The Chase Sapphire Reserve has the best package of travel insurance benefits out of any credit card. I’ve used them on a few occasions and they have been a lifesaver, usually saving me several hundred dollars, not to mention the peace of mind that you can’t put a price on.

But what exactly are the benefits of this insurance?

This comprehensive article will walk you through all of the Chase Sapphire Reserve travel insurance benefits, such as trip cancellation, trip delay, rental car insurance, and more. You’ll see what type of losses qualify for claims and what type of benefits don’t.

I will also offer some comparisons to what you might expect to find when purchasing a third-party travel insurance package, such as Allianz.

Table of Contents

What is Chase Sapphire Reserve travel insurance?

Chase Sapphire Reserve travel insurance offers several key benefits which include:

- Primary rental car coverage

- Baggage Delay Reimbursement

- Emergency Evacuation and Transportation

- Emergency Medical and Dental Benefit

- Lost Luggage

- Roadside Assistance

- Travel Accident Insurance

- Travel and Emergency Assistance Services

- Trip Cancellation and Trip Interruption

- Trip Delay Reimbursement

Each of these protections come with different requirements and restrictions and I’ll go into detail about each of these perks below.

Some of these benefits might not seem that valuable to you until you actually need to use them and at that point they become a godsend.

So when thinking about these perks, really try to imagine the convenience and relief they’d provide you with in order to get a sense of how much value to attach to them. And then multiply that number by 100 because that is how good you’ll feel about having those perks when you need them.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Do I have to pay extra for Chase Sapphire Reserve travel insurance?

No, travel insurance is built in to the Chase Sapphire Reserve.

This is a big difference from the competitor, the Platinum Card from American Express. The Platinum Card, and other Amex cards, don’t provide you with the full array of benefits by default. In fact, you’ll have to pay extra for those benefits.

So don’t take these benefits for granted.

Would buying travel insurance be better?

Before I jump into all of the details of the Chase Sapphire Reserve travel insurance, I think it is worth addressing whether or not you should consider buying travel insurance through a third-party or just use the benefits included with this card.

Obviously, since these benefits are free and included with your card the only reason you would go out of your way to purchase other travel insurance protections is if they had much better protections.

I researched other travel insurance policies and I think the decision just comes down to the individual and their needs.

Since the cost of travel insurance depends on factors like the amount of your trip, the destination, and the length of your travels, it is hard to give universal advice for all people (there are also annual plans to consider).

So my advice would be to look at a travel insurance package and compare that package to the details below. In my experience I have found some of the key differences to be the following.

Emergency medical coverage

This is probably the biggest difference that I have seen. When it comes to needing medical treatment at your travel destination, typically the travel insurance packages from third parties offer much more comprehensive coverage and much higher limits (like up to 10X to 20X the limit of the Reserve). If emergency medical care is a top concern of yours, I would not rely on the Chase Sapphire Reserve to cover you here.

Pre-existing conditions

Travel insurance packages with credit cards like the Chase Sapphire Reserve tend to exclude pre-existing conditions from coverage but many third-party travel insurance packages will still provide coverage. Your limits might be a little bit lower but some coverage is better than no coverage.

Pre-paid expenses

When it comes to protections like trip delay, you can get coverage for prepaid expenses with insurance providers like Allianz whereas the Reserve won’t cover you there.

The Reserve is superior to basic packages

The Chase Sapphire Reserve offers some pretty solid travel insurance protections, and I tend to find the overall protections offered much better than a standard basic package you will get with a third-party. If you want enhanced benefits from the Reserve chances are you will need to buy a third-party mid-tier or top-tier package. And even then, the Reserve might offer better value for some benefits.

Those mid-tier or top-tier packages could end up costing you several hundred dollars so you would just have to decide whether or not it is worth it to take advantage of certain higher limits with respect to specific benefits and protections.

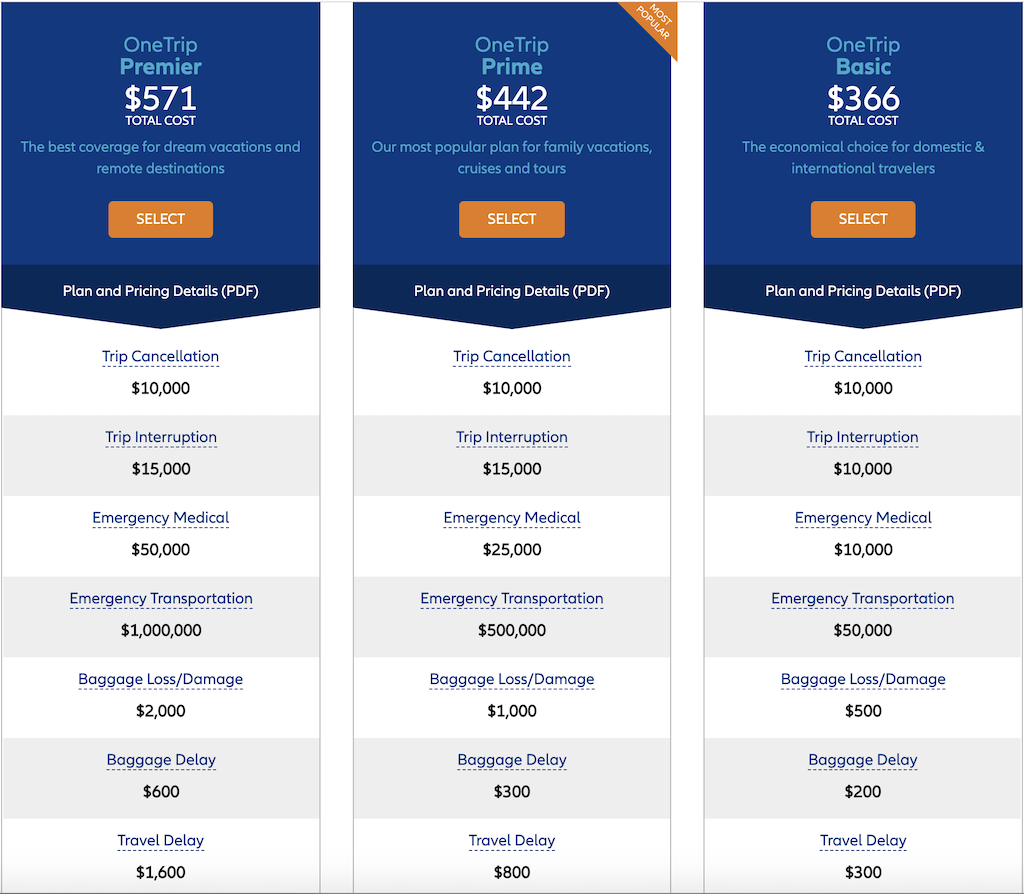

If you are curious about prices check out the quotes below which are for a one-week trip to Italy that is expected to cost $10,000.

Primary rental car insurance

Primary rental car coverage is one of the most valuable perks of the Sapphire Reserve. With primary rental car coverage, you can avoid paying extra for coverage from the rental car company and usually won’t have to file a claim with your rental car insurance provider if you get into some type of an accident.

This will save you a lot of headache and not to mention a lot of money on your monthly premiums in the future. Most credit cards offer secondary rental car coverage which only covers what your auto insurance provider or equivalent doesn’t cover.

The rental car coverage will cover you up to up to $75,000 and will last for a period not intended to exceed 31 consecutive days. For built-in coverage, these limits are great but if you needed higher coverage limits up to $100,000 or for a longer amount of time, it could be worth it to pay for coverage offered by other cards like the Platinum Card.

Here are some of the rules for rental car coverage for the Sapphire Reserve.

Who is covered?

The cardholder is covered as the primary renter of the vehicle and any additional drivers permitted to operate it under the terms of the rental agreement (“Authorized Person”) are also covered.

What’s Covered?

- Physical damage and/or theft of covered rental vehicle

- Reasonable and customary towing charges related to a covered loss to take the vehicle to the nearest qualified repair facility

- Valid loss-of-use charges incurred by the rental car agency

What’s Not Covered?

This is not an exhaustive list. Examples include:

- Antique automobiles; vans designed to carry more than 8 people; vehicles that have an open cargo bed; trucks; motorcycles, mopeds, and motorbikes; limousines; and recreational vehicles

- Expenses reimbursed under your personal auto insurance policy, your employer or your employer’s insurance

- Any obligation you assume under any other agreement

- Injury of anyone or anything inside or outside of the vehicle

- Leases and mini leases

- Any violation of the auto rental agreement

- Loss or theft of personal belongings

One of the biggest exclusions to note is that coverage does not apply to injuries to anyone or anything outside of the vehicle. Coverage is not liability coverage (sometimes referred to as supplemental liability insurance) and is strictly limited to damage to the rental vehicle.

You also are not covered for any injuries that could happen to you (that would be personal accident insurance).

These exclusions mean that you should still take sufficient preparation to make sure that you have adequate coverage in the event of an accident. You can get broader coverage through your car/health insurance provider, a third-party, or perhaps through the rental car agency.

Anytime I ever rent a car, I use the Sapphire Reserve to book it. You can read more about the Sapphire Reserve rental car coverage here.

Baggage Delay Reimbursement

I’ve personally had to use this benefit before and it was a terrific convenience to be able to hit up a mall in Auckland, New Zealand and buy some new clothes while on a trip — it really helped take the stress out of waiting so long for my bags to be delivered.

With this protection, If you are delayed more than 6 hours, you are covered for essential expenses, such as toiletries and clothes for up to $100.00 per day for a maximum of five days. The minimum threshold of six hours is very competitive and it is nice that you can get coverage for up to five days since many cards will limit you to coverage of only three days.

Who is covered?

The primary insured person and immediate family members are covered.

What’s Covered?

You’ll get reimbursement for the emergency purchase of essential items like toiletries and clothing, and in my personal experience they are pretty liberal when it comes to defining toiletries and clothing. For example, I once purchased a blazer and I got that reimbursed so you don’t have to stick to clothing such as underwear and socks.

What’s Not Covered?

Chase does specifically exclude certain items and some of those include:

- contact lenses, eyeglasses or hearing aids

- artificial teeth, dental bridges or prosthetic devices

- tickets, documents, money, securities, checks, travelers checks and valuable papers

- business samples

- jewelry and watches

- cameras, video recorders, cellular telephones and other electronic equipment and their accessories other than charging cables for cellular telephones

So when it comes to electronics, pretty much the only thing you can get is a charging cable.

Emergency Evacuation and Transportation

If you get injured or become ill during your trip you can get emergency evacuation and transportation from your destination. In order for coverage to apply, the duration of the trip cannot be less than five days and cannot exceed 60 days. It also must be in excess of 100 miles from the cardholders residence. The coverage limit for this benefit is $100,000.

There are basically two conditions that must be met in order to get coverage:

- Your medical condition warrants immediate transportation to the nearest hospital where you can get appropriate medical treatment.

- Or after being treated at a local hospital your medical condition warrants transportation to the primary cardholder’s residence to obtain further medical treatment or to recover.

Who is covered?

The cardholder and immediate family members are covered when a portion of the entire cost of the trip is purchased with the Sapphire Reserve.

What’s covered?

You can get expenses covered like transportation, medical services, and medical supplies. Depending on where you are, those transportation costs can be extremely expensive so this benefit has the potential to be very valuable.

If you are hospitalized for more than eight days you might be able to get coverage for a friend or relative to come to your bedside. Chase will cover the cost of an economy class round-trip ticket.

What’s not covered?

Some things that are not covered include travel for the purpose of obtaining medical treatment, non-emergency services, care rendered outside of hospitals and not by physicians, experimental care, and some other conditions. Read more here.

Emergency Medical and Dental Benefit

The Reserve will cover you for up to $2,500 in emergency medical or dental work per trip, with a $50 deductible.

This $2,500 limit is a big difference from traditional travel insurance where you can get coverage for medical expenses from $10,000 up to $50,000.

So if you really want to sleep peacefully at night then you might want to look into other ways to ensure that you have adequate emergency medical care coverage when traveling.

I’ve been involved with a medical emergency while traveling (in Singapore) and let me tell you having the assurance that you’re not going to have to come out of your wallet with several thousand bucks is a huge relief and can really relieve you of some stress when unexpected things happen abroad.

Who is covered?

The cardholder and immediate family members are covered when a portion of the entire cost of the trip is purchased with the Sapphire Reserve.

What’s covered?

You’ll need to make sure that you’re receiving the services of a legally qualified position, surgeon, dentist, or qualifying medical professional. You can also get coverage for hospital visits and charges for certain types of procedures like x-ray examinations and laboratory tests. If you require ambulance services or the administration of medication those can also be covered.

You can even get a $75 allowance if the doctor states that you need to hang around in a hotel after you leave the hospital.

What’s not covered?

Things that are not covered are medical tourism, non-emergency services, care that is not prescribed by the direction of a qualified position or dentist, etc.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Lost Luggage

The Sapphire Reserve has some solid travel insurance perks for lost luggage.

You’ll be covered for checked or carry-on bags that are damaged or lost by the carrier up to $3,000.00 and up to $500.00 for jewelry, watches, cameras, video recorders, and other electronic equipment.

You’ll be able to get reimbursement for costs you incur to repair or replace checked and/or carry-on baggage damaged or lost (including theft) that happens during a covered trip on a common carrier such as airline, bus, cruise ship or train.

The Platinum Card limits you to up to $2,000 for checked bags so the Reserve offers higher overall coverage limits.

Who is covered?

The cardholder and immediate family members are covered when a portion of the entire cost of the trip is purchased with the Sapphire Reserve.

What’s covered?

This benefit covers physical loss or damage of your checked baggage and or carry-on baggage and of course the personal property within the baggage.

What’s not covered?

Exclusions to look out for are loss of documents, paper, tickets, etc. There are also exclusions when the loss results from you or a family member committing any type of illegal or intentional act. So if your drunk uncle throws your luggage out of the overhead bin and breaks belongings within it, that is probably not going to be covered.

Roadside assistance

The Sapphire Reserves offers roadside assistance for free for up to $50 and up to 4 times per year. The roadside assistance includes services that help with things like flat tires, dead batteries, or mechanical breakdowns.

The service is available 24 hours a day, 365 days a year by calling this number: 1-866-860-7978.

Who is covered?

Cardholder driving your owned or leased vehicle or a vehicle furnished by the owner, while traveling away from home.

What’s covered?

This benefit provides coverage for on the road breakdowns such as battery boost, flat tire service, fuel delivery, towing, and lockout assistance.

Not all of these benefits are completely free, however. For example, if you run out of gas the cost of fuel will be covered for up to 2 gallons. If you need towing assistance, you will only be covered for up to $50. Also if you need locksmith services you will only be covered for up to $50.

Also, here is what Chase states about qualifying vehicles:

All self-propelled, four-wheel vehicles designed, licensed, and used for private on-road transportation, with trucks limited to a carrying capacity of up to 2,000 pounds, are covered

I keep the number saved in my phone just so I have it for quick and easy reference in case I ever need to give it a call.

Travel accident insurance

Travel accident insurance consists of two benefit types, Common Carrier Travel Accident Insurance and 24-Hour Travel Accident Insurance, which provide coverage for accidental death or dismemberment, or a combined loss of speech, sight or hearing, experienced on a covered trip.

Hopefully you’ll never have to use it but here’s who is covered:

- Common Carrier Travel Accident Insurance provides benefit for a covered loss when entering, exiting, or riding as a passenger on a common carrier, such as airline, bus, train or cruise ship.

- 24 Hour Travel Accident Insurance provides benefit for a covered loss beginning on the departure date printed on a scheduled airline ticket and ends on the return date printed on the ticket (if your trip is longer than 30 days in length, see additional terms in your Guide to Benefits).

Here are the coverage amounts:

- Common Carrier Travel Accident Insurance

- Benefit amount for loss of life is $1,000,000

- Benefit amount for dismemberment and/or a combined loss of speech, sight and hearing are expressed as a percentage of the loss of life benefit and are available in your Guide to Benefits maximum payout is $1,000,000.

- 24 Hour Travel Accident Insurance

- Benefit amount for loss of life is $100,000

- Benefit amount for dismemberment and/or a combined loss of speech, sight and hearing are expressed as a percentage of the loss of life benefit and are available in your Guide to Benefits; maximum payout is $100,000.

Travel and Emergency Assistance Services

Travel and emergency assistance services provide assistance to you by finding you a good referral for your emergency. This benefit can help you in a variety of ways but it is important to remember that you will have to pay for any costs associated with the services.

For example, the administrator can help you find a local English-speaking doctor or other physician or even find you a doctor that can give you an over the phone consultation but you would be responsible for the costs assuming that another benefit does not cover that cost.

You can also get a referral for an attorney if you run into legal trouble, such as getting into a car accident or some other type of dispute.

One cool feature of this benefit is that they can assist you with lost luggage. Sometimes trying to coordinate the recovery efforts for your lost luggage can be a huge headache especially if there are multiple airlines involved and they are not necessarily admitting fault. In that type of situation, you could call this number and get them to help sort out the mess.

Some of the other benefits like getting information on currency exchange rates and weather reports are easily accessible with smart phones now so they are not as much needed.

To use the services, call the 24-hour Benefit Administrator line at 1-800-992-6029. If you are outside the United States, call 1-804-673-1675.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Trip Cancellation and Trip Interruption

This is one of the most important travel insurance benefits that you need. If your trip is canceled or cut short by covered situations, you can be reimbursed up to $10,000 per trip for your pre-paid, non-refundable travel expenses.

This is a solid perk with a high coverage limit but you really need to consider how much money you’ve spent on pre-paid expenses.

If you’re taking a 6 person family vacation for 7 days in Hawaii for example there’s a good chance you might need coverage for more than $10,000 and that’s when other plans could be helpful.

Here are the differences between trip cancellation and trip interruption.

- Trip Cancellation provides reimbursement if a covered loss prevents you from traveling on or before the departure date and results in cancellation of the travel arrangements.

- Trip Interruption provides reimbursement if a covered loss on the way to the point of departure or after departure causes interruption of your covered trip. It can also provide reimbursement if a trip is postponed due to a covered loss and certain fees are incurred if a new departure date is set.

The limits for this protection are up to $10,000 per covered trip and a maximum limit of $20,000 per occurrence and a maximum benefit amount per 12-month period of $40,000.

Who is covered?

The cardholder and immediate family members are covered.

What’s Covered?

This is not an exhaustive list. Examples include:

- Accidental bodily injury, loss of life, or sickness experienced by the cardholder, a traveling companion or an immediate family member of the cardholder or a traveling companion

- Severe weather that prevents the start or continuation a covered trip

- Terrorist action or hijacking

- Jury duty or a court subpoena that cannot be postponed or waived

- Financial insolvency of the cardholder’s travel agency, tour operator, or travel supplier.

Getting coverage for sickness is super important because that is such a common reason for why you may not able to take a trip. If you try to cancel a nonrefundable airline ticket or tour due to feeling sick, there is a good chance you may not be able to get reimbursed. So this benefit is so very important in those cases.

What’s Not Covered?

This is not an exhaustive list. Examples include:

- Travel arrangements canceled or changed by a common carrier, tour operator, or any travel agency unless the cancellation is the result of severe weather or an organized strike affecting public transportation

- Change in plans or financial circumstances

- A pre-existing condition

- Traveling against the advice of a physician

- A declared or undeclared war

- Trips that exceed 60 days in duration are not covered

One of the main exclusions is when the travel arrangement is canceled or changed by a common carrier. It is possible that if you booked two separate itineraries that one itinerary could be changed and that could force you to miss a flight. If that happened you would not be covered so you need to always take precaution when scheduling your flights.

Another exclusion to be noted is that your cancellation will not be covered if it is due to a pre-existing medical condition or if you simply have had a financial issue forcing you to cancel a trip. Some travel insurances will still allow you to get travel cancellation protection when you are dealing with a pre-existing condition so that is something to think about.

Trip Delay Reimbursement

This perk will have you covered if you are delayed more than 6 hours for expenses, such as meals and lodging, up to $500 per ticket. This is an upgrade from the Sapphire Preferred which required 12 hours (read more on the Preferred here).

Many times you will not be guaranteed any type of compensation or anything when your flight has been delayed by six hours. And if you are offered some type of compensation it might be limited to something like an airline credit or to a specific hotel for a night.

So this benefit allows you to make your own decisions on how to handle a delay and gives you a pretty generous allowance when choosing to do so. Since the delay only has to last for six hours, this benefit is also much easier to use than what many other credit cards offer.

Although I wouldn’t necessarily recommend it, I’ve heard of others using this benefit to stay at a 5-star hotel for one night when their trip is delayed and then getting comped for the $500 stay. I would probably not push it to that extreme but I would still book a nice hotel for my stay if I wanted.

While I think $500 is a decent amount of money to handle a trip delay, there are some travel insurance packages that will offer you $1,500 or more for a six hour delay.

Who is covered?

The cardholder and their spouse, and dependent children under 22 years of age are automatically covered when a portion or the entire cost of the Common Carrier fare is purchased with your Chase Sapphire Reserve.

What is covered?

You will be covered for reasonable expenses that include things like meals, lodging, toiletries, medication and other personal use items.

What is not covered?

You will not get coverage for any delay that was made public or known to you prior to the departure of the covered trip. You also will not get coverage for prepaid expenses. That is a departure from some travel insurance policies that will cover you for a prepaid expense.

Final word

The Reserve’s travel insurance is among the best for any credit card. But if you’ve spent a substantial amount on pre-paid trip expenses, you might want to consider getting another policy. Also, if you need to rent a car for longer than 31 days, you might want to seek rental car coverage elsewhere.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Hey Daniel – my wife has a CSR. To take advantage of primary auto coverage can the rental be in my name? Or for flight insurance can flights be in my name? I was an AU on her CSP card for years but when she upgraded to CSR I had her drop me as an AU because of the fees. Now I’m questioning that decision. I’m the travel booker in the family.

Great article!

Flights can be in your name and you’ll be covered. The language is a little less clear for car rentals. The terms state “You [the cardholder]

are then covered as the primary renter of the vehicle and any additional drivers permitted to operate it under the terms of the rental agreement

(“Authorized Person”) are also covered.” So it almost seems like they want the cardholder to be the primary renter of the vehicle but that you are also covered if you are permitted to operate it under the terms of the rental agreement. I’d need to contact them to get a for sure answer but my guess is that you would be covered.

Hi Bonnie, All you have to do is put a portion of your trip on the Chase Sapphire Reserve and your entire trip (cruise you are paying for) will covered. So you’ll be covered.

I have done my research and this looks like a great card with the benefits I would use since we do travel several times a year. Is the list of reasons for the trip insurance comparably to say Allianz? I thought there was an amount for medical evacuation say if you were overseas and have to be brought back home, or did I miss that? For me, just the savings on individual trip policies on cruises would offset the annual fee. Great column by the way.

Hey Gary, I just updated the article to address some of your questions. It is now much more comprehensive and should cover some of your concerns.

I believe the Ritz card also has the same level of insurance as the Reserve unless that has changed.