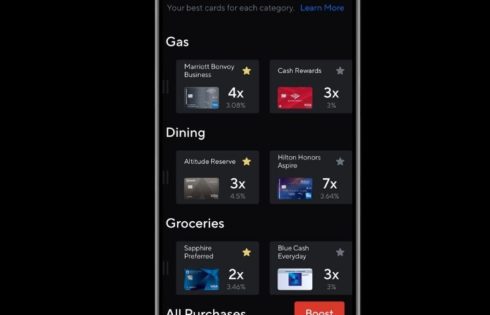

How to Know Which Credit Card to Use to Earn the Most Points

There are now a lot of credit cards that have rotating or changing bonus categories and other cards that get special promotional offers sometimes a few times a year. If

There are now a lot of credit cards that have rotating or changing bonus categories and other cards that get special promotional offers sometimes a few times a year. If

WalletFlo, Inc. is looking to add a new team member! If you want to join an early stage start up that is growing every month with proven traction this could

A lot of hotel credit cards offer you automatic hotel elite status or elite status perks. These are cards like the Amex Platinum, Chase Sapphire Reserve, Hilton cards, Marriott cards,

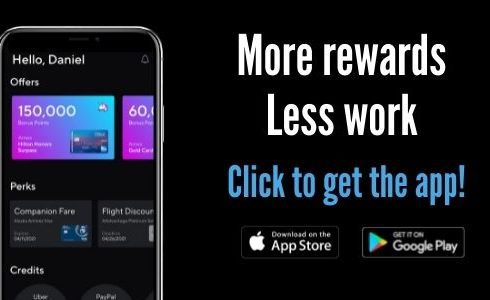

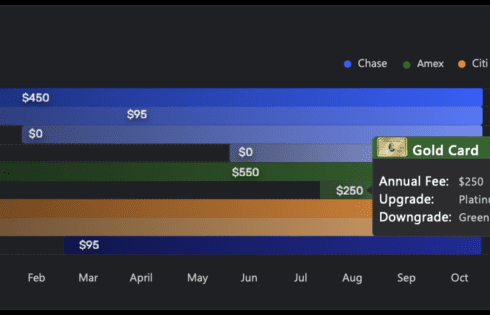

WalletFlo is a new mobile app that helps you optimize your credit card rewards and savings. The app is the ultimate credit card manager as it breaks down all of

Exciting news. The WalletFlo mobile app is coming soon! After being in the works for several months, it’s on pace for a December launch. The direction of this app was absolutely

WalletFlo is officially here! After a long six months, we’ve gone from crude sketches on a legal pad to a fully functioning platform. Putting this together has not been easy

I have given away a lot of gift cards over the past few years on this website but now I am ready to give away something I believe will be

It’s probably way easier than you think to get credit card details like your account opening dates and product change dates. In this article, I will break down how you

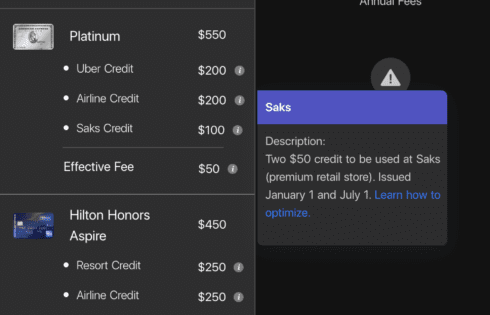

The big trend these days is for credit card issuers to attach special credits to your credit cards. These credits serve a few purposes. They allow the issuer to increase

After almost 6 months of working toward this project, I finally have a live demo to show you of WalletFlo! This demo is mostly focused on showing the features and

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |