The Zales credit card is very popular for anyone thinking about making a large purchase at Zales.

That’s because it offers 0% APR for different lengths of time depending on the payment option that you go with. But is this card a good credit card option?

This article will dive in deep to review the Zales credit card’s benefits and show you why you need to be careful going with this card and its various payment options.

I’ll also show you how to save money when shopping at Zales and give you some info to ponder about Zales diamonds.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Table of Contents

Zales (brief history & locations)

Zales is one of the most well-known jewelry stores in the US.

The company started back in 1924 in Wichita Falls, Texas, when Morris (M. B.) Zale, William Zale, and Ben Lipshy opened the first Zales Jewelers store.

As part of their marketing strategy, the Zale brothers launched a credit plan where customers paid “a penny down and a dollar a week,” which helped make jewelry and other merchandise like cameras affordable for the average working American.

The success of this credit strategy led to the company expanding to12 stores in Oklahoma and Texas by 1941. Zales Jewelers eventually moved its headquarters from Wichita Falls to Dallas in 1946 and in 1998, it opened up online shopping at www.zales.com.

Over the past 90+ years, Zales grew from a single store selling jewelry, appliances and cameras to a major international jewelry corporation.

Zales has expanded to over 700 stores and become one of the largest fine jewelers in retail shopping malls across North America and Puerto Rico.

If you’re looking for a Zales store you can search for store locations here.

Who issues the Zales credit card?

Comenity is the parent company of Comenity Bank and Comenity Capital Bank and Comenity Capital Bank issues the Zales Credit Card.

Some report that if Comenity Bank approves you then you might have to put down money at the time of purchase. If Comenity Capital Bank approves you then you should get a standard credit line.

Comenity is also known for issuing various store credit cards, including:

- Bed Bath & Beyond

- Big Lot

- Crate and Barrel

- DSW

- Forever21

- Game Stop

- J. Crew

- LOFT

- And many, many others.

I don’t usually hear a lot of great things about the Comenity customer service but I’ve never had a personal experience with them.

Zales Credit Card application

Here’s a breakdown of the Zales credit card benefit.

- No down payment Everyday Promotional Plans

- Receive exclusive cardholder coupons, jewelry inspection reminders and cleaning notifications via email** throughout the year

- $50 Off a purchase of $149 or more on your birthday

- Free standard shipping

- 10% OFF any repair service when you use your Zales credit card

You can find the Zales credit card application here.

No down payment; Everyday Promotional Plans

Being able to walk out of a jewelry store with no down payment is pretty special but you’ll only be able to do that if you sign-up for a special promotional plan.

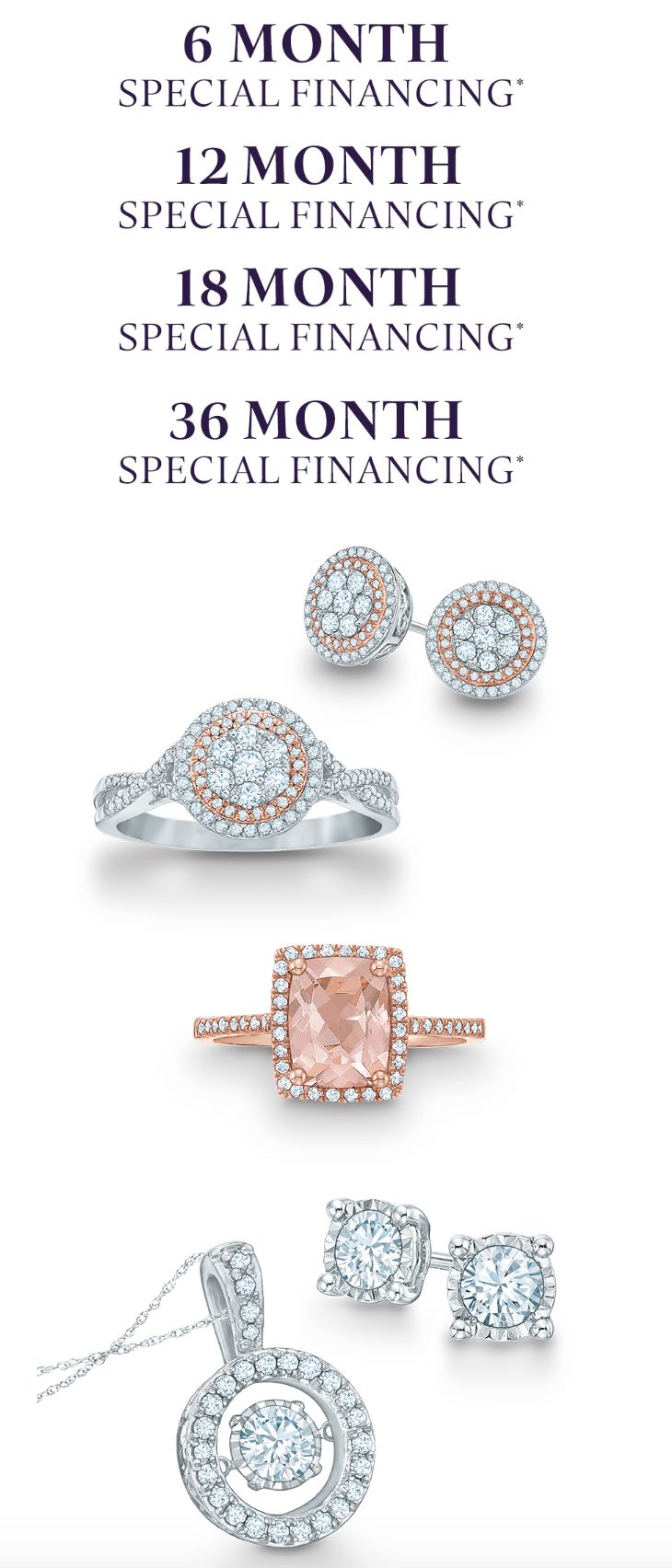

There are two promotional plans available to cardholders.

- No Interest if paid in full within 6, 12 or 18 months.

- 9.99% APR if paid in full in 36 months

So if you can pay off your balance within 6 to 18 months you can get an interest free plan but if you extend it out to 36 months you you’ll have to pay 9.99% for your APR.

Interest will be charged to your account from the purchase date if the purchase balance is not paid in full within the promotional period or if you make a late payment.

I’ll talk more about the deferred interest below, but one major factor to consider here is that you’ll be charged interest even if you make a late payment. Some report that they’re not able to set up auto-pay which could mean they are at a bigger risk to miss a payment.

So if you struggle to pay your bills on time, this could be a very bad thing because failing to pay your bill on time could amount to hundreds or even thousands of dollars worth of interest fees.

Receive exclusive cardholder coupons, jewelry inspection reminders and cleaning notifications via email throughout the year

Jewelry inspection and cleaning notifications can be important because under some care plans, you can lose the perks if you don’t regularly get your piece inspected or cleaned.

For example, Zales states:

You may have your Zales diamond cleaned and inspected as many times as you want, free of charge, for as long as you own it. To maintain your Lifetime Diamond Commitment limited warranty, you need only bring your diamond to Zales every six months for cleaning and inspection, along with your record-keeping card.

So if you miss an appointment, you can miss out on that valuable perk.

And while it’s very easy to mark your own calendar to remind yourself about making an appointment, it is nice to receive an automatic reminder just in case you forget to mark it down or mark it down incorrectly.

But still, I wouldn’t put that much value in this benefit.

I’m also not sure about the frequency that coupons are sent out to cardmembers. I didn’t find a lot of raving reviews about them so it makes me feel like they’re not that special.

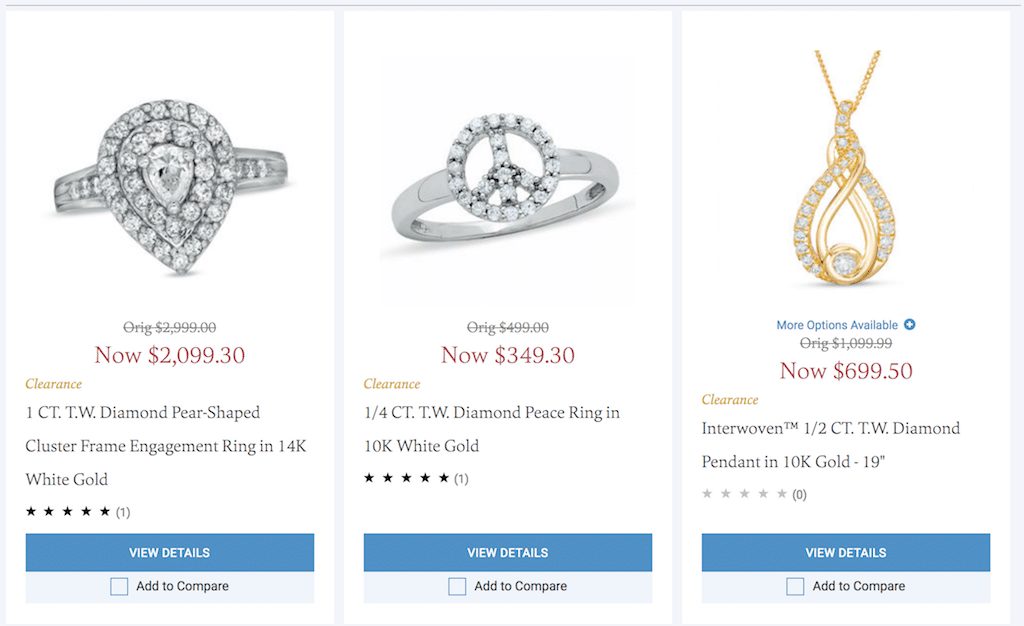

Also, Zales regularly puts on many sales and promotions so it’s not like there’s a shortage of those to go around.

$50 Off a purchase of $149 or more on your birthday

This is a decent benefit since it is essentially a $50 sign-up bonus which for a store card is okay. But this perk is often offered when signing up for the Zales email list so it’s not very exclusive (although some require you to spend $300).

Accounts opened in your birthday month or in the 2 months prior to your birthday will receive the birthday benefit during your birthday month the following calendar year.

It honestly feels a little cheap that you don’t get your discount if your birthday is in the two months following when you open up your card and that you have to wait 14 months for that coupon to come around.

Tip: If you want to save money on your Zales purchase then be sure you go through a shopping portal to earn cash back. It’s often possible to get over 5% back through many portals.

You can check the current cash back rates on CashBackMonitor.

Free standard shipping

You’ll get free standard shipping (3-5 business days) valid for the U.S. and U.S. territories when you use your Zales credit card.

It would be nice if they offered expedited shipping since some promos found on the Zales website offer free shipping on other purchases. So you’re really not coming out that far ahead.

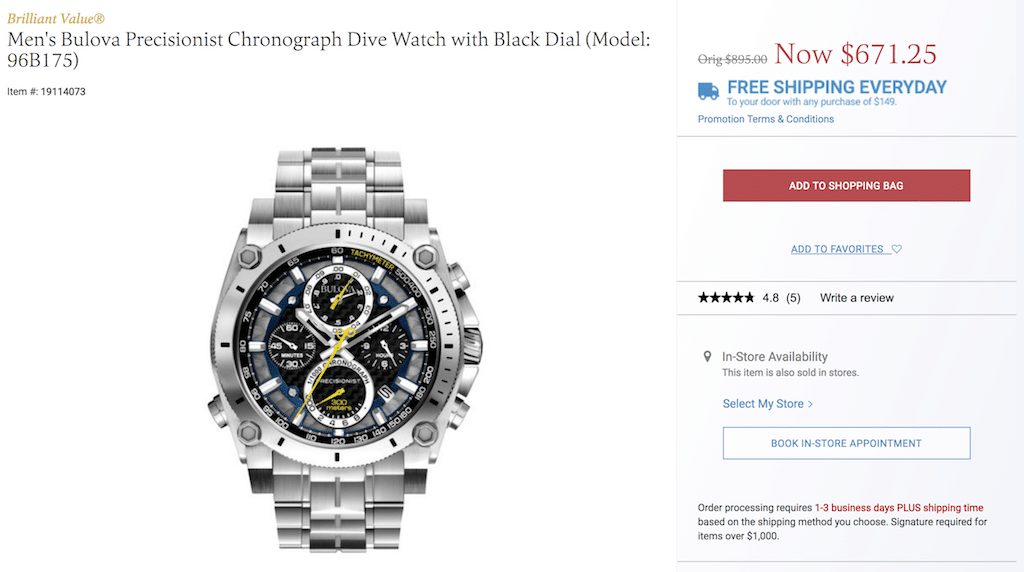

10% Off any repair service when you use your Zales credit card

I know quite a few people who have purchased or received nice jewelry over the past few years but not many of them have needed repairs. And if they did, the repairs weren’t that expensive.

So getting 10% off something you will rarely need that’s likely not that expensive in the first place, isn’t the strongest benefit.

Overall

Overall, this is not a very strong credit card when it comes to the benefits department.

They don’t offer a lot of unique value propositions and so the card doesn’t stand out. The strongest point of the card is the 0% APR that you’re eligible for but that perk comes with a lot of warning as shown below.

But the 0% APR with no down payment is very competitive.

As a point of comparison, the Jared credit card requires a down payment for its lowest special financing plans.

Specifically, the Jared credit card requires:

- 12 Month Special Financing: $1,000 minimum purchase and 20% down payment require

- 18 Month Special Financing: $5,000 minimum purchase and 20% down payment required.

Also, the Kay Jewelers credit card also requires a down payment for its lowest special financing plans ($500 minimum purchase and 20% down payment required).

So if you’re not wanting to make a down payment for an engagement/wedding ring, the Zales credit card can be one of the best jewelry store cards.

Tip: If you’re in need of a guide for engagement rings, check out this article here.

Zales Credit Card payment options

The biggest perk of this card is the ability to pay 0% interest on your purchases.

But you need to proceed with tons of caution on this.

As already stated, missing one payment can kick in interest. But if you fail to pay off your balance in time that can also kick in interest as shown below.

Deferred interest

Deferred interest can be a beautiful thing when you pay off your balance in the required time.

How it works is that you’re allowed to receive special financing for a large purchase like an engagement ring.

If you pay off your entire balance within the promotional period (e.g., 6 months, 12 months, etc.) then you don’t pay any interest. But if you fail to pay off that balance, you’ll get hit with all of the interest from those prior months.

About 1 in 5 people do not pay off their balances in time when dealing with deferred interest.

And the data is even more revealing when you break it down by credit scores.

People with “deep subprime credit scores” only pay off their deferred interest balance 46 percent of the time. So if you’ve got a poor credit score, the statistics say that you are more likely to fall victim to deferred interest — this should be a major red flag.

People with “super-prime credit scores” payed off their balance by the deadline 86 percent of the time. So if you’ve got a perfect credit score or at least a great credit score, you probably will be able to avoid the interest based on the stats.

In the end, it all comes down to how responsible you are and how prepared you are to deal with potential surprises down the road that could interfere with your ability to pay off your cards. If you’re financially stable, deferred interest isn’t so bad.

How much can you owe in deferred interest?

The amount owed will obviously vary based on the purchase price of the jewelry but because were’ dealing with diamonds, gold, and other expensive materials, the potential for paying a lot in interest is huge.

Men spend an average of $5,978 on engagement rings. If you assume that much on a purchase and interest at 29.99% for 18 months, the total spent on interest would be $2689.20!

And that’s with the average cost.

So in many cases, this can result in owing thousands of dollars.

If the balance is not paid in full in 36 months or if you fail to make any payment when due, regular credit terms will apply and interest will be imposed from the end of the promotional period at the standard, variable Purchase APR of 29.99%, based on the Prime Rate.

So not only will you owe interest, but you’ll owe interest at a very high rate.

Why this is all such an issue

A lot of people don’t understand how deferred interest works, so they end up signing up for these programs without even knowing what they are getting themselves into.

Then they miss a payment or don’t pay off their balance 100% and the next thing they know, they feel like they’ve been blind-sighted with a $2,000 surprise bill.

And then there’s a lot of people also don’t have experience in dealing with deferred interest or even credit cards in general for that matter.

All it takes is you getting a little sloppy with your record keeping or organization for you to make a simple mistake that could cost you thousands of dollars.

So unless you’re a very organized and disciplined person, you may not be the best fit for a deferred interest payment plant.

You can read more about deferred interest here.

Fees

For purchases made under the 12 and 18 months promotional Credit Plans, they will add a transaction fee of $9.95 per transaction.

However, when you make a purchase under the 6 months promotional Credit Plan, they will waive the transaction fee of $9.95. It also seems that you can get the fee waived for 36 month plans.

This seems like a very pesky fee but it’s something to be aware of so that you can consolidate your transactions the best way that you can.

Can you get the Zales Credit Card with bad credit?

One of the great things about the Zales Credit Card is that you don’t need superior credit to qualify for the card.

People have gotten approved for this card with credit scores in the 500s though you might want to try to get your score up into the 600s so that you have better approval odds and can get a credit line you’ll actually be able to use (remember, this is a jewelry store).

If your credit score is really low then there are some cards that will offer you decent options to help rebuild your credit score.

These include the following cards:

Discover it Secured Credit Card

- No annual fee

- Minimum deposit is $200

- No late fee on first payment and paying late wont increase APR

- Rewards (see below)

- Reports to all three credit bureaus

- Free FICO score

Capital One® Secured Mastercard®

- No annual fee

- Minimum deposit is $49, $99, $200

- Variable APR 24.99%

- Credit line increase possible

- No foreign transaction fees

- Reports to all three credit bureaus

Capital One Platinum Credit Card

- No annual fee

- Get access to a higher credit line after making your first 5 monthly payments on time

- Fraud coverage if your card is lost or stolen

You can also read my guide on how to instantly improve your credit score if you think you’re in need of a boost.

Final word

The Zales card isn’t a horrible card if you’re responsible and you know exactly what you’re getting yourself into. In that case, getting 0% APR on your large purchases can be a great benefit that saves you tons of money.

The only issue is that there is the potential for this to backfire for many and there aren’t a lot of other solid perks that make this card attractive. I’d probably just go with another 0% APR card if that was the benefit I needed since those other options can present you with more value.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Could you tell me what it means when I see someone talking about locking their credit reports?? Thank you for any help oh, I’ve just started my journey

Hey Roy, they are probably talking about preventing any entities from pulling their credit reports. It can be a security tactic or in some cases help reduce the number of inquiries on your credit report, since a bank may only be able to pull from one bureau if you locked or froze two of them.