The Chase Hyatt Card and the Amex Hilton Ascend are two of the hottest co-branded hotel credit cards. They both come with a range of valuable perks and each of them has their strengths and weaknesses. This review article will highlight the pros and cons of each card so that you’ll have a better idea of which is the better card for you.

Update: Some offers are no longer available — click here for the latest deals!

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Table of Contents

Welcome bonus

The World of Hyatt Card

- Earn 40,000 points after you spend $3,000 on purchases within the first 3 months of account opening

- Plus, earn an additional 20,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months of account opening.

The Hyatt card offers an initial 40,000 point sign-up bonus after spending $3,000 in the first three months. 40,000 points can get you at least one night at a very nice Hyatt property or two nights at a category 5 property, which could still be a very nice Hyatt property.

The additional 20,000 points could help you cover some expensive hotel stays but you only get it if you spend a total of $6,000 in the first 6 months. You can think of this offer as its own sign-up bonus of 20,000 Hyatt points after spending $3,000 (since you would have already spent $3,000). That’s not a bad offer considering how valuable Hyatt points are so it’s definitely worth considering the higher offer.

The one major drawback to Hyatt is that the global footprint is much smaller than it is for Hilton. If you choose to go with Hilton, you’ll be able to find properties in many areas around the globe much easier (but not always). So if you’re someone who really likes simplicity and you want to use be able to use your awards more consistently, Hilton might have more of what you’re looking for.

Amex Hilton Ascend

- 125,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card within your first 3 months of Card Membership

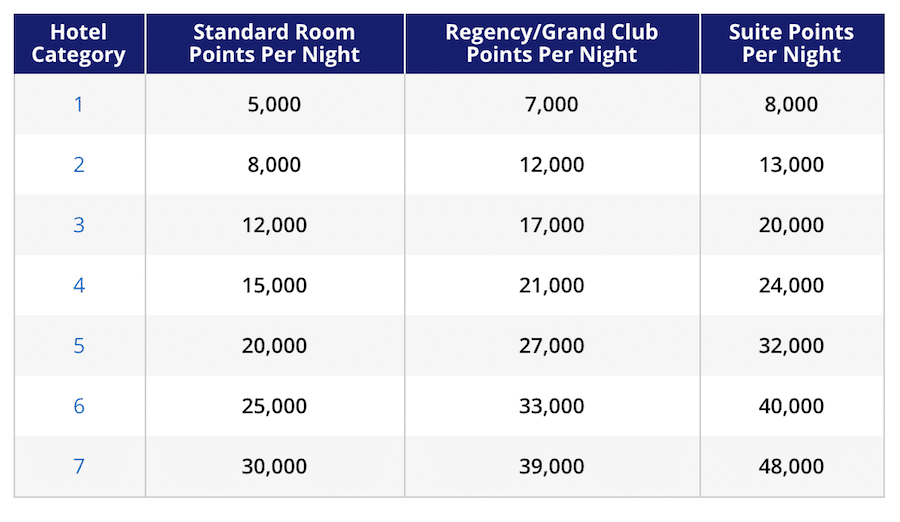

125,000 points could cover two nights at a great hotel but you won’t get as much value out of Hilton points compared to Hyatt points. In fact, Hilton points can be worth as little as 1/3 of Hyatt points so a Hilton 125,000 points offer would be roughly equivalent to a Hyatt 41,000 point offer. So don’t be misled by the apparent value of the welcome offers.

Bonus earnings

The World of Hyatt Card

- 4X spent with your card at Hyatt hotels, including participating restaurants and spas

- 2X on local transit and commuting, including taxis, mass transit, tolls and ride-share services

- 2X at restaurants, cafes and coffee shops

- 2X on airline tickets purchased directly from the airline

- 2X spent on fitness club and gym memberships

If you value Hyatt points at 1.5 cents per point, that’s like getting 6% back at Hyatt properties and 3% back on the other categories like local transit, restaurants, cafes, coffee shops, and airline tickets. You’ll also earn bonus points for spend at fitness clubs and gyms, which is a special perk not offered by many other credit cards.

Amex Hilton Ascend

- 12X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 6X Hilton Honors Bonus Points at U.S. supermarkets, U.S. restaurants, and U.S. gas stations

- 3X Hilton Honors Bonus Points on all other eligible purchases

If you value Hilton Honors points at .5 cents per point, then you’re getting a 6% return on Hilton purchases and 3% return at U.S. supermarkets, U.S. restaurants, and U.S. gas stations, which is actually very good. The only slight bummer is that the categories are restricted to US establishments.

Both of these cards offer good returns, so you’ll just have to decide which bonus categories fall within your preferred way to spend.

Personally, I wouldn’t put the focus on bonus earning. For one, you can usually earn better points with other credit cards on many of these purchases. For example, you could use Sapphire Reserve for dining purchases to earn 3X Ultimate Rewards which would be worth more than what both of these cards offer.

Secondly, I’d focus more on the welcome offer, free night, and elite status as the primary things I’m concerned with when it comes to a hotel credit card. That’s usually where the value is going to be primarily at for a lot of people.

Free nights

The World of Hyatt Card

- Receive one free night at any Category 1-4 Hyatt hotel or resort every year after your cardmember anniversary

- Earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year

You can find a breakdown of category 4 Hyatt properties here.

Amex Hilton Ascend

- One Weekend Night Reward at a hotel or resort in the Hilton portfolio after spending $15,000 in purchases in a calendar year

- Sometimes offered with the welcome offer

The World of Hyatt offers a free night each year regardless of how much you spend on your card. But you can also get another free night if you spend $15,000 on your card. The Hilton Ascend sometimes offers a free night with the welcome offer which is huge plus. But if it’s not offering that, you’ll only get a free night once you’ve spent $15,000.

So it’s nice that you’ll always get a free night with the Hyatt card but keep in mind that those free nights are limited to hotels in category one through four. The Hilton free nights are limited to weekend nights (Fri, Sat, and Sun) but you can use those free nights at any category hotel with Hilton, which means they can be much more valuable.

For example, you could redeem your free night certificate at the Hilton Maldives for a water villa (when available), a value that could exceed $1,000!

Elite status

The World of Hyatt Card

The World of Hyatt Card comes with Hyatt Discoverist status.

That is the bottom tier status that doesn’t offer you a whole lot but it can get you a ten percent point bonus on the Base Points, upgrades, premium in-room internet access, late check-out, and discounts on purchases.

The real elite perks of this card come in two forms:

- Receive 5 qualifying night credits toward your next tier status every year

- Earn 2 additional qualifying night credits toward your next tier status every time you spend $5,000 on your card

So with the Hyatt card you can more easily qualify for elite status with five qualifying night credits. Explorist requires 30 qualifying nights while Globalist requires 60 qualifying nights.

And what’s even sweeter is that you can continue to climb the elite status ladder with your spend. For every $5,000 you spend, you’ll get two elite credits which is fantastic for big-spenders. If you’re a high spender and Hyatt loyalist then the new Hyatt card is very tempting.

Amex Hilton Ascend

The Amex Hilton Ascend comes with automatic Hilton Honors Gold status.

Unlike the status that comes with the Hyatt credit card, the Amex Hilton Ascend offers meaningful status in the form of Hilton Gold. This is a mid-tier status that will get you the following benefits:

- Upgrades (sometimes even with lounge access)

- Free breakfast

- Free wifi

- Late check-out

Hilton Gold is one of my favorite mid-tier statuses and getting that perk with the Hilton Ascend is a huge plus. If you want to have a status where you can actually look forward to enjoying real, valuable benefits then the Hilton Ascend may be the better choice for you.

Annual fee

The World of Hyatt Card

$95 (not waived)

Amex Hilton Ascend

$95 (not waived)

Foreign transaction fees

Both cards do not come with foreign transactions.

Don’t forget about the Hilton Aspire

The Hilton Aspire is one of the most loaded premium cards in terms of benefits. Here’s a look at everything the Hilton Aspire card has to offer.

- 100,000 points after spending $4,000 in the first 3 months

- 14X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 7X Hilton Honors Bonus Points on flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and at U.S. restaurants

- 3X Hilton Honors Bonus Points on other purchases

- Complimentary Hilton Honors Diamond status

- One weekend night at any hotel or resort in the Hilton portfolio (upon opening account and on account anniversary)

- Weekend night after spending $60,000 on the card within a calendar year

- Unlimited Priority Pass membership

- $250 airline incidental fee statement credit

- $250 Hilton resort statement credit

- $100 on property credit at Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts when booking the exclusive Aspire Card package

- $450 Annual Fee

Final word

Both of these are solid credit cards. I think that when the Hilton Ascend comes with a free night with the sign-up bonus, it’s by far one of the best hotel cards and I’d consider going with that card at that time. But for other times, I would focus more on my overall needs for a hotel card. Are you trying to benefit from elite status? Are you interested in the free nights? Etc.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.