The World of Hyatt credit card and the IHG Rewards Club Premier Card are two of the most popular co-branded hotel credit cards. Both of these credit cards are issued by Chase and while do they offer some common perks they also come with some with unique benefits. In this article, I’ll take a detailed look at each of the benefits offered by these cards and give you some insight into which card might be the better fit for your travel plans.

Table of Contents

Welcome bonus

The World of Hyatt Card

We’ve seen recent offers go out allowing you to earn 50,000 to 60,000 points with up to $6,000 worth of spend in the first 6 months from the time of account opening. 60,000 Hyatt points could cover two nights at a top tier Hyatt property like the Park Hyatt and 50,000 points could still cover two nights at a fantastic property as well. So with these bonuses you’re looking at potentially several hundred dollars of value here (or even more).

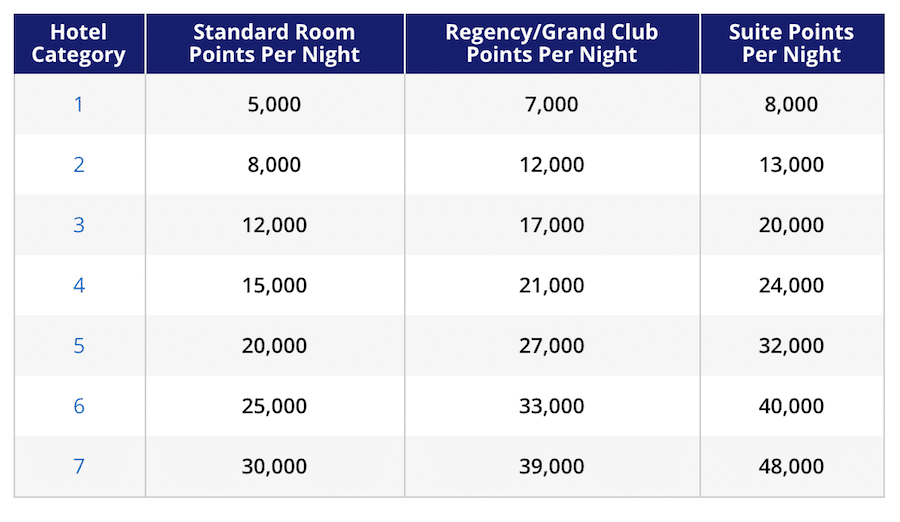

Here’s a look at the Hyatt award chart.

IHG Rewards Club Premier Card

We’ve seen IHG Rewards Club Premier Card bonuses ranging around 80,000 to 140,000 IHG points but IHG points are not as valuable as Hyatt points. In fact, with the recent IHG award price changes, those points are not going to take you as far.

For example, it’s going to be impossible to cover two nights at top properties even if you were able to find the 100,000 point offer since the most expensive properties go for 70,000 points per night.

Here are some examples of redemption rates as of 2019:

- InterContinental Sydney: 65,000

- InterContinental Tokyo Bay: 55,000

- InterContinental Tokyo Bay: 65,000

So when it comes to covering award stays at top properties, I’d take the welcome bonus from Hyatt any day over the IHG Card since it’s often possible to get two nights covered at a time.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Bonus categories

Both of these cards are transfer partners of Chase Ultimate Rewards at a 1:1 ratio.

This means that if you have a Chase card that earns bonus points on these same categories, you may want to use your Chase card instead of the co-branded card. For example, you’ll get 3X with the Chase Sapphire Reserve on dining and travel versus the 2X you’d get with both of these cards.

However, when it comes to spending money at these respective brands, you’ll usually want to go with the co-branded cards since you’ll get better value.

The World of Hyatt Card

- 4X spent with your card at Hyatt hotels, including participating restaurants and spas

- 2X on local transit and commuting, including taxis, mass transit, tolls and ride-share services

- 2X at restaurants, cafes and coffee shops

- 2X on airline tickets purchased directly from the airline

- 2X spent on fitness club and gym memberships

If you value Hyatt points at 1.5 cents per point, 4X is like getting 6% back on Hyatt purchases, which is great.

IHG Rewards Club Premier Card

- 10X for spend at IHG

- 2X at gas stations, grocery stores and restaurants

The bonus spending rate for the IHG card is also strong with 10X at IHG properties. If you value IHG points at .7 cent per point, that’s like getting 7% back which is great.

So both of these cards offer strong earning opportunities with their respective brands. However, since the IHG card comes with more rewarding elite status, the spend on IHG properties is even better (as shown below).

Free nights

The World of Hyatt Card

The World of Hyatt Card offers you the chance for multiple free nights.

- Receive one free night at any Category 1-4 Hyatt hotel or resort every year after your cardmember anniversary

- Earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year

You can find a breakdown of category 4 Hyatt properties here.

It’s relatively easy to use your free night certificate at a Hyatt hotel that offers more value than what the annual fee costs so it is not too difficult to offset the annual fee of the Hyatt card with this perk alone.

However, Hyatt does have one of the smallest footprints so it will not be that easy for everybody to use.

IHG Rewards Club Premier Card

The annual free night with the old IHG credit card allowed you to book a free night at any IHG property, including top level InterContinentals. For that reason it was one of my top choices for earning a free hotel night stay. However, the new free night is capped at point redemption level of 40,000 points or less.

This was a huge loss to the IHG card. While it was a major loss, it really just put the IHG card on the same level as other co-branded hotel credit cards like the Marriott and Hyatt card which both offer free nights in the mid-tier range.

The IHG card doesn’t give you a free night for annual spend but it does offer 10,000 points after you spend $20,000 and make one additional purchase each cardmember year. I would take the Hyatt free night for $15K worth of spend over that offer, though.

Elite status

The World of Hyatt Card

The World of Hyatt Card comes with Hyatt Discoverist status.

That is the bottom tier status that doesn’t offer you a whole lot but it can get you a ten percent point bonus on the base points, upgrades, premium in-room internet access, late check-out, and discounts on purchases.

The bonus earning comes out to 5.5 points which on top of the 4X with the Hyatt card adds up tp 9.5 Hyatt points per dollar. At a valuation of 1.5 cents per point, that’s 14.25% back which isn’t bad but not on par with the IHG card.

The real elite perks of this card come in two forms:

- Receive 5 qualifying night credits toward your next tier status every year

- Earn 2 additional qualifying night credits toward your next tier status every time you spend $5,000 on your card

So with the Hyatt card you can more easily qualify for elite status with five qualifying night credits. Explorist requires 30 qualifying nights while Globalist requires 60 qualifying nights.

And what’s even sweeter is that you can continue to climb the elite status ladder with your spend. For every $5,000 you spend, you’ll get two elite credits which is fantastic for big-spenders. If you’re a high spender and Hyatt loyalist then the new Hyatt card is very tempting.

The ability to climb the elite status ladder with this card is a major unique perk. If you truly value Hyatt elite status and you think that you will be a loyal Hyatt member then you might want to seriously consider the potential value that you can get from this card over the Sapphire Preferred.

IHG Rewards Club Premier Card

The IHG card comes with IHG Platinum status which is a mid-tier status and here are some of the key benefits.

- 50% bonus earnings

- Complimentary Room Upgrades

- Extended Check-Out

- Priority Check-In

- Guaranteed Room Availability

- $30 In-Room Spa Credit

With the 50% bonus you’ll earn 15 IHG points per dollar spent on your hotel stay as a Platinum member. So if you value IHG points at .7 cent per point, that’s 10.5% back. That is very good compared to other major hotel loyalty programs and makes IHG one of the most rewarding hotel programs available.

When you factor in the additional 10X the points you’d earn with the IHG credit card, you can earn 25 points per dollar spent, which amounts to 17.5% back on your IHG stays which is very solid.

Special IHG Card perks:

20% discount on IHG points

IHG has been offering some great promos on purchased points recently and has even lowered the price of their points. Combining these point promos with the 20% discount offered by this card has opened up some great opportunities, allowing members to save tons of cash on their stays by simply booking with purchases points instead of paying cash.

4th night free

With this card, you’ll be given the 4th night free on award stays. Some other hotel programs offer 5th night free but getting the 4th night free is a major perk because it’s much easier to use.

This perk can also increase the value of point purchases with the 20% discount. If you think you would normally make a 4 night stay at an IHG property with points, then this perk alone could make it worth getting this credit card.

Global Entry/TSA PreCheck credit

Global Entry is a program that will grant you expedited entry through customs and immigration and TSA Pre-Check will get you through priority security.I highly recommend enrolling in Global Entry since it comes with automatic TSA Pre-Check status.

Annual fee

The IHG card comes with an $89 annual fee while the Hyatt card comes with a slightly higher $95 annual fee.

Final word

Both of these cards to a great job of offering unique perks to those who are loyal to their programs. I think that the average traveler will get more from the World of Hyatt card due to the higher sign-up bonus and because you won’t lose as much value when you transfer your Chase Ultimate Rewards to Hyatt.

And while the Hyatt card offers an exciting way to earn elite status quicker, it’s hard to deny the value of the stronger earning potential with the IHG card and the ability to get the 4th night free on award stays. Overall, I’d probably go with the World of Hyatt card but it’s very hard to pick one over the other and I think they are both extremely valuable cards for their respective loyalists.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.