There are now a lot of credit cards that have rotating or changing bonus categories and other cards that get special promotional offers sometimes a few times a year.

If you have multiple credit cards you might find it difficult to remember which card to use in order to maximize your points.

Luckily, you can use WalletFlo to help you sort all these things out and keep you updated.

Table of Contents

How to know which credit card to use to earn the most points

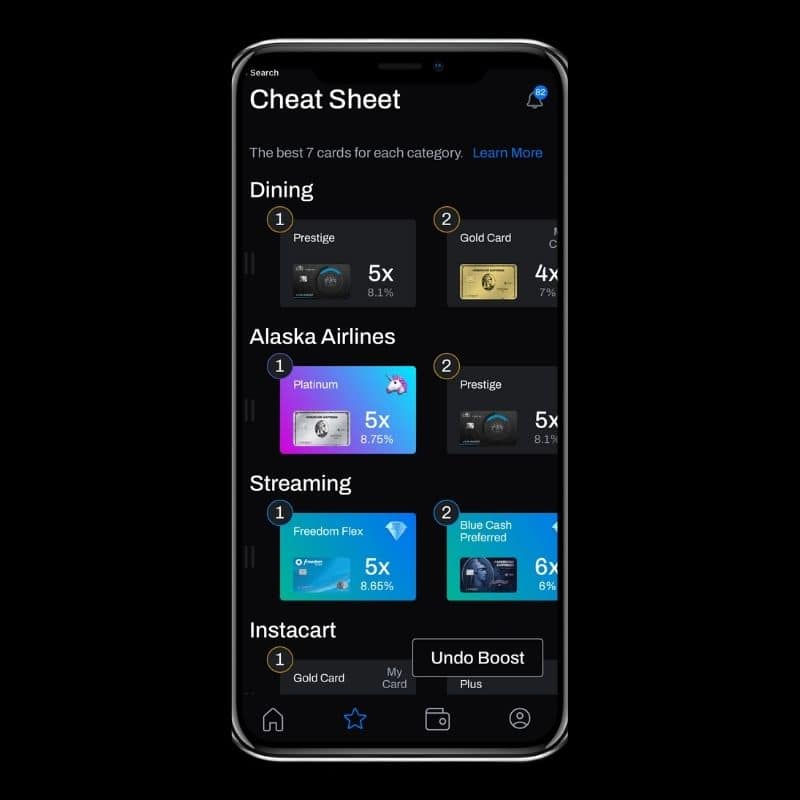

The easiest way to know which credit card to use to earn the most points is to use WalletFlo’s Cheat Sheet.

The Cheat Sheet is just one feature in the app and it keeps track of your earning rates for different spend categories and allows you to easily favorite cards you would prefer to use.

The WalletFlo app is available on both Apple and Android and it’s optimized to work with all major issuers like American Express, Chase, Citi, Bank of America, and many others.

The app has a lot of features that are great for people interested in optimizing their credit cards.

For example, there’s the Eligibility Checker which automates calculations for credit card eligibility rules, making it easier than ever to know if you are eligible for a given card.

But if you were trying to figure out which credit card to use at all times it is the Cheat Sheet feature you will be after.

How to use the Cheat Sheet

After you download the app you will have the ability to select all of your credit cards which shouldn’t take long.

You can then input your open dates which will help unlock other features like auto reminders for credits, perks, and annual fees.

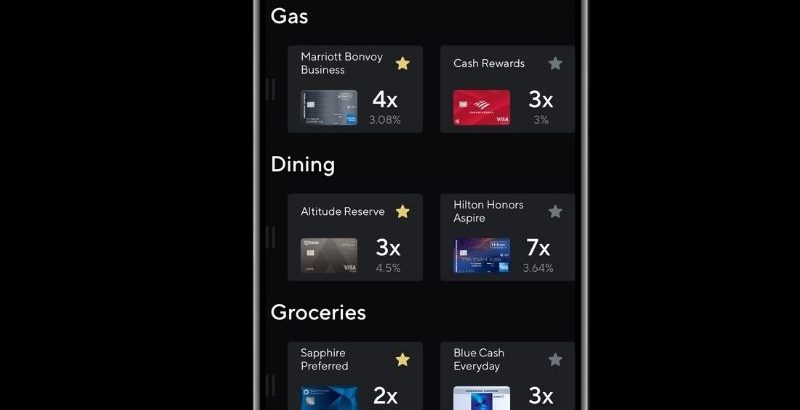

Once you are all set up simply tap on the Cheat Sheet and you will see a full breakdown of all of your spending categories, including the name and latest card art design for quick and easy recognition.

The cards are ranked in the order of the value that they bring you.

You will see the multiplier which means how many points you are earning per dollar spent in that category and then you will also see a percentage which shows you the cash back equivalent of that value.

The cards with the highest percentage are ranked at the top because those are seen as the most valuable.

If you have your own point valuations you can input those into the app and the Cheat Sheet will adjust accordingly.

Also, if you tap on the card you will see all of the other bonus category information for that card.

Swipe over and then you can see your full breakdown of things like the credits and perks, which makes it really easy to keep up with things like hotel free night certificates, policies for things like Centurion Lounge access, etc.

Note: If you have rotating quarterly categories, WalletFlo will automatically update those categories every quarter so you just need to remember to activate them if needed.

The star feature

Also, if you have a preference to use other cards then you can use the “Star” feature to bring those cards to the front of your category so that you will remember to use that card.

The star feature can be really helpful if you were trying to meet a minimum spend on a card or if you were trying to focus on a specific type of currency like United miles or Chase Ultimate Rewards.

Another nice feature is the ability to drag and drop the categories.

A lot of people may only care about a handful of spend categories and so you can drag and drop those categories to the top of your Cheat Sheet.

If you want to completely remove your bonus category, just tap into the settings and you can view/hide bonus categories.

And if you have a P2, you can also choose to show the best cards between the two of you.

Boost

There’s also a little red “Boost” button on the Cheat Sheet you can tap which will show you all of the credit cards that can earn you even more points for your purchases.

This is a really quick and easy way to find the best credit cards for each bonus spend category that you care about or that you currently spend on.

What is cool about the Boost feature is that it also combines the offer ranking system with the functionality of the Cheat Sheet.

So you not only see which cards will earn you more points but you also see what their current offer is.

If you see a Diamond or a Unicorn on one of the cards, you know that one of the best offers is currently available.

That allows you to take advantage of the double whammy — earning more points while also snagging an awesome bonus offer.

Customizable bonus categories

Something else that is cool about the app is that you can customize your bonus categories.

So if there are special targeted offers that you are eligible for you can simply tap the “Customize” button and then add those categories to your card or edit current categories.

You are also able to input things like spending limits, cut-off dates, etc.

Your Cheat Sheet will then be updated based on those details that you input, making it super easy to keep track of everything in one place.

Finally, if you have a unique credit card that is not mainstream (such as one from a credit union or regional bank) you can submit a request to have it added to the database. WalletFlo admins will promptly add the card and you’ll be able to keep up with all of the earning rates!

Final word

Overall, if you want a fun but still easy to use and thorough solution for keeping up with which credit card to use to earn the most points, WalletFlo is fantastic solution.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.