Offers contained within this article maybe expired.

The Amex Hilton Aspire card is one of the best hotel credit cards on the market. That’s because the card is full of valuable benefits for Hilton members like top-tier elite status and airport lounge access. But some of the most valuable perks of this card are the travel credits which total up to $600.

That means you could literally turn a profit each year by fully utilizing the travel credits for the Hilton Aspire. However, there are some restrictions with these credits that you’ll definitely want to consider when placing value on them. Here’s everything you need to know about the Amex Hilton Aspire travel credits, which include the $250 resort credit, the $250 airline credit, and the $100 property credit.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

Amex Hilton Aspire benefits

- 14X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 7X Hilton Honors Bonus Points on flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and at U.S. restaurants

- 3X Hilton Honors Bonus Points on other purchases

- Complimentary Hilton Honors Diamond status

- One weekend night at any hotel or resort in the Hilton portfolio (upon opening account and on account anniversary)

- Weekend night after spending $60,000 on the card within a calendar year

- Unlimited Priority Pass Select membership

- $250 airline incidental fee statement credit

- $250 Hilton resort statement credit

- $100 on property credit at Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts when booking the exclusive Aspire Card package

- $450 Annual Fee

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Amex Hilton Aspire Travel credits

There are three main travel credits for the Hilton Aspire.

- $100 Hilton on-property credit

- $250 Hilton Resort Credit

- $250 Airline Fee Credit

Note that there is NO Global Entry or TSA Pre-Check credit for the Hilton Aspire.

$100 Hilton on-property credit

The $100 Hilton on-property credit is pretty limited in use, so you’ll have to make sure to abide by the restrictions for it. Also, some of the restrictions diminish the value of the credit a little bit so you’ll want to be aware of that.

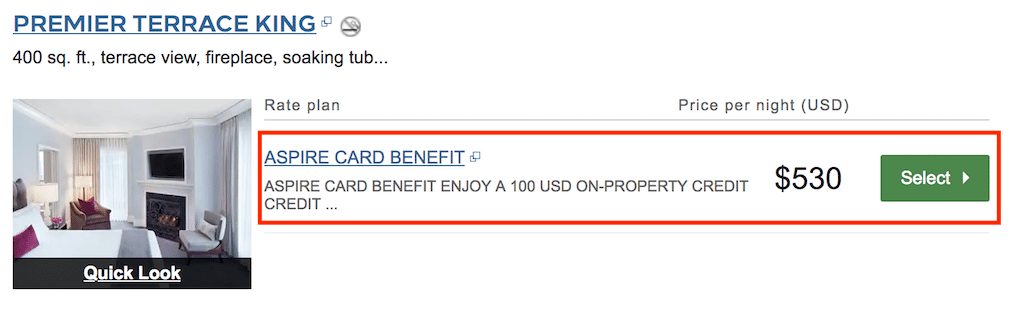

Book through the right portal/phone line

In order for this credit to work, you need use your Hilton Honors American Express Aspire Card to book through HiltonHonors.com/aspirecard or by call Hilton Honors at (855) 292-5757. You will need to confirm you are booking a room package eligible for the $100 property credit benefit at time of booking and if you are booking via phone you need to reference ZZAAP1.

2 night stay at Waldorf or Conrad

You must be booking a two-night minimum stay at Waldorf Astoria Hotels & Resorts, and Conrad Hotels & Resorts.

You will receive a property credit of up to $100 per booking. Back-to-back stays within a 24-hour period at the same property are considered one stay so don’t try to book multiple nights in a row as separate bookings.

The property credit will be applied as hotel credit on your bill at checkout (and not on your American Express billing statement), so don’t be looking for a statement credit after you use the property credit.

What purchases qualify?

It’s really important to note that qualifying charges do NOT include property fees, taxes, gratuities and the cost of the room. So this credit is to be used for things like spa treatments, dining, etc. and not for room rates.

Stays booked by either the Basic or an Additional Card Members on the eligible Card account are eligible for the $100 property credit benefit.

Buy flexible routes

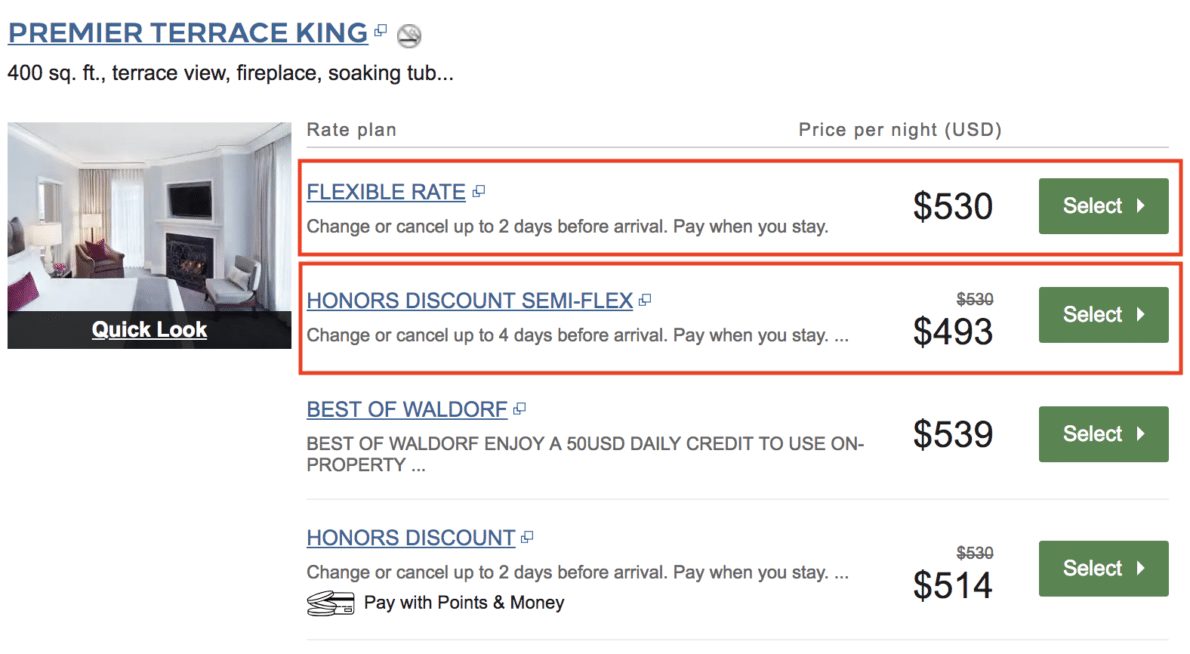

When you shop for properties online, you’ll notice that you’ll need to book the flexible room rates.

This means that you won’t be able purchase the cheapest rates so you’ll need to factor that into your savings. When I searched for the Waldorf in Chicago, I was given a rate of $530 per night for the Aspire rate but the Hilton Honors rate was $514 and the Honors discount semi-flex rate was $493 — $37 per night cheaper.

So if you went for the $100 Aspire credit in this case, you’d only be netting about $25 worth of savings on a 2-night stay, which is a huge cut into the value of the $100 property credit. And if you chose to book three nights, you’d actually be losing money! Unless, you normally book the flexible rates, this credit will not offer you the face value of $100.

$250 Hilton Resort Credit

During each year of your Card Membership (“reward year”), you are eligible to receive up to $250 total in statement credits for eligible purchases made directly with participating Hilton Resorts with your Hilton Honors American Express Aspire Card during that reward year.

Your first reward year begins on your account opening date. Each subsequent reward year begins on the anniversary of your account opening date.

Eligible properties

You can visit hilton.com/resorts for the list of participating Hilton Resorts. At the time of this writing, there were 226 resorts in the database so there’s a pretty wide selection of options to choose from.

There are reports of the credit working for at least one resort that does now show up on the link above and that’s for the Hilton Waikiki Beach. There are probably other “hidden resorts” but you’d just have to test it out to find out.

Eligible Hilton Resort purchases must be made directly with the participating Hilton Resort and charged to your Hilton Honors American Express Aspire Card account for the benefit to apply.

What purchases qualify?

What’s great about this credit is that even room rates qualify for your credit. So if you have any plans to stay at a Hilton hotel and spend at least $250, this credit is truly offering you $250 worth of tree travel which knocks down the annual fee.

Note that incidental charges (including charges made at restaurants, spas, and other establishments within the hotel property) must be charged to your room and paid for with your Hilton Honors American Express Aspire Card at checkout in order for them to be recognized as Hilton Resort purchases.

Since the charges must be made to your room, you probably can’t get this credit to work on purchases you make at hotel restaurants, bars, etc. and you’re not staying at the property.

Eligible rates

Be aware that purchasing advanced room rates (pre-paid rates) for US properties has complicated the process for others in the past and not allowed the credits to post due to billing quirks. So you probably want to purchase a flexible rate to avoid issues, although the credit seems to work with advanced rates on international properties.

Update: Advance Purchase Rates/Non-Refundable Rates are now NOT eligible for the resort credit for any property. Read more about the different Hilton rates and cancellation policies here.

Purchases made by both the Basic and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is eligible for up to a total of $250 per renewal year in statement credits across all cards.

Allow 8-12 weeks after the eligible Hilton purchase is charged to your Card Account for statement credit(s) to be posted to the Account. Please call the number on the back of your Card if statement credits have not posted after 12 weeks from the date of purchase. Card Members remain responsible for timely payment of all charges.

After our stay at the Maldives, our credit posted the day after check-out so this credit can post very quickly.

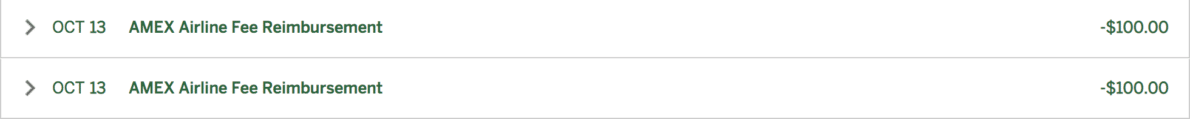

$250 Airline Fee Credit

The Hilton Aspire offers a $250 airline credit for various airline expenses. This is the same type of annual airline credit offered by other Amex cards like the Platinum Card and the Gold Card but the Aspire offers the highest credit out of all of those cards.

Before you make any purchase, you need to select the airline that you’ll be making the purchase with. When you receive your card you can go online at www.americanexpress.com/airlinechoice or call the number on the back of your card to select an eligible airline for the credit.

Qualifying airlines include:

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

American Express officially states that the following qualify for the airline credit:

- Checked baggage fees (including overweight/oversize)

- Itinerary change fees

- Phone reservation fees

- Pet flight fees

- Seat assignment fees

- In-flight amenity fees (beverages, food, pillows/blankets, headphones)

- In-flight entertainment fees (excluding wireless internet because it’s not charged by the airline)

- Airport lounge day passes & annual memberships

The following items are explicitly excluded:

- Airline tickets

- Mileage points purchases or mileage points transfer fees

- Gift cards

- Upgrades

- Duty–free purchases

- Award tickets

It’s best to do some research on FlyerTalk to see what the most current qualifying purchases are for a respective airline since it can differ dramatically between airlines.

FlyerTalk has individual threads for different airlines with specific breakdowns of the different types of purchases that were successful and it usually provides a date that they were last successful. So you can check on the status of purchases for things like gift cards and upgrades.

For example, here are some of the threads for the major US airlines.

Amex states that you’ll receive a statement credit covering those fees, typically 2–4 weeks after you pay for them. In reality these credits usually only take a couple of days to hit my account. (In some cases, it’s almost like a back-log occurs and it takes longer.)

Card Members who have already selected one qualifying airline will be able to change their choice one time each year in January at www.americanexpress.com/airlinechoice or by calling the number on the back of the card. Note that Amex will also usually allow you to switch your airline later on in the year as a “one time exception.” You can even switch you airline after you’ve used some of the credit in some instances!

Final word

These credits can offset the entire $450 annual fee and $500 worth of these credits are very easy to use. For that reason, these travel credits provide the Aspire card with a lot of its value. With the addition of Diamond status, 14X on Hilton purchases, and Priority Pass, the Aspire is one of the most rewarding hotel cards.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Your FT link for AA points to an old version. The latest is https://www.flyertalk.com/forum/american-express-membership-rewards/2063842-airline-fee-250-200-reimbursement-reports-aa-only-2022-a.html