UponArriving has a new tool in the works that has the potential to be a true game changer when it comes to your credit card game. This new tool will help you to save time, money, and a ton of mental energy when managing your credit cards and trying to maximize credit card applications. Below, I’ll break down all of the benefits and explain how much value you’ll get.

Intro to the project

For better or for worse, automation is the future. I’ve automated my life in many different ways, from automatic bank transfers to auto reminders to check for my phone and wallet when I leave from visiting my parents. I’m pretty much obsessed with the ways that automation can improve our lives and give us more time to spend doing the things that we love.

Over the past few years, I’ve received many of the same questions from readers and I’ve also found myself looking up many of the same things over and over again for myself. I’ve realized that when it comes to all things credit cards, there are many ways that automation could make things easier. A lot easier.

So I’ve narrowed down some different features that implement automation, and I have been working with developers to package up those features into a sleek, easy-to-use (and fun) product.

I’m very close to giving this project the full green light, but I first wanted to breakdown what this product would have to offer and get some feedback from UponArriving readers (the crowd this product is designed for).

The new credit card tool

This tool is all about making your life easier by saving you time, money, and mental energy when dealing with credit cards.

Easy credit card management

This new tool will feature a colorful timeline, organized by issuer, that displays all of your credit card accounts in a simple and clean fashion that’s fun to use.

This will be an easy and efficient way to manage of all of your credit cards (including closed accounts when needed). With a quick glance and scroll, you’ll be able to view any card’s information like credit limits, account age, and other important details.

I’ve always used spreadsheets for this but this tool will be an easier (and better looking) way to view all credit cards over multiple years and it will come with the below special features you’d never be able to get from an Excel doc.

Timeline view of all credit card rules

This is when things get interesting….

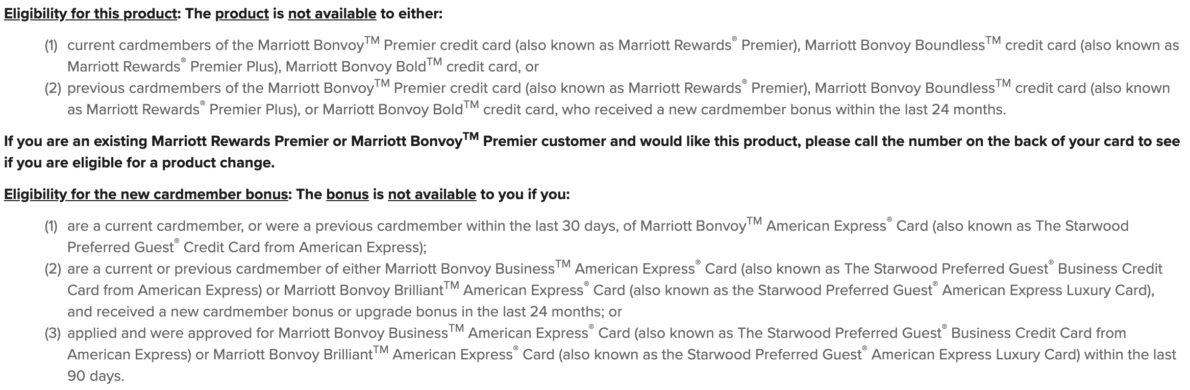

Credit card application rules are becoming increasingly common and complex. Have you seen the eligibility terms for a Chase Marriott card?

Just take look:

And those aren’t even all of the rules that apply to this card!

What if you never had to try to: 1) locate, 2) interpret, and 3) apply those terms and conditions?

With this tool, you’ll never have to worry about finding or calculating credit card application rules again. Whether it’s 5/24, 2/30, 2/90, 8/65, 6/24, 1/24 or whatever — occupying your mind with that confusion will be a thing of the past.

And why is that?

When you add a new card to your timeline, that card will immediately pop up on your timeline at the soonest eligible application date based on your unique portfolio of credit cards. This will save you a lot of time and effort and I’m not aware of any other tool that offers this feature.

In addition, you’ll instantly see every credit card rule that applies to all of your current cards in the future and you’ll be able to see exactly when those rules lose their effect, all on a clean and easy to view timeline.

So if you’re trying to plan out multiple credit card applications or plan long-term into the future, this will be your essential road map on what will work.

The tool will also offer advisories on “soft rules” like when you might need to lower a credit limit or when you have too many hard inquiries. These advisories will help you to increase your approval odds.

Family features

What I’m really excited about is creating timelines for families and groups. You will be able to create a profile for you and your partner/spouse or even a family and when you add a card to your timeline, it will show you who can get the card and when, so you can maximize rewards as a couple (or group) without having to spend an evening breaking out the credit reports, calculators, and calendars.

This feature could also help you organize your card portfolios between multiple people so that you can see which cards are missing from each person.

Personalized emails

You’ll also be able to sign-up for email updates that will tell you when you are close to being eligible for a card, which will make it much easier to plan your future credit card applications. Other emails may consist of helpful reminders to put spend on a credit card (to keep it from getting closed) or to request a credit limit increase.

What’s even better is that you can opt in for custom credit card offers. You will be able to choose to only get offers for cards you’re eligible for so you’ll know that an offer is worth looking at if it shows up in your inbox.

This will save you time (and disappointment) since you won’t have to worry about reading up on irrelevant offers — or even worse, wasting a hard inquiry on them. To my knowledge, there is no other feature like this currently available.

Annual fees

With the click of one button, you’ll get a timeline view of every annual fee attached to your cards and even be able to see your “effective annual fees.”

This will make keeping up with all of your annual fees much less time consuming and allow you to get a sense of how much space you have between them.

But what’s really special is that you’ll be able to see all of the upgrade, downgrade, and product change choices for your cards available at that time. And if there are known retention offers currently being offered, you’ll get notified about those, too.

I anticipate that the annual fee feature will help some people save hundreds of dollars over the span of just a couple of years. Again, I don’t know of any service offering this.

Summary Data

There will be a panel where you can see a summary of all your important credit card features like:

- Bonus categories (listed in order of most lucrative based on your valuations)

- Travel credits

- Annual fees

- Credit card protections

- Travel benefits (keep track of Priority Pass memberships, etc.)

- Anniversary nights

- Elite status

It’s easy to forget about protections like extended warranties and get mixed up about things like which card has the best trip delay insurance, but this panel will help you keep these things in order and will be especially helpful for couples/groups.

Also, there will be helpful links that will give you all the details you need to know about the benefits like how travel credits work, etc.

Future features

The above features are only about 40% to 50% of what I envision this thing eventually doing. I’ve got many other time-saving features in mind, but I’ll save announcing those special features for sometime in the future.

Oh yeah, and this will likely also be developed as a mobile app.

Of course, there’s going to be an element of YMMV to some of these things but even in those cases, it will be very helpful to have some specific guidance (based on data points) on what to do (and not do).

What the tool won’t have

This tool won’t link with any banks or loyalty programs so you don’t have to worry about security breaches. The goal at this point is to keep this simple and secure.

This does mean you’ll need to manually enter in some of your details but it’s not hard to find most of those details in a credit report and the time spent upfront will pay huge dividends in the future.

Price

So you might be wondering about the price of a tool like this.

Well, there will be a free version with some basic features. However, if you want to save many cards and take advantage of many of the advanced features above, that’s when the subscription plans will come in.

There will likely be two to three levels of subscriptions ranging from ~$12 to ~$22 per year. Yes, that’s per year — NOT month. Also, the prices would be per “family” — not per person.

I think many people would value their time and money saved with this tool well above $20 per year, so I think many will find the prices pretty reasonable.

Would you buy this?

Now that you know most of the features and the price, I’d love to get your input below on whether or not you’d actually purchase this. If there’s enough interest, I can get the ball rolling on this project as soon as this week and have this ready in a couple of months!

Also, if you’d be interested in being a beta user and testing out the tool (for free), email me at: [email protected].

Final word

Thanks for your feedback and for checking out this article. I have little doubt that this tool will make life much easier for tons of people by saving them time, money, and a lot of mental effort. If you agree, be sure to let me know via email or the comments!

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

For what it’s worth (not even 2 cents, really,) my opinion:

I would pay (roughly) 1 to 2 dollars a month for this.

Having said that, a lot of people are spoiled by the freebies, or ad supported stuff out there.

And I so, so, so much appreciate what you share online. Just the right amount.

Thanks, that’s extremely helpful!

Hi Daniel,

Great idea, it will be a great time saver for new and advance points and miles hobbyist. I’m also trying to automate as many processes around me as I can by using google home, Alexa and Siri.

In my opinion, having a simple and intuitive UX/UI will be key to the success of the tool, especially as the number of cards increases. It would be nice if you could share the app mockup via Invision for feedback from the community.

Best of luck!

What’s your projected timeline?

Should be around 6 to 8 weeks!