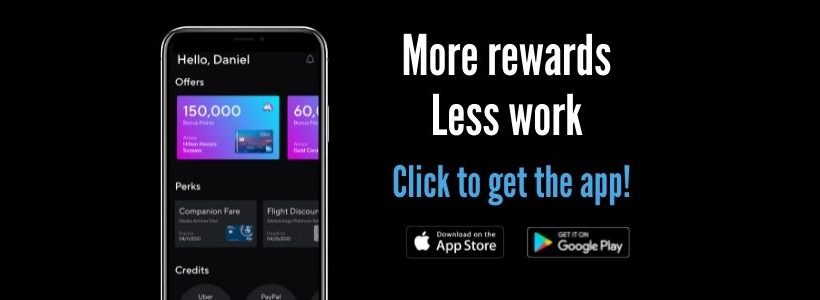

WalletFlo is a new mobile app that helps you optimize your credit card rewards and savings.

The app is the ultimate credit card manager as it breaks down all of your credit card features in a simple way that helps you easily figure out how to maximize them.

It also consolidate some of the best savings opportunities (deals and promotions) available and shows you how to stack them with other earning opportunities.

The end result is that you earn more savings and rewards with less effort.

WalletFlo is available on the Apple App Store and Google Play and there is a desktop version but this review is going to focus on the mobile app.

Below, I will highlight all of the current features and give you some insight into how they can add value to your life.

Table of Contents

Onboarding

Onboarding is pretty simple.

You can expedite the log-in experience by using Facebook, Apple, or Google.

You’ll be asked to supply a phone number for two-factor authentication. The phone number is never used for marketing and only used to keep your account secure but you can skip it if you would like.

After you have created your account, all you need to do is select the credit cards that you currently have which is pretty easy to do because they are searchable by issuer.

Tip: If you don’t see your credit card that you have you can submit it to the database and one of the admin’s will add the card to the database.

After you have selected your cards you then get a chance to input your account details. The most important detail to add is the open date.

You can still get a lot of value from the app if you don’t put in your accurate open dates but you will get much more value from all of the features if you take the time to get your open dates from your banks and/or credit report.

(One of the easiest ways to get your open dates is to simply call the number on the back of your credit cards.)

Something to note is that you do NOT have to input any type of personal information such as your credit card numbers, social, date of birth, etc. Combined with the bank-level encryption and two-factor authentication, this makes WalletFlo a very secure platform.

Once you’ve added your details you were ready to jump into the app!

Dashboard

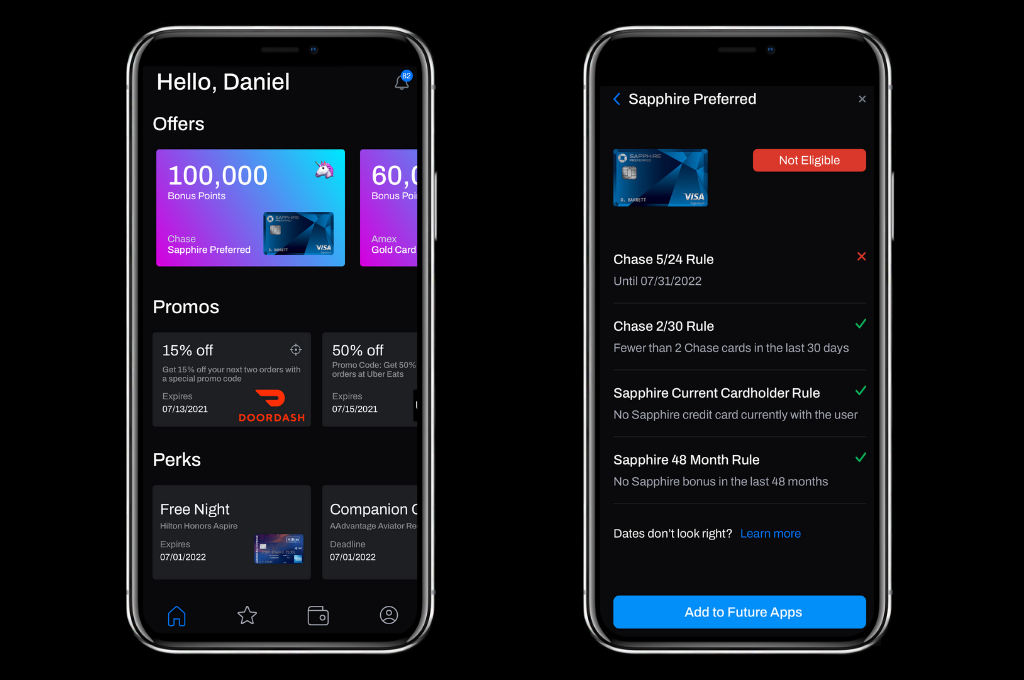

On your dashboard, you can find everything that matters to your credit card and savings life at a quick glance.

Offers

You’ll see the top credit card offers available.

The offers are ranked using emojis.

- A unicorn is a rare offer that typically has surpassed anything previously offered by a good margin.

- A diamond offer is an all-time high offer

- A fire offer is a strong offer but not the best that has gone out

There is also a mini review that gives you a breakdown of the history of the bonus and some context for how valuable the offer is.

When you click on an offer, you can instantly check your eligibility status within seconds just to make sure that you are eligible for the card and/or bonus.

For example, you will see a green check mark or red “X” for important rules like the 5/24 rule and dozens of other lesser known approval rules.

(This is why it is so helpful to input your open dates accurately.)

You can also find a direct link to the credit card offer and if you click on the tabs such as categories or perks you can browse the different benefits offered by the card.

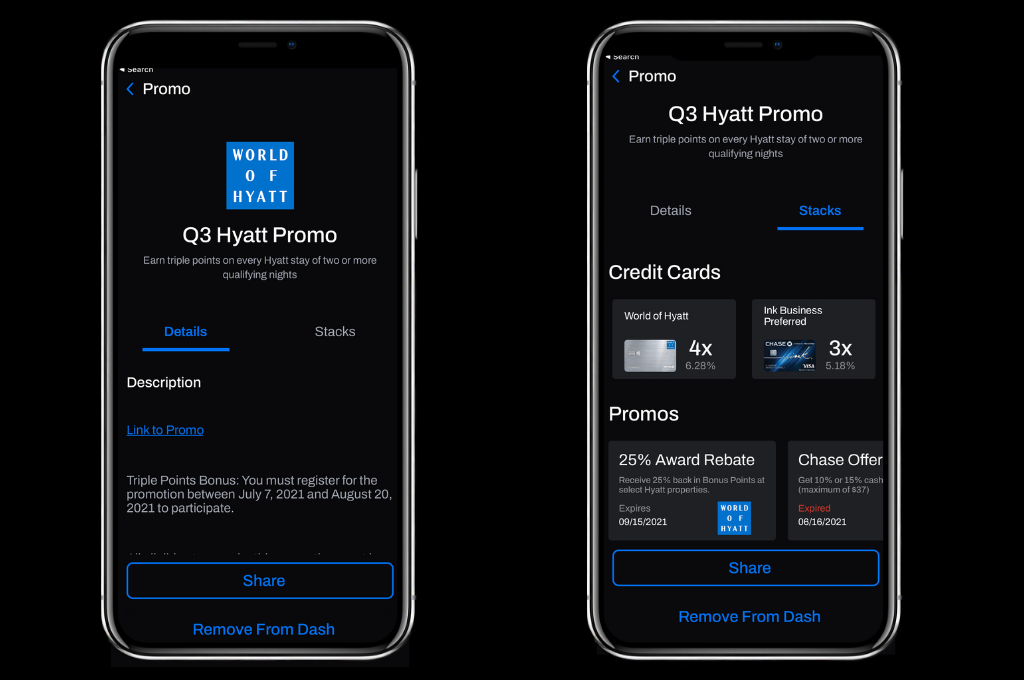

Promos

WalletFlo will give you a running list of all of the most popular promos (deals and savings) currently going on. These are offers like hotel promotions, Uber Eats/DoorDash promo codes, Amex Offers, freebies, etc.

If you click on a promo you will see the details of the promo and you will find a direct link to the promotion page if one is available.

Sharing

You can use the share button at the bottom to quickly share this promotion via text message, email, social media with friends and family so that they can also join in on the fun. (They do not have to have the app downloaded to see the promotion.)

Stacks

If you taps on “Stacks” you can see if any stacking information is available. (Stacking is when you take advantage of multiple opportunities at once in order to increase your savings or earnings.)

WalletFlo will show you which credit card to use for the promotion and how much you can potentially earn.

If there are any other promotions that stack with the promo you will see those. Also, if you have any perks or credits that can be used with the promotion those will also appear.

For example, maybe you have a travel credit that can be used with a Hyatt promotion or an Uber credit that can be used with Uber Eats, etc.

Perks and credits

The perks and credit tiles will show you all of your available perks and credits.

For example, if your card offers a free night you will see it displayed as a dashboard tile along with the expiration date. If you have any credits you will see how much of your credit is currently available and when it expires.

If you click on a perk or credit you can see the full details of your benefit. Many of the perks and credits also have a link that takes you to a detailed article on the perk or credit so that you can learn more about how to optimize it.

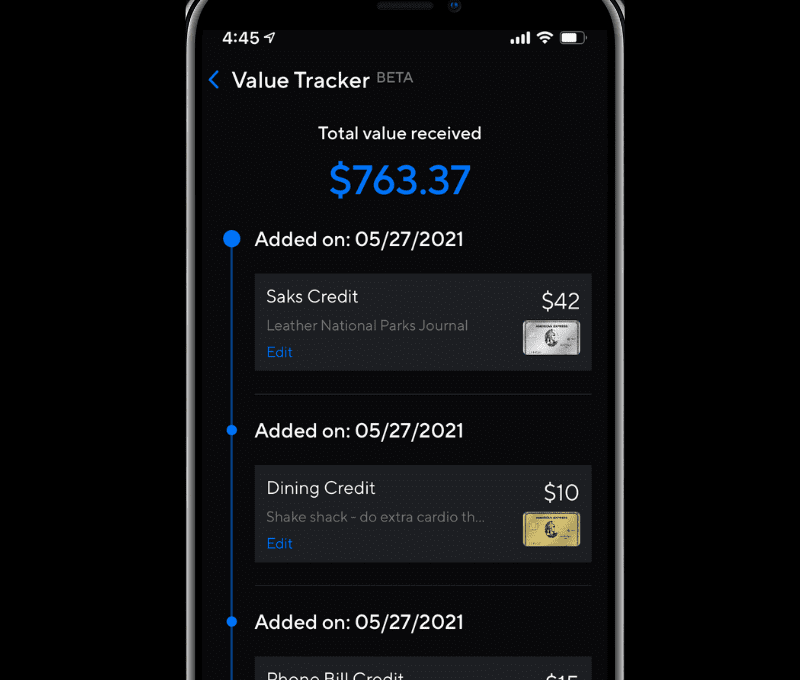

You can tap on “Track Usage” at the bottom of the screen and that will allow you to start tracking all of the credits and perks that you are using.

For things like credits you simply enter the amount that you used and if you would like to, you can also include notes that help you remember how you used your credit.

For perks, the feature is a bit more sophisticated.

You can track things like lounge visits and even keep up with benefits that have a limited quantity such as upgrades or lounge passes.

This is extremely helpful because it allows you to remember which benefits you still need to take advantage of so that you do not lose out on value.

Also, your entries go to your Value Tracker which keeps track of all of the value you earn from your credit cards over time.

Tip: You can also access your perks and credits by clicking into the wallet from the bottom navigation menu, and then clicking on a card.

Fees

You can see a running carousel of your upcoming annual fees along with due dates. This section is still getting developed so there’s still a lot to come!

Get WalletFlo on the Apple App Store and Google Play!

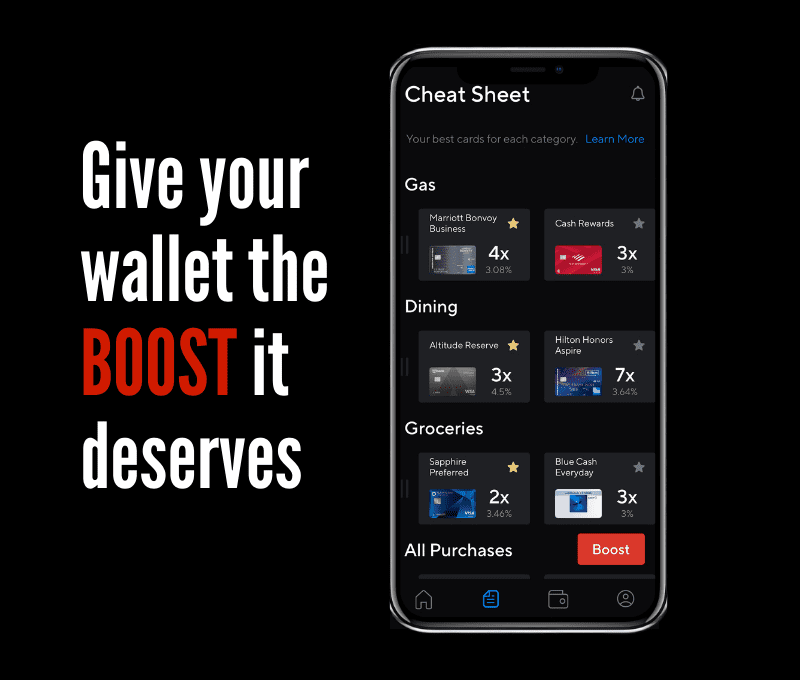

Cheat Sheet

The Cheat Sheet shows you which credit card is recommended for each category.

It will show you how many points you are projected to earn for a given category and also there is a percentage below the multiplier that translates this multiplier into approximate cash back value. (You can always customize your point values.)

You can “star” a card within each category if you would like to designate that card as your preferred card. You can also drag and drop the categories so that you can push all of the categories you care about to the top of your Cheat Sheet.

If you have rotating bonus categories every quarter these will automatically be updated in your Cheat Sheet.

There is also a little red button in the bottom corner called “Boost.”

If you tap Boost you will instantly see the top seven cards for each category you currently earn with. Not only that but you will also see the offer designation such as unicorn, diamond, fire, if there is an offer available for the card.

This is very helpful because it not only shows you which cards will earn you more points but it gives you insight into whether or not you should apply for one of those cards at the given time.

For example, if you see a card earned you 2X more points in a given category and has a unicorn offer that is a pretty clear signal that this card is worth applying for (assuming you’re eligible which you can check with the eligibility checker).

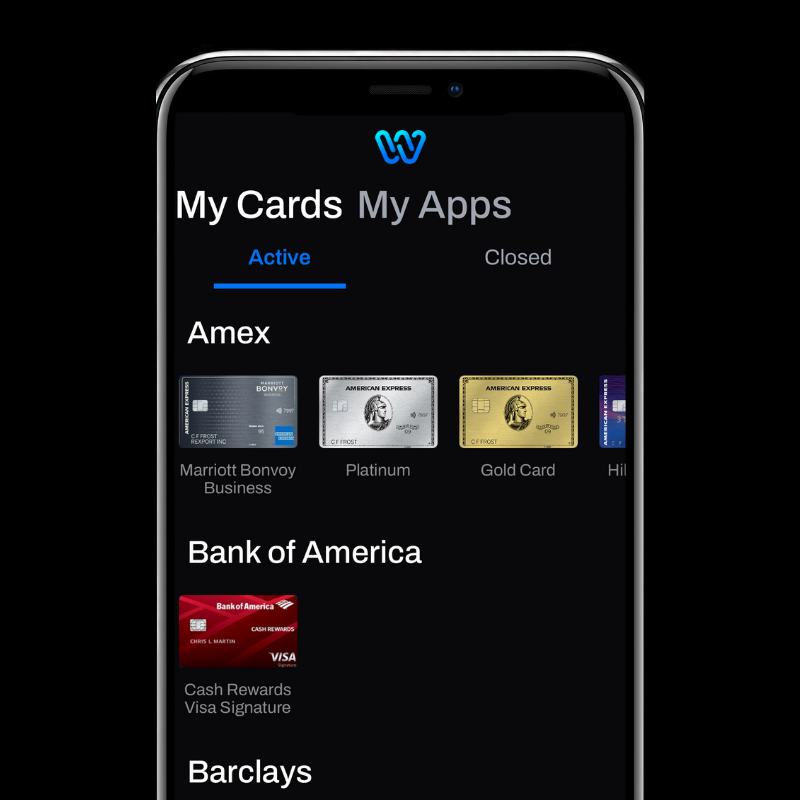

Wallet

Your wallet is where you can find all of your current credit cards and applications.

Under “My Cards” you will see a tab for both active and closed.

Active cards are all of the cards that are currently open, and closed cards are those that you have closed out. Pretty simple.

If you click on a card in your wallet you will see a complete breakdown of your card’s details.

You will see the bonus categories, perks, credits, fees, account details, and product change history.

A lot of the perks and credits will have direct links you can click on to learn more. (As mentioned, if you click on a perk or credit you can track your usage.)

Under account details you can input a nickname for the card which can be helpful if you have multiple cards or need to segregate your expenses. You can also edit your open date and add credit limit information.

WalletFlo is one of the only apps that allows you to track all of your product changes over time which is really helpful for getting the most accurate eligibility status.

If you click on the blue floating button in the bottom right corner you can add active or closed cards. You can also use the Eligibility Checker which checks to see if you are in violation of any application rules for major issues like Chase, American Express, Citibank, Barclays, etc.

The “My Apps” section is used to store your applications.

- If you see a card you are interested in but you are not ready to apply, you can add it to your future apps.

- If you have applied for a card but have not been approved you can add it to your pending apps so that you remember to follow up.

- If you were rejected you can add it to the rejected apps so that you can always keep tabs on what banks are rejecting you.

Profile

On this screen you can switch your profile or create an additional profile (perfect for a P1/P2 situation). And if you have more than one additional player you can also create numerous profiles.

Under your profile you will see your Value Tracker. Once again, to input entries into the Value Tracker simply click on a perk or credit in your dashboard tiles or in your wallet.

You can also find the “Contact Us” button so that you can always send a message if you need any help or need to point out any changes that need to be made within the app.

Newsletter

WalletFlo will hook you up with a newsletter that comes out about twice a week. It updates you on all of the latest offers and news in the credit card rewards/travel space. You will also get notified about new features when they are rolled out.

A lot of users have found the newsletter to be very valuable in terms of savings and staying on top of the latest news so it’s a great added plus to the product.

Get WalletFlo on the Apple App Store and Google Play!

Final word

That is the app as it exists right now. New features are constantly being dropped so when you sign up don’t be surprised for a new feature to come out shortly after!

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.