There’s nothing worse than feeling like you have everything figured out when it comes to your travel plans only to be blindsided by some situation that you would have never expected to deal with. Not only is it stressful trying to adapt to a situation on-the-fly but many times it can be extremely costly, especially when you are dealing with nonrefundable travel expenses.

Luckily, there are cards like the Citi Prestige that offer substantial travel insurance benefits that can help you get coverage and mitigate your expenses. In this article, I will go over all of the Citi Prestige travel insurance benefits, such as trip cancellation, trip delay protection, baggage delay protection, and many more.

Table of Contents

What is Citi Prestige travel insurance?

The Citi Prestige offers an entire suite of travel insurance benefits, which come in the following forms:

- Trip cancellation and interruption

- Trip delay protection

- Baggage delay protection

- Lost baggage protection

- Roadside assistance

- Travel in emergency assistance

- World wide travel accident insurance

- Medical evacuation

Below, I will go into detail about each of these protections and tell you the key terms that you need to know about when it comes to things like coverage limits and what sort of expenses are eligible.

Eligibility

Before jumping into each of these benefits, it is good to know that for the most part the coverages going to apply to yourself into your family members.

Here is how family members are defined for these protections:

Family Members means Your children, spouse, fiancée, Domestic Partner and their children, including adopted children or step-children; legal guardians or wards; siblings or siblings-in-law; sons-in-law or daughters-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews.

Domestic Partner means a committed relationship between two unmarried adults, in which the partners, (1) are each other’s sole Domestic Partner, (2) maintain a common residence, (3) share financial obligations if both are employed, (4) are not married or joined in a civil union to anyone else or are not the Domestic Partner of anyone else, and (5) are not blood related.

NOTE: You are still eligible for coverage on many trips for Your Family Member(s) even if you are not traveling.

Documentation

If you have never dealt with filing a claim for any type of travel insurance related benefits/expense, you need to know that you will be required to have documentation for just about everything.

Thus, it is very important to maintain and record every single thing that you can related to your claim.

If your bags are delayed, you should take and store every single little item/form that you are given to sign or review because chances are that is going to come in handy. If you are ever given a reference number, case number, or anything like that be sure to jot that down. Also, try to note the names of any reps that you every speak with and get their numbers and extensions if you can.

And make sure that you maintain all of your receipts and try to keep a record of all of the dates and times that everything happened. Taking time-stamped photos with your phone of everything is a great way to do this.

Having all of these records will make your life much easier when it comes time to file your claim. Trust me.

Also, pay attention to the filing deadlines. Typically, you will have about 60 days to file your claim so be sure to do that. Sometimes if you wait longer than that they will still allow you to file your claim, but I would not count on an exception.

Trip cancellation and interruption

This is a benefit that comes in handy whenever you have to cancel a trip or cut a trip short/extend a trip due to some unforeseen circumstances that qualify as a “Covered Reason.” These usually involve things like illnesses, personal situations, and travel and/or weather issues.

Here are some examples of some covered situations:

- You become sick and are advised by a doctor not to travel

- You are advised not to travel by a doctor due to the outbreak of some type of disease

- A family member has an injury or illness that is very serious

- You lose your job

- You’re summoned to jury duty

- Severe weather or natural disaster halts all travel to or from your destination for 24 hours

- You miss more than half of your trip due to two missed connections or delays

The key with this protection is that if you are not feeling well, you need to get a doctors note that you are not able to travel. Simply not feeling well but still being able to travel it will not allow the coverage to kick in.

How much is covered?

With this protection, you can get reimbursed for up to $5,000 per trip. Getting $5,000 worth of protection isn’t bad but note that you can get up to $10,000 worth of protection with the Sapphire Reserve.

In order to get coverage you will need to use your Citi Prestige card and pay for at least a portion of the trip with that card. Note that if you only pay a portion of your trip, you will only be reimbursed up to that amount.

You will be covered for a lot of different type of expenses which could include:

- The value of unused transportation tickets

- Change fees

- Costs to get the traveler home as long as the arrangements are with in the same class of service as the original booking

- Costs to get the traveler to rejoin the trip that has been interrupted as long as the arrangements are within the same class of service as the original booking

- Reasonable expenses for similar accommodations and meals that are incurred because of an interruption or reasonable extension of the trip

You will need to file a claim within 60 days of cancellation or interruption.

Trip delay protection

Trip delayed protection kicks in whenever a common carrier is delayed.

Common Carrier means a vehicle that’s licensed to transport any public passenger who pays a fare or buys a ticket, and is available on a regular schedule. Examples include planes, trains, ferries and cruise ships, but does not include taxis, car service, rental car and rideshare service.

How much is covered?

If a common carrier is delayed for at least six hours you can get reimbursed for up to $500 per traveler, per trip.

This benefit should cover the following expenses:

- Lodging

- Ground transportation excluding car rentals

- Mills

- Personal or business necessities such as toiletries

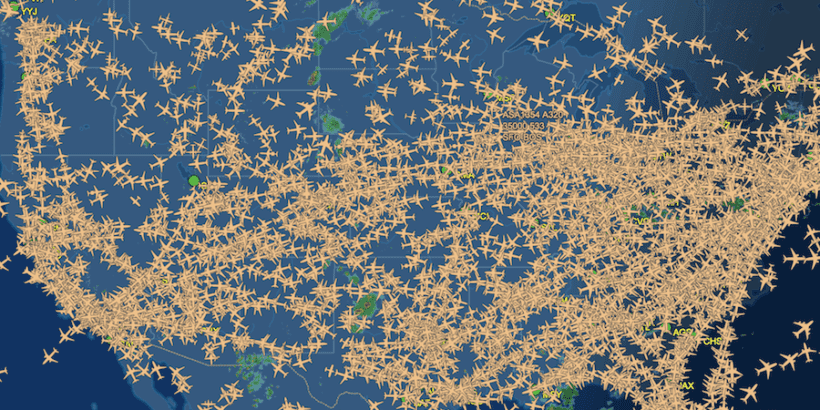

This is a great benefit because many airlines are not required to provide you with any type of compensation if their flights are delayed and the reason for the delay is not their fault. So for example if bad weather causes a flight to be delayed eight or 10 hours the airline is often not required to provide you with anything (see infographic). So with insurance like this you are covered in those scenarios.

Also even if the delay is the airline’s fault and they offer to provide you with some type of benefits, you may only get a stay covered at a nearby contract hotel so getting $500 worth of coverage per traveler can be a much better and more comfortable scenario.

You will need to file a claim with in 60 days of the delay.

Baggage delay protection

If your checked baggage with a common carrier is delayed six hours or more you can be covered for up to $500 per per trip. This protection used to kick in after only three hours of delay, which was industry-leading. So it is a little bit of a bummer to see it back at six hours but six hours is still very good for this type of protection.

What is covered?

This benefit covers personal and business items that the traveler may need when their baggage is delayed. This includes things like toiletries and a change of clothes.

The terms exclude any item that is not contained in the checked baggage. This means that you want to be careful when shopping for new clothes because if you go out and purchase something that you did not already happen your checked baggage that is technically not covered.

Something else that is interesting about this benefit is that it gives you $500 per trip and is not based on a set amount per day. Other cards might limit you to something like $100 per per day so this is actually one of the more liberal policies.

You will need to file a claim within 60 days of the baggage being delayed.

Lost baggage protection

If your baggage is lost, stolen or damaged by the common carrier while on a trip you might be refunded for the purchase price of the missing items or the cost to repair or replace the damaged items whichever is less.

What is covered?

You are covered for up to $3,000 per traveler, per trip. Or you might be covered up to $10,000 in total for all travelers.

There are certain items that are not included in this coverage and these include the following:

- Antique items

- Collector items

- Rare precious metals

- Stamps and coins

- Contracts

Note that coverage does not apply whenever the item is seized by customs or by a government agency.

You will need to file your claim within 60 days of the bags being lost, stolen, or damaged.

Roadside assistance

Roadside assistance is available 24/7 whenever you have trouble and are on the road in any of the 50 United States or in certain territories.

You can get the following types of services:

- Towing and winching (You will be responsible for expenses associated with the towing beyond 10 miles)

- Jump starts

- Flat tire changes

- Lockout service

- Delivery of up to 2 gallons of fuel

This is very similar to the roadside protections offered by other cards such as American Express cards.

In order to use this benefit you will need to make sure that you are with the vehicle and that you are in a regularly travelled area. Basically, if you are off road somewhere that is not easily accessible you probably won’t get coverage.

The phone number for this is: 1-866-506-5222.

Travel and emergency assistance

If you need assistance before or during a trip you can find services and referrals worldwide in case of emergencies or help with travel requirements with complications. This is the exact type of benefit that you want whenever you are in a country and you don’t speak their language but you need immediate assistance to resolve something.

Here are the type of services provided:

- Around-the-clock access to emergency travel arrangements

- Emergency transfer of cash from a family member friend or business account

- Information on travel requirements such as visas

- Help locating the loss travel items such as lost luggage

- Monitoring of threats

- Referrals to local doctors dentists or other services (You can also have these dispatch to your location)

- Assistance with prescriptions

- Coordination with doctors or nurses in the US you can consult with the local medical professionals to help monitor you

Just note that the cost of utilizing these professionals is not covered and will be your responsibility. This benefit basically just helps you get in connection with those who can help you.

I wish I had utilized a benefit like this a few years ago when I got very sick in Iceland. We struggled to find any medications that we could understand and I probably could have used a service like this to find something to take and to find a doctor to see. So trust me having a service like this can be a life-saver.

Worldwide travel accident insurance

Hopefully you or anyone that you love will never need this but this is the type of coverage that applies if you or a loved one dies in a tragic accident or gets seriously injured. You can get coverage for up to $1 million per person depending on the type of injury you had.

You need to file a claim with in 60 days of the accident.

Medical evacuation

If you experience a serious medical emergency and need help getting home or to the right medical facility you can get coverage up to $100,000.

What is covered?

This benefit will ply in the following situations:

- A traveler becomes seriously sick, injured or even dies while traveling wanted trip

- A doctor certifies that the traveler has an illness or injury that is severe enough to require emergency medical evacuation

- In the process of the medical evacuation, the traveler is transported to the most direct and cost-effective route

- The trip is less than 60 consecutive days long

And here are the type of expenses that you can get covered:

- Transportation from the place where the traveler became sick or injured to the nearest medical facility where they can receive treatment

- Transportation to the travelers home or to an appropriate medical facility near their home. This is if they need further treatment after being treated at a local medical facility.

- Related medical services and supplies needed while transporting the traveler

- In the case of death transportation to return the travelers remains to their home

Final word

The Citi Prestige has some quality travel insurance benefits offered for any premium card. The biggest limitations to note is that these apply to yourself and to family members so if you have non-family members traveling with you don’t get coverage for them. However, if you’re traveling with family then you can take advantage of some solid protections. Just remember to maintain all of the documents needed to support your claims.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.