

These can take various forms which might include:

- Annual fee waived

- Statement credit for annual fee

- Annual fee partially waived or reduced

- Bonus miles equal to annual fee

- Bonus miles less than value of annual fee

- Bonus for spending $X amount

- Credit limit increases (with no hard pulls)

- 0% APR promotional spending periods

Because retention offers can take so many different types of forms, it’s a good idea to go into the phone call with an idea of what you’re most interested in.

What Barclays cards offer retention offers?

You might try to get a retention offer from the following cards.

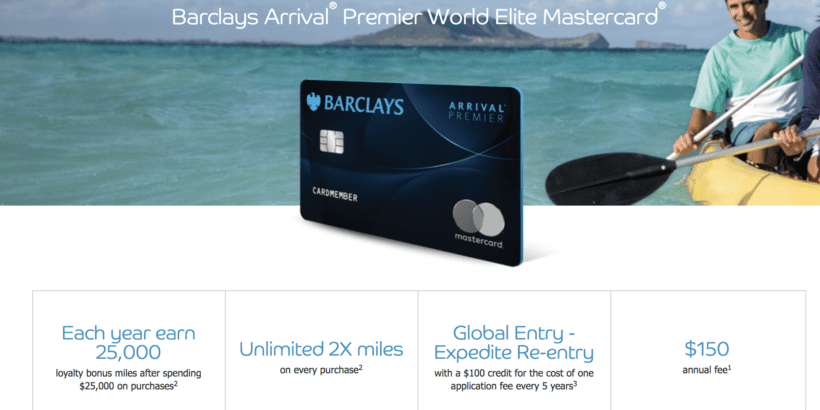

- Arrival Plus

- Aviator Red

- Aviator Silver

- Lufthansa

- Hawaiian Airlines

- Wyndham Rewards

- JetBlue

Here are some examples of retention offers others have reported in the past for the Aviator Red:

- Annual fee waived

- Annual fee waived + 5,000 miles for spending $1,000 in 90 days

- 0% APR on new purchases for 9 months

- $4,500 credit limit increase

- Bonus miles on spend (gas, groceries, etc.)

For the Arrival Plus, annual fee waivers seem to be a little tougher to come by but they will still sometimes offer you something like 1,000 bonus points after the first use of your card (sometimes after a downgrade).

For the JetBlue card, many have reported getting the annual fee waived by 50% and 5,000 points after $1,000 spend.

Other cards might have different offers, but it seems like the most common retention offer across all cards is 5,000 points after spending $1,000 over the course of 3 months.

Tips for getting retention offers

Here are several tips for getting your retention offers from Barclays.

Put spend on your card

Your odds of receiving a retention definitely go up as you put more spend on your credit card, so I always suggest putting spend on your credit cards before your annual fee hits (and preferably throughout the year). It’s not clear exactly how much spend you need, but generally putting at least a few thousands dollars in a year is a good starting point.

With that said, you don’t always have to put a lot of spend on your card. I’ve been given retention offers from Barclays for some cards like the Aviator Red, despite the fact that I had very little spend on my card (less than $500).

But there does seem to be a recent trend where Barclays is requiring more spend for retention offers and just becoming less generous with these offers as a whole.

Wait until your annual fee hits

For the most part, you’re not going to be able to request a retention offer if your annual fee has not hit. There are some exceptions, but generally you’ll need to wait until you see that annual fee hit your account.

Contact Barclays

Once your annual fee hits, then you want to call up the number on the back of your card.

You usually want to tell the phone representative something like “I noticed my annual fee hit recently, and I wanted to check and see if I was eligible for any any offers as an incentive to keep my card open.” You can specifically mention retention offers but I try to be a little more subtle/vague when I call in, at least initially.

Also, I try to avoid using the words “cancel” or “close” because in the past over-zealous/incompetent agents have closed cards upon hearing those words and re-opening cards often involves a lengthy “investigation” of your phone call, file, etc. (If you are actually seriously considering cancelling your cards then obviously this is not as much of a risk for you.)

If you bring up closing your card, you might be asked why you are thinking about closing your card so it’s best to be prepared to give them a reason. Don’t overthink it — simply telling them that you’re having trouble justifying the annual fee is usually sufficient.

After telling the rep the purpose of your phone call you will probably get transferred to an “account specialist” and/or the “retention department” and they will then review your file and then let you know if there are any offers.

Here’s the thing, don’t take them up on the first offer that they give you. It’s often the case that there will be multiple offers available for you but you will need to request for them to tell you about alternative offers.

What if I don’t get an offer?

If Barclays doesn’t offer you anything or they don’t offer you something that you like, you can always get on the phone and call them back and try again with another agent.

If there are no offers for you, the rep might offer you the chance to downgrade your card if you’re calling in about a card like the Arrival Plus, which was a no-annual fee version. They might also give you the chance to close your card and have your credit line transferred over to another card which is always a smart way to close your card.

Final word

Getting retention offers from Barclays for cards like the Aviator Red has been pretty easy in my experience. All you need to do is call in and be sure to inquire about alternative offers so that you don’t end up leaving anything on the table.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.