WalletFlo is getting very close to completion now!

I finally had my first glimpse of the product and WalletFlo is no longer just an idea or a series of sketches or screenshots but an actual web platform that performs real functions!

A couple of technical issues still need to be ironed out, but I will soon have a live demo of the product to share with you. In the meantime, I just wanted to give you another sneak peek of a couple of features and talk about my plans for them.

What is WalletFlo?

WalletFlo is a digital smart wallet that helps you maximize and manage your credit cards via smart automation.

It’s designed to replace spreadsheets with something much more functional that, at the end of the day, just makes you feel better about applying for credit cards and optimizing them in the future.

WalletFlo is for both beginners and advanced users and will be ideal for individuals or couples. It will initially exist as a web platform but will eventually be a mobile app as well.

WalletFlo give-a-way

I’ll be giving away one-year subscriptions to WalletFlo to randomly selected commenters on any UponArriving posts until the launch this winter.

A small number of people will also be gifted a free lifetime membership to WalletFlo — and all you have to do is leave a comment (preferably a quality comment) on any post (like this one) to enter.

The more comments you leave, the better your odds (but spam-type comments won’t count).

Check out the first sneak peek

First, just in case you have not seen the first sneak peek I recommend you take a look at that here. That sneak peek offers a much more in-depth look at the core features of this platform so make sure you check it out.

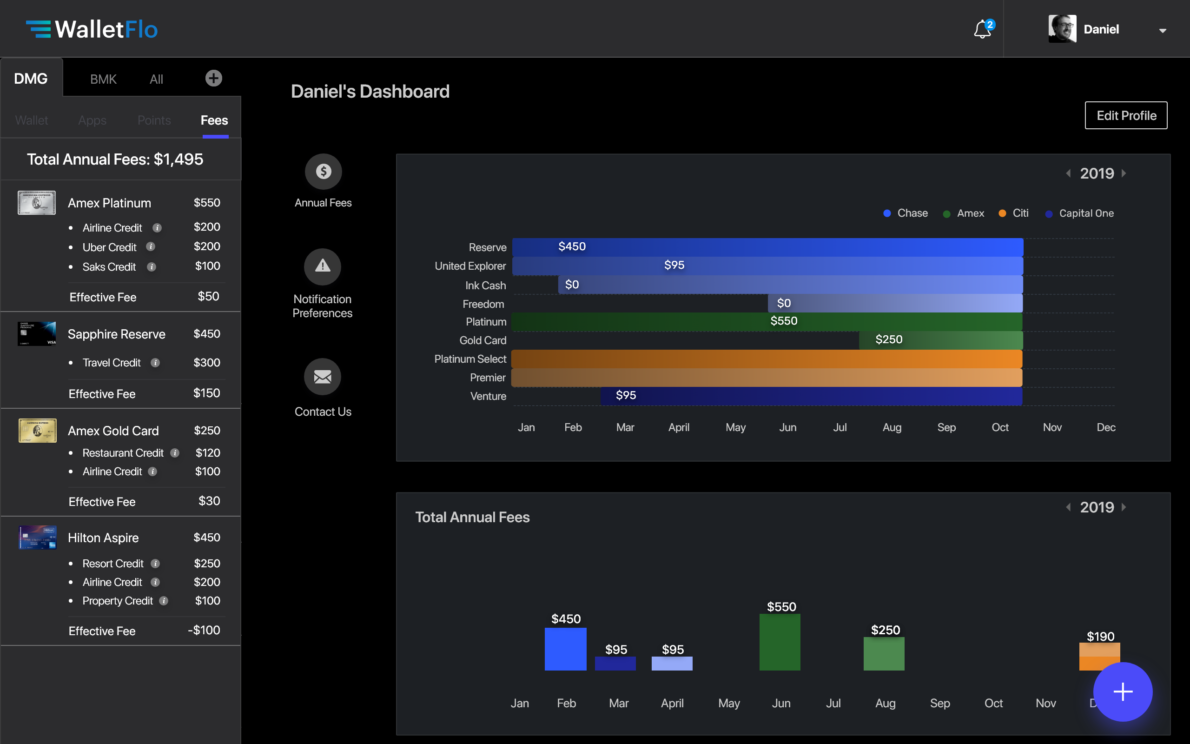

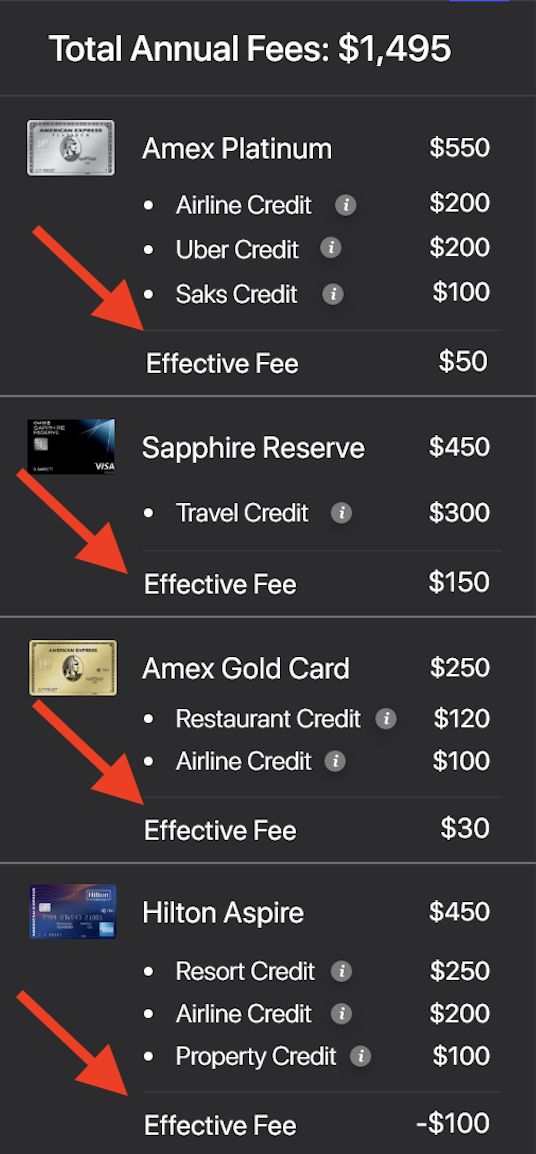

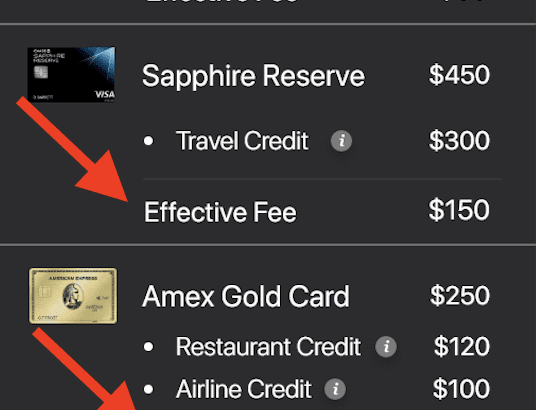

Annual fees tab

The first feature I want to show is the annual fees tab. This tab provides you with a breakdown of all of your annual fees and credits.

You can also view your annual fees on the timeline which will help you see how your fees will hit throughout the year but the purpose of the fees tab is to have a list view of all of your fees (for easier sorting) and provide you a way to easily keep track of all of your credits.

Take a look at the example below and you will see there are credits listed for the Platinum Card, Gold Card, Chase Sapphire Reserve, and the Hilton Aspire. The annual fee for the card is listed and the effective annual fee is also listed which shows you how much that card is costing you if you utilize all of your credits.

Each credit has an information box that can be pulled up by clicking on the “info” (i) circle, which will be extremely helpful. This information box will give you quick details of how the credit works and will tell you things like deadlines and whether the credit is issued on a calendar or anniversary year basis.

Links will also be provided so that you can click on a link and find out more detailed information about the credits. Some of the credits can be a little confusing and also many people have questions about things like gift cards related to the credits so this will prevent you from having to hunt down information about your credits.

Eventually, I think it would be helpful to have a cheat sheet for the credits so that you could see a breakdown of monthly credits. That would make it easy to remember to use your credits up each month.

It would be amazing to be able to link your credit card accounts to WalletFlo so that you could be notified about your unused credits in real time but I’m not sure about those capabilities yet.

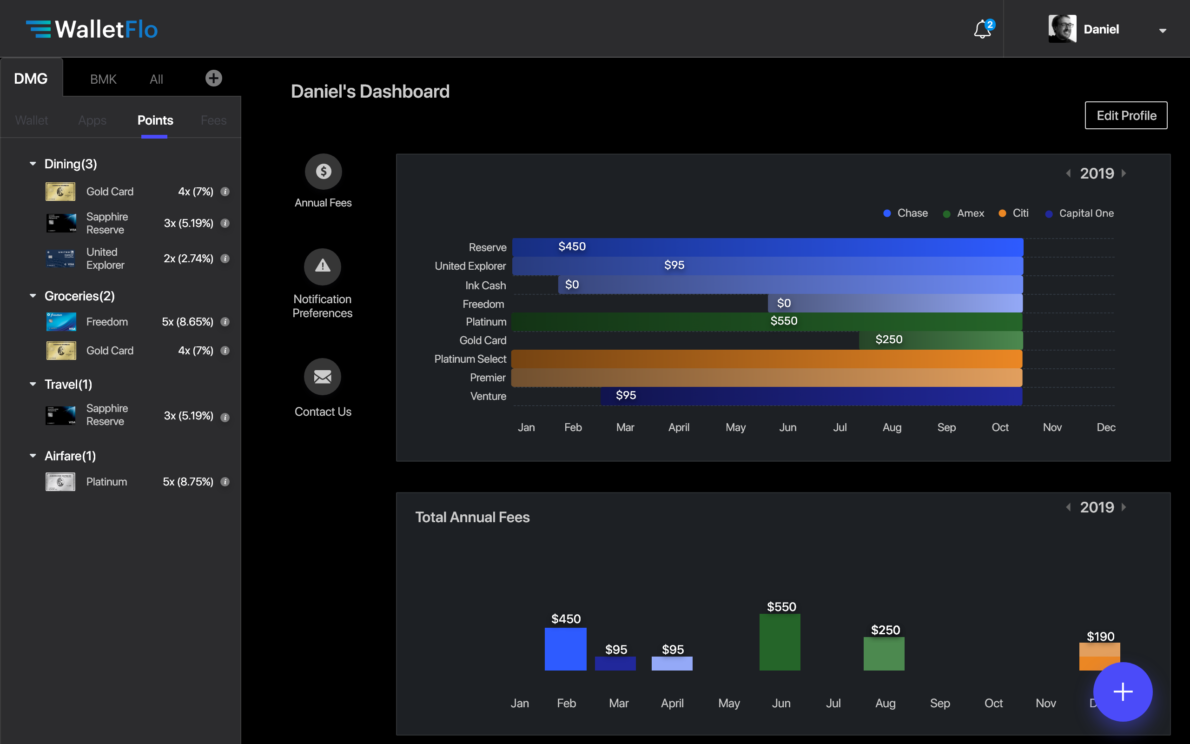

The points tab

The points tab is another feature that is designed to make it easier to sort and understand your wallet.

You will see all of your bonus categories listed and cards ranked in order of how much value they can return for you in that category. (Cards that earn quarterly bonus categories will be updated in real-time.)

Here is an example of what the points tab would look like (note that we did not input every category that would be there).

Notice there are also information boxes that will help give you instant guidance on how the bonus categories work or can be maximized.

In this first version you will simply see all of the bonus categories that are attached to various cards. So you would have categories for things like groceries, travel, dining, and also categories for specific brands like Hilton, United, etc.

But future versions will be a little bit more sophisticated.

For example, under the airfare category, you would see cards like the Platinum Card that earns 5X on airfare but you would also see other cards like the Sapphire Reserve that earns 3X on travel or co-branded airline cards that earn miles for one airline.

So you will always see which cards you should potentially use for a category and they will be sorted based on valuations of their points so you can see which cards will be the most lucrative ones to use.

I think this is going to be extremely beneficial for hotel spend. I want to give users a way to input their hotel elite status and there could be a way to automate calculations for hotel spend that factors in your hotel credit card and hotel elite status.

Let’s say that you had Hilton Diamond status and had the Hilton Aspire card. And let’s also say that you had the World of Hyatt card and were a Hyatt Globalist. If you were curious about which program would offer you more value for your spend, it would only take you a second to see that calculation.

There is also a feature called SmartBoost that I want to implement.

SmartBoost will be a little button that you could find next to a category dropdown like dining, for example. You click SmartBoost and then you can see the best card that you are eligible for to optimize that category which would be your dining spend.

It could be an easy and efficient way to discover new cards for your specific needs and discover any strengths or weaknesses in your credit card portfolio.

Notifications

We are still finalizing the notifications future but right now it is set to give you notifications for things like:

- When you become eligible for certain cards

- When you need to put spend on a card to prevent it from getting closed

- When you should request for credit limit increases

The notifications are what will help put your credit card optimization on cruise control.

With so many of the rules now requiring you to wait time periods of 2 to 4 years for eligibility, having your credit card strategy on cruise control is going to help a lot.

You won’t have to worry about remembering what cards you are waiting for or worry about checking for the latest updates/changes on rules that may have happened over the past couple of years. All of that will be taken care of for you.

Some people like to step out of the credit card game for a while just to let their credit reports cool down and because they lose interest. And WalletFlo will allow them to easily get back in the game since they won’t have to worry about reading up on the latest changes and what not — it will all be right there in front of them.

Once we incorporate sign up bonus features, notifications are really going to help you as well because you will be one of the first people to know about an increased offer for a card you are interested in (and eligible for).

The next step

There are a handful of really helpful features that I hope to roll out over the span of the next year.

The next feature would probably be a perks feature that would break down all of the perks for your cards including things like:

- Free anniversary nights

- Elite status

- Annual spend bonuses

- Free checked bags

- Lounge access

I would also like for it to be able to list and sort your benefits and protections like:

- Trip cancellation

- Baggage delay

- Purchase protection

The idea is to give you a place to go so that you can easily see a breakdown of your benefits and all of the important details that go along with them.

Also, with the information boxes and links to specific articles you will always have the details that are important to your perks so that you don’t have to go hunting down information every time you have a question about how a perk works or how to maximize it.

Final word

I am hoping to be able to release WalletFlo to beta testers in the next couple of weeks. I will work with them for a few weeks to iron out any issues and then hopefully we will launch sometime in January!

I’m still trying to figure out how all of the pricing and packages will work but I am pretty sure there will be a free version and a premium version. The maximum cost will be $25 per year but all of you readers will be given a discount for the first year.

[By the way, I got overwhelming interest about pre-orders (88% said yes!) but I just feel more comfortable taking orders after I have the product fully developed.]

One last thing….

I don’t believe we will include affiliate links in this product at least not for the first year. The reason is I want ultimate freedom to make this the most helpful credit card tool possible.

Once you introduce affiliate links, you have to deal with compliance issues and that can hinder development. After one year, I would probably send out a poll to users and get their input on how they feel about affiliate links. But that is a bridge that we will cross when we get there.

I really appreciate all the comments up to this point about this product and all of the feedback. There have been some excellent recommendations and I’m sure that as the product is rolled out you readers will have even more great feedback.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I’m so excited for this to be released! This is going to alleviate so much stress and organize my credit cards so much. Can’t to use it!

Same here! Can’t wait to automate a lot of these features!

Looking good! Definitely looks like it’ll make credit card/points organization easier.

Thanks, looking forward to the launch!

This does look like a great tool. I’m anxious to load my own data to see how useful it will be.

Go with the Flo…

Haha, I love it!

Point valuation is critical. Some cards offer a seemingly enticing number per amount charged only to require a huge number of earned points per dollar of benefits.

Yeah I think the valuations are going to help a lot of people better understand the value of their rewards.

Looks great! Looking forward to its release.

This is going to be such a big help to track everything.

I completely agree!

i am reading it twice

not easy to see exatlly how it will works but looks promising

after learning…

will do it

Don’t worry we will have detailed instructions whenever we roll it out!

It’s so overwhelming that your brain is working like a programmer. This will definitely a genius product from genius brain.Just eagerly waiting to see this product

RAMESH Shah

[email protected]

Looking forward to the beta, this will make keeping track so much easier and I am going to recommend to friends and family that are struggling to keep track all the deals I push to them to open

This is going to be great! I also can’t wait as it will help my credit card strategy.

Im excited for this to be finally available. I love organizing credit cards with categories etc this will surely help me. I will also recommend this to friends and family.

Stop teasing us…I can’t wait to get started!!!

This is great! I need it to better track and get organized! Can’t wait for it to go live.

What security measures or encryption will be used?

Will this be a phone app? Computer app? both?

I can’t wait for the beta use… final product. Like all apps there will be tweaks to iron out the bugs.

Do you have credits on those who are building this product? Is this something you are personally developing?

I would definitely be interested in such a tool. I currently pay $10 a year for awardwallet, which I find very helpful for tracking points and certificates. I think a similar price point would be very nice for initial subscribers.

I especially like the tracking for annual fees, bonus categories, and application rules assistance. I am currently using spreadsheet plus calendar reminders, and would love a more organized method offered with walletflo. Please try to make this link up/be as automated as possible. For example, bring able to login using my amex account and pull card data, instead of my having to manually specify when I opened the card and the annual fee dates.

Thanks for the feedback. We are definitely working on automating the syncing at some point. Do you have a discount for AW? I thought it was around $30/year?

Thanks for your efforts in creating this all in one app. I have used award wallet for years but this sounds like a real step up. It’s always exciting to learn how to do things better!