Two of the most popular credit cards issued by Chase are the Chase Ink Cash and the Chase Sapphire Preferred. These cards have some similarities in that they both offer a lot of value but there are some key distinctions to be made between these cards, too.

Here’s a comparison of the Chase Ink Cash vs the Chase Sapphire Preferred and many of the key considerations that you’ll want to review before making your decision on which one to apply for.

Table of Contents

Business vs personal cards

The first thing to consider when choosing between these cards is that the Chase Ink Cash is a business credit card and the Chase Sapphire Preferred is a personal credit card.

This means that you’ll need to have a business in order to apply for the Chase Ink Cash.

But that doesn’t mean you have to have a traditional business — there are lot of different types of businesses and even things like selling items on eBay could be a sufficient business. You can read more about how to get approved for business credit cards here.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Sign-up bonus

Chase Ink Cash

The Chase Ink Cash comes with a very solid sign-up bonus of $500 in cash back after spending $3,000 in the first three months.

The Ink Cash earns cash back for its sign-up bonus. Basically, you’ll earn 50,000 Ultimate Rewards which can be cashed out at a rate of 1 cent per point for a total of $500.

However, if you have a premium card like the Chase Ink Preferred, Sapphire Preferred, or Sapphire Reserve then you’ll take home 50,000 Ultimate Rewards which can be transferred to a lot of travel partners (more on that below).

The Chase Ink Cash also comes with 0% introductory APR for 12 months on purchases, which adds a lot of value for many people.

Chase Sapphire Preferred

The Chase Sapphire Preferred offers 60,000 Ultimate Rewards after spending $4,000 in the first 3 months.

The Chase Sapphire Preferred has two major advantage over the Ink Cash when it comes to using your points. First, you get a 25% bonus on your points when using the Chase Travel Portal which means your points will be worth 1.25 cents per point when using the travel portal.

The travel portal is great for booking flights and not having to worry about open award inventory, black out dates, etc.

Getting that extra bit of value will allow you your points to last longer and it can be a good way to cover the cost of cheaper flights which would usually offer poor value for your miles.

The other advantage that the Sapphire Preferred has over the Ink Cash is that you can transfer your points out to the various travel partners. Transferring your points out to these partners means that you’ll be getting a lot more in value from your points.

For example, you can use your Ultimate Rewards to fly on some amazing first class and business class products like the new Singapore Airlines first class product.

Here’s a list of all of the transfer partners.

Chase Ultimate Rewards Airlines

- Aer Lingus

- British Airways Executive Club

- Emirates

- Flying Blue (Air France/KLM)

- Iberia Airways

- JetBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Chase Ultimate Rewards Hotels

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

So while the sign-up bonuses are very similar, the Sapphire Preferred wins out due to the increased value when using the Chase Travel Portal and for the added flexibility of being able to transfer points to travel partners. It is much more of a true travel credit card than the Ink Cash.

Bonus spending

The bonus categories for these cards are quite different, so you’ll want to make sure that you put proper value on the categories that line up with your spending.

Chase Ink Cash

The Chase Ink Cash will earn you 5% cash back on the first $25,000 spent in combined purchases each account anniversary year at:

- Internet, cable and phone services

- Office supply stores

Getting 5X is great especially considering that the Chase Ink Plus no longer is available to new applicants.

This is really where the “special value” of the Chase Ink Cash is in my opinion. Earning 5X adds up remarkably quickly so being able to pay your everyday bills like internet, cable, and phone services is a great way to supplement your point earnings.

5X at office supply stores can also be very lucrative if you can maximize that as well. Just keep in mind that the $25,000 spending limit is combined for these categories, so if you do whole lot of spending each year, your rewards may be capped (the rewards for the Sapphire Preferred are not capped).

Earn 2% cash back on the first $25,000 spent in combined purchases each account anniversary year at:

- Gas stations

- Restaurants

Getting 2X on dining is the same as the Sapphire Preferred and while 2X on gas is nice, it’s not the most rewarding card for spend on gas purchases.

- Related reading: 10 Best Credit Cards for Online Businesses

Chase Sapphire Preferred

The Chase Sapphire Preferred earns the following rates:

- 2X on dining

- 2X on travel

The 2X back on dining is basically the same as the Ink Cash but it’s worth more since you can get more value from your Ultimate Rewards than with the Ink Cash.

But besides that, the 2X on travel is where the Sapphire Preferred is most different from the Ink Cash. These aren’t bad earning categories but keep in mind that the Chase Sapphire Reserve earns 3X on both of those categories.

Overall, the bonus categories are very different so this is a situation where it makes sense to pick up both of the cards so that you can have a well-rounded way of earning rewards.

The Ink Cash definitely has the more diverse bonus categories but for someone primarily concerned with travel (and using points for travel), the Sapphire Preferred could still be the better option.

Primary rental car coverage

Both of these cards come with primary rental car insurance which can save you a lot by allowing you to avoid filing any kind of claim with your insurance provider.

But you should note that the Chase Ink Cash offers primary rental car coverage when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the U.S. and abroad.

The fact that you can get primary rental car coverage with a no-annual fee credit card is huge in my opinion but the restriction on travel for business purposes could mean that the protection is not as valuable as the protection offered by the Sapphire Preferred which covers personal use. (The Ink Cash offers personal coverage for international trips.)

Other protections

The line-up of additional protections is very similar between these cards but there’s at least one key difference.

Baggage delay

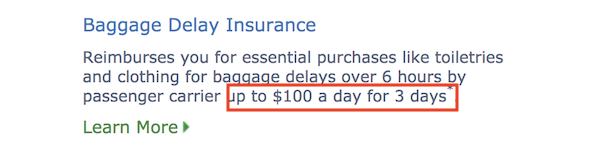

The Chase Ink Cash provides baggage delay coverage for delays over 6 hours up to $100 a day for three days. Meanwhile, the Sapphire Preferred provides coverage for delays over 6 hours up to $100 a day for five days. It’s pretty rare for baggage delay to (need to) extend to over 3 days but it’s a good idea to be aware that there’s a difference in coverage here.

Lost luggage

Both cards cover up to to $3,000 per insured person per covered trip with a $500 limitation for coverage for jewelry, watches and electronics.

Extended warranty

Both cards extend the time period of the U.S. manufacturer’s warranty by one additional year, on eligible warranties of three years or less.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Annual Fee

Chase Ink Cash

- No annual fee

Chase Sapphire Preferred

- $95 annual fee

Again, the Chase Ink Cash stands out as being one of the most rewarding credit cards with no annual fee. Meanwhile, the Chase Sapphire Preferred has a pretty standard annual fee of $95.

Chase application rules

Both of these cards are subject to the Chase 5/24 rule and because of that you will be denied for these cards if you’ve opened up 5 or more accounts within the past two years.

One positive thing about the Chase Ink Cash is that it won’t count toward your 5/24 status with Chase. This means that if you have 3 cards opened up in the past 24 months right now and then you open up an Ink Cash, Chase will still view you as someone who has only opened up 3 cards. Thus, it could make sense to apply for the Chase Ink Cash now and then to get on board with the Chase Sapphire Preferred later on.

In addition to 5/24 there are some other Chase application rules you might want to read up on to make sure that you’re not violating any of these rules. If you want to find out your 5/24 status, you can use the new app WalletFlo to help you out!

Chase Refer a Friend

Both of these participate in the Chase Refer a Friend program, but currently the Chase Ink Cash does not pull up referral offers. This means that with the Sapphire Preferred you’ll be able to earn many more points with referrals which is definitely something to consider.

Also, it’s probably easier for the average person to refer someone to a personal card than it is to refer someone to a business card so that’s another consideration. You can read more about the referral program here.

Chase Ink Cash

The Chase Ink Cash is known for offering referrals although currently you might not be able to pull them up. But typically, the Chase Ink Cash referral allows you to earn 10,000 Ultimate Rewards per approval up to a maximum of 50,000 points per calendar year.

Chase Sapphire Preferred

The Chase Sapphire Preferred referral allows you to earn 10,000 Ultimate Rewards per approval up to a maximum of 50,000 points per calendar year.

Chase Shopping Portal

Both of these cards will give you access to the Chase Shopping Portal. The Chase Shopping Portal is a special website open only to Chase cardmembers that allows you to earn additional bonus Ultimate Rewards when making purchases at various online retailers. It’s a fantastic way to increase your earnings and rack up points — you can learn more about this portal here.

Approval odds

Both of these credit cards are going to require you to have good to excellent credit scores. And beyond that, you’ll want to have established credit history spanning at least a couple of years before applying.

I wouldn’t apply for either one of these cards if I was brand-new to credit cards and lacked a proven credit profile. If you want to read more about approval odds for the Sapphire Preferred you can do that here.

Since the Ink Cash is a business card you might need to call in to Chase business reconsideration to try to get your application approved. I’ve got an article on how to deal specifically with Chase business reconsideration, which you can read about here.

Final word

The Chase Sapphire Preferred and the Chase Ink Cash are a duo that can really make sense to pursue. They’ve both got great sign-up bonuses but they have very different bonus categories, making them a good pair to utilize. I think the decision for which cards to choose will often come down to:

- Spending habits and limits

- Travel goals (redemption goals)

- Travel habits and purpose (business vs personal)

- 0% APR

- Annual fee

- 5/24 status

- Referral potential

If you get a good grasp on those factors, you should be able to make a sound decision on which card is best for you.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.