Offers contained within this article maybe expired.

American Express cards come with limited protections for travel insurance, so many Amex customers will be interested in getting American Express travel insurance.

But what type of coverage do you get with this type of travel insurance?

This review article will show you which travel protections and benefits you are given with American Express travel insurance, the prices for those policies, and how to sign-up.

I’ll also show you some benefit comparisons to other major credit cards so you can see what alternatives might make more sense for you.

Interested in finding out the hottest travel credit cards for this month? Click here to check them out!

Table of Contents

What is American Express Travel Insurance?

American Express travel insurance is a set of protections offered to travelers that come in different packages that vary in price and coverage. These protections will cover things like canceled trips, lost luggage, medical emergencies, and several other scenarios.

This insurance is offered by AMEX Assurance Company, which is a wholly owned subsidiary of American Express Company.

And it’s worth noting that you don’t have to have an Amex card to get coverage from the program.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

American Express credit card protections

American Express cards offer great purchase protections but one area where they definitely lag is when it comes to travel insurance protections.

However, they still do offer some protections in that department. I’ll first highlight the Amex Platinum Card travel insurance and then show you which main protections are missing.

That way, you’ll get a sense of whether or not you might want to look to other credit cards for your desired protections instead of relying on Amex travel insurance.

American Express Platinum Card travel insurance

Baggage Insurance Plan

- Will pay a benefit for the Replacement Cost, up to $3,000, for each Covered Person on a Covered Trip for Loss of carry-on Baggage.

- Will pay a benefit for the Replacement Cost, up to $2,000, for each Covered Person on a Covered Trip for Loss of checked Baggage

Secondary rental car insurance

- Excess rental car insurance (may cover what your insurance company doesn’t cover), subject to exceptions such as no coverage for exotic cars and cars with retail value over $75,000.

Travel Accident Insurance

- Accidental death or dismemberment as a result of an Accident which occurs while riding solely as a passenger in, or Boarding, or Exiting from, or being struck by a Common Carrier on a Covered Trip.

Those are the main travel instance benefits offered by the Amex Platinum Card. Other Amex cards, such as the Premier Rewards Gold Card, offer similar benefits but many of them will offer lower coverage limits (e.g., $50,000 for rental car coverage).

Chase Sapphire Reserve comparison

As a point of comparison, take a look at some of the protections offered by the Chase Sapphire Reserve, which include:

- Trip Interruption: If your trip is canceled or cut short by covered situations, you can be reimbursed up to $10,000 per trip for your pre-paid, non-refundable travel expenses,

- Trip Delay Reimbursement: If delayed more than 6 hours you are covered for expenses, such as meals and lodging, up to $500 per ticket. (upgrade from the Sapphire Preferred which required 12 hours).

- Baggage Delay Reimbursement: If delayed more than 6 hours, you are covered for essential expenses, such as toiletries and clothes for up to one hundred ($100.00) dollars per day for a maximum of five (5) days.

These are some of the key travel protections I look for so it’s a big loss in my opinion that they aren’t standard on cards like the Platinum Card, Premier Rewards Gold Card, etc.

However, you can still get these protections by buying Amex travel insurance.

American Express travel insurance benefits

American Express travel insurance will provide you with the following benefits:

- Trip Cancellation/Interruption

- Global Medical Protection

- Global Trip Delay

- Global Baggage Protection

- Travel Accident Protection

- 24-hour Travel Assistance

I’ll take a look at each of these protections in detail below.

Note that many states have unique limitations for many of these benefits, so just use the below for general guidance.

Trip Cancellation/Interruption

May provide reimbursement for nonrefundable expenses if they need to cancel a trip before it starts or if it gets interrupted for reasons such as:

- Illness

- Injury

- Death

- Unemployment

- Adverse weather

- Natural disasters

- Terrorism

- Travel arrangement cancellation

(Gold and Platinum AETI Packages offer an upgrade to coverage, for an added premium, when a Covered Trip must be canceled for specified business reasons.)

Reimbursement may also be offered for:

- Unexpected or unintended injury, illness or disease only upon examination or treatment by a physician or dentist acting within the scope of his or her practice prior to the cancellation or interruption of the Covered Trip.

- Death of a Covered Person, family member or traveling companion occurring within 30 days of the departure date or during the trip.

Note that Amex will not pay benefits for cancellation or interruption of a Covered Trip due to cancellation of the event that is the reason for the Covered Trip or due to concerns about an event that has not come to pass, such as a potential illness or the possibility of bad weather conditions.

Also they will not pay benefits for a medical condition if, within 90 days prior to the coverage effective date, a Covered Person received or was advised to receive medical advice or treatment for the condition.

The Platinum package covers up to 100% of the costs for Trip Cancellation and up to 150% for Trip Interruption, which is great.

But the Chase Sapphire Reserve covers up to $10,000 for trip interruption, which is a very high limit for something already built into a credit card.

Global Medical Protection

Amex may provide the following benefits, as long as care is received from a medical provider authorized by us

- Emergency Medical/Dental Expense – may cover emergency medical and dental expenses if Covered Person suffers a sickness or accidental injury on a Covered Trip.

- Emergency Medical Evacuation/Repatriation – may help arrange and cover the cost of emergency transportation to a medical facility in the event of sickness or accidental injury.

- The costs of a visitor’s economy class round-trip transportation to the Covered Person’s bedside during hospitalizations lasting 5 or more days.

- Dental expenses are limited to $750

The key here is to obtain approval for the medical provider prior to getting care.

With the 24 hour phone line available, you should be able to call them up and explain the urgency of the situation and hopefully get that resolved so you can go about receiving care.

Limits for medical care are up to $100,000 and up to $1,000,000 for emergency evacuation and/or repatriation.

Global Trip Delay

Amex may provide reimbursement for lodging and other necessary expenses if:

- A Covered Person’s flight is overbooked and the Covered Person is involuntarily denied boarding

- A Covered Person misses the flight connection due to the late arrival of the incoming flight, or

- A Covered Person’s flight departure is delayed or canceled.

They will reimburse only if no alternative transportation is made available to the Covered Person within the time specified in the Plan documents.

Also, they will pay benefits only for flights on scheduled airlines; no other common carrier-caused delays or cancellations are eligible for coverage.

For the Platinum package you can get coverage after a six hour delay (or by 11:00 pm of the same day as your flight) for up to $300 per day and up $1,000 per trip.

Global Baggage Protection

May provide reimbursement for lost, damaged, or stolen baggage, whether checked or carried-on the Covered Person’s flight, in a personal or rented vehicle or on the Covered Person’s hotel premises while on a Covered Trip.

It may also provide reimbursement for essential replacement items if baggage has been delayed.

Amex will pay for items lost in carry-on or checked baggage, in a personal or rented vehicle, or on hotel premises limited to the lesser of:

- The actual purchase price of the item

- The replacement cost of the item if the Covered Person provides a receipt for the item, or

- 75% of the replacement cost of the item.

They will also pay benefits due to a loss, subject to a per-article limitation of $300 for each replaced item and a high-risk article (such as jewelry, sporting equipment, or computers) limitation of $500 per occurrence.

For the Platinum package you can get coverage after a three hour delay for up to $500 and for baggage loss up to $2,500.

Three hours is very short and that’s what the Citi Prestige used to offer for baggage delay before it got extended to six hours (the same as the Sapphire Reserve).

Travel Accident Protection

Amex may provide coverage for an accident resulting in death or dismemberment while on a Covered Trip, starting from the moment Covered Person leaves to the moment they arrive home.

24-hour Travel Assistance

- Worldwide access to 24-hour hotline providing you with travel support before and during your trip.

How does American Express travel insurance work?

Visit the home page

Visit the Amex travel insurance home page.

Enter your details

These details include:

- Departure date

- Return Date

- Number of travelers

- State of residence

- Trip cost per traveler

Choose your package

Once you input these details, you’ll be brought to a screen where you can choose your package or build your own package.

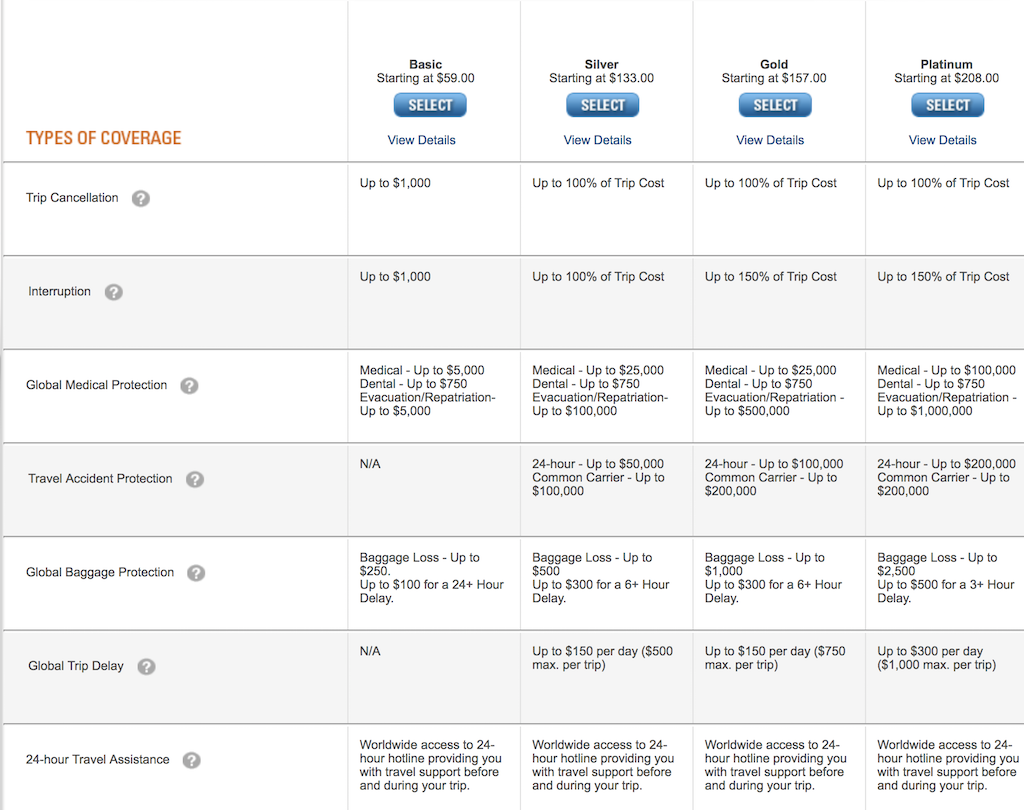

There are different tiers of packages available which include:

- Basic

- Silver

- Gold

- Platinum

You’ll be able to see a break down of each of the different protections offered as well as the main coverage limitations.

As you can tell, there are pretty big differences in price.

The lowest package below starts at $59 and once you get up into the Platinum packages they can make their way up to the $300, depending on certain factors.

Confirm your benefits

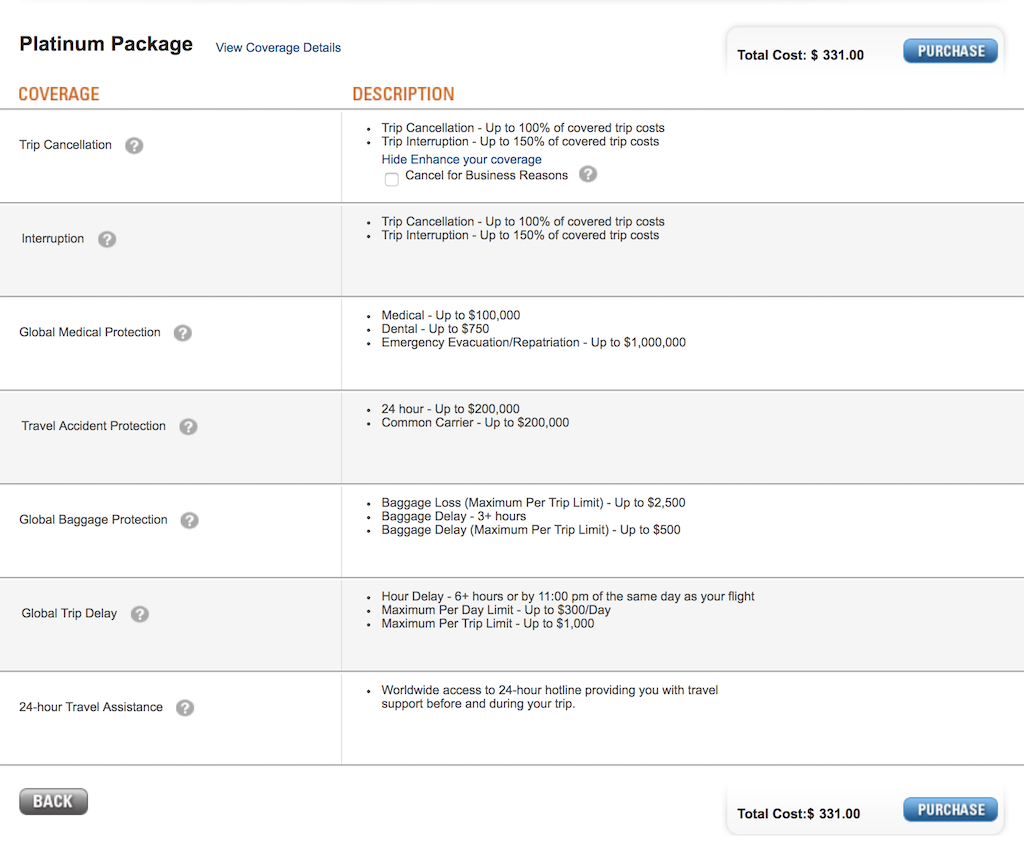

Once you select your package, you’ll be brought to another screen where you’ll confirm the benefits and see a summary of each perk you’ll be receiving.

You’ll be able to see the price at the top and if you have a Gold or Platinum package you’ll be able to enhance your coverage for trip cancellation to include covered business reasons (for an extra $55).

The below Platinum package is priced at $331 for a $6,000 trip.

The perks like baggage delay after only 3 hours are very solid since other cards require you to wait 6 or more hours for the protection to kick in.

And I’ve had my luggage delayed substantially before so that 3 hour wait time can be a huge relief.

Still, it’s hard for me to justify spending that much on many of these benefits when I have a card like the Chase Sapphire Reserve that offers many of these perks already (albeit with lower limitations).

And that’s the big question you’ll have to ask yourself: is it worth spending more money on benefits you may or may not use when there are credit cards offering those benefits (for free) at or near the same level in many cases?

If you want to see an example of an insurance policy you can click here.

How do I file a claim?

To file a claim, contact Amex through the claims phone number or address found in your Certificate of Insurance/Policy or in the “Claims” link on the top of their website.

Alternatively, here is the contact information for claims:

- Servicing/Claims Toll Free Number: 1-800-228-6855

- International Collect Number: 303-273-6497

Mailing Address for Claims:

PO-BOX 981553

EL PASO TX 79998-9920

What kind of proof do I need for a claim?

Amex advises that you retain the following:

- Receipts

- Police reports

- Medical bills, and

- Other documents relating to the loss(es) involved.

The specific proof you will need varies depending on what type of loss you incurred and under what benefit you are filing a claim.

You can refer to the Proof of Loss section in your Certificate of Insurance/Policy under the benefit for which you are submitting a claim for more on which documents will be required.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Amex rental car insurance

One of the drawbacks to the insurance is that it doesn’t offer built-in rental car insurance. Also, American Express cards don’t offer primary rental car coverage so if you’re wanting primary coverage you have to pay extra for it.

Why would you want primary rental coverage?

The biggest reason is that you can avoid your monthly premium rising since you won’t have to file a claim with your auto insurance company and can let Amex handle everything on their end.

So you’ll save money on that and also any associated fees (and headache) that would go along with that.

Flat rate

Flat rate of $19.95 / $24.95 per rental period, not per day depending on your coverage selection.

These prices are pretty competitive compared to what I’ve been offered by some rental car companies since these are per rental period.

But again, with cards like the Sapphire Preferred offering primary rental car coverage, it’s tough to justify paying for this perk.

Primary rental car coverage

Coverage is primary for theft and damage to a Rental Vehicle. If your rental vehicle is damaged, you can file that claim with Amex first as your primary provider.

Coverage provided is not subject to a policy deductible.

42 days

Coverage is for up to 42 consecutive days.

Standard Amex card rental car coverage lasts for 30 days and other cards limit the Chase Sapphire cards limit coverage to 31 consecutive days.

So this offers almost two weeks of additional coverage that most other cards don’t offer.

Extends to all Amex cards

Coverage automatically extends to other eligible American Express Card Account(s) when you enroll one of your Card Account(s).

Worldwide coverage

Coverage is worldwide, except for vehicles rented in Australia, Ireland, Israel, Italy, Jamaica, and New Zealand.

I’m not sure why some of these places are excluded but it’s a bummer because Australia, New Zealand, Ireland and Italy are fantastic places to rent cars and go road tripping when traveling.

However, after renting a car in Jamaica, I could see why that place wouldn’t be covered.

Limits

This coverage ups the limits for coverage to $100,000 which should be able to cover many rental vehicles.

- Up to $100,000 of primary coverage for damage or theft of a Rental Vehicle.

- Up to $100,000 of Accidental Death or Dismemberment coverage ($250,000 for California Residents).

- Up to $15,000 for secondary medical expenses per person.

- Up to $5,000 for secondary personal property coverage ($15,000 for Florida Residents).

That $100,000 limit is definitely on the higher side since rental car coverage from cards like the Chase Sapphire Reserve only cover up to $75,000.

But do you really need coverage up to $100,000? I doubt most people do.

Note that liability coverage is not included.

This means that if you crash your rental into a Prada store, you’re not off the hook for the damage you caused to the property or to people.

You can see a sample of the Amex car rental insurance here.

How can I enroll in Amex rental car insurance?

American Express Travel Insurance Review FAQ

Yes, even if you are not taking the trip, you may purchase American Express Travel Insurance for other parties but be mindful of eligibility requirements for certain states.

Coverage is worldwide except where coverage would violate US economic or trade sanctions. (To determine if a country you are planning to travel to is on the OFAC list, consult with the U.S. Department of the Treasury’s website.)

Also, note that only permanent residents of one of the 50 United States or the District of Columbia are eligible for coverage.

No, you must purchase insurance before your trip begins.

For coverage effective today, you can call the American Express travel insurance phone number: 1-800-228-6855.

The person buying the insurance must select the state in which they are a permanent resident.

You can request a full refund within 14 days after receipt of your Certificate of Insurance/Policy and other Plan Documents.

For answers to other common questions you can go here.

Final word

Many of these protections, especially with the Gold and Platinum packages, are superior to what is offered by some of the best travel credit cards.

But they also come with a premium price. Personally, I’d rather have free protections that are a little less “robust” than pay a few hundred dollars for top of the line protections that I probably won’t have a need for.

Still, if you don’t have a card that’s already offering these protections and you’re okay with spending money on the insurance, then these travel protections can be very valuable and worth it.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.