Offers contained within this article maybe expired.

American Express roadside assistance is one of the underrated benefits of Amex cards since many people aren’t even aware that the benefit exists. However, this benefit can an absolute life-saver whenever something goes wrong while you are on the road.

This article will tell you everything you need to know about American Express roadside assistance, include what exactly is covered and the phone number for finding out more.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

What is American Express roadside assistance?

American Express roadside assistance is a program offered by American Express cards that offers you special protections when you have issues with your vehicle, such as flat tires and dead batteries. These services are offered for no additional cost.

What cards offer roadside assistance?

The terms and conditions for different Amex cards will differ but you can look up your specific Amex card roadside protections here. Here’s a list of some of the more popular Amex cards that offer this perk.

- American Express® Green Card

- American Express® Classic Gold Card

- American Express® Gold Card

- Platinum Card® from American Express

- The Platinum Card® from American Express for Ameriprise Financial

- Delta SkyMiles® Credit Card

- Blue Delta SkyMiles® Credit Card

- Gold Delta SkyMiles® Credit Card

- Platinum Delta SkyMiles® Credit Card

- Delta Reserve® Credit Card

- Hilton Honors American Express Aspire Card

- Hilton Honors American Express Ascend Card

- Hilton Honors American Express Card

- Starwood Preferred Guest® American Express Luxury Card

- Cash Magnet® Card

- Blue Cash® from American Express

- Blue Cash Everyday® from American Express

- Amex EveryDay® Credit Card

- Amex EveryDay® Preferred Credit Card

For this article, I’m going to focus on the protections offered by the Amex Platinum Card.

What are the American Express roadside assistance benefits?

Premium Roadside Assistance provides the following services at no additional cost up to 4 times per calendar year:

- Towing up to 10 miles (Card Member will be charged for the costs of towing in excess of 10 miles)

- Winching

- Jump starts (for dead batteries)

- Flat tire change when Card Member has a workable spare

- Lockout service when key is in vehicle (lockout service may be unavailable for vehicles with transponder keys.

- Delivery of up to 2 gallons of fuel.

Towing

With your Amex cards, you can get towed up to 10 miles but you will be charged for the costs of towing in excess of 10 miles. Towing will be to the nearest authorized facility but you may request towing to a different facility provided that, if the towing exceeds 10 miles, the Card Member will be charged $3 for each additional mile.

The protections offered by American Express are similar to those offered by the Chase Sapphire Reserve and the Chase Sapphire Preferred. You can read more about those cards here.

Amex roadside assistance vs AAA

A lot of people have AAA coverage for these type of events and wonder how the Amex roadside protections stack up against AAA. AAA is a federation of independent clubs throughout the United States and Canada. You’ll want to look up the benefits offered in your region by going here. I’ll focus my comparison on benefits offered by Texas AAA.

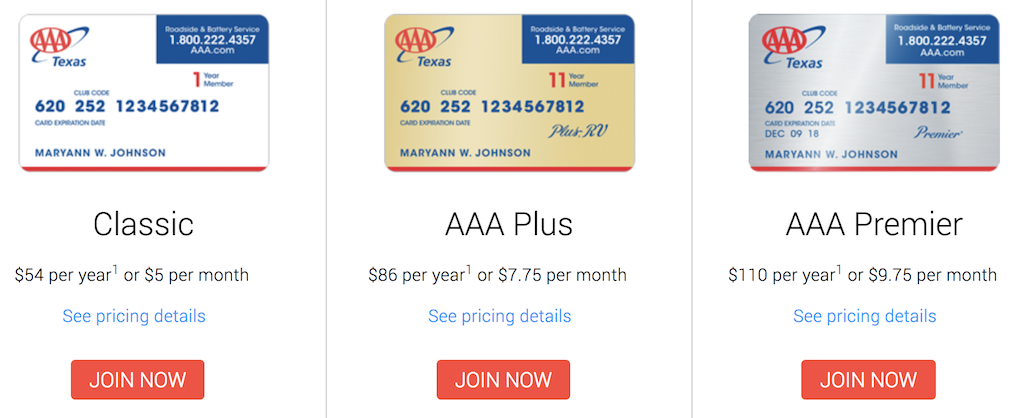

How much does AAA cost?

The cost of your AAA membership can vary based on the level of protection you want. For this comparison, I’ll focus on the cheapest package offered in Texas which goes for $54 per year or $5 per month.

Towing benefits

AAA offers towing for up to 7 miles or unlimited back to service provider, while Amex cards will provide you with up to 10 miles of coverage. You should also note that the upgraded AAA packages offer towing up 100 and 200 miles.

Fuel

The basic package offers free fuel delivery but the member pays for fuel. However, if you had a more premier AAA package, you’d get enough free fuel to get yourself to a service station. The Amex Platinum, like the Chase Sapphire Reserve, will cover you for up to 2 gallons.

Flat tires and batteries

AAA offers comparable service for flat tires and battery charges.

American Express roadside assistance FAQs

What vehicles are eligible?

Coverage is provided for self-propelled, four-wheel vehicles designed, licensed, and used for private on-road transportation, and trucks up to 10,000 pounds gross vehicle weight. Vehicles that are NOT covered include: rental vehicles, motorcycles, taxicabs, unlicensed vehicles, tractors and trucks over 10,000 pounds gross vehicle weight.

Where is coverage available?

Coverage is available in the 50 United States, the District of Columbia, Canada, Puerto Rico and the U.S. Virgin Islands, regardless of mileage from primary residence.

Who needs to be present when services are rendered?

The card member must be present with the vehicle at time of service.

Is this service always available?

Roadside Assistance may not be capable of contracting service on a “restricted roadway.” A restricted roadway is a roadway that only allows a specific towing company to service disablements that occur on the identified roadway.

Amex will attempt to arrange for a restricted roadway service provider to service the vehicle, at the cost of the Card Member and at the rate specified by the service provider, but may be unable to do so. If towing services at the cost of the Card Member are required, Amex will attempt to arrange service to a point where Roadside Assistance is able to provide further towing services under standard program coverage terms.

What is the Amex roadside assistance phone number?

The Roadside Assistance program phone number is: (855) 431-1156. You may also call the number on the back of your card.

Final word

American Express roadside assistance is a benefit that you definitely want to be aware of in the event that you ever need to use it. The benefits offered are very similar to those offered by AAA’s basic package so I don’t think it’s necessary to have both Amex roadside protections and AAA. But if you desired more thorough protections, you might want to consider enrolling in AAA.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Great Post! Thanks for sharing.