The Chase Sapphire Preferred card is a great travel rewards credit card with a low annual fee of $95. It comes with bonus earning of 2X on dining and travel and the ability to transfer points to some amazing travel partners. But this card also comes with some fantastic benefits like primary rental car coverage and many other solid protections. One of these protections is the Chase Sapphire Preferred extended warranty which I’ll cover in detail in this article.

Table of Contents

What is the Chase Sapphire Preferred extended warranty?

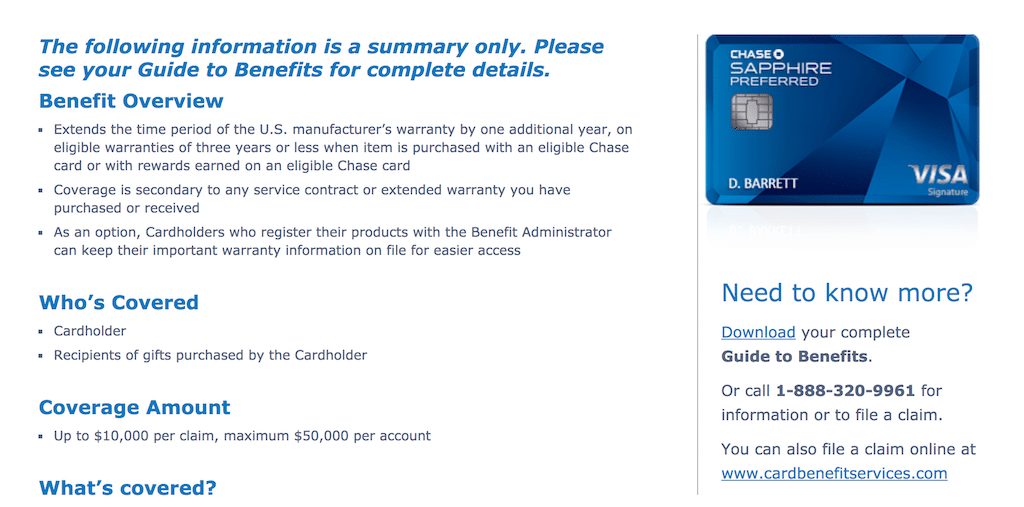

The Chase Sapphire Preferred extended warranty allows you to extend the warranty for certain products for an additional year on eligible warranties of three years or less, up to a maximum of $10,000 per claim, and a $50,000 dollars maximum per Account.

So the key here is that the warranties need to be of three years or less. What this means practically speaking is that if you have a warranty on a product for say, two years, then Chase will add an additional year to that warranty so that you end up with a total of three years of coverage.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How does the warranty compare to other credit cards?

It’s worth noting that while Chase offers superb protections in many categories, other issuers offer solid extended warranty protections, too.

For example, for cards like the Gold Card, American Express will provide one additional year if the original manufacturer’s warranty is five years or less. They cover you up to $10,000 per claim and up to $50,000 per calendar year which is the same offered by the Sapphire Preferred.

So it is a comparable coverage with the key difference being that you can get coverage up to five years instead of only three years. Personally, if I ever am concerned about an extended warranty, I make sure to make the purchase with an American Express card such as the Gold Card or the Platinum Card.

And in case you wondering, the extended warranty for the Sapphire Preferred is the same as the Sapphire Reserve.

What is covered by the extended warranty?

Not every purchase that you put on your Sapphire Preferred will be covered by the extended warranty coverage. Here are several qualifications for the extended warranty you need to know about:

The warranty covers:

- Eligible items with a valid original manufacturer-written U.S. repair warranty of three (3) years or less

- Gifts purchased with your Account that meet the terms and conditions

- Items purchased outside the United States are covered as long as they are purchased with your Account and the eligible item has either a:

- valid original manufacturer-written U.S. repair warranty of three (3) years or less,

- a store-purchased dealer warranty, or

- an assembler warranty.

It’s worth noting that Chase is one of the few issuers that allows for partial payment for a warranty to kick in but I would recommend trying to put the entire purchase on one card.

What items are not covered by the warranty?

There are many purchases which are not covered by the extended warranty.

For the most part these are major purchases like boats and vehicles that you probably wouldn’t expect to be covered by the warranty. Other excluded items are specialty equipment like medical devices or any kind of used or pre-owned products.

- Boats, automobiles, aircraft, and any other motorized vehicles and their motors, equipment, or accessories, including trailers and other items that can be towed by or attached to any motorized vehicle

- Any costs other than those specifically covered under the terms of the original manufacturer- written U.S. repair warranty, as supplied by the original manufacturer, or other eligible warranty

- Items purchased for resale, professional, or commercial use

- Rented or leased items or items purchased on an installment plan and for which the entire purchase price was not paid in full at the time of the occurrence

- Computer software

- Medical equipment

- Used or pre-owned items

One of the big things to note here is that the costs need to be covered under the terms of the original manufacturer written warranty. If you go buying warranties that didn’t come supplied from the original manufacturer those are not going to count.

Chase Sapphire Preferred extended warranty for iPhones and iPads

One of the most common uses of the Chase Sapphire Preferred extended warranty is to cover issues on iPhones or other cellular devices. I’ll use the iPhone specifically as an example, though.

Typically an iPhone will come with one of two warranties.

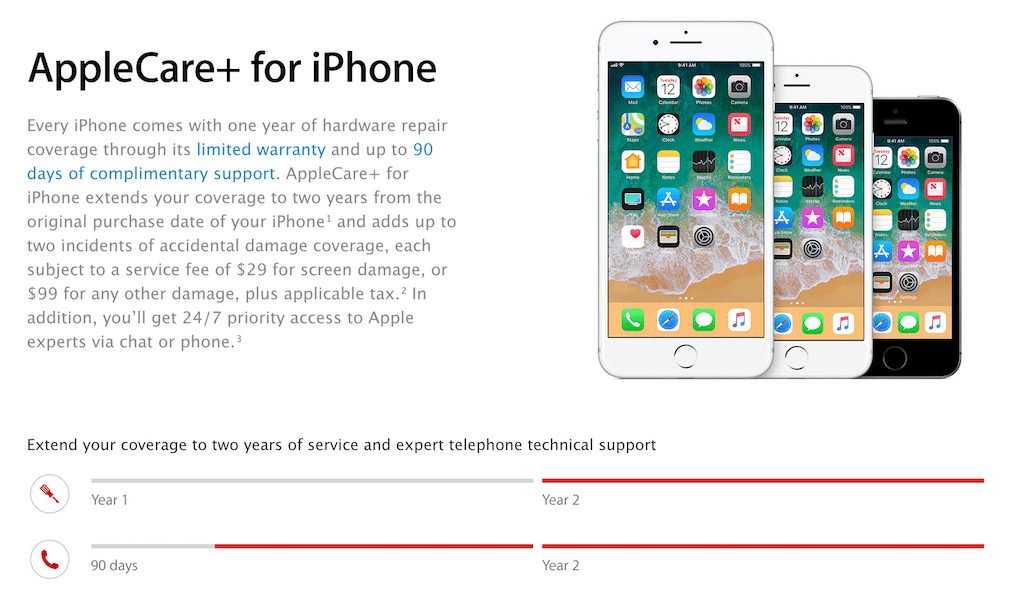

The first is the standard warranty known as the “Apple Limited Warranty coverage.” This warranty lasts for 12 months and covers various manufacturer defects, such as battery issues or defective touch screens.

AppleCare+ gives you expert telephone support and additional hardware coverage for up to two years from the day you bought your iPhone. It also includes Express Replacement Service and up to two incidents of accidental damage coverage. You can read more about Apple Care here.

So if you were to purchase a new iPhone with AppleCare+ and your battery stopped working properly two years after your purchase, the Sapphire Preferred would add an additional year to your iPhone warranty so you’d be covered for that defect even though AppleCare+ would not apply. Update: Some have reported that they’ve been denied coverage so this may no longer be possible.

How do I file a claim?

You can file a claim over the phone by calling the Benefit Administrator phone number at 1-800-874-7702 or you can do it online at cardbenefitservices.

I recommend first calling the Benefit Administrator (as soon as something happens) and allowing them to explain the claims process to you and answer any of your questions. If you wait longer than 90 days to notify them about the defect, your claim may be denied.

The phone call should be recorded so if they tell you any misinformation you should be able to refer to the phone call to back up your story.

The process for filing a claim online is pretty straight forward but I’ll walk you through some of the major steps.

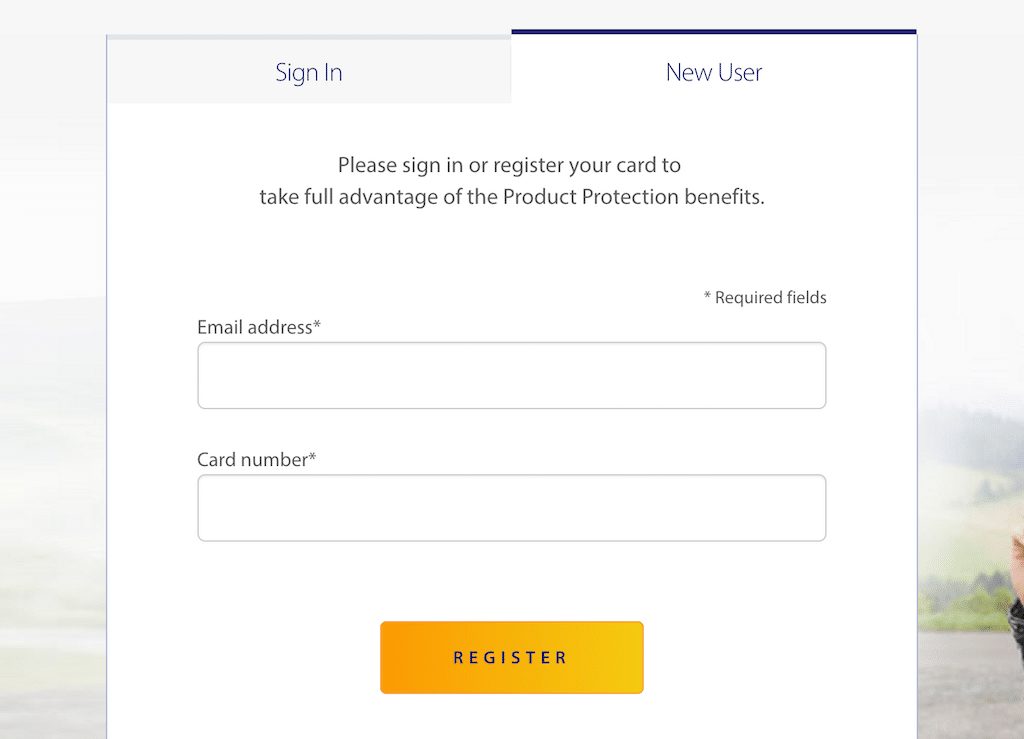

First if you’re new to Card Benefit Services, you’ll need to create a new account. Otherwise, you can just log-in.

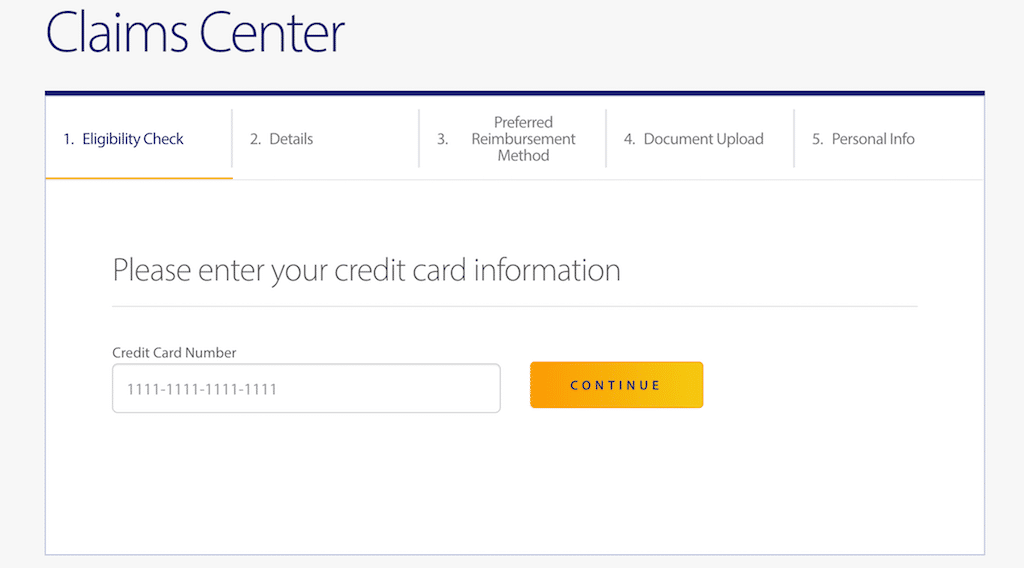

Once logged in, you’ll be taken to the “Claims Center” where you can initiate your claim by selecting “File a claim.”

You’ll be asked to input your credit card number to continue.

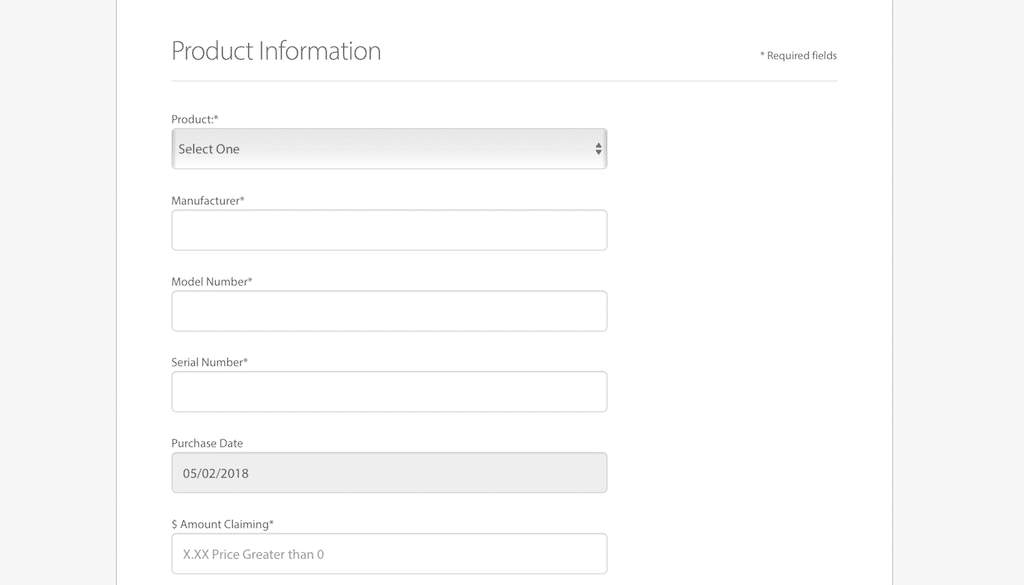

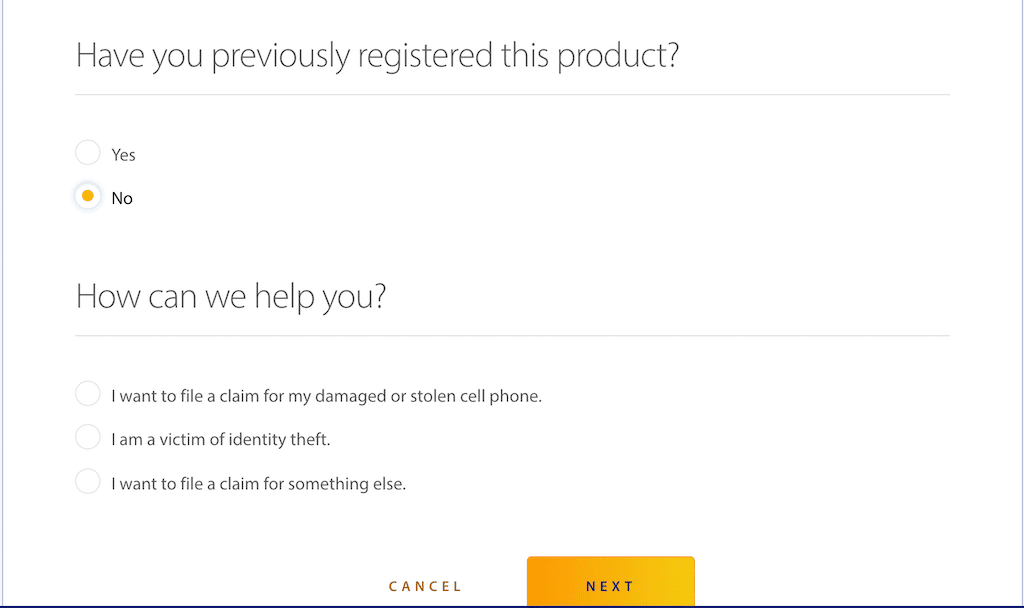

And then you’ll be able to select the type of product you’re claiming coverage on. You can tell that extended warranty coverage for cell phones is popular because it has its own category.

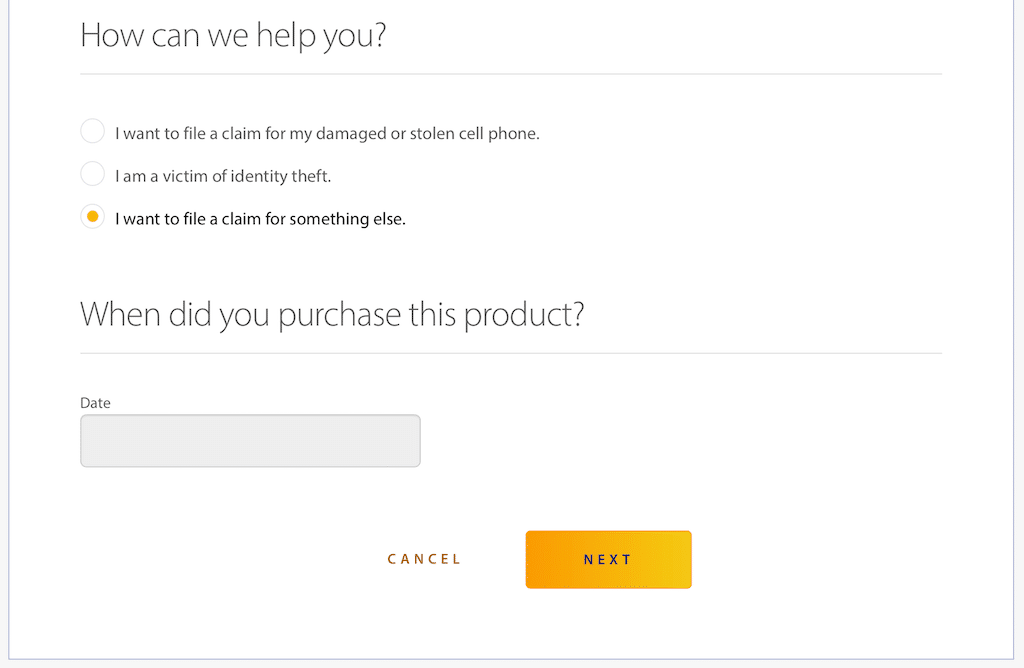

If you don’t select a claim for a damaged or stolen cell phone, you can select file a claim for something else. You’ll then need to input your date to continue.

At this screen you’ll be required to put in very specific details about your product, such as the manufacturer, model number, and serial number. You’ll also need to state the amount that you’re claiming.

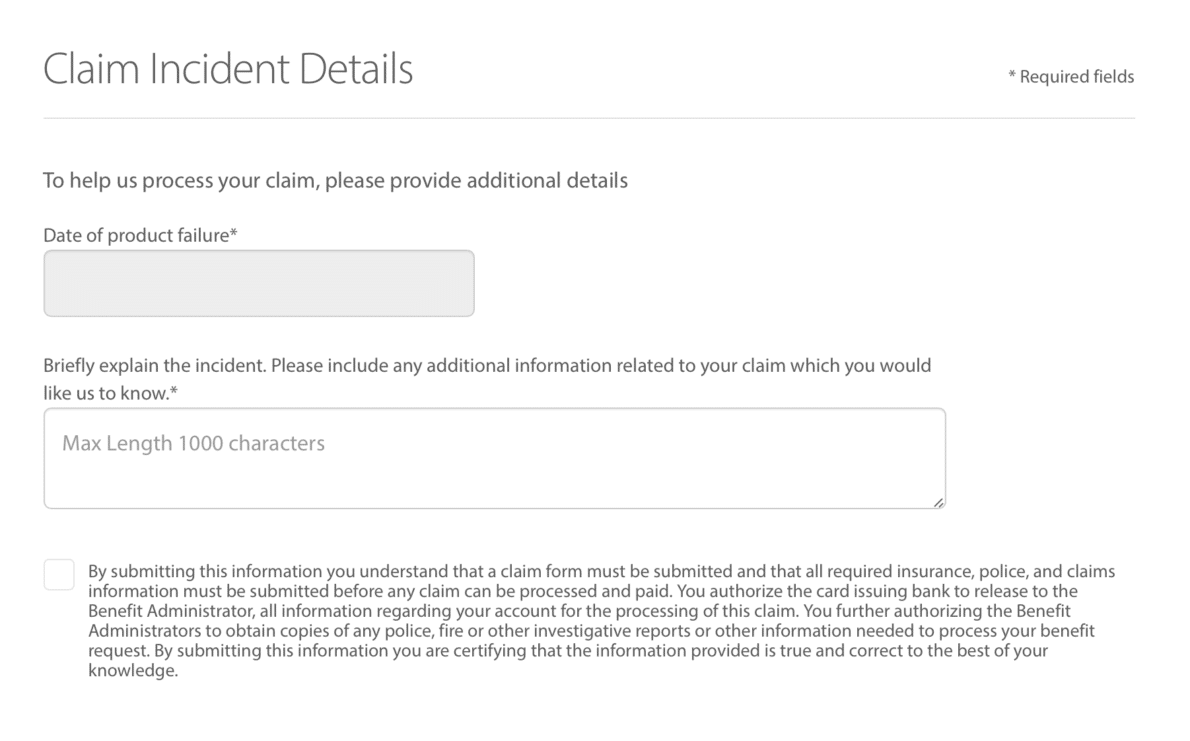

After that, you’ll be required to enter the date of product failure and then you’ll need to explain your incident with a max length of 1,000 characters.

At this point you’ll submit your claim but you’ll still need to finish the claims filing process.

You’ll be able to select your preferred method of payment (check or debit card reimbursement). You’ll then be required to upload all of your documents.

The terms state that your claim form must be completed, signed, and returned with all the requested documentation within 120 days of the product failure. Unless otherwise noted, the date of loss shall be the date you first notified the Benefit Administrator.

Once you report an occurrence, a claim file will remain open for six months from the date of the damage or theft. Also, no payment will be made on a claim that is not completed by the Benefit Administrator within six months.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

What documents do I need?

Your completed and signed claim form for the Chase Sapphire Preferred extended warranty may need:

- A copy of your card receipt/bank statement

- The itemized store receipt (if more than one method of payment was used, documentation linking the purchase back to the Account must be included)

- A copy of the original manufacturer – written U.S. warranty and any other applicable warranty

- The original repair order

- A description and serial/model number of the item

- Other documentation deemed necessary to substantiate your claim like bills and and copies of the maintenance record and receipts

If you don’t have a copy of the warranty, simply contact the manufacturer and they should be able to provide you with one.

You also probably want to keep the damaged product in your custody until your claim is finished processing because it’s possible that they could ask you to send it to them.

Getting repairs

Recall that an eligible repair will be for no more than the original purchase price of the covered item less shipping and handling fees. The Benefit Administrator should be able to guide you to help find a repair store for your product so that you can get an estimate on the repair.

Card Member Services will either pay the facility directly for repairs or you may go to an authorized repair facility and file a claim for reimbursement. They state that only valid and reasonable repairs made at the manufacturer’s authorized repair facility are covered.

So that’s why I recommend checking with the Benefit Administrator before you seek out a repair. It’s possible that if you jump the gun and seek out repairs from an unauthorized facility, you will have to pay for those out-of-pocket.

Getting a new phone

This is probably the most important step to clarify when you’re going through this process for a new phone.

Make sure that you clarify on a recorded phone call conversation with a Benefit Administrator exactly how much you’ll be covered for a new phone. There are reports where people were limited to the refurbished value of their original phone.

Also, if you enroll in a payment plan for your cell phone you probably won’t get coverage — you may need to pay for the phone in full.

So make sure you that you have clear guidance on what you’re covered on and either a paper trail or a recorded conversation that you can rely on if you end up getting denied coverage.

Credit card needs to be active

These warranties can last for years so you need to me mindful about your past purchases when considering cancelling your credit cards. If the card that you purchased your item on is no longer active then you lose your extended warranty coverage.

How long does the Chase Sapphire Preferred extended warranty reimbursement take?

Chase states that under normal circumstances, “reimbursement will take place within five business days of receipt and approval of all required documents.”

Many people have had positive experiences with the Chase Sapphire Preferred extended warranty but don’t be surprised if it takes longer than five business days for your claim to be processed.

Final word

The Sapphire Preferred extended warranty offers potentially valuable protection. The key is to keep good records every step of the way and to make sure that you know exactly what you’ll be covered for. You can do this by constantly checking with your Benefit Administrator to make sure you know what you’re doing.

And finally, if you’re thinking about applying for the Chase Sapphire Preferred make sure you know about all of the Chase application rules.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

2 comments