Offers contained within this article maybe expired.

Finding the right hotel credit card is all about lining up your personal preferences for things like hotel brands, upgrades, and free breakfast with the unique perks and features offered by cards.

To some people, a hotel benefit that requires $75,000 worth of spend each year is meaningless. And others might not want to touch a hotel card unless it comes with a free breakfast or free night every year. It all depends on the traveler.

In this article, I’ll give you a breakdown of all of the top hotel credit cards and also a lot of insight into how to choose the right card for you.

This article is broken down by common themes that you’ll find with hotel credit card features, so it will be easier for you to browse through your different options and see what type of perks you can look for.

Table of Contents

Best hotel credit cards summary

Here’s the breakdown of my top hotel credit cards for some of the major categories you might be looking for:

- Best hotel credit card for travel protections: Chase Sapphire Preferred

- Best hotel credit card for elite status: Platinum Card

- Best hotel credit card for free nights: IHG Rewards Club Premier Credit Card

- Best hotel credit card for hotel perks: Marriott Bonvoy Brilliant

- Best hotel credit card for hotel spend: Hilton Aspire

- Best hotel credit card for everyday spend: Hilton Surpass

- Best hotel credit card for high spenders: World of Hyatt Credit Card

- Best no annual fee hotel credit card: Hilton Honors Card

- Best small business hotel credit card: Hilton Honors American Express Business Card

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Best hotel credit card for travel protections

Before you even start talking about credit card perks like elite status or free nights, you want benefits that will protect you from the time of booking your hotel stay to the time of check-out.

In order to take advantage of the cheapest hotel rates, you will need to book prepaid rates which will be nonrefundable in the vast majority of cases. That means that if something comes up and you cannot travel, you will get stuck with the bill!

Luckily, if you book with the right card you can get reimbursed for these expenses.

Chase Sapphire Preferred

- Annual Fee: $95

If you book with a card like the Chase Sapphire Preferred, you can get trip cancellation protection for up to $10,000 per trip. For most people, that will cover hotel stays in addition to flights and other trip expenses like tours and activities.

You’ll also be able to earn two times the points on those hotel purchases so you can earn some valuable Ultimate Rewards and if you’d like, you can transfer those points to hotel partners like Hyatt, Marriott, and IHG.

Best hotel credit cards for elite status

Elite status is great because you can get more value from your stays and your hotel experiences will also be more enjoyable. Typically, the best you can do is a mid-tier elite status which will get you some perks like upgrades and late check out.

But if you go with the right card you can also get more meaningful perks like complimentary breakfast and even hotel lounge access.

Platinum Card

- Annual Fee: $695

The Platinum Card will offer you automatic elite status with both Hilton and Marriott. For Hilton, it will provide you with Hilton Gold and for Marriott you’ll get Marriott Bonvoy Gold.

Getting status with two hotel programs instantly is pretty top-notch. Marriott Gold is not as valuable to me as Hilton Gold because it doesn’t offer a free breakfast but it’s still nice to have a starting point with Marriott.

Also, the Platinum Card has the FHR program which is a collection of luxury hotels located around the globe. When you book through this program you can get elite-like benefits which include things like:

- Noon check-in, when available

- Guaranteed 4pm late check-out

- Room upgrade upon arrival, when available

- Daily breakfast for two people

- Complimentary Wi-Fi

- Special amenity unique to each property

And the lovely thing about the Platinum Card is that hotel elite status is just one small sliver of the pie when it comes to all of the benefits that this card offers. For the traveler who wants elite status perks but might be bouncing around from brand to brand, the Platinum Card is perfect.

Hilton Aspire

- Welcome Bonus: 150,000 Hilton Honors bonus points after you spend $4,000 within the first 3 months

- Annual Fee: $450

The Hilton Aspire is the only co-branded hotel card that provides you with automatic top-tier elite status. If you get approved for the Hilton Aspire, you’ll get automatic Hilton Diamond status.

Diamond status has a number of perks but the ones that stand out the most are the free breakfast and lounge access. Diamond status is a bit watered down because it is so easy to obtain via credit cards so upgrades won’t always be super impressive but in the past I’ve been upgraded to some pretty nice hotel suites.

Anybody who is interested in maximizing the Hilton Honors program and staying at Hilton properties on a regular basis should seriously consider the Aspire.

Related: Amex Platinum vs Hilton Aspire

Hilton Surpass

- Welcome Bonus: 150,000 Hilton Honors bonus points after you spend $2,000 within the first 3 months

- Annual Fee: $95

You’ll get automatic Hilton Gold status with the Hilton Surpass which is why I am a huge fan of it. When it comes to hotel elite statuses, a lot of hotels do not provide you with free breakfast. But this is one reason why I like Hilton Gold so much because it is one of the few that do.

The Surpass also hooks you up with a Priority Pass airport lounge membership that gives you 10 complimentary visits per year and it has great bonus earning potential. If you like Hilton but don’t want to cough up the high annual fee of the Aspire, the Surpass is an amazing offer.

Best hotel credit cards for free nights

If you’re just trying to get free nights there are a few options you can go with.

Some cards will provide you with a lot of points so that you can cover award nights for free and other cards may provide you with free night certificates that are issued on your anniversary year or perhaps after you meet a certain minimum threshold for spending.

And then there are cards that will offer you something like the fourth night free. You may want to highly consider getting multiple hotel cards that offer free nights because many times one free night can completely offset the annual fee for the card making it worth holding on to several hotel cards.

Here’s a look at a few of the top cards for free hotel nights.

IHG Rewards Club Premier Credit Card

- Bonus: 140,000 IHG points after you spend $3,000 within the first 3 months (plus, earn 10,000 bonus points after you spend $20,000 each account anniversary year)

- Annual fee: $89

The IHG Rewards Club Premier Credit Card is a great hotel credit card to use for helping to stretch the value of your points. One of the perks that it comes with is the fourth night free whenever you are using points to cover your stay. So this card is a great way to stretch the value of your points and cover more free nights.

You’ll also get IHG Platinum status (it’s just okay) and a free anniversary night each year at any IHG property in the world equal to 40,000 IHG points per night. There’s actually a lot of quality choices to choose from and you can read the full guide to the free night here.

World of Hyatt

- Bonus:

- Earn 25,000 points after you spend $3,000 on purchases within the first 3 months.

- Plus, earn an additional 25,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months.

- Annual fee: $95

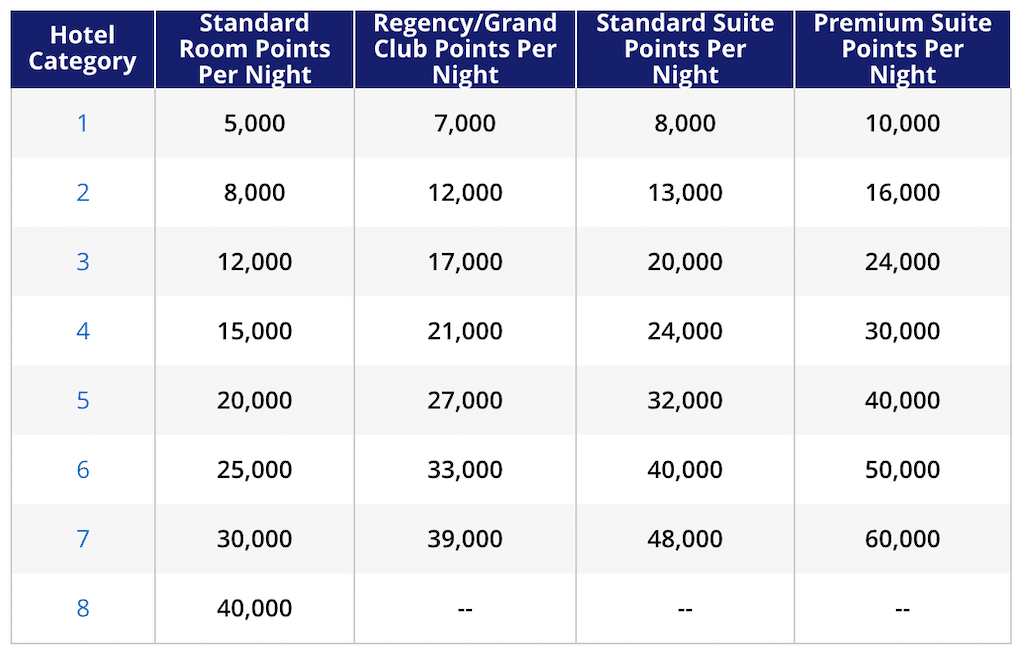

The World of Hyatt Credit Card is great because Hyatt points are some of the most valuable hotel points you can use. This means that you can get some quality free nights by just utilizing your welcome bonus in a smart way. Just take a look at the Hyatt award chart and you can see how far points could get you. With just 60,000 points, you could cover three nights at a super solid category five property.

But you can also get free nights other ways.

Every year you will receive one free night at any Category 1-4 Hyatt hotel or resort after your cardmember anniversary. And if you spend $15,000 during a calendar year, you’ll get one more free night. To see the best options to use your free night certificates for Hyatt be sure to check out our guide here.

Citi Prestige

- Bonus: 50,000 bonus Citi ThankYou points after you spend $4,000 within the first 3 months

- Annual fee: $495

The Citi Prestige is a great benefits-rich travel rewards credit card. It’s known for its high bonus categories of 5X on dining and air travel but it also has a great perk that allows you to get the fourth night free for hotel stays.

The bad news is that this benefit has been devalued over the past few years and now you only can use it a couple of times per year and must go through the Citi ThankYou portal to use it meaning that you could lose out on elite benefits.

Honorable mention also has to go to the Hilton Aspire for its free anniversary night and the Marriott Bonvoy Boundless and Bonvoy Brilliant with their free anniversary nights.

The Bonvoy Brilliant will get you a free night at up to a 50,000/night property which includes some truly luxurious brands so if you were looking for a free night at a more top-end property consider that card.

Related: Which Hotel Credit Card Has the Best Free Night Certificate?

Best hotel credit cards for hotel perks

Hotel credit card perks are how you can easily justify their high annual fees. It’s not uncommon to find cards that offer hundreds of dollars worth of credits that can be used for various things like room rates and on site purchases such as room service.

You have to keep an eye on some of the restrictions they come with but for the right person they can essentially offset an entire annual fee and easily be worth it.

Marriott Bonvoy Brilliant

- Bonus: 100,000 bonus Marriott Bonvoy points after you spend $5,000 within the first 3 months. Plus, earn an additional 25,000 bonus points after your first anniversary of Card Membership.

- Annual fee: $450

The Marriott Bonvoy Brilliant is very similar to the Aspire card because it’s a premium card with a lot of credits. I really like the $300 credit it comes with that can be used on room rates for Marriott bookings. So if you wanted to stay at an awesome Marriott Beach property, you could effectively mark down the price by $300 when you use this card. Pretty impressive.

In addition to that, it comes with a $100 property credit and other perks like Priority Pass and a $100 credit for Global Entry/TSA Pre-Check. The 6X it earns on Marriott properties isn’t too shabby either along with the 3X on US restaurants and flights booked directly with airlines.

In my opinion, this is a must have credit card for anybody who is a frequent Marriott traveler. Keep reading below for more details on this card when it comes to elite status.

Hilton Aspire

- Welcome Bonus: 150,000 Hilton Honors bonus points after you spend $4,000 within the first 3 months

- Annual Fee: $450

The Hilton Aspire makes the list again but this time it is because of the great perks attached to the card. The Aspire is unique because if you utilize all of its credits, you can pretty easily make a profit on this card and completely offset its $450 annual fee.

- $250 Airline incidental fee statement credit

- $250 Hilton resort statement credit

- $100 on property credit at Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts when booking the exclusive Aspire Card package

You’ll also get a complimentary Priority Pass Select membership and a free anniversary night. So for somebody staying at resorts or interested in using its on property credit for things like dining and spa treatment, it’s hard to beat the Aspire.

Sapphire Reserve

- Welcome Bonus: 50,000 Chase Ultimate Rewards after you spend $4,000 within the first 3 months

- Annual Fee: $550

The Chase Sapphire Reserve will get you access to the luxury hotels and resorts collection LHRC. This is a fine collection of luxury properties around the globe and when you book through it you can receive elite-like benefits such as:

- Daily breakfast for two

- Complimentary Wifi

- Room upgrade (based on availability)

- Early check-in and late check-out (based on availability)

- Special benefit at each property

It also gives you perks to Relais & Châteaux, which is a “prestigious collection of independently owned and operated luxury hotels and restaurants, representing approximately 500 establishments globally.”

At these properties, you can receive a VIP welcome which includes things like a bottle of champagne on arrival and also free breakfast (at some properties). Plus, you can get other many solid travel benefits which include a $300 travel credit that can be used on hotel stays.

Because this is a Visa Infinite card, you’ll also get access to the Visa Infinite Luxury Hotel Collection, with similar benefits including:

- Best available rate guarantee

- Automatic room upgrade upon arrival, when available

- Complimentary in-room Wi-Fi, when available

- Complimentary continental breakfast daily

- $25 USD food or beverage credit per stay

- VIP Guest status

- Late check-out upon request, when available

- Special amenity unique to each property, such as an additional dining credit or spa credit

The Sapphire Reserve earns 3X on dining and travel purchases so you can rack up points on hotel stays pretty quickly and you can also transfer points to some great travel partners including the best hotel partner: Hyatt. If you don’t want to transfer points, you can just use the Chase Travel Portal and redeem points at a rate of 1.5 cents per point.

Best hotel credit cards for hotel spend

For people who are going to do a lot of hotels stays each year, they should really be looking to maximize the spend on those stays by grabbing a co-branded hotel card for the specific brand they are planning on racking up nights and stays with.

If you want a hotel card that is going to give you the most value back whenever you use it to purchase hotel rooms, you want to look at the following parts.

Hilton Aspire

- Welcome Bonus: 150,000 Hilton Honors bonus points after you spend $4,000 within the first 3 months

- Annual Fee: $450

The Hilton Aspire makes the list again but this time for its great return on Hilton spend. You’ll earn a whopping 14X with the Hilton Aspire per dollar spent on Hilton stays which based on a WalletFlo valuation comes out to 7.28% back.

Because you’ll have automatic Diamond status, you’ll also be earning an additional 20X for a total of 34X per dollar spent on most Hilton brands. You can often stack this with ongoing Hilton promotions and earn even more points making this a super lucrative credit card for hotel spend.

World of Hyatt

- Bonus:

- Earn 25,000 points after you spend $3,000 on purchases within the first 3 months.

- Plus, earn an additional 25,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months.

- Annual fee: $95

The World of Hyatt Credit Card is also great for its value when staying at Hyatt properties. Using a WalletFlo valuation, you will be getting about 6.28% back when using your card at Hyatt properties.

If you consider the additional points you will earn with Hyatt Discoverist status you will be earning 9.5 points per dollar spent which comes out to about 14.9% back which is pretty solid!

Platinum

- Welcome Bonus: 75,000 American Express Membership Rewards after you spend $5,000 within the first 6 months

- Annual Fee: $550

If you don’t want to be locked into one single hotel brand the Platinum Card can be one of the best credit cards to use when purchasing hotel stays because it earns an amazing 5X per dollar spent. Utilizing WalletFlo valuations, that comes out to 8.75% back on hotels. That is extremely valuable.

The drawback to the Platinum Card is that you will have to book through Amex Travel to get the 5X earnings. Many times when you book through such a portal, you are not able to receive your elite status benefits so the increased earnings on your spend may be outweighed by the loss of certain benefits.

But it is worth pointing out that if you book through the FHR, you can earn 5X the points and still get elite perks.

One more thing worth mentioning is that you can take advantage of Amex Offers. Many of these offers will provide you with discounts at popular hotel brands like Hilton and Marriott so you can end up saving even more on your hotel stays (sometimes several hundred dollars).

Wyndham Rewards Visa

- Welcome Bonus: 30,000 Wyndham points after you spend $1,000 within the first 90 days

- Annual Fee: $75

In addition to 2X on gas, utility, and grocery store purchases, the Wyndham Rewards Visa offers 5X on Wyndham stays. Using a WalletFlo valuation of .87, 5X comes out to 4.3% back.

Since you will also get Wyndham Platinum status, you’ll be earning an additional 11.5 points per dollar spent for a total of 16.5 points. So your total return when staying at Wyndham properties would be at least 14.3% back. That’s actually very competitive and it’s definitely a strong point of this credit card.

Best hotel credit cards for your daily spending

Most hotel branded cards are not going to offer the best reward rates for every day spend purchases. Don’t get me wrong, you can still earn some decent rewards that make it worth using the card but most likely you will not be optimizing your spend in these categories by using a co-branded hotel credit card and should use a different type of travel credit card.

Hilton Surpass

- Welcome Bonus: 150,000 Hilton Honors bonus points after you spend $2,000 within the first 3 months

- Annual Fee: $95

When it comes to bonus categories, the Hilton Surpass is loaded. Here’s a look at some of those rates that it earns on purchases:

- 12X for charges with a hotel or resort within the Hilton Portfolio

- 6X at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations

- 3X on all other eligible purchases

6X amounts to about 3.1% back. So this effectively turns into a 3% back card on the categories like dining, groceries, and gas. And even its 3X on all purchases isn’t bad since it amounts to close to a 1.5% return.

World of Hyatt — Everyday spend

- Bonus:

- Earn 25,000 points after you spend $3,000 on purchases within the first 3 months.

- Plus, earn an additional 25,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months.

- Annual fee: $95

If you want to use a hotel card for every day non-bonused spend, it’s hard to not go with this credit card. With the valuation of 1.57 cents per point, you’re earning about 1.5% back on all purchases which is extremely competitive with some of the best cashback credit cards.

The World of Hyatt card is also good for other categories like transit and gym memberships where it earns an elevated amount of points (2X).

Best hotel credit cards for high spenders

If you are a high spender, meaning someone who spends $60,000 or more on credit cards, you can get some special perks from hotel credit cards. These perks could provide you with elite status upgrades or in other cases — additional free nights.

Here are a few of the hotel credit cards that should be on your radar if you are spending tons of money on your cards.

World of Hyatt

- Bonus:

- Earn 25,000 points after you spend $3,000 on purchases within the first 3 months.

- Plus, earn an additional 25,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months.

- Annual fee: $95

The World of Hyatt Credit Card allows you to earn 2 additional qualifying night credits toward your next tier status every time you spend $5,000 on your card. This means that it’s one of the few or only hotel cards where you can spend your way up into top elite status.

Here is what you would need to spend your way to these with these levels of spend:

- Explorist ($65,000 in spend)

- Globalist ($140,000 in spend)

Hilton Aspire

- Welcome Bonus: 150,000 Hilton Honors bonus points after you spend $4,000 within the first 3 months

- Annual Fee: $450

In addition to all of the perks discussed above, you’ll also earn an additional night after you spend $60,000 on purchases on your card in a calendar year. $60,000 is a lot to spend for just one free night but Hilton allows you to use those free night certificates at the most expensive properties so this is a pretty legit perk in my opinion.

Related: Which American Express Hilton Card is Best for You?

Marriott Bonvoy Brilliant

- Bonus: Earn 100,000 bonus points after you make $5,000 in eligible purchases on your Card within the first 3 months.

- Plus, earn an additional 25,000 bonus points after your first anniversary of Card Membership

- Annual fee: $450

With the Marriott Brilliant, you can get Marriott Bonvoy Platinum Elite status after making $75,000 in eligible purchases on your Card in a calendar year. Platinum elite status from Marriott is much more valuable than Gold and that is where the benefits start to offer real value.

Here are some of the benefits that you’ll be able to enjoy. (The top benefits for me are the guaranteed lounge access that can come with complimentary breakfast.)

- 50% Bonus on points

- Complimentary room upgrade

- Welcome gift

- Guaranteed Lounge Access

- 4pm late check-out

- Annual Choice Benefit

- Guaranteed Room Type

Best no annual fee hotel credit cards

Surprisingly, there are quite a few hotel credit cards that do not come with annual fees. Something to keep in mind about these cards is that you can often upgrade to more lucrative products once you get a sense of your needs for a hotel credit card. And sometimes you can get special offers for those upgrades.

Hilton Honors Card

- Welcome Bonus: 100,000 Hilton Honors bonus points after you spend $1,000 within the first 3 months

- Annual Fee: $0

The Hilton Honors Card no annual fee credit card is a great starter hotel credit card. It comes with some very respectable bonus earning including 5X on groceries, gas, and dining.

As far as elite status goes, you’ll be given complimentary Silver Status. While Hilton Silver status does not have much to offer, if you spend $20,000 in a calendar year you can earn an upgrade to Hilton Honors Gold status.

I also like that the Hilton Honors Card will often come with upgrade possibilities down the line that contain special bonus offers. These allow you to earn more hotel points while not opening up a new account and thus impacting your credit score.

Related: Hilton Honors Levels

Radisson Rewards Visa Card

- Bonus: 30,000 bonus points after you spend $1,000 within the first 3 months

- Annual fee: $0

The Radisson Rewards Visa Card is an underdog of a hotel credit card. This credit card can be a free night earning machine as you can earn one free night E-Cert for each $10,000 in spend (up to $30,000). So that’s a total of three free nights per year for only $30,000 in spend and there’s no annual fee. This is an awesome value proposition if you have plans to stay at any of the Radisson brands.

Marriott Bold

- Bonus: 30,000 bonus Marriott Bonvoy points after you spend $1,000 within the first 3 months

- Annual fee: $0

The Marriott Bold card is one of the newest hotel credit cards on the market. It will provide you with Marriott Silver status which while not my favorite elite status is better than nothing.

You will be able to earn 3X at Marriott properties and also on a wide variety of travel purchases. I like that the card has no foreign transaction fees making it a good option for international travelers. The welcome bonus may seem pretty low but there are actually a lot of cheap Marriott properties out there that aren’t that bad.

Small business hotel credit cards

Hilton Honors American Express Business Card

- Welcome Bonus: 130,000 Hilton Honors bonus points after you spend $3,000 within the first 3 months

- Annual Fee: $95

The Hilton Honors American Express Business Card is a solid business hotel credit card that is similar to the Hilton Surpass. It will provide you with complimentary Hilton Gold status and it also has some great bonus categories which include 6X on select business purchases at:

- U.S. gas stations

- Wireless telephone services purchases directly from U.S. service providers

- U.S. purchases for shipping

- U.S. restaurants

- Flights booked directly with airlines or with Amex Travel

- Car rentals booked directly from select car rental companies

You’ll also get a free weekend night when you spend $15,000 on eligible purchases in a calendar year and if you spend $60,000 total, you’ll get an additional free night. You’ll also be able to upgrade to Hilton Diamond after $40,000 in spend in one year. So as you can see, this card can be very rewarding to your business if you put your spend on it.

Marriott Bonvoy Business American Express Card

- Bonus: 100,000 bonus Marriott Bonvoy points after you spend $5,000 within the first 3 months

- Annual fee: $125

The Marriott Bonvoy Business American Express Card is another solid business hotel credit card. It will set you up with Marriott Silver status and it also comes with some decent bonus categories which include 6X at Marriott Bonvoy hotels and 4X at:

- U.S. restaurants

- U.S. gas stations

- Wireless telephone services purchased directly from U.S. service providers

- U.S. purchases for shipping

You’ll get one free night every year after your account anniversary and you can earn an additional free night after you spend $60K in a calendar year. The only thing that I am not crazy about with this card is its high annual fee of $125.

Final word

Like I stated above, finding the perfect hotel credit card is all about knowing your preferences and then shopping around for the right card. It’s really easy to do if you first narrow down the brands you are interested in and then you can just focus on your priorities like free nights, bonus spend, etc. In the end, I think it’s very smart to have multiple hotel credit cards so that you can take advantage of different programs.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.