Are you trying to find out how to check your Chase credit card application status? Or did you receive a message stating that your application is “under review” and that you will hear back in 30 days, 7 to 10 days, or even two weeks?

This article will show you exactly how to check your Chase credit card application status in three easy ways.

And it will also show you what each of these “under review” messages mean like the 30 day, 7-10 day, and 2 week messages and what you should do after you receive one of these.

I’ll also give you some much needed information that can help you overturn a denied application via the Chase reconsideration line.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

How to check your Chase credit card application status

The automated phone number to check your Chase credit card application status is: 1-888-338-2586.

If that doesn’t work, older numbers might work:

- 1-800-432-3117 and 1–800-436-7927 for personal cards

- 1-800-453-9719 for Chase business cards.

You should be prompted to input your social security number, and then you’ll simply wait to hear the status of your credit card application.

Be aware that sometimes you might be taken directly to an agent. If you don’t want to talk to a live person then just hang up the phone and there should be no harm. However, if you do want to talk to them then you need to read more about Chase reconsideration (which I talk about below).

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Can I check my credit card application status online?

Yes, you can check your application status online but only if you have an account with Chase — if you’re a new customer, you’ll just have to settle with calling the automated phone number above.

For a while, Chase didn’t have the ability for you to check your status online but now it’s very easy. I will break down the steps below.

Step one

Log-in to your Chase account.

Step two

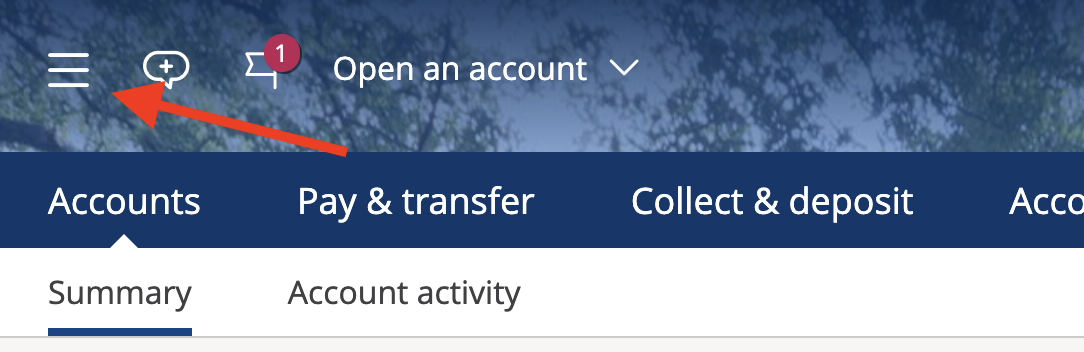

Once you are logged in, click on the three bars on the top left side of the screen.

Step three

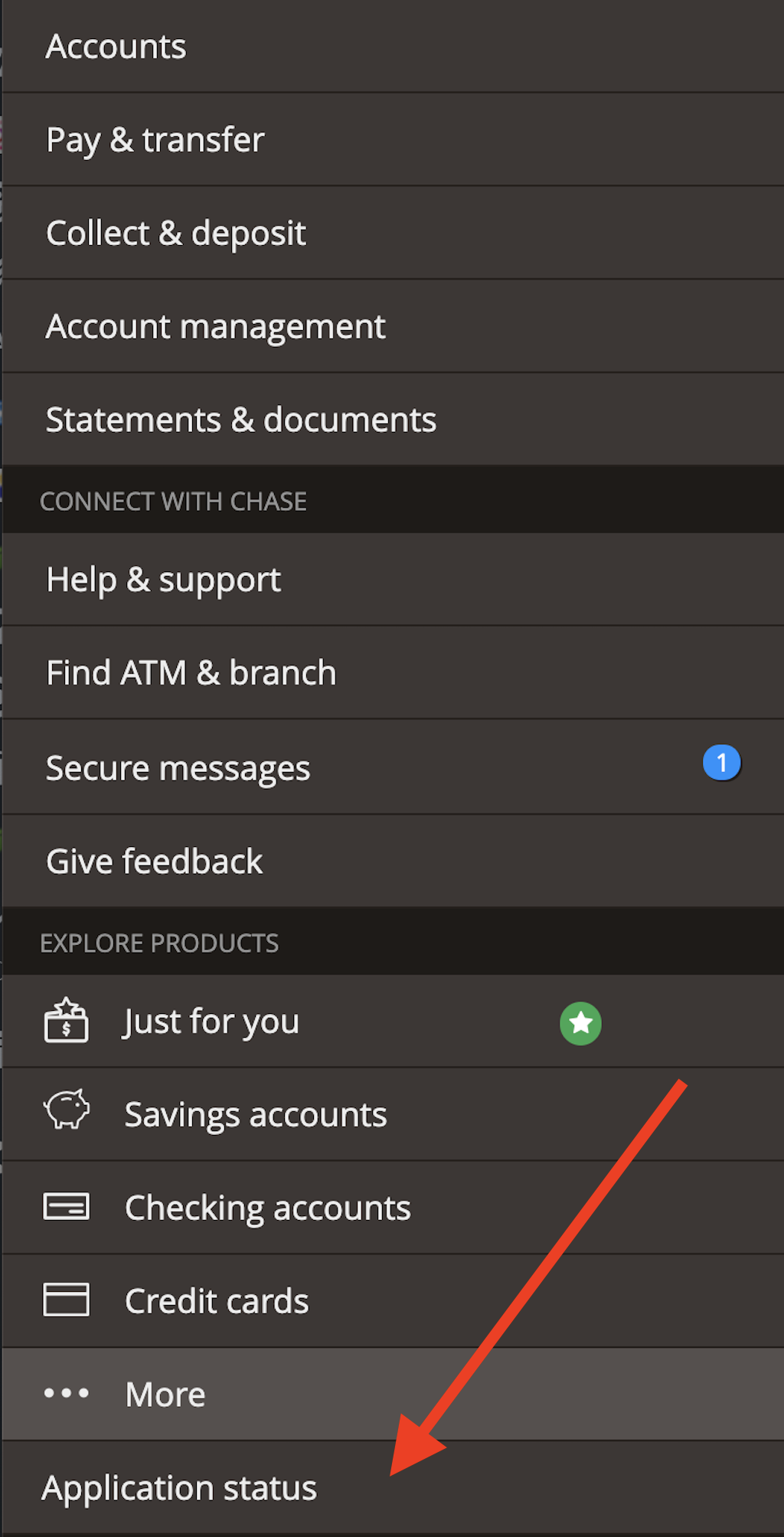

You will now see a side bar menu and there will be an option for you to select “Application status.” Look for the option at the bottom of the menu.

Once you click on that, you will be taken to the “My Applications” page and you should see all active applications there.

If you are still using the old Chase interface, follow the instructions below.

Log-in to your account and then go to the “Customer Center.” On the right side of the screen you should see a section called “Open a New Account” and underneath that a link you can click that says “Check my application(s) status.”

Click on that and you should be able to view your recent credit card applications which could include:

- The Chase Sapphire Reserve

- The Chase Sapphire Preferred

- The Chase Freedom

- The Chase Ink Preferred

- The Chase Ink Cash

- The Chase Slate

- Chase co-branded credit cards (Southwest Airlines, United Airlines, Hyatt, Marriott, Amazon, etc.)

Secured message

Some people prefer to check their application status via a secured message. If you want to do this, then log-in and go to the “Contact Us” and click on “Send us a message” using the Secure Message Center.

This will be the slowest method to get your answer, though. So I would prefer to go with calling in or just checking online.

Chase application status for loans

Note that there are different phone numbers that you can call to check on the status of your applications for other loans like mortgages and auto loans.

These numbers can be found below.

| Auto loan – Purchase New or Used Car | 1-866-804-6781 |

| Auto loan – Refinance | 1-866-481-4254 |

| Home equity | 1-888-e4CHASE (1-888-342-4273) |

| Mortgage | 1-866-524-9593 |

What does your Chase credit card application status mean?

Chase is known for sending out different types of messages when you apply for one of their credit cards and don’t get automatically approved. These messages can give you an indication on whether or not you can expect to be approved.

30 day message

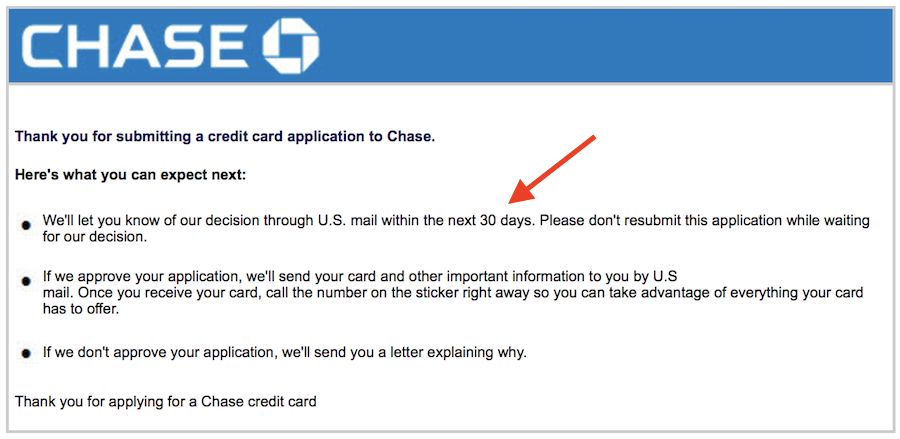

One of the most common messages to get after you are not automatically approved for a Chase credit card is the 30 day message.

If you receive this message all it means is that your application is being processed.

Sometimes it means that the computers are just back-logged and for whatever reason can’t spit you out an automatic approval. Other times it means that your application will likely be reviewed by an actual person (manual review).

At this point, you can just sit back and wait a few business days or usually at most a couple of weeks for Chase to get back to you. Or, you can be more proactive and you can consider calling into the reconsideration phone line but you may want to just hold off (more on that below).

Two week message

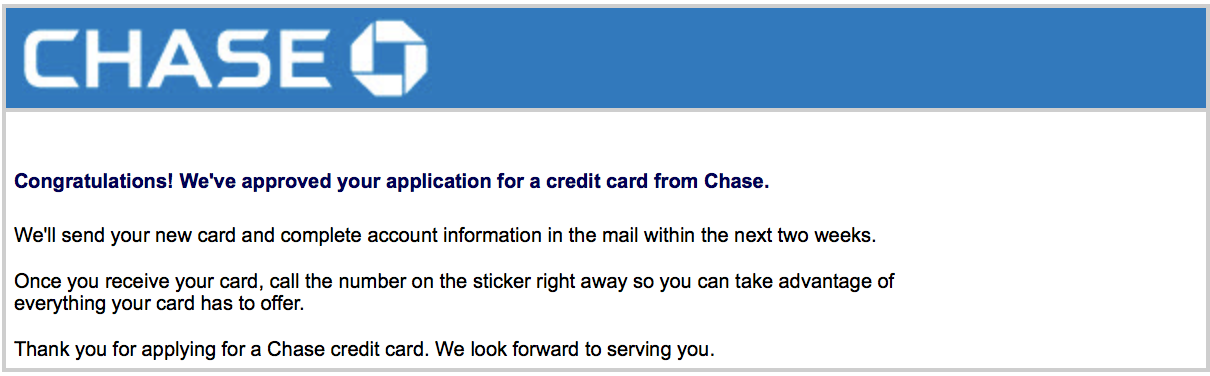

If the automatic status checker changes and tells you that you’ll be notified in two weeks, then you should be very happy because this message almost always means that you will be approved!

So I would recommend that you just be patient and await your approval email (assuming that it is coming) but you could also call in from time to time to check on it until you hear the official word.

Eventually, you will hopefully receive a message like the one below!

7 to 10 day message

If the automatic status checker changes and tells you that you’ll be notified in 7 to 10 days, I’ve got some bad news….

This message often means that you will be denied.

There are some situations where people receive the 7 to 10 day message and all they had to do was call in to verify some sort of personal information. For example, there could have been a discrepancy with the address they put on their credit card application versus the address that showed up on the credit report.

Or, Chase just might want to make sure that it was actually you who applied for the credit card. In that case, you might just have to answer a couple of easy security questions. For example, you might have to verify your old address or a car that you once owned.

So if you receive this message there still is some hope that you might get approved but for the most part you should expect a rejection to come.

At this point, you may want to go ahead and call into the Chase reconsideration line at: 1-888-270-2127.

Chase credit card application rules

Chase has some very specific credit card application rules that you want to make sure that you are following.Two of the most popular rules are the 5/24 rule and 2/30 rule.

Hopefully, you already had an idea about these rules before you ever applied and you made sure that you were not violating any of these rules.

However, if you just applied and were not automatically approved then you should read up on these rules and you might be able to find out why you were not approved.

If you are in violation of these rules, you stand a very, very small chance of getting approved and you should probably just expect to be denied.

But, if you were not in violation of any of these rules, and you were not automatically approved then you should probably look into calling into Chase reconsideration.

Chase reconsideration line

The Chase reconsideration line is your opportunity to plead your case and try to convince Chase to approve your credit card applications and even overturn rejections.

The goal here is to show Chase that you had a legitimate need or desire to open up a new Chase card or multiple cards so that they will reverse their decision and approve you for a card.

The Chase reconsideration line phone number is 1-888-270-2127.

The Chase reconsideration hours of operation are usually:

- 7am to 10pm EST Monday through Friday

- 8am to 1 pm EST Saturday

- 9am to 9pm EST on Sunday

How to handle a reconsideration call

There are some things that you don’t want to say in a phone call like this and then there are some things that you do want to say.

For example, you don’t want to tell Chase that the primary reason you are chasing a credit card is the amazing 50,000 point sign-up bonus. That makes you sound like an unprofitable customer (or even worse a “gamer”) and you are going to have an uphill battle to get approved once that happens.

But if you have a more legitimate reason for needing cards such as the need to segregate your expenses then Chase will likely be more onboard with your reasons for getting the card.

I suggest that you check out my article on the Chase reconsideration line and it will break down everything that you should say (and should not say) in a reconsideration phone call.

Chase business reconsideration line

Lastly, if you have applied for a Chase business credit card then there will be additional questions that you need to be prepared for in the reconsideration call.

These reconsideration calls for business credit cards are usually more intense and can be a little bit more stressful to get through.

So I highly suggest that you check out my article on Chase business reconsideration calls — it will walk you through everything you need to know to prepare for a business recon Phone call.

FAQ

The automated phone number to check your Chase credit card application status is: 1-888-338-2586.

Yes, you can check your application status online but only if you have an account with Chase.

If you receive this message it most likely means that your application is being processed.

The two week message usually means you will be approved.

This message often means that you will be denied (but not always).

Final word

Checking your application status with Chase is a little tricky because of all of the different types of messages that you can receive when your application is not automatically approved. But, once you understand what each of these messages mean it is actually pretty easy to get a sense of what to expect when it comes to your approval.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Great article! Thank you for posting. I have a question: My status went from the 30 days to the 7 to ten day message, so after reading this article I called the reconsidertion line, where I was told that my application was denied. I called back and a new agent asked me different types of address verification questions. At the end of our call, I was told that I was being recommended for approval and that I would hear from Chase within 14 days. This threw me for a bit of a loop because I heaven’t heard anything about this type of response anywhere. I called the application status line again two days later and I got the same 7-10 day message. Does anyone have any thoughts or insight about this?

I just applied for the Chase Credit Card and I’m wondering how long it will take for me to get an application status?