One frustrating thing about quarterly bonus categories is that sometimes the quarterly categories aren’t useful based on your specific type of spend. Also, the $1,500 spend limit on 5X bonus points is a little low for some people.

Well, the U.S. Bank Cash+ (Cash Plus) works to solve those problems for a lot of people and offers a nice cash back product with the ability to customize your rewards. In this review article, I’ll tell you everything you need to know about the U.S. Bank Cash Plus Visa Signature card.

Table of Contents

U.S. Bank Cash+ intro

The U.S. Bank Cash Plus is a great cash back credit card for people who want to earn 5% cash back rates in specific (somewhat niche) categories and don’t want to pay an annual fee.

It’s one of the only cards that offers you 1) the ability to choose your own bonus categories (from a wide variety of options each quarter) and 2) 5% quarterly earnings on more than $1,500 in spend. This is ideal for those who are interested in keeping tabs on changing bonus categories but for those who want simplicity a card like the Chase Freedom Unlimited could be better.

Note: If you have a high number of inquiries on your credit report, you probably don’t want to apply for US Bank cards because they are known to reject applicants or even shut down their accounts.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Welcome Bonus

The U.S. Bank Cash Plus offers a $150 welcome bonus after you apply online and spend $500 within the first 90 days of account opening. In the past this welcome bonus has been MIA or at $100 so catching it at a $150 level is a solid opportunity and it’s on par with many other no annual fee cash back cards.

Bonus categories

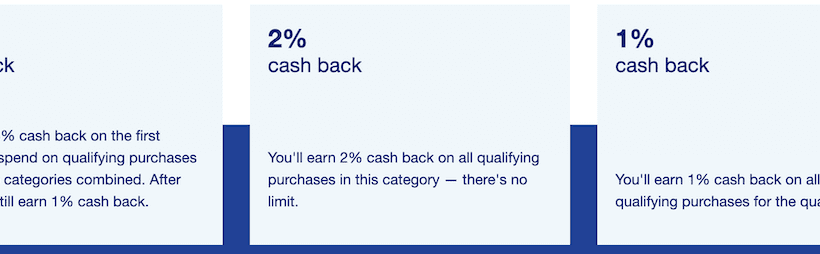

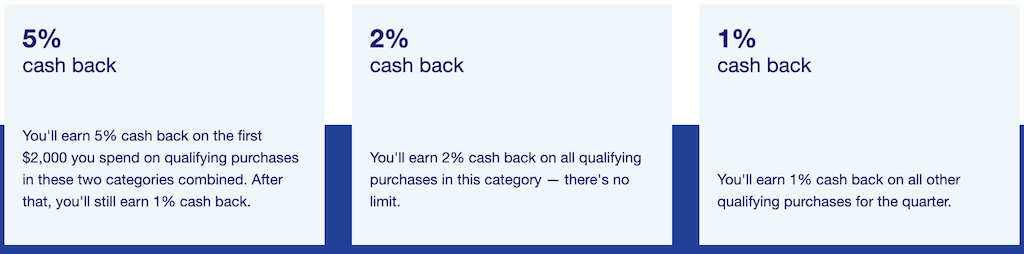

- 5% on your first $2,000 in combined eligible net purchases each quarter on two categories you choose

- 2% on one everyday category, like gas stations, grocery stores or restaurants

Each quarter you’ll be able to choose two categories (out of a dozen or so) that you can earn 5% back on up to $2,000 in spend. The 5% back allows you to earn up to $100 per quarter compared to the $75 per quarter offered by other cards like the Chase Freedom.

You’ll also be able to choose one 2% category every quarter.

Quarterly categories

The quarterly categories is where this card really shines.

First, the ability to earn 5% on up to $2,000 in spend versus $1,500 in spend on a card like the Freedom is nice. Yes, it’s only $25 more in rewards per quarter but that’s still an extra $100 per year in rewards which is not insignificant for many people.

But what I really like is the ability to choose two categories each quarter to put your spend on. This makes it much more practical to optimize your earnings. I really like the ability to choose categories like Electronics Stores where you can earn 5% back on purchases at places like Best Buy, the Apple Store, and others.

If you’re trying to earn some good rewards on shopping for the holidays, the ability to choose categories like electronics, clothing stores, sporting goods stores, and others could be really useful.

Something to note is that it doesn’t have 5% categories for groceries which you can often get with other cards like the Chase Freedom. Instead, some of these categories are little bit more niche, so you’ll want to pay close attention to your spending habits to know if this card is right for you.

Here are the types of categories you might be able to choose from:

- TV, Internet & Streaming Services

- Fast Food

- Cell Phone Providers

- Department Stores

- Home Utilities

- Select Clothing Stores

- Electronics Stores

- Sporting Goods Stores

- Movie Theaters

- Gyms/Fitness Centers

- Furniture Stores

- Ground Transportation

I’ll talk more about the 5% bonus categories tomorrow.

Earn 2% back on

You can choose one category below to earn 2% back on.

- Grocery Stores

- Gas Stations

- Restaurants

Being able to choose one 2% category is not very special and that’s why I think the focus for this card should be on the 5% bonus earning potential.

U.S. Bank Cash Plus Rewards

The redemption process for the Cash Plus is pretty simply. To redeem your cash back, you can choose to redeem your cash back as a deposit into a U.S. Bank deposit account (checking, savings, or money market), as a statement credit, or as a U.S. Bank Rewards Card (this is basically a non-reloadable VISA gift card).

Something that’s nice about the card is that there’s no minimum for deposits into your U.S. Bank deposit account or for statement credits. However, there is a $20 minimum redemption (in $5 increments) for U.S. Bank Rewards Cards.

Details on the bonus categories

Choosing your categories

You can view and choose your Cash+ bonus categories beginning 45 days prior to the start of the upcoming quarter and up until five days before the end of the quarter. Below are the deadlines you might encounter for registering for your bonus points.

| Annual Quarter | Registration Opens |

|---|---|

| January – March | November 17 |

| April – June | February 15 |

| July – September | May 17 |

| October – December | August 17 |

Something you need to keep in mind is that you won’t earn bonus points until three business days after you make your selections. Also, you can change your selected categories up to five days before each quarter begins.

If you do not choose your bonus categories, all your eligible net purchases will only earn 1% cash back. Also, unlike a card like the Chase Freedom, you don’t earn retroactive awards so you’ll always need to choose your bonus categories before you plan on putting spend on your card.

To choose your categories you can go to usbank.com/cashplus or you can call the phone number on the back of your U.S. Bank Cash+ Card. I would recommend to sign-up for reminders via text message or email so that you’ll be reminded to select your bonus categories.

Bonus category examples

Below, you can see some examples of what type of places should trigger the bonus categories. Keep in mind that these are not exclusive lists but are meant to give general guidance.

TV, Internet & Streaming Services

- Charter

- Comcast

- DIRECTV

- DISH Network

- Time Warner Cable

TV or Movie Streaming

- FandangoNOW

- Hulu

- Netflix

- Sling TV

- Vudu

Music Streaming

- Apple Music

- Pandora

- SiriusXM

- Slacker Radio

- Spotify

Fast Food

- Arby’s™

- Burger King®

- Carl’s Jr.®

- Chick-fil-A®

- Chipotle Mexican Grill

- Culver’s®

- Dairy Queen

- Domino’s®

- In-N-Out Burger®

- Jack in the Box®

- Jimmy John’s®

- KFC™

- McDonald’s®

- Panda Express

- Papa Murphy’s®

- Qdoba® Mexican Grill

- Sonic

- Subway®

- Taco Bell®

- Wendy’s®

Cell Phone Providers

- AT&T® Wireless

- Boost Mobile®

- CenturyLink™

- Consumer Cellular®

- Cricket® Wireless

- GreatCall®

- MetroPCS® Wireless

- Sprint® Wireless

- Straight Talk® Wireless

- T-Mobile®

- TracFone® Wireless

- U.S. Cellular® Wireless

- Verizon Wireless

- Virgin Mobile®

- XFINITY MOBILE

Department Stores

- loomingdale’s

- Bon-Ton®

- Boston Store®

- Dillard’s

- JcPenney®

- Kohl’s®

- Loehmann’s

- Macy’s

- Nordstrom

- Nordstrom Rack

- Off 5th

- Saks Fifth Avenue

- Sears®

- Soma Intimates

- Von Maur®

Home Utilities

- Ameren Corporation

- ComEd Payment

- Duke Energy

- Kansas City Power and Light Company

- Los Angeles Department of Water & Power

- Nicor Gas

- NW Natural

- Pacific Gas and Electric Company

- Portland General Electric

- Portland Water Bureau

- Puget Sound Energy

- Republic Services

- Seattle City Light

- Waste Management

- Xcel Energy

Select Clothing Stores

- Aeropostale®

- American Eagle Outfitters

- Ann Taylor®

- Banana Republic

- Eddie Bauer®

- Express®

- Forever 21®

- GAP

- J.Crew®

- Jos A Bank™

- Old Navy

- Talbots®

- The Limited®

Electronics Stores

- Apple Store

- Best Buy®

- Bestbuy.com®

- Bose®

- Electronic Express®

- firstSTREET

- Fry’s Electronics

- Frys.com

- h.h. gregg®

- Huppin’s

- Magnolia

- Monoprice®

- Newegg.com®

- O&M Electronics

- Video Only

Sporting Goods Stores

- Academy Sports + Outdoors®

- Backcountry.com

- Bass Pro Shops®

- Big 5® Sporting Goods

- Cabela’s®

- Camping World™

- Dick’s Sporting Goods®

- Golf Galaxy

- Hibbett Sports®

- MLB.com

- Orvis®

- Play It Again Sports®

- REI®

- Scheels®

- Sportsman’s Warehouse®

Movie Theaters

- AMC Theatres

- Atom Tickets

- Century Theatres®

- Cinemark®

- Edwards Cinemas

- Fandango.com®

- Harkins Theatres

- Megaplex Theatres

- movietickets.com

- Rave Cinema

- Regal Cinemas

- Showplace Icon Theatres

Gyms/Fitness Centers

- 24 Hour Fitness®

- Anytime Fitness®

- Crunch Fitness

- Equinox

- Genesis Health Clubs

- LA Fitness®

- Life Time Fitness

- Orangetheory® Fitness

- Planet Fitness

- Pure Barre®

- Snap Fitness™

- SoulCycle

- Weight Watchers

- XSport® Fitness

- ZUMBA® Fitness

Furniture Stores

- American Furniture Warehouse

- Art Van Furniture

- Ashley Furniture®

- Bob’s Discount Furniture

- Ethan Allen®

- Furniture Row®

- Hom Furniture

- Homemakers™ Furniture

- IKEA®

- La Z Boy®

- Living Spaces®

- Mattress Warehouse®

- Mor®

- Nebraska Furniture Mart®

- RC Willey®

- Restoration Hardware

- Room & Board®

- Slumberland® Furniture

- Steinhafels

- Value City Furniture®

Ground Transportation

- Amtrak®

- car2go®

- Catalina Express®

- Clipper®

- Greyhound®

- Lyft®

- Metra®

- NYC Taxi

- Sound Transit

- TriMet®

- Uber

- Ventra

- Washington State Ferries

- Yellow Cab

- Zipcar®

Grocery stores

- Albertsons®

- Cub Foods®

- Dierbergs

- Fred Meyer®

- Giant Eagle®

- Hy-Vee®

- Jewel-Osco®

- King Soopers

- Kroger®

- Lunds & Byerlys

- Pick’n Save®

- Publix®

- Ralphs®

- Safeway

- Schnucks

- Sprouts Farmers Market

- Target®

- Trader Joe’s

- Wal-mart®

- Whole Foods Market

Gas stations

- 7-Eleven®

- 76® Gas Stations

- BP

- Cenex®

- Chevron®

- Costco Gasoline

- ExxonMobil

- Fred Meyer Fuel Center

- Holiday Stationstores®

- Kroger® Fuel Center

- Kum & Go®

- KwikShop

- Love’s® Travel Stops

- Marathon Oil

- Maverick Country Store

- Phillips 66

- QuikTrip®

- Shell®

- Speedway®

- SuperAmerica®

Restaurants

- Applebee’s

- BJ’s Restaurant

- Bob Evans

- Buffalo Wild Wings®

- Cheddar’s Casual Café

- Cracker Barrel

- Famous Dave’s BBQ

- IHOP

- Longhorn® Steakhouse

- Old Chicago

- Olive Garden®

- Outback Steakhouse®

- P.F. Chang’s®

- Perkins®

- Pizza Hut®

- Red Lobster

- Red Robin®

- Ruby Tuesday

- Sizzler®

- Skyline Chili

- Smashburger®

- T.G.I. Friday’s

- Texas Roadhouse

- Village Inn

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Visa Signature Luxury Hotel Collection

The Visa Signature Luxury Hotel Collection consists of over 900 hotels around the world and offers you special privileges during your stay which could include:

- Best available rate guarantee

- Automatic room upgrade when available

- Complementary in room Wi-Fi when available

- Complementary breakfast for two

- $25 food and beverage credit

- VIP guest status

- Late checkout upon request when available

Many of these hotels are world-class properties like the Conrad Maldives, Park Hyatt Bangkok, and many others but the program also has a lot of properties under $299/per night.

Benefits and protections

- Auto Rental Collision Damage Waiver

- Travel and Emergency Assistance Services

- Roadside Dispatch

- Extended Warranty Protection

- Purchase Security

0% Balance transfer

This card will offer you the ability for a 0% balance transfer for a period of 12 months.

Annual fee

The U.S. Bank Cash Plus has no annual fee.

Final word

The U.S. Bank Cash Plus is a great no annual fee card that allows you to customize your cash back categories so that you can optimize your rewards. I really like some of the 5% categories and so I think this is a great options for people who want to tailor their rewards to their spending.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.