Priority Pass Select membership can be one of the most valuable credit card perks available. With this membership, you’ll be able to access over 1,300 airport lounges all across the globe. But what exactly are the Priority Pass Select benefits and rules?

In this article, I’ll take an in-depth review of the Priority Pass Select program. I’ll discuss different ways to enroll in Priority Pass Select with different credit cards and go over things like the different guest policies and costs. I’ll also show you how to find Priority Pass lounge locations and what to expect when you visit them.

Interested in finding out the hottest travel credit cards for this month? Click here to check them out!

Table of Contents

What is Priority Pass Select?

Priority Pass Select is a type of Priority Pass membership that is offered through various U.S. financial institutions and grants you access to over 1,300 Priority Pass airport lounges all over the globe.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

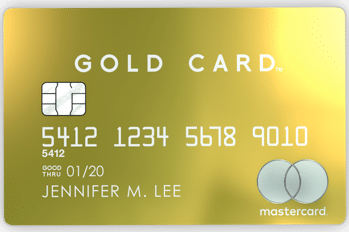

Priority Pass membership cost

Priority Pass Select memberships are gained through credit cards so the cost for those memberships are essentially the annual fee paid for those cards.

But there are also different types of Priority Pass memberships that you can purchase without being a credit card holder. Those memberships are listed below.

- Standard: $99 annual fee

- Standard Plus: $329 annual fee

- Prestige: $469 annual fee

Priority Pass Select memberships are very similar to these memberships that you can pay for. For example, some Priority Pass Select memberships will grant you unlimited access while others might limit your visits to only 10 per year.

But one major distinction between the two is that with Priority Pass Select you are often allowed to bring guests with you into the lounge free of charge. And if you exceed your guest limit, you can have guests enter with a reduced fee of around $35 per guest.

If you’re talking about a Priority Pass Select membership that offers unlimited lounge visits, you can quickly see how valuable the membership is. For example, the Prestige membership will cost you $469 per year, so you’re getting at least that much value.

But as noted the Prestige membership does not allow you to bring in guests for free. So if you regularly bring along a companion with you or a family, you’re potentially getting much more than $469 worth of value from your membership.

Priority Pass Select guest policy

Take a look at the cards below and you will notice that the guest policy for the cards differ. Most cards offer two complimentary guests while some other cards also allow for immediate family members to enter or even unlimited guests. As stated, if you exceed the guest policy, you can usually have guests enter with a reduced fee of around $35 per guest.

One thing to take into consideration is that the individual lounges can impose their own restrictions on guest policies. You usually won’t have a problem when bringing in one or two guests but if you’re trying to bring in more than that you could run into issues if the lounge is facing crowding.

How to get a Priority Pass Select membership

There are many different ways to get a Priority Pass membership. Below, I will discuss several of the different credit cards that you can choose from in order to get a membership. I will also highlight some of the key benefits of these cards so that you can have an idea of why these cards might be a good fit for you.

Amex Platinum Card

The American Express Platinum Card is the number one card for lounge access in my opinion. You’ll get Priority Pass membership for you and two other guests but you’ll also get Centurion Lounge access along with Delta Sky Club access, making this the most complete lounge package out there.

The Platinum Card is also a great card if you want elite status, as it offers Gold status with Hilton and Marriott. It’s also a very rewarding card with 5X on airfare and other benefits.

The annual fee for the Platinum Card is $695 but it is offset by the $200 annual Uber credit and the $200 annual airline credit. In addition, you’ll also get a $200 hotel credit, $300 Equinox credit, CLEAR credit, and $240 entertainment credit.

Chase Sapphire Reserve

The Chase Sapphire Reserve offers Priority Pass Select membership for you and two guests. It used to offer unlimited guests but that got a little too popular and Chase cut back the benefit to only allow for two guests.

Beyond Priority Pass, the Sapphire Reserve is a very strong contender of a credit card with its 3X on dining and travel, $300 travel credit, and ability to cash in your points through the Chase Travel Portal at a rate of 1.5 cents per point. It also comes with a host of worthwhile benefits.

The annual fee for the Chase Sapphire Reserve is $550 but with the easy to use $300 travel credit and $60 DoorDash credit, it’s very easy knock down the effective annual fee to $190.

US Bank Altitude Reserve

The US Bank Altitude Reserve Visa Infinite Card offers an interesting Priority Pass membership that gives you four complimentary entries each year and four individual accompanying guest visits as well. After the free visits have been used, the member’s card will be charged a lounge visit fee of $27 per person per visit for the member and each guest.

The Altitude Reserve also comes with a sign-up bonus of 50,000 points (worth $750 in travel) after spending $4,500 within the first 90 days. It also has one of the highest travel credits of $325 making it easy to offset the $400 annual fee.

This is a great card for those who utilize mobile wallets because it earns 3X on eligible mobile wallet purchases, which can be a significant advantage for some. The card also earns 3X on travel booked directly with airlines, hotels, taxis, trains, etc. (but no OTAs).

Amex Hilton Aspire

The Amex Hilton Aspire will grant you Priority Pass for you and two guests, just like the Platinum Card. The Aspire really shines in a few ways. First, it offers you Hilton Diamond status, which is the top-tier status offered by Hilton. That status can get you free breakfast, lounge access, and suite upgrades, among other benefits.

The Aspire also comes with a number of credits that help offset the $450 annual fee:

- $250 airline incidental fee statement credit

- $250 Hilton resort statement credit

- $100 on property credit at Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts when booking the exclusive Aspire Card package

You also get a free anniversary night which can be used at even the most expensive Hilton properties.

And finally you can earn a ton of Hilton points with this card as it comes with the following bonus categories:

- 14X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 7X Hilton Honors Bonus Points on flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and at U.S. restaurants

- 3X Hilton Honors Bonus Points on other purchases

Amex Hilton Surpass

The Amex Hilton Surpass comes with 10 free Priority Pass lounge passes. You can use these for yourself and for guests if you’d like, so there’s a lot of flexibility with this card.

The Ascend is a much more basic card compared to the Aspire but it’s still a very good hotel credit card. You’ll get Hilton Honors Gold status and the ability to earn one free weekend night at a hotel or resort in the Hilton portfolio after spending $15,000 in purchases in a calendar year

You’ll also get some strong bonus earning potential by being able to earn:

- 12X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 6X Hilton Honors Bonus Points at U.S. supermarkets, U.S. restaurants, and U.S. gas stations

- 3X Hilton Honors Bonus Points on all other eligible purchases

For only a $95 annual fee, this card is a bargain for many people.

Marriott Bonvoy Brilliant American Express Card

The Marriott Bonvoy Brilliant American Express Card comes with the standard Priority Pass Select membership that allows access for you and two guests with unlimited visits. Overall, it’s a pretty strong hotel card and also offers a $300 credit towards Marriott that can even be used at room rates and an annual free night for properties that cost up to 50,000 Marriott points.

There’s also some decent bonus earning potential with the card as it earns:

- 6X on Marriott purchases

- 3X on US restaurants

- 3X on airlines booked directly with airlines

- 2X on other purchases

The card does come with Marriott Gold elite status but that elite status is less valuable than it was before.

Citi Prestige

The Citi Prestige comes with one of the better Priority Pass memberships. You’ll get unlimited visits for yourself and two guests or your immediate family members.

The card earns a whopping 5X on dining and airfare and 3X on cruise lines and hotels, as well as 2X on entertainment. The $250 travel credit is now expanded so you’ll be able to offset the annual fee easier though the fee is increased to $495.

Luxury Card Black Card

Reportedly, the Luxury Card Black Card allows for unlimited guests with your Priority Pass membership. I haven’t been able to confirm that in the terms and conditions but if that’s the case, the Luxury Card offers the most generous type of Priority Pass membership.

Unfortunately, the Black Card is kind of a bust overall. It doesn’t offer a welcome bonus and while it earns 2% back when used for airfare and 1.5% back on all purchases, you can find no annual fee cards that earn that same rate so that’s not entirely impressive.

It does have a $100 airline credit that helps offset the $495 annual fee and some special VIP perks like 24/7 access to Luxury Card Concierge, Luxury Card Travel, and “Priceless” access. But beyond that, there’s not a whole to rave about with this card.

Luxury Card Gold Card

The Luxury Card Gold Card is very similar to the Black Card only it earns 2% back when used for airfare and 2% back on all purchases. Again, that’s not bad but considering there are no-annual fee cards which can earn you the same rates, that’s not that impressive.

Other card options

- City National Bank Visa Infinite

- Ritz-Carlton Rewards Card (no longer available for new applicants)

Authorized users

Many of these cards allow authorized users to get access to the Priority Pass lounges. Utilizing authorized users is a great way to get more guests into the lounge with you since each authorized user can bring in their own guests. So for example if you and a companion had a Platinum Card, then you each could bring in two guests for a total of four guests. Many times, the fees for adding authorized users are very reasonable so consider using this to your advantage.

How Priority Pass Select works

The way Priority Pass works is pretty simple.

Get approved for an eligible card

First, you need to get approved for a credit card that has Priority Pass Select.

Enroll/activate

You will typically need to enroll in Priority Pass after you are approved for a credit card, so don’t assume that you will be automatically enrolled. You can usually do this online when logging in to your account but you also might be able to do this by calling in.

Show your card

After you enroll into the program, you should receive your physical card in the mail within a couple of weeks. Make sure that you bring your physical card with you when you visit the lounges.

Many programs will allow you to link your Priority Pass card to the mobile app so you won’t always have to bring the physical card but some lounges have issues when trying to use your app. Thus, I always carry my physical card with me when traveling.

Cancelling

Something you need to know is that if you cancel your credit card you will lose out on the lounge membership immediately. If you somehow are given access to the lounge with your Priority Pass card, you will likely get billed for that visit on your credit card on a later date.

Renewing

Your Priority Pass Select membership should automatically renew if your card remains in good standing. However, it’s a good idea to monitor your card membership to make sure that the renewal process goes smoothly.

Priority Pass Select app (digital card)

You can download the Priority Pass app from the App Store or Google Play.

This app is how you can access your digital card. Also, they are now starting to show indoor airport maps to help you better navigate the terminals and find your lounge. Other features include tracking your visit history and saving your “must visit” lounges to access them from the search screen.

Priority Pass Select benefits (lounges experiences)

The lounge experience can differ dramatically between Priority Pass lounges but here are some benefits you can expect to find at these lounges.

Wifi

Virtually every Priority Pass is going to offer complimentary wifi, at least for a while. Generally, the wifi speed is good enough to get things done but I’ve visited some lounges where the speed was severely lacking.

Food items

The type of food you’ll find in these lounges is going to vary. At the minimum, you’ll usually be able to find snacks and finger foods, such as pretzels, chips, and other light bites. But some lounges will provide you with a spread of hot items — sometimes these are actually pretty tasty items and other times they leave a bit to be desired.

Complimentary drinks

Most Priority Pass lounges that I’ve visited have offered a selection of complimentary alcohol. Beer and wine is common to find but some lounges will have a pretty solid line-up of spirits that you can take advantage of.

Comfy seating

Most lounges will have seating options that are superior to what’s offered in the terminals. Again, it all depends on the lounge.

Showers

Some Priority Pass lounges have showers though there are usually only a small number (or only one shower stall) available. If you want to shower at one of these lounges, your best bet would be to contact the front desk as soon as you arrive in order to secure a stall.

Some of the showers will provide you with amenities like soaps, shampoos, and conditioners, though it varies.

Nap rooms

Nap rooms are more rare to come across but I’ve seen some with some nice nap rooms (sometimes you have to reserve them).

Crowding

With so many credit cards offering Priority Pass now, crowding has definitely become an issue in some of these lounges. As a result, some lounges now limit access to Priority Pass members during busy hours. This is something that you always want to check on before heading out to your lounge.

How to find Priority Pass Select locations

It’s very easy to find Priority Pass lounges.

Simply visit their website and click on “Find a Lounge” at the top of the screen. You can then enter the city, airport name or code.

Once you are taken to the search results, simply click on the “Lounges” tab to see what lounges are available at the airport. You should then be able to select the lounges to find out all of the details for that lounge.

- Opening Hours

- Location

- Conditions

- Additional Information

You can also easily see the amenities offered like alcohol, showers, wifi, and things like whether Digital Cards are accepted.

It’s really important to make sure that you’ll be able to visit these lounges from the terminal that you’re flying out of. Many airports don’t allow you to connect between terminals after you go through security, so it’s not always practical to visit these lounges.

Sometimes you can exit the terminal and go through security twice to visit a lounge but some of these lounges might not be worth the effort. If you’re trying to figure out whether or not you can get between terminals, Flyertalk is a great place to research and ask questions.

Priority Pass restaurants

One of the cool new trends is that Priority Pass has added airport restaurants to its lounge network. For example, At SFO, you can visit the San Francisco Giants Clubhouse or Yankee Pier.

This is great if you can’t make it to a terminal with a lounge or if the lounges are full. And you can sometimes register multiple guests so you and a small party of three can enjoy a meal together.

These restaurants are constantly changing so you want to make sure that you’re checking the most up to to date information on them before you visit.

Which Priority Pass Select membership is right for you?

Airlines

Since Priority Pass offers you airport lounge access you will likely be seeking out benefits related to airlines. The Platinum Card is a great way to go to maximize your rewards with airlines because it offers 5X rewards on purchases made directly with airlines.

But note that if you want lounge access with specific airlines like United, American Airlines, Delta, etc., there are co-branded cards that you can get that will offer you lounge access for those specific airlines.

Hotels

If you are interested in hotel rewards then the Hilton Aspire Card might be on the top of your list. Personally, I would go with the Hilton Aspire Card because I like that it offers top tier diamond status and also offers such amazing credits. I would also give the American Express Platinum a really good look because it comes with Hilton Gold Status as well as Marriott Gold as well.

Spending

Now, more premium cards are offering bonus spending for various types of bonus categories like dining and travel. The Chase Sapphire Reserve is a great option for earning bonus points on travel purchases and it will also earn you three times the points on dining is well. The new Citi Prestige Card is a great option for maximizing earnings on dining with its new 5X rewards as well.

Limited visits

Some people might only visit airports a few times a year. For these people, they don’t really need an unlimited membership for airport lounges. Instead, they can be 100% satisfied with a card that only provides them with a handful of visits each year. These people might want to consider cards like the Hilton Ascend or Altitude Reserve.

Multiple cards with Priority Pass

A lot of people wonder if they should hold multiple cards that offer them a Priority Pass Select membership.

The answer to this question is very often: yes.

Now that so many valuable credit cards offer Priority Pass memberships, it is almost difficult to not have multiple memberships with Priority Pass. In fact, right now I could have a hand full of Priority Pass memberships if I chose to enroll each individual credit card.

But that is not because I am a Priority Pass fanatic. It is just because there are several cards out there that offer such great benefits that they are worth picking up individually.

For example, I hold the American Express Platinum Card, Chase Sapphire Reserve, American Express Hilton Aspire, and will soon be picking up the Citi Prestige. Each of those cards offer me unique benefits that I can take advantage of in different ways.

- American Express Platinum Card: Centurion Lounge access, 5X airfare earning Membership Rewards, FHR

- Chase Sapphire Reserve: 3X on dining and travel earning Ultimate Rewards, 1.5 cents per point through the Chase Travel Portal

- Hilton Aspire: Hilton Diamond status, 14X on Hilton purchases

- Citi Prestige: 4th night free, 5X on dining and airfare earning Citi ThankYou Points

If you do enroll in multiple Priority Pass programs then I suggest that you mark your Priority Pass cards so that you do not get your memberships mixed up. This is especially important if the guest policy is different for your different cards.

List of US lounge locations

Hartsfield-Jackson Atlanta Intl (ATL)

XpresSpa

Terminal

- Concourse A

Location

- Airside – opposite Center Food Court, near Gate A18

Hours

- Daily: 6:00am to 10:00pm

Samuel Adams Brew House

Terminal

- Concourse B

Location

- Airside – Samuel Adams Brew House is located in the Food Court Area

Hours

- Daily: 7:00am to 10:00pm

- The Kitchen operates between 11:00am – 8:00pm daily. No orders will be taken outside these hours.

Minute Suites

Check out the full Minute Suites guide.

Terminal

- Concourse B

Location

- Airside – located near Gate B16

Hours

- Daily: 24 hours

Minute Suites

Terminal

- Concourse B

Location

- Airside – near Gate B24

Hours

- Daily: 24 hours

Be Relax Spa

Terminal

- Concourse B

Location

- Airside – after Security, near Gate B22 inside the Traveler’s Oasis

Hours

- Daily: 7:00am to 10:00pm

XpresSpa

Terminal

- Concourse C

Location

- Airside – across from Gate C37

Hours

- Daily: 6:00am to 10:00pm

XpresSpa

Terminal

- Concourse D

Location

- Airside – across from Gate D25

Hours

- Daily: 6:00am to 10:00pm

Minute Suites

Terminal

- Concourse E

Location

- Airside – the lounge is located in the atrium at the top of the escalators to the left

Hours

- Daily: 24 hours

XpresSpa

Terminal

- Concourse E

Location

- Airside – the spa is located to the left of the Centre Concourse Food Court

Hours

- Daily: 6:00am to 10:00pm

Minute Suites

Terminal

- Concourse F

Location

- Airside – between Gates F2 & F4, past the main Food Court Area, next to the ‘InMotion’ store

Hours

- Daily: 24 hours

The Club ATL

Terminal

- International Terminal / Concourse F

Location

- Airside – Mezzanine Level, next to the Chapel

Hours

- Daily: 6:00am to 10:00pm

- Access may be periodically restricted due to space constraints, in particular during the hours of 1:00pm – 9:00pm daily

Baltimore/Washington International Thurgood Marshall Airport (BWI)

Minute Suites

Terminal

- Concourse C

Location

- Airside- after security, Minute Suites is located between Gate C3 and C5 right next to Urban Bar-B-Que

Hours

- Sunday-Monday: 7:00am to 10:00pm

- Tuesday-Saturday: 5:00am to 10:00pm

The Club BWI

Terminal

- Concourse D

Location

- Airside – Upper Level. After Security Checks, proceed to Gate D10 and the lounge is located next to ‘Dunkin Donuts’. The lounge is also accessible to passengers travelling from Concourse E. Please allow sufficient time to return back to the departure gate

Hours

- Daily: 4:15am to 10:30pm

Boston Logan International Airport (BOS)

Chase Sapphire Lounge by The Club

Terminal

- Terminal B

Location

- Airside – located in the Terminal B to Terminal C connector. Closest Gate is B40

Hours

- Daily: 5:00am to 11:00pm

Stephanies

Terminal

- Terminal B

Location

- Airside – after Security, Departures Level, opposite Gate B24. Domestic flights only

Hours

- Daily: 5:00am to 10:00pm

The Lounge

Terminal

- Terminal C

Location

- Airside – 1st Floor, Concourse Level across from Gate C19. The lounge is not accessible from Gates 40 – 42

Hours

- Monday, Thursday, Sunday: 6:00am to 9:00pm

- Tuesday, Wednesday, Friday, Saturday: 6:00am to 10:00pm

- Access may be periodically restricted due to space constraints, in particular during the hours of 12:30pm – 8:00pm daily

Davio’s Northern Italian Steakhouse

Terminal

- Terminal C

Location

- Airside – 3rd Floor, near Gate C25. Domestic flights only

Hours

- Daily: 5:00am to 10:00pm

Air France Lounge

Terminal

- Terminal E

Location

- Airside – after Security, turn right towards Gate 4. Take the dedicated lounge lift or stairs to where the lounge is located

Hours

- Wednesday – Monday: 9:30am to 10:30pm

- Tuesday: 9:00am to 10:30pm

Stephanies

Terminal

- Terminal E

Location

- Airside – after Security, Departures Level, opposite Gate E7

Hours

- Daily: 7:00am to 10:00pm

Buffalo Niagara International Airport (BUF)

The Club

Terminal

- N/A

Location

- Airside – after Security Checks, between Gates 6 and 7

Hours

- Daily: 4:00am to 7:00pm

Charleston International Airport (CHS)

The Club CHS

Terminal

- N/A

Location

- Airside – after Security, walk towards Concourse B. The lounge is located on your left after Chick-fil-A. Take the lift to the 3rd Floor to access the lounge

Hours

- Daily: 4:10am to 8:30pm

Charlotte Douglas International Airport (CLT)

Minute Suites

Terminal

- Atrium

Location

- Airside – the lounge is located in the main atrium, next to the Food Court Area

Hours

- Daily: 24 hours

The Club CLT

Terminal

- Concourse A

Location

- Airside – turn right at Starbucks and proceed towards Gates A21 – A29. The lounge is located on the left hand side just before reaching Gates A22 and A21

Hours

- Daily: 5:00am to 9:30pm

- The lounge may exceed their seating limit between the hours of 2:30pm – 6:30pm and access is at their sole discretion

Be Relax Spa

Terminal

- Concourse A

Location

- Airside – Be Relax Spa is located after Security, between Gates A and B

Hours

- Daily: 8:00am to 4:00pm

Minute Suites

Terminal

- Concourse D

Location

- Airside – D/E Connector near the Food Court

Hours

- Daily: 24 hours

Gameway

Terminal

- Concourse E

Location

- Airside – after Security, follow signs for E Gates. Gameway is located opposite Gate E36. This location is accessible post-security to all concourses

Hours

- Daily: 7:00am to 8:00pm

Chicago O’Hare International Airport (ORD)

Swissport Lounge

Terminal

- International Terminal 5

Location

- Airside – after Security, turn right and the lounge is located next to Gate M13

Hours

- Daily: 7:00am to 9:00pm

- Closed: Dec. 25 & Jan 1

- Access will be periodically restricted due to space constraints in particular during the hours of 3:00pm – 8:30pm daily

Cincinnati/Northern Kentucky International Airport (CVG)

The Club CVG

Terminal

- Concourse A

Location

- Airside – the lounge is located between Gates A8 and A10. The lounge is also accessible to passengers travelling through Concourse B or C but will need to allow sufficient time to reach the departure gate

Hours

- Daily: 6:00am to 8:30pm

Escape lounge

Terminal

- Concourse B

Location

- Airside – take the train to Concourse B, continue upstairs and turn left. The lounge is located between Gates B21 and B23

Hours

- Monday, Wednesday, Friday, Saturday, Sunday: 5:00am to 8:30pm

- Tuesday, Thursday: 5:00am to 8:00pm

Cleveland Hopkins International Airport (CLE)

The Club CLE

Terminal

- Concourse B

Location

- Airside – after Security Checks, head straight to Concourse B, turn right into the hall after ‘Ohio Gameday Sports’

Hours

- Daily: 4:30am to 9:00pm

Bar Symon

Terminal

- Concourse C

Location

- Airside – after Security, go to Concourse C and Bar Symon is located between Gates C4 and C6

Hours

- Daily: 5:30am to 5:30pm

Colorado Springs Airport (COS)

Colorado Springs Premier Lounge

Terminal

- N/A

Location

- Airside – after Security Checks, adjacent to Gate 6

Hours

- Daily: 4:00am to last scheduled flight departure

- DUE TO CONSTRUCTION WORKS, THIS LOUNGE IS TEMPORARILY CLOSED UNTIL FURTHER NOTICE

John Glenn Columbus International Airport (CMH)

Escape lounge

Terminal

- Concourse B

Location

- Airside – Level 2. Turn left at the end of Concourse B and the lounge is located next to Gate 32B

Hours

- Daily: 5:00am to 8:00pm

- Food and beverages service stops 30 minutes before closing time

Dallas/Fort Worth Intl (DFW)

Minute Suites

Terminal

- Terminal A

Location

- Airside – located near Gate A38

Hours

- Daily: 24 hours

XpresSpa

Terminal

- Terminal B

Location

- Airside – near Gate A24

Hours

- Daily: 6:00am to 10:00pm

Gameway

Terminal

- Terminal B

Location

- Airside – near the Skylink and Gate 42

Hours

- Daily: 6:00am to 8:00pm

Be Relax Spa

Terminal

- Terminal B

Location

- Airside – after Security Checks, Be Relax is located on the left hand side of Starbucks, next to Gate B28

Hours

- Daily: 7:00am to 9:00pm

The Club DFW

Terminal

- Terminal D

Location

- Airside – located on the Mezzanine Floor near Gate 27

Hours

- Daily: 4:00am to 10:30pm

Minute Suites

Terminal

- Terminal D

Location

- Airside – located near Gate D23

Hours

- Daily: 24 hours

Be Relax Spa

Terminal

- Terminal D

Location

- Airside – after Security Checks, Be Relax is located on the right hand side after 7eleven, next to the Gate D21

Hours

- Daily: 8:00am to 8:00pm

Plaza Premium Lounge

Terminal

- Terminal E

Location

- Airside, near Gate E31

Hours

- Daily: 6:00am to 8:00pm

Drew Pearson’s Sport 88

Terminal

- Terminal E

Location

- Airside – near Gate 05

Hours

- Daily: 6:00am to 8:00pm

Gameway

Terminal

- Terminal E

Location

- Airside – after Security, near Gate E16

Hours

- Daily: 6:00am to 8:00pm

Denver International Airport

Mercantile Dining and Provision

Terminal

- Concourse A

Location

- Landside – located in the center core of Concourse A, near Gate 39. This location is post Security and is accessible for passengers departing from Concourses A, B and C

Hours

- Daily: 6:00am to 12:00am

SweetWater Mountain Taphouse

Terminal

- Concourse B

Location

- Airside – proceed to the end of Level 2, pass Gate 79 and the SweetWater Mountain Taphouse is located on the right hand side next to Starbucks before Level 1 in Concourse B Gate 80

Hours

- Daily: 6:00am to 8:00pm

- THIS LOCATION IS TEMPORARILY CLOSED FOR REMODELLING UNTIL FURTHER NOTICE

Detroit Metropolitan Wayne County Airport (DTW)

Minute Suites

Terminal

- McNamara Terminal

Location

- Airside – near Gate A66

Hours

- Daily: 24 hours

Be Relax Spa

Terminal

- McNamara Terminal

Location

- Airside – located near the middle of the water fall between Johnston & Murphy & Vino Volo, near to Gate A46

Hours

- Daily: 7:00am to 9:00pm

- Hours may vary according to flight schedules

Be Relax Spa

Terminal

- McNamara Terminal

Location

- Airside – located on the south end of the terminal, near Starbucks at Gate A18

Hours

- Daily: 7:00am to 9:00pm

- Hours may vary according to flight schedules

Lufthansa Business Lounge

Terminal

- Warren C. Evans Terminal

Location

- Airside – after Security Checks turn left, the lounge is located next to Gate D8

Hours

- Monday, Wednesday, Friday: 6:00am to 12:00pm & 4:00pm to 9:00pm

- Tuesday, Thursday, Saturday: 6:00am to 12:00pm & 4:00pm to 7:00pm

- Sunday: 4:00pm to 7:00pm

Anitas Kitchen

Terminal

- Warren C. Evans Terminal

Location

- Airside – near Gate D23

Hours

- Daily: 8:00am to 8:00pm

Fort Lauderdale–Hollywood International Airport (FLL)

Kafe Kalik

Terminal

- Terminal 4

Location

- Airside – after Security proceed towards Concourse G and Kafe Kalik is located near Gate G6

Hours

- Daily: 10:00am to 8:00pm

Greenville-Spartanburg International Airport

Escape Lounge

Terminal

- Concourse B

Location

- Airside – Ground Level . After the TSA checkpoint, turn right and head towards the end of the Hall. The lounge is located under Gate B1

Hours

- Daily: 4:30am to 7:30pm

Daniel K. Inouye International Airport (HNL)

The Plumeria Lounge

Terminal

- Terminal 1

Location

- Airside – 3rd Floor, the lounge is located near the Wiki Wiki shuttle pick up area

Hours

- Daily: 6:30am to 10:00pm

I.A.S.S Hawaii Lounge

Terminal

- Terminal 2

Location

- Airside – after Security Checks, proceed to Garden Court (Airline Lounge Area) towards Gates 14-23 of the Central Concourse. Take the lift or stairs to Ground Level and follow the signs to the lounge

Hours

- Daily: 7:30am to 1:30pm & 2:00pm to 6:00pm

George Bush Intercontinental Airport (IAH)

Cadillac Mexican Kitchen & Tequila Bar

Terminal

- Terminal A

Location

- Airside – proceed to Security Checkpoint for Gates A17-A30 and Cadillac is located near Gate A17

Hours

- Daily: 7:00am to 10:00pm

Landry’s Seafood

Terminal

- Terminal C

Location

- Airside – after Security Checkpoint, turn left and Landry’s is located near Gate C42

Hours

- Daily: 7:00am to 9:00pm

Minute Suites

Terminal

- Terminal C

Location

- Airside – near Gate C14

Hours

- Daily: 24 hours

Air France Lounge

Terminal

- Terminal D

Location

- Airside – after Security, opposite Gate D18B

Hours

- Daily: 3:30pm to 6:45pm

- Cardholders will not be admitted into the lounge outside these hours

KLM Crown Lounge

Terminal

- Terminal D

Location

- Airside – the lounge is located near Gate D16

Hours

- Daily: 6:00am to 9:00pm

- Hours may vary according to flight schedules

- Access may be restricted between the hours of 1:00pm – 6:30pm daily due to space constraints

William P. Hobby Airport (HOU)

Gameway

Terminal

- N/A

Location

- Airside – after TSA Security Checkpoint, follow signs to Gates 1 – 5. Gameway is located near Gate 1

Hours

- Daily: 6:00am to 9:00pm

XpresSpa

Terminal

- N/A

Location

- Airside – Central Concourse, near Gate 45

Hours

- Daily: 6:00am to 9:00pm

Indianapolis International Airport (IND)

The Tap

Terminal

- Concourse B

Location

- Airside – after Security, turn left and The Tap is located at the end of Concourse B, near Gate B17

Hours

- Daily: 8:00am to last scheduled flight departure

Kahului Airport (OGG)

Premier Club

Terminal

- N/A

Location

- Airside – 2nd Floor, opposite Gate 17

Hours

- Daily: 6:00am to 8:30pm

Harry Reid International Airport (LAS)

The Club LAS

Terminal

- Terminal 1

Location

- Airside – Level 2. After passing through Security Checkpoint D, take the Blue Line train to D Gates – Level 0. Take the escalator and head West or right towards Gate D33. The lounge is located between Brooks Brothers & Tumi. It takes approximately 15 minutes.

- Access from Terminal 3 – Level 0. After passing through Security Checkpoint D and E, take the Red Line train to the D Gates-Level 0 and follow the same directions as above. It takes approximately 18 minutes

Hours

- Daily: 5:00am to 11:30pm

XpresSpa

Terminal

- Terminal 1

Location

- Airside – Concourse D. Near Gate D32, across from “The Club”

Hours

- Daily: 7:00am to 11:00pm

XpresSpa

Terminal

- Terminal 1

Location

- Airside – Concourse B, near the A/B Concourse Connector

Hours

- Daily: 7:00am to 9:00pm

The Club LAS

Terminal

- Terminal 3

Location

- Airside – the lounge is located across from Gate E2

Hours

- Daily: 5:00am to 12:00am

XpresSpa

Terminal

- Terminal 3

Location

- Airside – Concourse E, near Gate E3

Hours

- Daily: 8:00am to 11:00pm

Los Angeles International Airport (LAX)

Be Relax Spa

Terminal

- Terminal 1

Location

- Airside – after Security Checks, turn right and Be Relax is located next door to Rock n Brew Restaurant

Hours

- Daily: 6:00am to 10:00pm

Gameway

Terminal

- Terminal 3

Location

- Airside – near Gate 30B. This location is accessible post-security to Terminals 2 & 3

Hours

- Daily: 6:00am to 9:00pm

Gameway

Terminal

- Terminal 6

Location

- Airside – opposite Gate 65A. Accessible from Terminals 7 & 8 via a connecting walkway located near the TSA Checkpoint

Hours

- Daily: 6:00am to 9:00pm

Be Relax Spa

Terminal

- Tom Bradley International Terminal

Location

- Airside – Be Relax Spa is located near Gate 154

Hours

- Daily: 9:00am to 9:00pm

Melbourne Orlando International Airport (MLB)

MLB Premium Lounge

Terminal

- N/A

Location

- Airside – after Security, enter the Departure Area and follow signs to the ‘Premium Lounge’

Hours

- Daily: 12:00pm to 7:00pm

Miami International Airport (MIA)

Turkish Airlines Lounge

Terminal

- North Terminal Concourse D and E

Location

- Airside – after TSA Check Point in Concourse E. The lounge is located on Level 2, past the escalator on the left hand side. Access from Terminal D – pass through the connector to the Central Terminal (E Gates Concourse) and the lounge is located directly ahead

Hours

- Daily: 5:00am to 10:00pm

Corona Beach House

Terminal

- North Terminal Concourse D and E

Location

- Airside – between Gates D23 and D24

Hours

- Daily: 6:30am to 9:00pm

XpresSpa

Terminal

- North Terminal Concourse D and E

Location

- Airside – near Gate D11

Hours

- Daily: 8:00am to 8:00pm

Turkish Airlines Lounge

Terminal

- South Terminal Concourse H and J

Location

- Airside – the lounge lift lobby is located midway between Concourses H and J. Take the lift to the 3rd Floor, keep to the left until you reach the lounge entrance

Hours

- Daily: 24 hours

Minneapolis–Saint Paul International Airport (MSP)

PGA MSP Lounge

Terminal

- Terminal 1

Location

- Airside – proceed to the north end of the Airport Mall (towards Concourses D/E). Take the lift or stairs located between Concourses D and E (corner) up to the Upper Level

Hours

- Monday – Friday: 7:00am to 8:00pm

- Saturday – Sunday: 8:00am to 7:00pm

Escape Lounge

Terminal

- Terminal 1

Location

- Airside – MSP Mall, above the entrance to Concourse E (mezzanine level)

Hours

- Daily: 4:00am to 9:00pm

XpresSpa

Terminal

- Terminal 1

Location

- Airside – the spa is located at the end of Concourse C and the entrance of Concourse D

Hours

- Daily: 7:00am to 9:00pm

Nashville International Airport (BNA)

Minute Suites Nashville

Terminal

- Concourse D

Location

- Airside – near Gate D3

Hours

- Daily: 4:00am to 11:00pm

Louis Armstrong New Orleans International Airport (MSY)

The Club MSY

Terminal

- Concourse A

Location

- Airside – after Security Checks, follow the signs for Concourse A and pass Cafe Du Monde. Take the lift located on the right hand side to the 3rd Floor

Hours

- Daily: 4:00am to 9:00pm

Newark Liberty International Airport (EWR)

Be Relax Spa

Terminal

- Terminal A

Location

- Airside – Be Relax Spa is located after Security, near Gate A7

Hours

- Daily: 9:00am to 9:00pm

John F. Kennedy International Airport (JFK)

Lufthansa Business Lounge

Terminal

- Terminal 1

Location

- Airside – after Security Checkpoint on the left hand side

Hours

- Monday: 3:00pm to 7:00pm

- Tuesday: 5:30pm to 1:00am

- Wednesday: 5:30pm to 1:30am

- Thursday, Friday, Sunday: 12:00pm to 4:00pm

- No Entry on Saturday

- Cardholders will not be admitted into the lounge on Saturdays and outside these hours

Primeclass Lounge

Terminal

- Terminal 1

Location

- Airside – after Security, next to Gates 8 and 9

Hours

- Monday: 7:00am to 11:30pm

- Tuesday, Saturday: 9:00am to 1:00am

- Wednesday, Friday: 11:30am to 11:30pm

- Thursday, Sunday: 7:00am to 1:00am

Turkish Airlines Lounge

Terminal

- Terminal 1

Location

- Airside – after TSA Security Checks, the lounge is located between Gates 2 and 3

Hours

- Daily: 9:00am to 12:10am

Air France Lounge

Terminal

- Terminal 1

Location

- Airside – near the Air France Boarding Area by Gate 1

Hours

- Daily: 10:00am to 11:45pm

- Access may be restricted between 2:00pm – 9:00pm daily due to space constraints

KAL Business Class Lounge

Terminal

- Terminal 1

Location

- Airside – after Security Checkpoint, the lounge is located on the right hand side, across Gate 3

Hours

- Daily: 9:30pm to 12:50am

- Cardholders will not be admitted into the lounge outside these hours

VIP ONE Lounge

Terminal

- Terminal 1

Location

- Landside – Departure Level. The lounge is located behind counters E and F next to the TSA Check Point

Hours

- Daily: 8:00am to 12:00am

Be Relax Spa

Terminal

- Terminal 1

Location

- Airside – Be Relax is located near Gate 5

Hours

- Daily: 9:00am to 9:00pm

Virgin Atlantic Clubhouse

Terminal

- Terminal 4

Location

- Airside – the lounge is located above Boarding Gates A4 and A5

Hours

- Daily: 5:00am to 1:30pm

Air India Maharaja Lounge

Terminal

- Terminal 4

Location

- Airside – after Security, next to Gate 5

Hours

- Daily: 8:15am to 8:00pm

Primeclass Lounge

Terminal

- Terminal 4

Location

- Airside – next to Gate A2

Hours

- Daily: 24 hours

Chase Sapphire Lounge by The Club with Etihad Airways

Terminal

- Terminal 4

Location

- Airside – after Security, turn left and continue on the same level. The lounge is approximately a 3 minute walk

Hours

- Daily: 5:00am to 11:00pm

Minute Suites

Terminal

- Terminal 4

Location

- Airside – proceed to B Gates and the Minute Suites is located near Gate 39

Hours

- Daily: 24 hours

XpresSpa

Terminal

- Terminal 4

Location

- Airside – near Gate B22

Hours

- Daily: 8:00am to 10:00pm

XpresSpa

Terminal

- Terminal 4

Location

- Airside – near Gate B24

Hours

- Daily: 6:00am to 11:00pm

Be Relax Spa

Terminal

- Terminal 5

Location

- Airside – after Security Checks, opposite Gates 6 & 7

Hours

- Sunday, Monday: 9:00am to 7:00pm

- Tuesday – Saturday: 7:00am to 9:00pm

Bobby Van’s Steakhouse

Terminal

- Terminal 8

Location

- Airside – after Security, turn right and Bobby Van’s Steakhouse is located opposite Gate 14

Hours

- Daily: 6:00am to 9:00pm

LaGuardia Airport (LGA)

Chase Sapphire Lounge by The Club

Terminal

- Terminal B

Location

- Airside – the lounge is located next to Brooklyn Diner on Level 4

Hours

- Daily: 4:30am to 9:30pm

Be Relax Spa

Terminal

- Terminal B

Location

- Airside – located after TSA Security Checkpoint

Hours

- Daily: 9:00am to 7:00pm

- Hours may vary according to flight schedules

San Francisco Bay Oakland International Airport (OAK)

Escape Lounge

Terminal

- Terminal 1

Location

- Airside – between Gates 8 and 8A

Hours

- Daily: 5:00am to 8:00pm

- Food and beverages service stops 30 minutes before closing time

Ontario International Airport (ONT)

Aspire Lounge

Terminal

- Terminal 2

Location

- Airside – 2nd Floor, between Gates 209 and 210, exit Security and turn left

Hours

- Daily: 5:00am to 12:00am

- Subject to change due to flight schedules

- Access may be restricted due to space constraints, in particular during the hours of 8:00pm – 12:00am daily

Aspire Lounge

Terminal

- Terminal 4

Location

- Airside – 2nd Floor, between Gates 410 and 411, exit Security and turn left

Hours

- Sunday – Thursday: 4:00am to 6:00pm

- Friday – Saturday: 4:00am to 5:00pm

Orlando International Airport (MCO)

The Club MCO (Gates 1-29)

Terminal

- Terminal A Concourse 1

Location

- Airside – Gates 1-29, adjacent to XpresSpa

Hours

- Daily: 5:00am to 10:00pm

XpresSpa (Gates 1-29)

Terminal

- Terminal A Concourse 1

Location

- Airside – Gates 1-29, adjacent to The Club MCO

Hours

- Daily: 7:00am to 9:00pm

XpresSpa (Gates 30-59)

Terminal

- Terminal B Concourse 3

Location

- Airside – Centre Hall, near Gates 30-59

Hours

- Daily: 7:00am to 9:00pm

The Club MCO (Gates 70-99)

Terminal

- Terminal B Concourse 4

Location

- Airside – accessible from Gates 70-99, next to the ‘InMotion’ Store, near Gate 91

Hours

- Daily: 5:00am to 9:00pm

Plaza Premium Lounge

Terminal

- Terminal C

Location

- Airside after Check Point, proceed through Palm Court and lounge access is on Level 2, next to Gate 241

Hours

- Daily: 7:00am to 9:00pm

Philadelphia International Airport (PHL)

Minute Suites

Terminal

- Terminal B

Location

- Airside – located between Concourses A and B in the AB Connector

Hours

- Daily: 24 hours

XpresSpa

Terminal

- Terminal B

Location

- Airside – near Gate B2

Hours

- Daily: 7:00am to 9:00pm

Be Relax Spa

Terminal

- Terminal C

Location

- Airside – after Security Checks, opposite La Colombe Cafe, near Gate C18

Hours

- Monday – Thursday: 7:00am to 7:00pm

- Friday – Sunday: 8:00am to 7:00pm

Phoenix Sky Harbor International Airport (PHX)

Escape Lounge

Terminal

- Terminal 3

Location

- Airside – between Gates E and F

Hours

- Daily: 4:30am to 10:00pm

- Food and beverages service stops 30 minutes before closing time

Pittsburgh International Airport (PIT)

The Club

Terminal

- Concourse C

Location

- Airside – take the tram from landside to airside, go up the two sets of escalators and turn right towards Concourse C. The lounge is located 50 yards away on the left between Bar Symon and Gate C51

Hours

- Daily: 4:30am to 8:00pm

Portland International Airport (PDX)

Westward Whiskey

Terminal

- Concourse C

Location

- Airside – near Gate C6

Hours

- Daily: 7:00am to 10:00pm

Capers Cafe Le Bar

Terminal

- Concourse C

Location

- Airside – immediately after Security on the left hand side

Hours

- Daily: 4:00am to 2:00pm

Capers Market

Terminal

- Concourse D

Location

- Airside – immediately after Security

Hours

- Daily: 4:00am to 10:30pm

Rhode Island T. F. Green International Airport (PVD)

Escape Lounge

Terminal

- N/A

Location

- Airside – between Gates 18 and 20, towards the end of the North Concourse

Hours

- Daily: 6:00am to 7:00pm

- Food and beverages service stops 30 minutes before closing time

Providence Provisions Kitchen & Bar

Terminal

- N/A

Location

- Airside – through Security Checkpoint, turn left into the North Concourse and Providence Provisions Kitchen & Bar is located on the left hand side

Hours

- Daily: 11:30am to last scheduled flight departure

Salt Lake City International Airport (SLC)

Minute Suites

Terminal

- Concourse A

Location

- Airside – near Gate A33

Hours

- Daily: 24 hours

XpresSpa

Terminal

- Concourse A

Location

- Airside – near Gate A15

Hours

- Daily: 6:00am to 11:00pm

San Diego International Airport (SAN)

Aspire Lounge

Terminal

- Terminal 2

Location

- Airside – after East Security Checkpoint, take an immediate left and proceed towards Gate 33. The lounge is located between Gates 33 and 23

Hours

- Daily: 5:00am to 10:00pm

PGA Tour Grill

Terminal

- Terminal 2

Location

- Airside – near Gate 35

Hours

- Daily: 7:00am to 9:00pm

Be Relax Spa

Terminal

- Terminal 2

Location

- Airside – after Security Checks on the right hand side, near Gate 27

Hours

- Monday, Wednesday, Thursday, Friday, Sunday: 6:00am to 9:00pm

- Tuesday, Saturday: 6:00am to 8:00pm

- Hours may vary according to flight schedules

San Francisco International Airport (SFO)

China Airlines Lounge

Terminal

- International Terminal A

Location

- Airside – near Gate A1, Level 4, Post-Security. Proceed through the Security Checkpoint A and turn left

Hours

- Daily: 9:00am to 12:30am

- Access may be periodically restricted due to space constraints, in particular during the hours 6:00pm – 12:30am daily

Golden Gate Lounge

Terminal

- International Terminal A

Location

- Airside – take the first left after the TSA checkpoint on Level 4, the lounge is located on the right hand side

Hours

- Daily: 7:00am to 11:30pm

- Hours may vary according to flight schedules

- Access may be restricted between 11:00am – 1:00pm & 5:00pm – 10:30pm daily due to space constraints

Virgin Atlantic Clubhouse

Terminal

- International Terminal A

Location

- Airside – Concourse A. After Security Checks, turn left and take the lift to Level 5

Hours

- Daily: 8:30am to 12:30pm & 10:00pm to 12:00am

- Cardholders will not be admitted into the lounge outside these hours

Mustards Bar & Grill

Terminal

- International Terminal G

Location

- Airside – after Security, near Gate G3

Hours

- Daily: 7:00am to 10:00pm

The Club SFO

Terminal

- Terminal 1

Location

- Airside – After the main security checkpoint, keep left and follow the signs to B gates. The Club is located on the right, just before Gate B4 and across from Mills Cargo. The lounge can also be easily reached from International Terminal A, a short 5-minute walk, post-security

Hours

- Daily: 4:30am to 11:30pm

Lark Creek Grill

Terminal

- Terminal 2

Location

- Airside – after Security, proceed straight ahead and the restaurant is located on the right hand side

Hours

- Daily: 5:00am to 10:00pm

San Francisco Giants Clubhouse

Terminal

- Terminal 3

Location

- Airside – after Security, Concourse F, near Gate F13

Hours

- Daily: 5:30am to 11:00pm

San Jose Mineta International Airport (SJC)

The Club SJC A8

Terminal

- Terminal A

Location

- Airside – the lounge is located on the Main Level Concourse, across from Gate 8

Hours

- Daily: 5:00am to 8:30pm

The Club SJC A15

Terminal

- Terminal A

Location

- Airside – the lounge is located on the 3rd Level, across from Gate 15

Hours

- Daily: 5:00am to 10:00pm

Seattle-Tacoma International Airport (SEA)

Brewtop Social

Terminal

- Central Terminal

Location

- Airside – Brewtop Social is located Post Security, between Concourses B and C

Hours

- Daily: 5:30am to 12:00pm

The Club SEA

Terminal

- Concourse A

Location

- Airside – across from Gate A11. Access is available to all Concourses by train which runs every few minutes

Hours

- Daily: 5:00am to 12:00am

Ninth & Pike Artisan Kitchen

Terminal

- Concourse C

Location

- Airside – follow signs for the C Gates and the Ninth & Pike Artisan Kitchen is located opposite the Alaska Airlines Customer Service Desk, before Gate C10A/B

Hours

- Daily: 6:00am to 11:00pm

Bambuza

Terminal

- North Satellite

Location

- Airside – once you disembark the train, take the escalator to Concourse Level and turn left. Bambuza is located on the left hand side

Hours

- Daily: 5:00am to 10:30pm

The Club SEA

Terminal

- South Satellite

Location

- Airside – the lounge is located above Gate S9. The lift to the lounge is on the Concourse Level. Take the lift up one floor to access the lounge on the Mezzanine Level

Hours

- Daily: 6:00am to 2:00am

St. Louis Lambert International Airport (STL)

Wingtips Lounge St. Louis

Terminal

- Terminal 2

Location

- Airside – after TSA Security, turn left. At the end of the terminal hallway (near Gate E22), turn left. The lounge is located opposite Gate E29

Hours

- Monday, Tuesday, Thursday: 7:00am to 8:00pm

- Wednesday, Friday, Sunday: 7:00am to 1:00pm & 3:30pm to 8:00pm

- Saturday: CLOSED

- Closed Dec 25

The Pasta House & Schlafly Beer

Terminal

- Terminal 2

Location

- Airside – located on the Upper level, through Security on the right, opposite Gate E6

Hours

- Sunday – Friday: 6:00am to 10:00pm

- Saturday: 6:00am to 6:00pm

Syracuse Hancock International Airport (SYR)

Johnny Rockets

Terminal

- N Terminal B

Location

- Airside Connector – after Security Checkpoint, turn left and head towards North Concourse B. The restaurant is located on the left hand side

Hours

- Monday – Friday: 11:00am to 6:00pm

- Saturday – Sunday: Closed

- Closed Thanksgiving

Escape Lounge

Terminal

- S Terminal A

Location

- Airside – after TSA, turn right and the lounge is located before Gates 1 – 15

Hours

- Daily: 4:30am to 8:30pm

- Food and beverages service stops 30 minutes before closing time

Tampa Intl (TPA)

The Café by Mise en Place

Terminal

- Airside F

Location

- Airside – after Security, the restaurant is located directly in front of the Security Checkpoint by Gate F85. Access is available to any Airside with a valid Boarding Pass, by train which runs every few minutes. Please allow sufficient time to reach the Departure Gate when accessing the restaurant from other Airsides

Hours

- Daily: 5:30am to 2:00pm

Tucson International Airport (TUS)

Barrio Brewery Co.

Location

- Landside – 2nd Floor, opposite the ‘Arroyo Trading Post’

Hours

- Monday – Friday: 10:00am to 3:00pm

- Saturday – Sunday: Closed

Washington Dulles International Airport (IAD)

Air France – KLM Lounge

Terminal

- Concourse A

Location

- Airside – opposite Gate A22. Passengers departing from other Concourses can access the lounge by train

Hours

- Daily: 7:30am to 9:00pm

- Hours may vary according to flight times

- Access is not permitted between the hours of 3:00pm – 6:00pm daily

The Etihad Lounge

Terminal

- Concourse A

Location

- Airside – from the Main Terminal, take the train or use the walkway to A Gates and follow the signs to Gate A14. The lounge is near Gate A14

Hours

- Daily: 6:00am to 10:00pm

Virgin Atlantic Clubhouse

Terminal

- Concourse A

Location

- Airside – opposite Gate A32

Hours

- Daily: 8:00am to 6:00pm

- Cardholders will not be admitted into the lounge outside these hours

- DUE TO ESSENTIAL MAINTENANCE WORKS THE LOUNGE WILL TEMPORARILY CLOSE FROM 30SEP-02OCT24. IT IS SCHEDULED TO RE-OPEN ON 03OCT24

Turkish Airlines Lounge Washington

Terminal

- Concourse B

Location

- Airside – near Gate B43. After Security, take the stairs to the next level and turn right. Passengers departing from other Concourses can access the lounge by train or walk way to Concourse B

Hours

- Daily: 7:15am to 9:30pm

Lufthansa Business Lounge

Terminal

- Concourse B

Location

- Airside – the lounge is located near Gate B50

Hours

- Daily: 1:30pm to 10:00pm

- Access may be restricted between the hours of 3:00pm – 6:00pm daily due to space constraints

Chef Geoff’s

Terminal

- Concourse C

Location

- Airside – after Security, take the shuttle bus or train to Concourse C and proceed to Gate C14

Hours

- Daily: 6:00am to 10:00pm

Bradley International Airport (BDL)

Escape Lounge

Terminal

- Terminal A

Location

- Airside – turn right after the TSA checkpoint and continue down the concourse. The lounge is located before Gate 1

Hours

- Daily: 5:00am to 8:00pm

- Food and beverages service stops 30 minutes before closing time

Final word

Priority Pass Select can be a valuable credit card perk. But it’s often a secondary perk for a lot of these credit cards that offer strong perks like elite status and great bonus earning potential. Because so many cards offer Priority Pass membership, it isn’t difficult to prioritize these other benefits and go with the card that offers you the best perks beyond Priority Pass.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.