The Chase Sapphire Preferred and the World of Hyatt Card are two of the most popular travel cards offered by Chase. But each of these credit card offers unique benefits and advantages that the other one does not. Here is a look at both of these cards and a comparison of the benefits.

Update: Some offers are no longer available — click here for the latest deals!

Table of Contents

Welcome bonus

Chase Sapphire Preferred

The Chase Sapphire Preferred comes with a 60,000 point sign-up bonus after you spend $4,000 in the first three months after account opening. This is a fantastic offer. 60,000 Ultimate Rewards can take you pretty far and you can transfer these points out to the following partners.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Chase Ultimate Rewards Airlines

- Aer Lingus

- British Airways Executive Club

- Flying Blue (Air France/KLM)

- Iberia Airways

- JetBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Chase Ultimate Rewards Hotels

- World of Hyatt

- IHG Rewards Club

- Marriott Rewards

- The Ritz-Carlton Rewards

If you don’t want to transfer your Ultimate Rewards to these travel partners, you might want to utilize the Chase Travel Portal to book your travel. The Chase Travel Portal offers decent redemption rates for your points as you’ll get 1.25 cents per point with your Chase Sapphire Preferred (and 1.5 cents per point with the Chase Sapphire Reserve).

The World of Hyatt Card

- Earn 25,000 points after you spend $3,000 on purchases within the first 3 months of account opening

- Plus, earn an additional 25,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months of account opening.

I would much rather have 60,000 Chase Ultimate Rewards than have 50,000 Hyatt points. That is mostly because I value the flexibility that the Chase points would have and also because I could get much more value for those points when using them for certain airline partners.

Also, when factoring to minimum spend requirement I think that you get much more “bang for your buck” when receiving 60,000 Ultimate Rewards after spending $4,000 versus when you receive 50,000 Hyatt points after spending $6,000 (although you get up to six months to meet that spending requirement).

Bonus categories

Chase Sapphire Preferred

- 2X on dining

- 2X on travel

The Sapphire Preferred earns 2X on dining and travel which is pretty basic but still not bad, especially for travel. Keep in mind that the Chase Sapphire Reserve earns 3X on dining and travel, so if you’re looking to maximize those bonus categories you might want to look to that card.

The World of Hyatt Card

- 4X spent with your card at Hyatt hotels, including participating restaurants and spas

- 2X on local transit and commuting, including taxis, mass transit, tolls and ride-share services

- 2X at restaurants, cafes and coffee shops

- 2X on airline tickets purchased directly from the airline

- 2X spent on fitness club and gym memberships

If you value Hyatt points at 1.5 cents per point, that’s like getting 6% back at Hyatt properties and 3% back on the other categories like local transit, restaurants, cafes, coffee shops, and airline tickets. You’ll also earn bonus points for spend at fitness clubs and gyms, which is a special perk not offered by many other credit cards.

I would rather earn 2X points with the Chase Sapphire Preferred on many of the overlapping categories. The Chase Sapphire Preferred earns 2X on travel expenses which covers things like local transit, taxis, airline tickets and it also earns 2X on dining which should cover restaurants, cafés, and coffee shops.

So you could either earn Ultimate Rewards which are flexible and can be transferred out to various partners including Hyatt or you could simply earn higher Hyatt points with the Hyatt card. If you are just trying to maximize your points in the value of those points then it will almost always make sense to earn Ultimate Rewards.

With that said, the World of Hyatt Card does have some good bonus spending. It offers the unique ability to earn 2X at gyms and fitness clubs but it also earns 4X at Hyatt hotels. So it would make more sense to use the World of Hyatt Card When paying for Hyatt days because you would earn more high points than you would with the Chase Sapphire Preferred.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Annual Fee

Chase Sapphire Preferred

The Chase Sapphire Preferred comes with a $95 annual fee that is NOT waived the first year.

The World of Hyatt Card

The the World of Hyatt Card comes with a $95 annual fee that is NOT waived the first year.

Free nights

The World of Hyatt Card

The World of Hyatt Card Comes with the unique perk of free nights. Here’s how you can get free nights with this card:

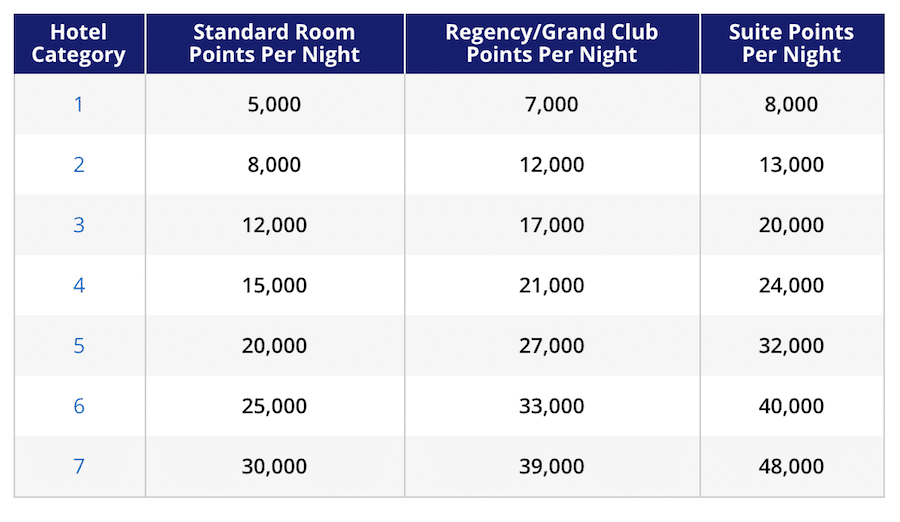

- Receive one free night at any Category 1-4 Hyatt hotel or resort every year after your cardmember anniversary

- Earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year

You can find a breakdown of category 4 Hyatt properties here.

It’s relatively easy to use your free night certificate at a Hyatt hotel that offers more value than what the annual fee costs so it is not too difficult to offset the annual fee of the Hyatt card with this perk alone. However, Hyatt does have one of the smallest footprints so it will not be that easy for everybody to use. These free night certificates do expire in one year so there is some pressure to use these.

Primary rental car coverage

The Sapphire Preferred comes with primary rental car coverage which means that you’ll usually be able to avoid filing a claim with your insurance company if you get into an accident.

The fact that the Sapphire Preferred has this benefit built in to it is huge and it could end up saving you a lot of money and headache depending on how often you rent cars. So if you’re a frequent traveler who is constantly driving around in rental card, you might want to give the Sapphire Preferred the nod here.

Elite status

The World of Hyatt Card comes with Hyatt Discoverist status.

That is the bottom tier status that doesn’t offer you a whole lot but it can get you a ten percent point bonus on the Base Points, upgrades, premium in-room internet access, late check-out, and discounts on purchases.

The real elite perks of this card come in two forms:

- Receive 5 qualifying night credits toward your next tier status every year

- Earn 2 additional qualifying night credits toward your next tier status every time you spend $5,000 on your card

So with the Hyatt card you can more easily qualify for elite status with five qualifying night credits. Explorist requires 30 qualifying nights while Globalist requires 60 qualifying nights.

And what’s even sweeter is that you can continue to climb the elite status ladder with your spend. For every $5,000 you spend, you’ll get two elite credits which is fantastic for big-spenders. If you’re a high spender and Hyatt loyalist then the new Hyatt card is very tempting.

The ability to climb the elite status letter with this card is a major unique perk. If you truly value Hyatt elite status and you think that you will be a loyal Hyatt member then you might want to seriously consider the potential value that you can get from this card over the Sapphire Preferred.

Shopping perks

The Chase Shopping Portal allows you to earn extra points when shopping online at various retailers. This is a great way to cash in on extra points when making larger purchases or even everyday items. Chase has offered a special offers program for the Hyatt card but it is currently unavailable.

Final word

Both of these cards are high-quality travel cards. Ultimately, it comes down to how You plan to use your travel points. However, because of the broad flexibility of the Chase points, I would venture to guess that more people would get more value from the Chase Sapphire Preferred than from the Hyatt card.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.