The big trend these days is for credit card issuers to attach special credits to your credit cards. These credits serve a few purposes. They allow the issuer to increase the annual fee while providing a benefit that many consumers will not remember to use or maximize. They also allow the credit card companies to tap into targeted markets such as the rideshare markets that are popular with millennials.

As a result of these new trends, it is now more difficult to keep tabs of credits attached to credit cards because there simply are so many and they all work differently. Below, I will cover some factors you want to consider for maximizing your credits and then show you the best way to keep track of all of your credits.

Table of Contents

Issuing dates

Credit card credits usually are issued in the following ways.

Calendar year

This is probably the most popular type for a credit. If a credit is issued every calendar year, that just means that it will reset on January 1. Sometimes if your purchase does not process until the new year, you will miss out on the credit even though you made the purchase in the year before so keep that in mind. Also, it is possible that some credits like Chase reset after your December statement closes so that is something else to be mindful of.

Anniversary year

A credit is issued on an anniversary year if it resets every year on the date that you opened the card. So if you opened up your card on August 13, then that credit should reset every year on August 13. These type of credits have become less common due to people double dipping and abusing awards.

Monthly credits

There are some cards like the Amex Platinum and Gold that offer a monthly credit for rideshare services or food delivery services. These credits do not usually roll over from one month to the next so you have to use them up each month which means you need to remember to use them.

Some months might even offer a higher credit than others so that is something else you need to keep tabs on.

Other times

Other credits may be issued in the middle of the year or at various points throughout the year. It is also possible that the credit is not dependent on time but simply issued when you take an action like booking a certain type of hotel.

Purchases that trigger the credit

Some credits are very specific and only work with a specific type of retailer or company such as DoorDash. However, some other credits are more broad and might apply to different types of airline purchases or to all types of travel purchases.

There will usually always be exclusions to be aware of and then there will be exceptions to these exclusions that you can often find on online forums, etc. In order to optimize your credits, you really want to be informed on the latest exceptions and trends.

Activation

Some credits will be instantly activated when you make a qualifying purchase but there are a few credits out there that require you to activate the credit or take some other action to enroll in a benefit. For example, American Express airline credits require you to select an airline each year in order to activate your credit. Some banks may offer you some grace for forgetting to do this from time to time but generally you want to abide by the activation requirements in order to get your credits.

Tracking your spend on the credit

Some issuers offer trackers so that you can track the spend on your credits. For example, the Sapphire Reserve offers a tracker for its $300 travel credit. Not all of the banks offer these trackers though so sometimes you have to keep tabs on your spend yourself.

The best way to track your credits

So how are you supposed to keep track of all of this information? The best way to keep track of your dining and travel credits is with the new app coming out called WalletFlo.

WalletFlo is a digital smart wallet that automates all of the credit card eligibility rules but it also does a lot more to help you manage your credit cards.

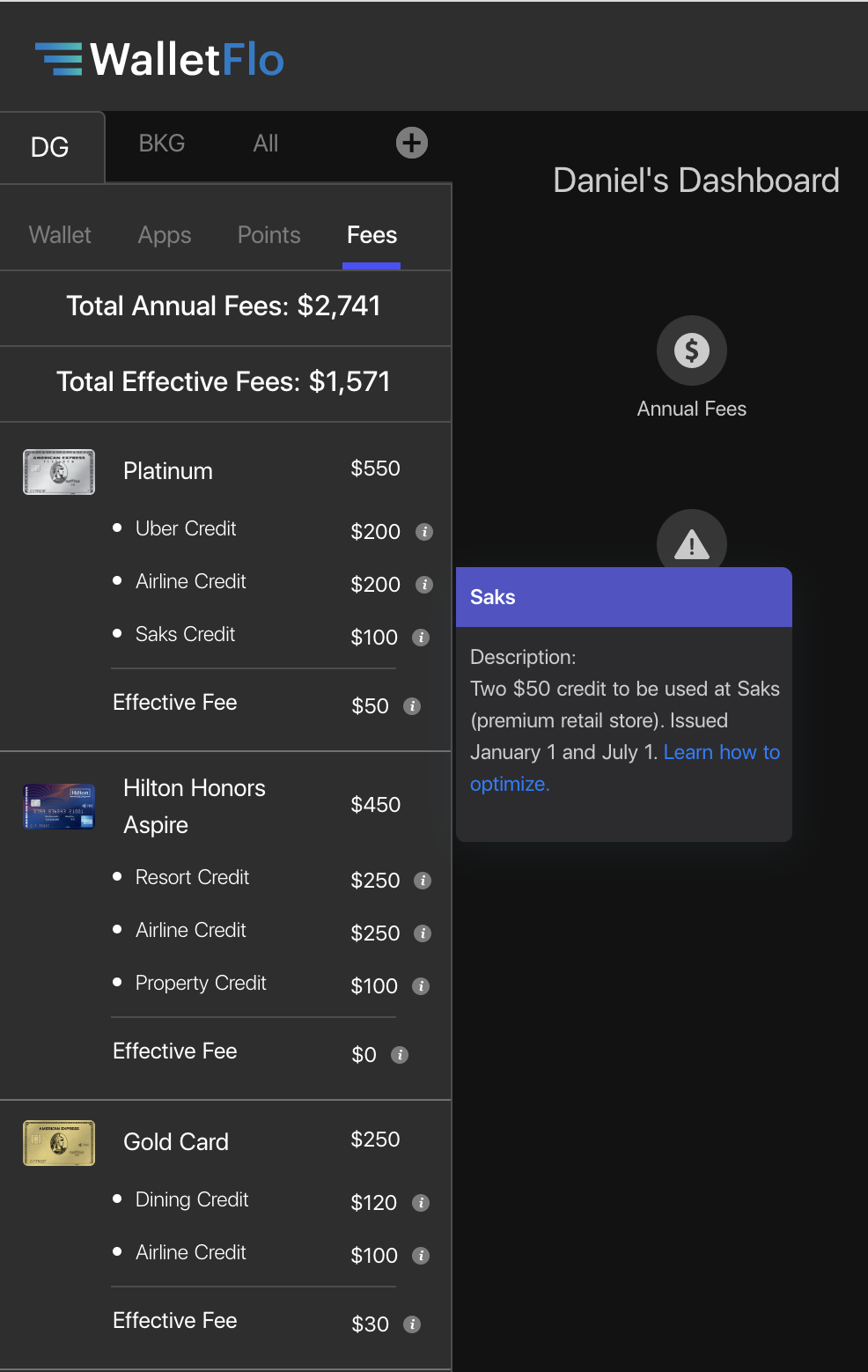

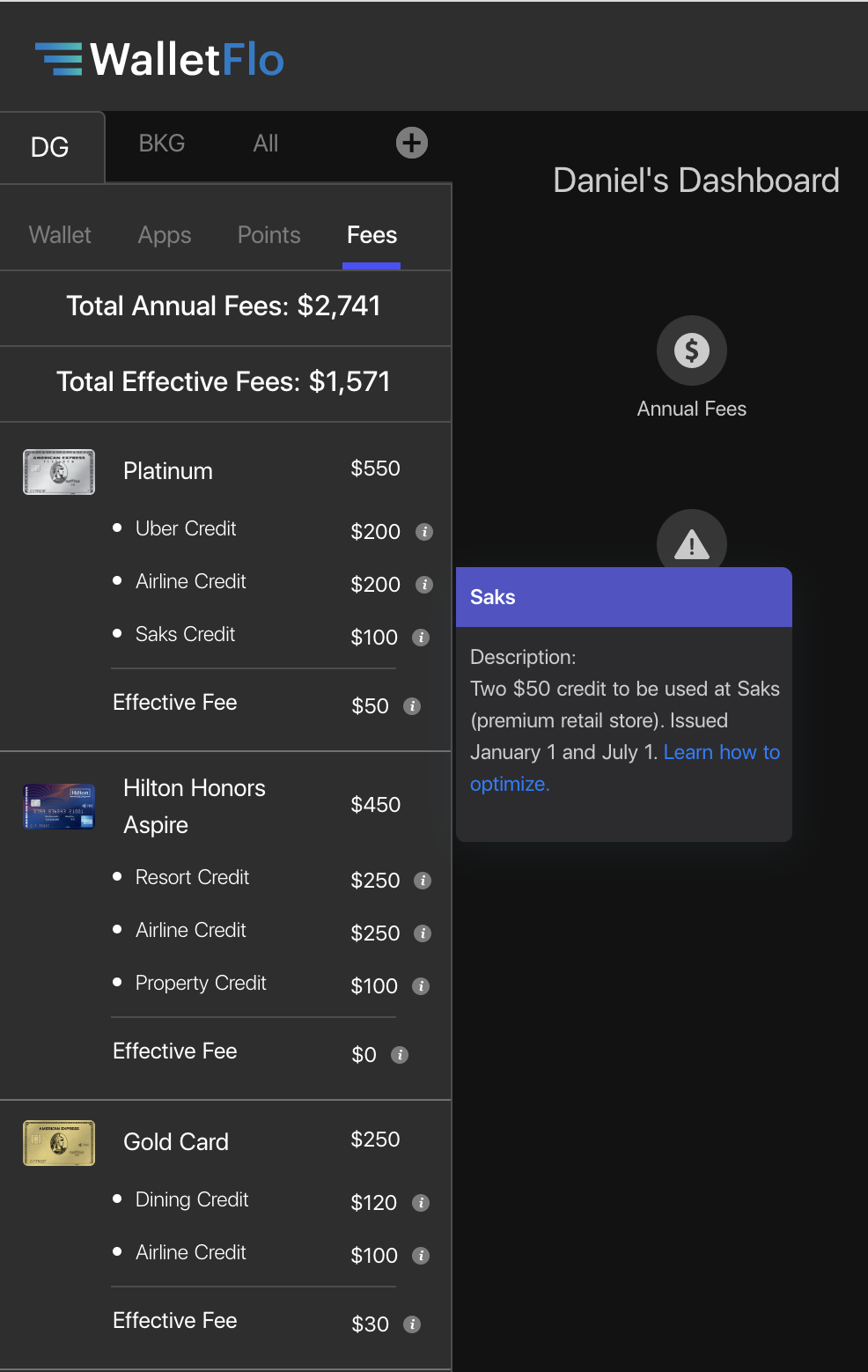

One of the features is what is known as the fees tab which tracks your annual fees and credits attached to your cards. To use this feature you simply click on the fees tab and you will see a full breakdown of your fees and credits.

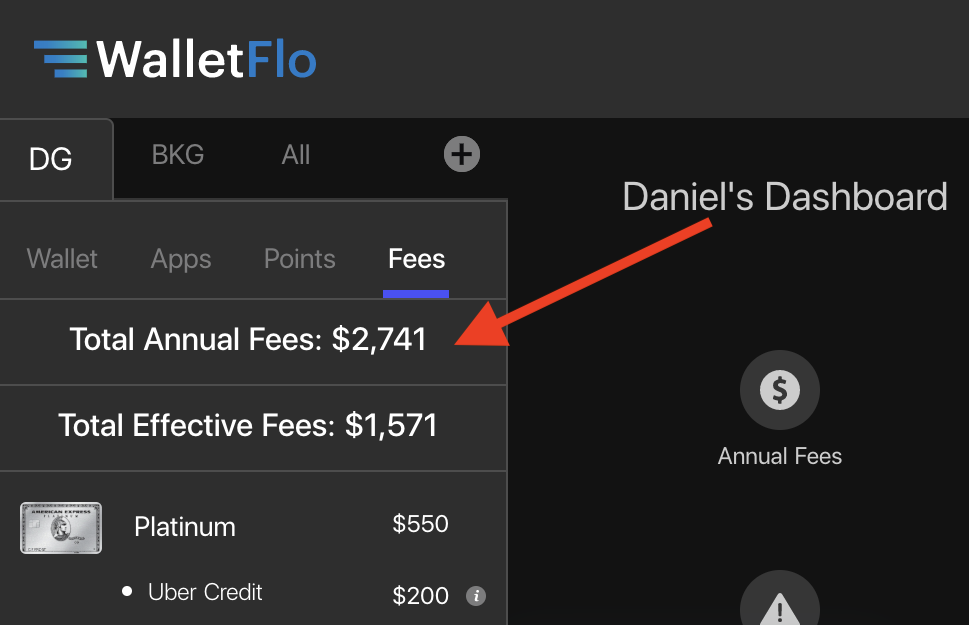

Annual fees total

The first thing you will see is the annual fees total. This calculates the total amount of annual fees that you are paying each year. (If you have a partner with you then you can click on the “all tab” and see the total amount of annual fees due between the two of you.)

If you have opened up a lot of cards and never calculated your total annual fees, you might be surprised to see how much you are paying in fees per year. This simple calculation will open many people’s eyes as to how much they are putting into annual fees each year.

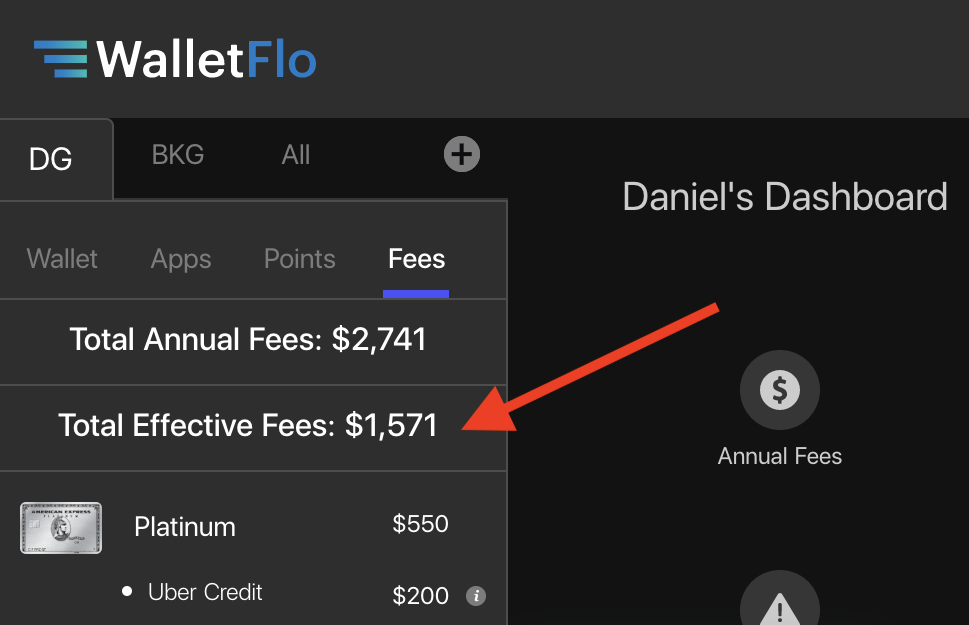

Effective annual fees total

Right underneath that you will see your effective annual fees total. This total is calculated by adding up the total amount of annual fees and subtracting the total amount of annual credits you are issued. The idea is to give you an instant picture of how much you are paying on your fees if you utilize all of your credits.

You can also see the effective fee for each credit card that you have.

Breakdown of your credits

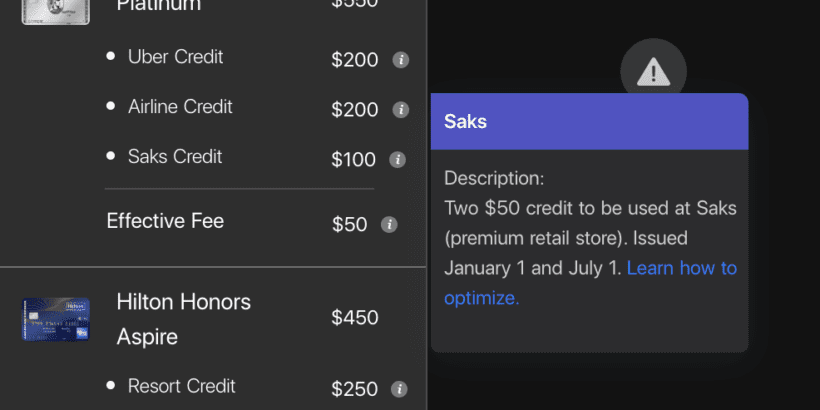

For each card, you will see the name of the credit and an accompanying information box that you can click on to get relevant details about the credit. The relevant details that you will find include information like how much the credit is, what the credit works with, and when it is issued.

This will be an easy way to keep track of when your credits will reset, whether that is on an anniversary or a calendar year basis or some other period of time like a month to month basis.

In some cases, you will have questions about the details regarding your credit. In those cases you can click on a link to be taken to a helpful and up-to-date article regarding that credit. In those articles, you can find ways to optimize your credit and find out important details like if gift cards are excluded, etc.

Reminders?

The next iteration will likely have reminders that you can opt into if you want to be reminded to use your credits. For example, you might get a reminder 30 days before the end of the year to use your credit or you might get a reminder a couple of days before the end of the month to use a monthly credit.

Final word

The credit card companies are getting smarter and realizing how to make more money while increasing annual fees. But you can get just as smart by keeping tabs on all of your credits and staying on top of the different ways to maximize them by using an app like WalletFlo.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.