Japan Airlines (JAL) first class was on my bucket list for a while. Now, I have flown them, tasted their food and drinks, enjoyed their hospitality, relaxed for hours in their first class lazy-boy style seat, and even had two seats all to myself.

In this review, I’ll cover my experience flying JAL first class from Tokyo (HND) to New York City (JFK) and why I would recommend JAL first class to anyone. From the ground experience of JAL first class to the onboard memory-foam mattress in first class, I will put you in my slippers of what makes JAL first class a great way to cross the Pacific.

Trip briefing

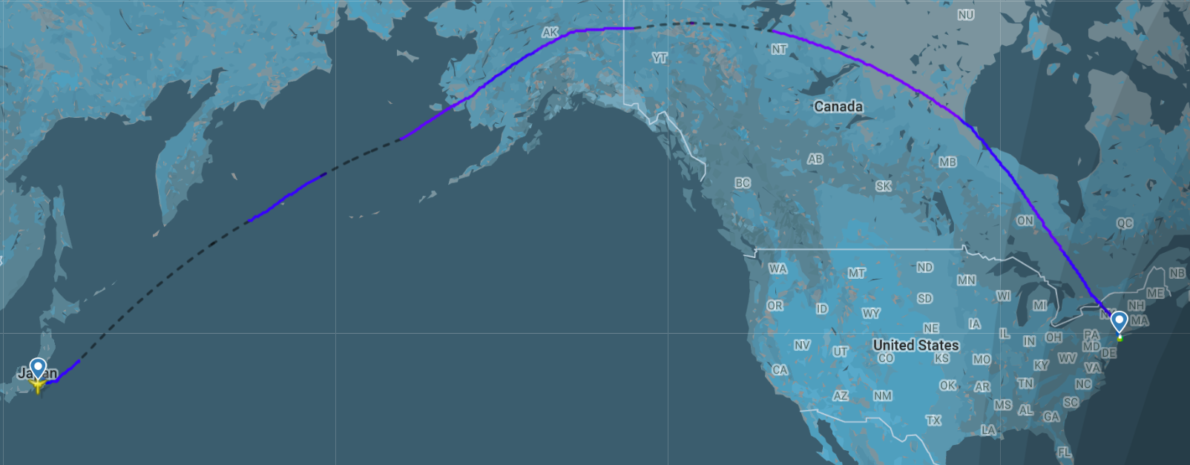

Flight routes

This was my third flight during my trip to the USA with a night in each Bangkok and Tokyo coming back from Kuantan, Malaysia. These flights spanned over three days and the routings were all on purpose to try the products I haven’t flown before. There was one flight change before my first flight, but it turned out alright resulting in only one night in Tokyo besides two.

- Kuantan (KUA) -> Kuala Lumpur (KUL): Malaysia Airline 737-800 Economy Class

- Kuala Lumpur (KUL) -> Bangkok (BKK): Royal Jordanian 787-8 Business Class

- Bangkok (BKK) -> Tokyo (HND): Thai Airways 747-400 First Class

- Tokyo (HND) -> New York (JFK): Japan Airlines 777-300ER First Class

- New York (JFK) -> Detroit (DTW): Delta Airlines CRJ900 First Class (domestic product)

Hotel stays

- Hyatt Regency Kuantan (5 nights on cash)

- Le Méridien Suvarnabhumi, Bangkok Golf Resort & Spa (1 night points)

- Hyatt Regency Tokyo (1 night points)

Flight details

Here are the details for the flight:

- Route: Tokyo (HND) -> New York (JFK)

- Flight No.: JL 6

- Aircraft: 777-300ER

- Registration: JA743J

- Class: First Class

- Seat: 2K

- Date: July 25, 2019

- Scheduled Departure Time: 10:40 am | Actual Departure Time: 11:04 am (+24 minutes)

- Scheduled Arrival Time: 10:45 am | Actual Arrival Time: 9:47 am (-58 minutes)

- Flight Time: 11 hours, 44 minutes

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

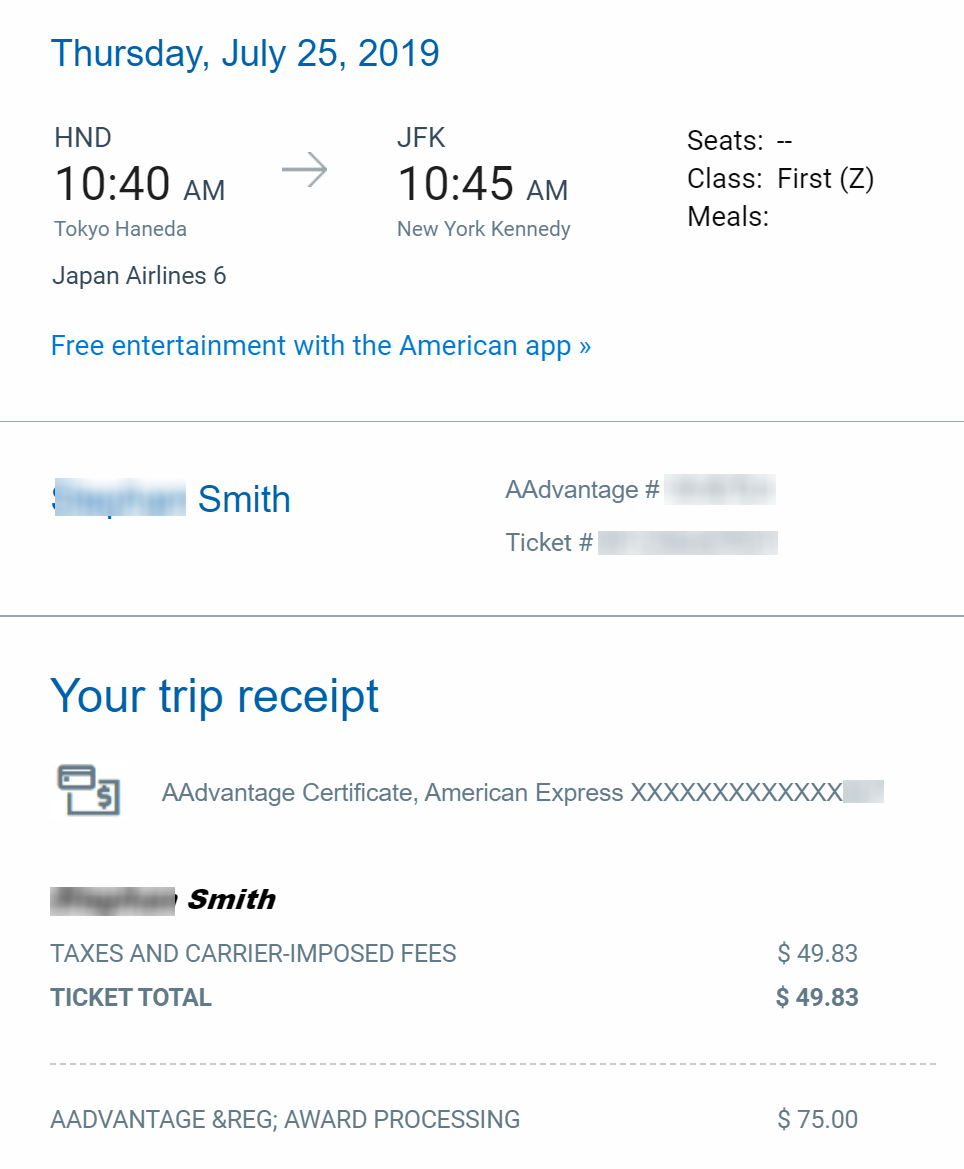

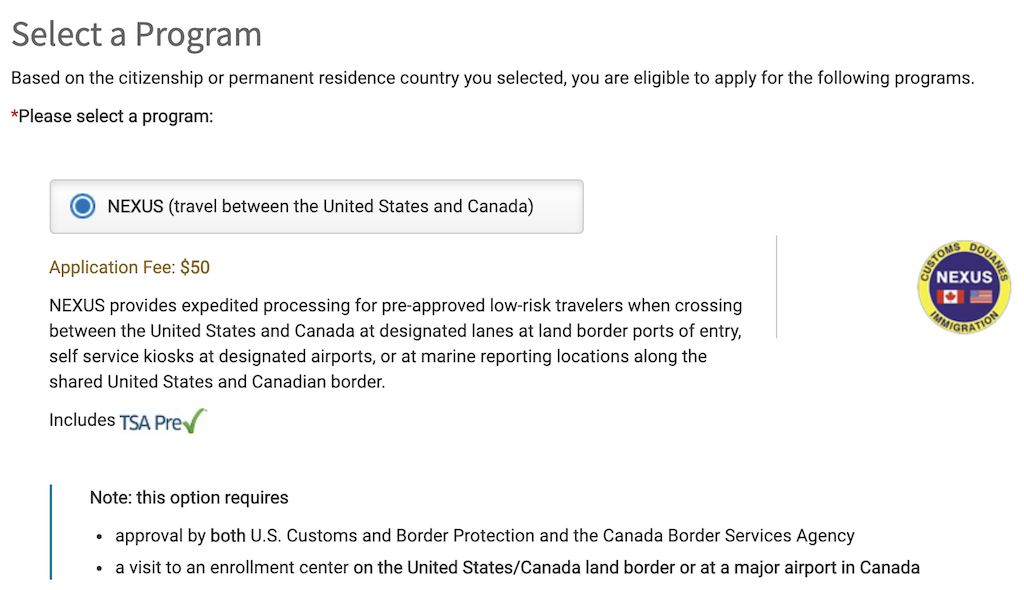

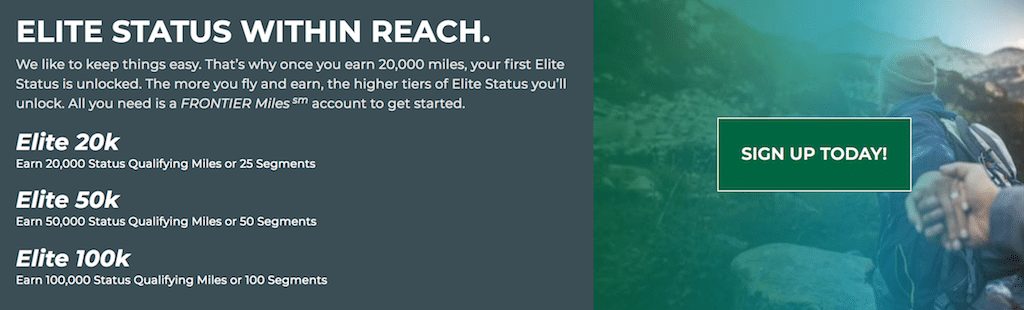

How to book Japan Airlines First Class (JAL F) using miles

I booked my JAL first class ticket using 80,000 AA miles plus $49.83 taxes and fees. However, as I booked it a week before departure, I was charged by AA for a close-in booking fee of $75. If I was an AA elite, I would have had the close-in booking fee waived.

This has to be one of my favorite uses for AA miles as it’s not too expensive of a redemption cost, plus the taxes and fees are cheap.

You can now book JAL flights on AA website making it super easy to redeem AA miles for JAL flights. In the past, you would have had to call in to redeem AA miles for JAL. I just searched on AA’s website and was able to make the booking.

Getting to HND

From the Hyatt Regency Tokyo, which is located in Shinjuku, I took the taxi as the time I left the hotel didn’t have the airport limousine bus till an hour later leaving from the hotel. Plus, I kinda had a headache from drinking the night before with a friend.

The taxi took about 40 minutes from the hotel to the international terminal at Haneda and costed bout $75. I knew it would cost a good chunk of cash, but in this situation, I was happy to pay it.

Japan Airlines first class check-in at HND

HND is a lovely airport. It’s easy to get to from downtown Tokyo, easy to get around the terminal as it’s not too big, and has many food options. Plus, arriving at HND is always better with the shorter immigration queue when comparing to Narita (NRT).

The departures hall might be slightly crowded with people, but once you pass the crowds for the check-in counters, it’s smooth and easy with little to no queues for elites, business or first class passengers.

Japan Airlines has a separate section for first class and Oneworld Emerald elites. In fact, there are six counters open, one being occupied, just for first class and Emerald elites.

I walked right up to the counter without any hassle or wait. At the counter was a fabulously friendly check-in agent helping me. She explained where I had to go for first class security and lounge.

After check-in, I went straight to Japan Airlines first class security. After security was immigration. The whole process from check-in to getting airside took no longer than 10 minutes. Plus, I got a nice little first class tag for my carry-on bag and personal item.

Japan Airlines first class lounge and Red Suites

I specifically wanted to fly out of Haneda (HND) instead of Narita (NRT) for Red Suites, which is located in Japan Airlines first class lounge at HND.

I walked a short distance from immigration to Japan Airlines first class lounge, called the Sakura Lounge. Notice the lounge is right outside of gate 112. Gate 112 is the gate JL 6 usually flies out of. So, this is a great placement for the lounge and one of Japan Airlines lucrative routes.

Entering the lounge is as simple as scanning your first class ticket issued by Japan Airlines or Oneworld airline. Emerald elites can also enter this lounge.

I love the hallway entering the main part of the lounge.

Red Suites is almost like a tiny Japan Airlines AvGeek (aviation geek) museum, and comes with other features like an adult game room, shoe shining, and champagne sake room.

You will typically never find anyone in the Red Suites. Maybe one or two other passengers visiting, but it’s very private.

All over the Red Suites, you can find old aircraft parts, pictures, brochures, tickets, books, etc. It’s really made for AvGeeks.

In the game room, you can find a foosball table and multiple different chessboard designs having all the walls covered in aeronautical charts.

Then there is the champagne and sake room that doesn’t serve the most expensive champagne on the ground but does satisfy my taste for the bubbles. Plus, if you like sake, you can find a few options in that room along with other parts of the lounge.

Don’t worry, there are other sections in the First Class Sakura lounge like the buffet with a made to order section, massage chairs, showers, various seating, and tables.

You might notice, the lounge isn’t so crowded, especially in the Red Suites. Comparing to JAL First Class Sakura Lounge at NRT, the HND lounge is far better in my opinion due to the factor of the Red Suites.

The seating is standard, but comfy with great placement of outlets in the main section of the lounge. There is even a proper dining area.

Selection of food is alright. I did enjoy the made to order breakfast dish, JAL Original Rye Galette, but if you only care about food from first class lounges, then the offering from ANA will be better. Even JAL’s First Class Sakura Lounge at NRT offers a better selection of food. Nevertheless, I would rather eat in the air because JAL knows how to do proper inflight dining just like ANA.

Japan Airlines first class boarding

Within five minutes of boarding, I left the First Class Sakura Lounge and found myself in front of the gate. I love the fact that Japan Airlines has its HND to JFK flight right across from the lounge at gate 112.

When I arrived, lines were formed for both first and business class. As it’s a Oneworld airline, many Oneworld elite passengers are ready to board via the first class lane, making it feel less like first class. This has to be my biggest gripe with the Oneworld program, the fact that they give away first class benefits to elites. First class boarding and lounge access should be more exclusive, right?

At least boarding in Japan is always efficient. After scanning my boarding pass, I walked down the exclusive jetbridge for first class it was empty.

Arriving in first class, the experience changes from being crowded to calm and private.

When I walked up to the cabin door ready to step on the aircraft, the flight attendants were greeting me with big smiles. I was welcomed by name and escorted to my seat where I would be sitting for the next 12 hours.

At that time I was offered a pre-departure drink of my choice. I chose champagne, at that time I didn’t know they had three different champagnes and they randomly selected one for me. They also gave me a scented hot towel.

Later in the boarding process, the flight attendants came to introduce themselves to me. There were three flight attendants working in first class named: Chinen (went by I), Osishi, and Maseda. I will explain more about them in the service section below, but a brief statement about service — they were great. They were excited as much as I was.

Chinen and I ended up having a conversation that went something like this:

Chinen: “Have you flown JAL first class before.”

Me: “No, but I have flown your competitors first class three times and loved it. I hope to compare yours to theirs for the ultimate showdown.”

Chinen: “Oh wow, well I guess we will have some fun this flight winning you over.”

We laughed a little and then talked more about how she lived in New York City before, how much she loves her job, and her husband. They also made sure my champagne was filled during the whole, but short, boarding process.

I would like to point out, the crew didn’t give me any special treatment. All the other passengers in first class were looked after as much as I was.

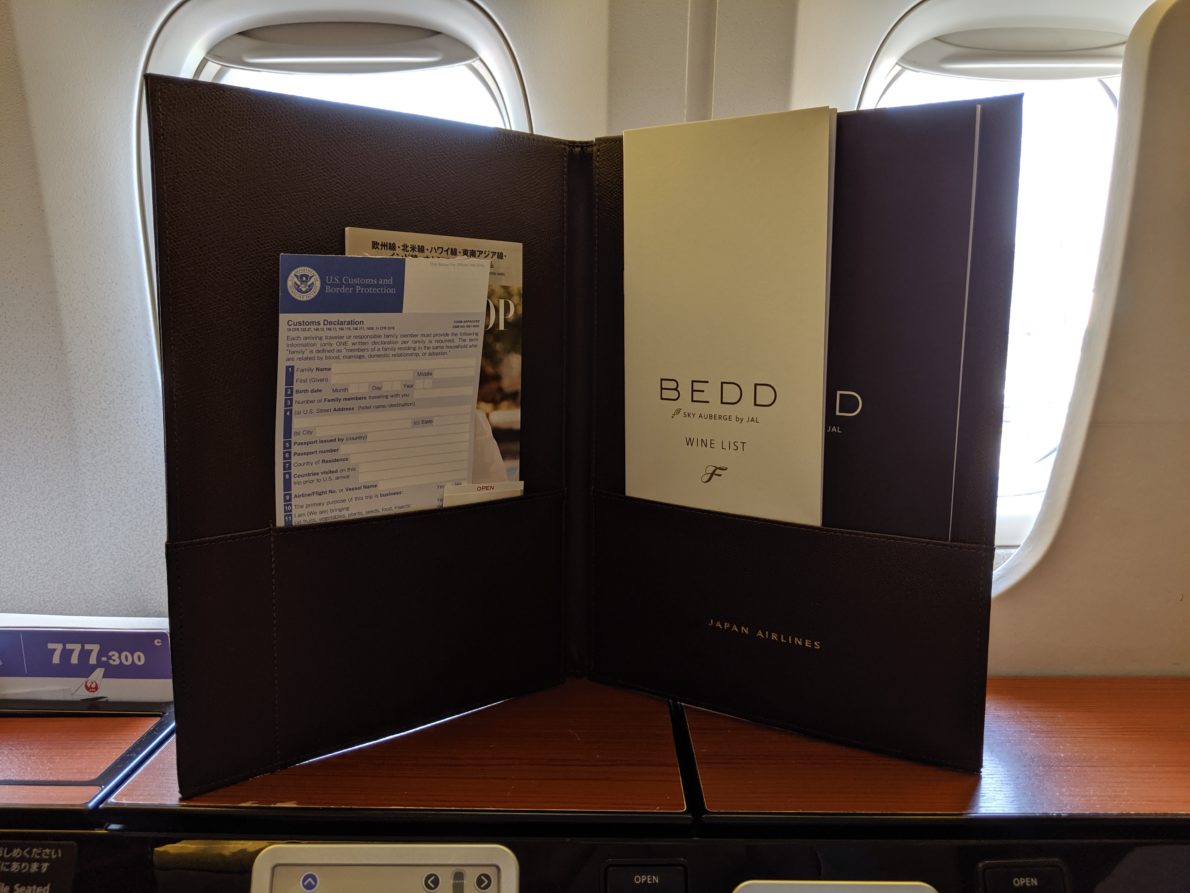

Waiting at my seat were the menus, amenity kits, headphones, and other little goodies like the wifi voucher and immigration card.

Japan Airlines first class cabin

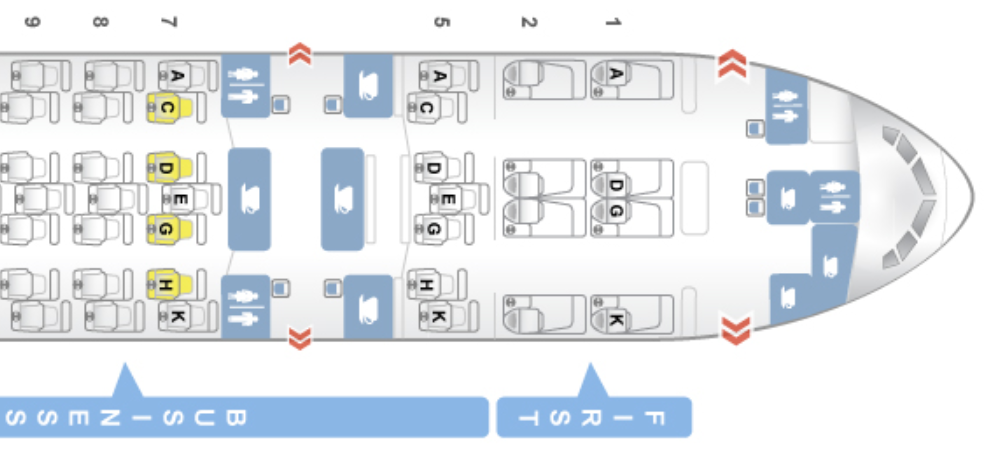

Japan Airlines 777-300ER first class cabin has a total of eight seats arranged in a 1-2-1 configuration. There are two lavatories, one larger than the other in the front of the cabin by the galley and flight deck. The smaller lavatory is used by the flight crew, but open to passengers as well.

Behind the first class cabin, you will find business class laid out in a 2-3-2 configuration. While it looks like a dense configuration each business class seat has direct aisle access as they are Apex Suites. In fact, they are one of my favorite seats for privacy and seat width in business class.

Japan Airlines first class suite is considered an open suite, but are private enough. They are designed better than ANA first class seats. Comparing directly with ANA first class suites, you will find them a little less private, but at least you can look out of the window easier along with less obstruction talking with your companion in the seats next to each other.

Plus, JAL first class supports dual dining.

Before take-off, there isn’t much in terms of amenities around the cabin, unless you count the amenities at the seat. However, after take-off in the front galley by the lavatories is a display for whiskey, bottles of water, and snacks.

Japan Airlines first class seat

Since Japan Airlines uses an open suite seat, it has a roomy airy feeling. Like most Japan Airlines first class flights, not every seat is occupied. My seat was 2K and there was no one seated across from me.

The seat itself was basically a big lazy boy chair that went into the lie-flat position. There was plenty of counter and storage space for everything you might want to store, even enough storage to store a 15 inch Surface Book.

Design, comfort, and privacy

The seat offers a lazy boy style chair that is wide in upright, reclined, and lie-flat positions. It’s very comfortable and nicely padded with very little flaws.

There is minimal wear and tear making it shine over other foreign competition first class seats. It just shows how Japanese always try to keep premium seats well maintained, even on an older seat like this.

In comparison, the seat itself is somewhat similar to ANA first class seat called ANA First Square. The difference would be ANA first class seat is cloth instead of leather that JAL uses.

When it comes to privacy, you will find the open suite design slightly more airy and less like a cubical than ANA’s first class seat. It’s not the most private open suite design, but it does its job and it’s a nice change of pace compared to a more confide suite design that has bigger higher walls.

It’s still nothing like Emirates fully enclosed first class suite, but it’s still better than Lufthansa’s first class seat for privacy.

If you are seated in the middle aisle seats, you will find that there is a divider that is almost the length of the seat. It’s controllable by soft-touch physical buttons. JAL beats ANA for traveling with a companion as you can easily talk to your seatmate when you have the divider down.

Seat features (controls, storage)

JAL first class has more than enough storage for my needs. Even one compartment is big enough to fit my Surface Book 15 inch along with a few other things.

There is the overhead bin over the window seats, but none in the middle of the cabin.

You then have the beautiful huge side console storage along the side of the seat.

Then you have room under the ottoman to put a briefcase, backpack, or purse.

While it doesn’t have small little storage compartments as ANA has in their first class suite, this is by far better in terms of overall space given to you.

Seat controls are easy to use being soft-touch physical buttons. There are three preset positions and individual adjustments for the seat.

Then you will find the touchscreen IFE remote in a super small storage compartment with a tiny mirror. There is another remote in the big storage compartment, but it isn’t operational.

In the most forward storage compartment, you can find the USB port and universal outlet. The USB port didn’t work, but neither did the other seat I used for my bed. I didn’t mention anything, but I think the USB ports were disabled. (Luckily I don’t need the USB port as I rather use my fast charger with the outlet.)

For a video of the seat tour, you can see here:

[embedyt] https://www.youtube.com/watch?v=98RhOr4Fpuc[/embedyt]

Japan Airlines first class amenity kit

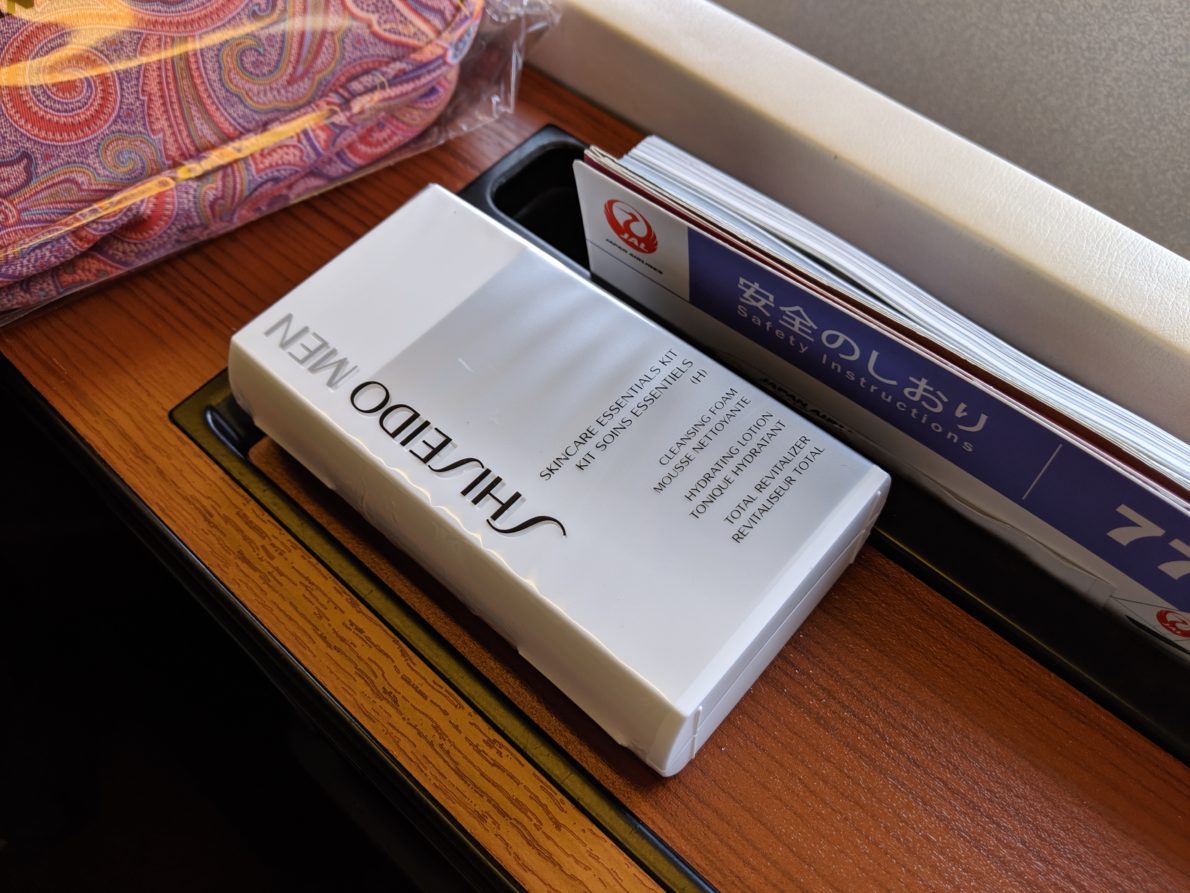

The beautiful first class amenity kit bags were made by ETRO, an Italian fashion house brand. The ETRO amenity kit mainly contains JAL branded item and with three ETRO branded items. You will find an eye mask, moisture mask (more airlines need to add this), a hairbrush, tissues, mouth wash, toothbrush, earplugs, ETRO lip balm, ETRO body lotion, and ETRO perfume.

Then you will find a Shiseido skincare kit that is gender-specific. I still use my skincare kit to this day as I found the cleanser great. Both the ETRO and Shiseido amenity kits were waiting at my seat before I boarded.

Then you will also find slippers (again, more airlines need to offer slippers on every one of their routes), a shoehorn, and wifi voucher.

After takeoff and meal service, I asked for PJs. I find them soft and comfy. Not as good as Emirates, but still great. However, when I compare PJs service to ANA, I prefer the ANA PJs service better as when you board an FA gives you PJs and asks if you want to change or not. JAL doesn’t do it as proactively, but JAL will still fold and hang your clothes.

I forgot to take pictures of the PJs without me wearing them, so here is a selfie with my breakfast and some champagne. 😉

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Japan Airlines first class headphones & IFE

If you ever read any of my other reviews, which I highly recommend, you would know I never use the IFE for anything else besides the in-flight map. That results in me me never using headphones. But for your information, the new Bose headphones offered by JAL is certainly a great headwear for movie or TV watchers on a plane.

The Magic-V controlled IFE isn’t going to blow you away with many options for movies and TV shows, but you will be entertained by Eastern and Western options. For the inflight map lovers, JAL uses a decent inflight map, but again, not going to blow you away.

Japan Airlines first class wifi

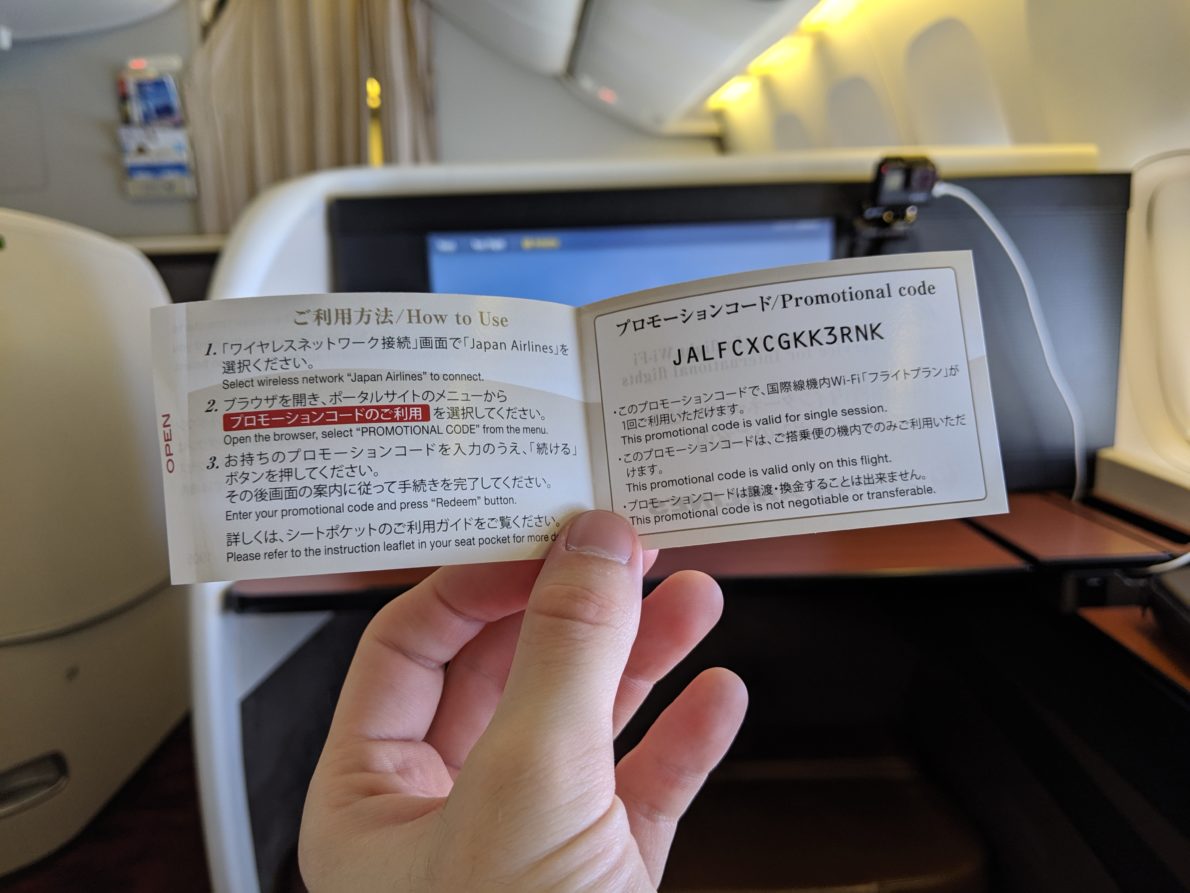

JAL gives every first class passenger a complimentary first class voucher. It’s good for the whole flight and it’s unlimited. You can connect right away and not worry about any data or time limits.

I could easily watch YouTube and communicate over many different apps without any issues what so ever. Even uploading photos wasn’t time-consuming.

Japan Airlines first take-off experience

Take-off was a beautiful and wonderful experience. I saw Thai Airways 747, which I flew the day before to Tokyo Haneda (HND). Then when we took off and rotated, an ANA flight on the other runway also took off.

For about three minutes, our aircraft and the ANA aircraft were ascending at the same rate and at this moment, it reminded me how amazing flying is.

[embedyt] https://www.youtube.com/watch?v=uq0wsDlgUYE[/embedyt]

Japan Airlines first class dining experience

My favorite time of any flight is the meal service as food is life and life is food. When an airline has good food, they should be proud of it. Well JAL is extremely proud of their food and they are right to be proud.

Compared to my outrageous meal in Singapore business class, this was night and day. I would say it’s on par with ANA first class taste and quality. It’s really hard to decide which one is better, but when food is great it shouldn’t matter, right?

JAL does have an edge over ANA as JAL first class supports dual dining, where you can dine together with another passenger. However, I wasn’t flying with anyone I knew, so I dined alone watching YouTube videos or talking to Chinen.

Maybe there is a winner, but that would be for the ultimate comparison between JAL and ANA first class.

After take-off

Right after take-off, the flight attendants went into action pulling out the massive tray tables, setting up a table cloth, and getting our drink orders onto our tables. (I would like to note how easy it is to move the tray table. Plus, you can easily get out of your seat even when all the food is on the table.)

I started off with Salon 2007 champagne. A bottle of the Salon 2007 goes for $599 on wine.com making it one of the most expensive bottles of bubbles in the sky. It was good and my first time trying it but wasn’t my favorite out of the three. Nonetheless, I still had two glasses of Salon.

I found something strange though, JAL doesn’t have a proper champagne flute during the rest of the flight. I found this strange as they had proper champagne flutes during boarding for our pre-departure drinks. Although, I don’t mind and see no difference, but the change in glasses threw me off.

At the same time, we were served the canapés.

The canapés consisted of three different bite-sized dishes. To be honest, the food items escaped my mind after they told me what they were. I did enjoy them, but as the canapés aren’t on the menu and change frequently, just know you can look forward to them.

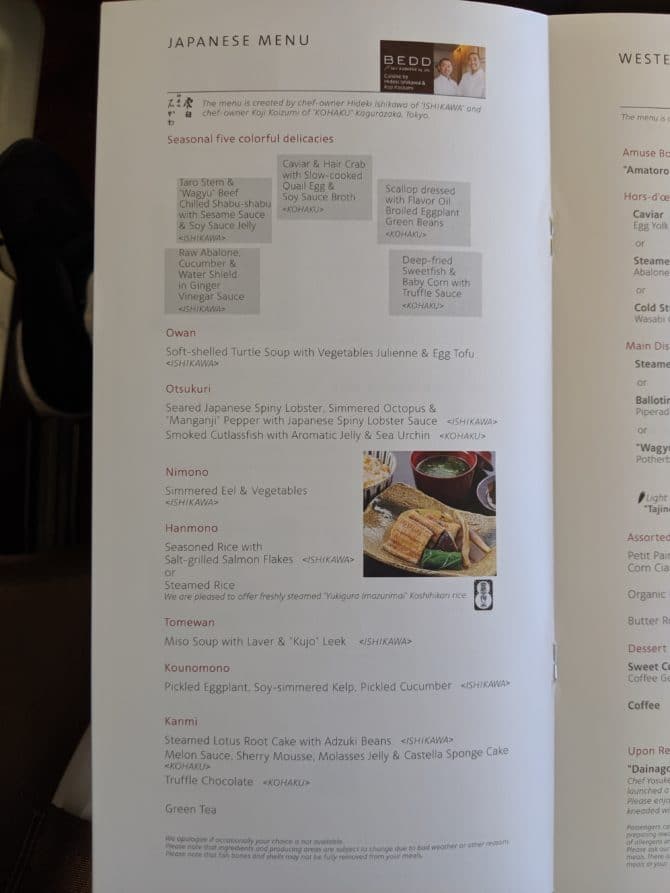

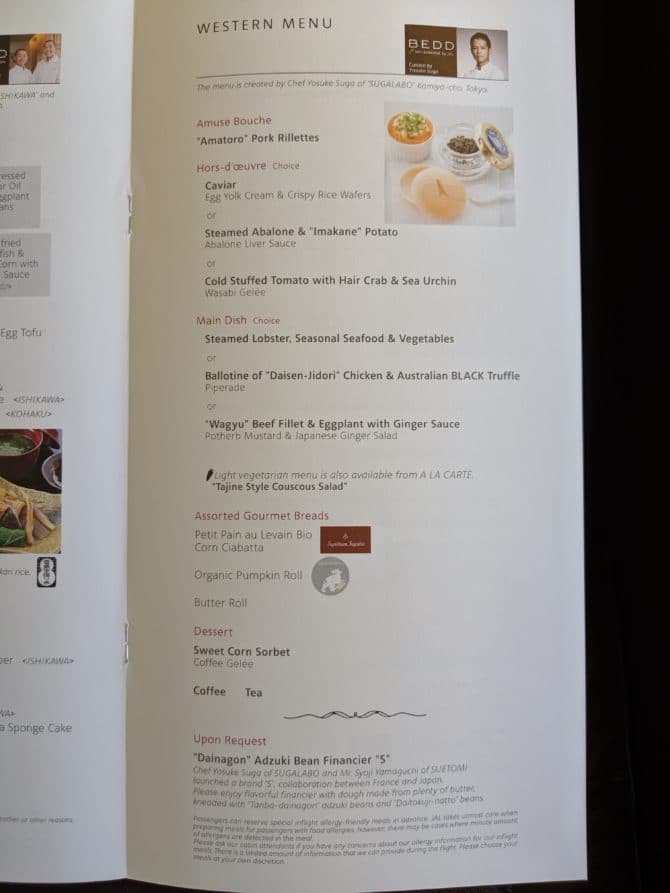

At this moment I ordered my meal. I decided to go with the western option. I was hungry and ready to eat enough to gain a few extra pounds… even though I already gained a few pounds over the past few months.

After the canapés were taken away, the flight attendants set table with dining wear and gave me more to drink. This time I chose Comtes de Champagne 2007. This has to be my favorite champagne out of the three and in actuality it’s a “cheaper” wine compared to the other two and at wine.com it goes for $135 bottle.

For the amuse I had amatoro. (Amatoro is pork rillettes.)

This was my very first time trying amatoro. I was skeptical of how it would taste, but wow amatoro is good.

Chinen was even happy to offer me seconds if I wanted to eat it later on during the flight. From the pork to the crunchy bread, I was happy to eat every single crumb of the amatoro. If you like pork, you gotta try amatoro. (Don’t worry, next time I go to Japan, which is in November to fly Garuda Indonesia first class, I will eat more amatoro.)

For the hors-d’oeuvre, I got caviar.

The caviar presentation was on-point and came with a mother of pearl spoon and was served with egg yolk cream topped with white and green onions. The crispy rice wafers had a little Eiffel Tower on them.

I found the taste of the rice wafers and egg yolk cream complementing the tiny black pearls. Simple and small, but well done JAL.

For the main, I ordered wagyu beef fillet & eggplant with ginger sauce.

It was accompanied with potherb mustard and a Japanese ginger salad. I ordered it medium to medium-well and it was cooked as I requested. I wasn’t expecting much as the salad was on top of the wagyu, but wow it was so good.

In actuality, I am not a huge meat eater, I prefer vegetables, but I finished it all. It wasn’t overpowered by the ginger sauce and the salad created a light taste to the wagyu. Both complemented the wagyu. The wagyu itself was also very tinder and had no trouble cutting or chewing.

I had two desserts, the first one was a sweet corn sorbet with coffee gelee.

The corn sorbet with coffee gelee was my first. In Japan, it was the season for corn and it tasted interesting. Having the bitter coffee gelee with each bite of the sorbet was actually good.

The second dessert was an item on request called dainagon adzuki bean fancier “S”.

No, I don’t understand the name, but for your information, Japan loves to use the words fancy and premium… to be honest, Japanese use those two adjectives a little bit too much, but this discussion is better left for another time.

The “S” dessert was delicious. It’s influenced by the French and found it a great way to end the meal. I loved how crunchy and soft it was while having a sweet buttery taste that wasn’t overpowering.

Overall, this meal was just too good. I would say this was the peak of my meals on JAL, but the rest was still delicious.

Mid-flight snack

I woke up after my nap, as the flight left at noon, and ordered some snacks. I also drank some Louis Roederer Cristal 2009 champagne. Louis Roederer Cristal 2009 goes for $250 a bottle at wine.com making it the second most expensive champagne on this flight. I didn’t care for Louis though making it my least favorite out of the three. I then had Hibiki Suntory Whisky Blender’s Choice on rocks with some little snacks. I’ve had Hibiki before and knew I wouldn’t get another glass, but as a bottle of Hibiki goes for $183 at Kabikui Whisky, it’s still worth it to have some.

I first ordered the JAL original Japanese soba noodles tsuta ramen noodles in soy sauce soup infused with truffle oil.

Yes, a long name, but ramen with truffle oil is always wonderful. I was on a truffle kick and this hit the spot. While it’s just a hit of truffle, it still was a nice addition to the ramen that I really enjoyed.

Then I ordered JAL the curry… yes, the names are interesting with Japanese airlines.

I love curry, but this curry was just alright. It claims to be a one star Michelin curry, but I don’t think so. While it’s not bad, but compared to ANA’s curry offering, I prefer ANA’s curry as it’s slightly my rich in spice and presentation.

Overall, the mid-flight snack filled me up making me happy. After the meal, I fell right back to sleep.

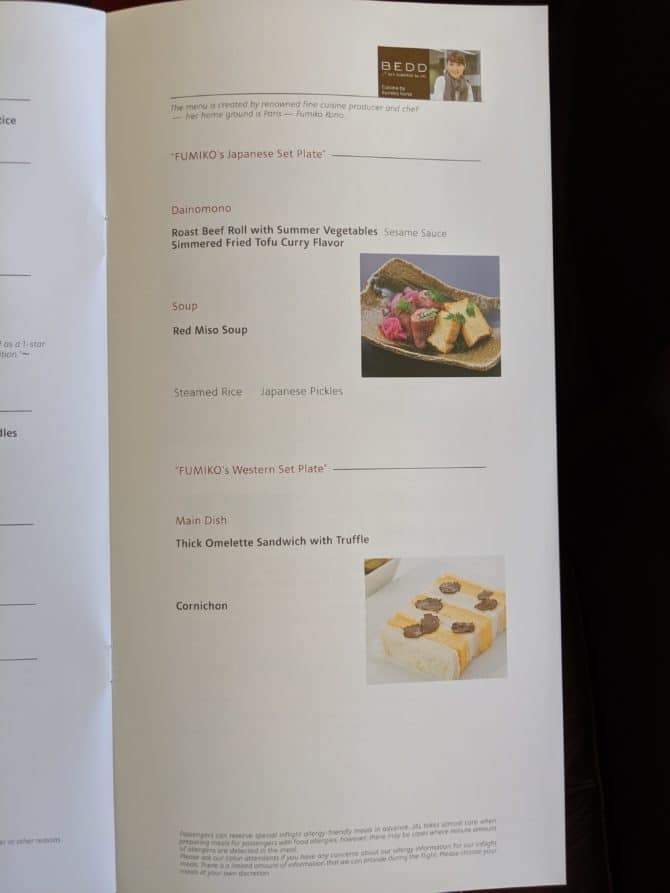

Before landing

The before landing meal, or also known as breakfast, was good.

I started off with another glass of champagne, this time I went with Comites. I found Comites smooth and refreshing, even though it’s the cheapest one.

For the meal, I went with the Japanese breakfast option. Everything tasted good but I found that the roast beef rolls lacked flavor. Then the tofu curry flavor was also pretty bland. Nothing was bad, but I expected more comparing to the main meal.

Yet, for a meal before landing, this definitely hit the spot and filled me up even more.

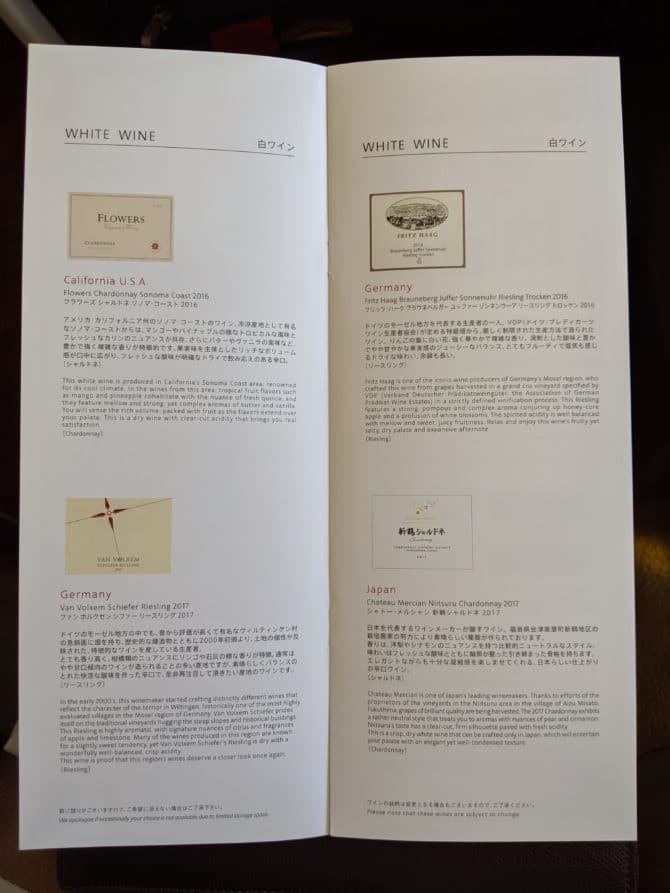

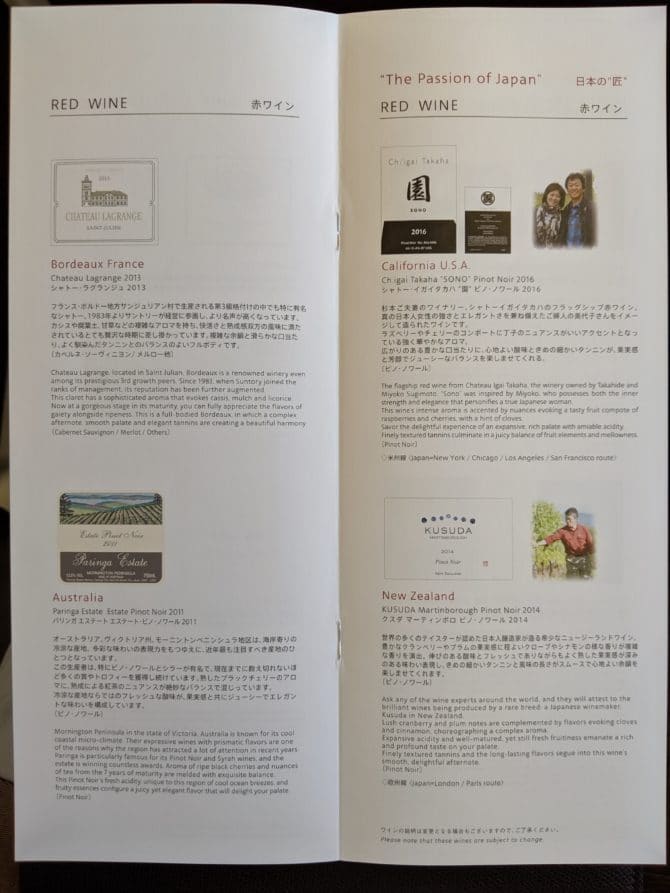

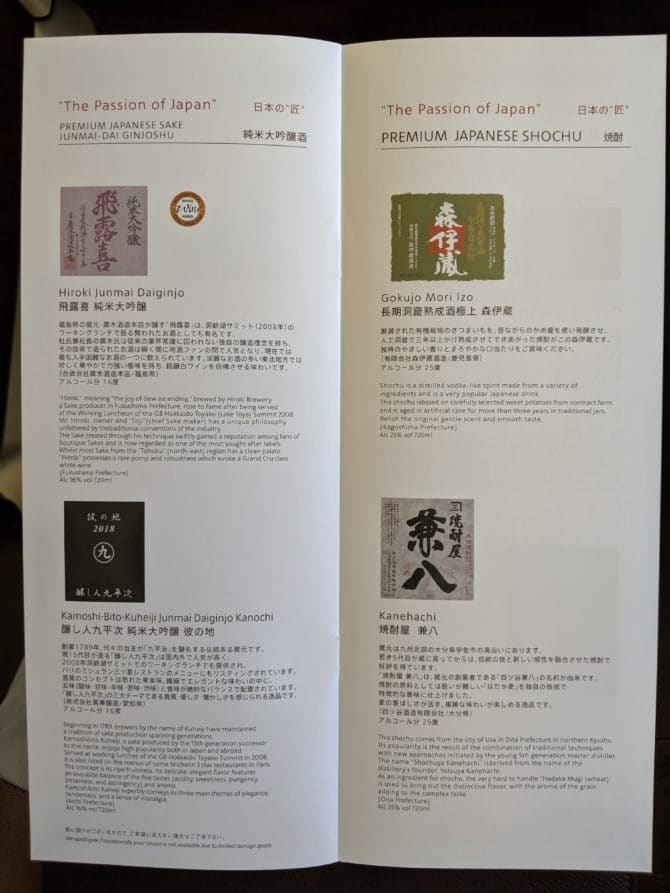

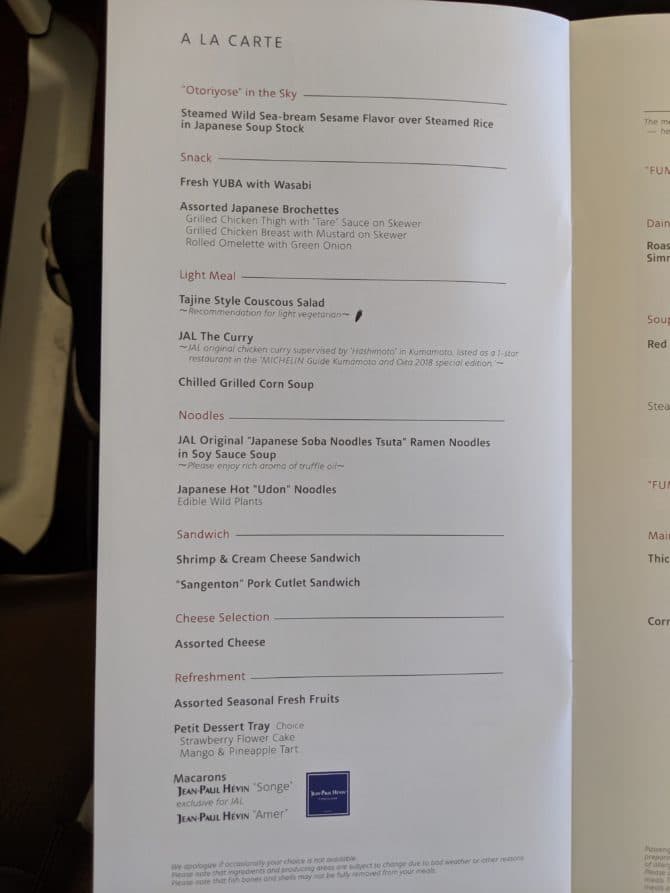

Menu

To keep hydrated during the flight, you can refer to their beverage menu here:

And here is the food menu:

Japan Airlines first class service

JAL service shined on this flight. Like, wow. The flight attendants were near perfection when it comes to hospitality. It wasn’t only me that they were attentive with, but they watched over every first class passenger equally.

Chinen, Osishi, and Maeda were wonderful. In fact, it was Osishi’s first time working in first class. She was super nervous and working the galley most of the time, but she was still excellent. Maeda was the senior officer and almost like a veteran for JAL. She was super warm and not like most senior flight attendants as she wasn’t jaded. Then, Chinen, we talked for almost hours. Such a lovely person and made the flight truly special as our talks were like we were best friends.

At the end of the flight, Chinen, Osishi, Maeda, and the purser visited every first class passenger.

At the time of their goodbye, they gave me and the rest of the first class passengers some Jean-Paul Hevin JAL macaroons, which I ate right away.

The whole time, they were on top of their game making sure glasses were filled and empty plates were cleared. They always presented the bottles encouraging me to take pictures.

When I left the aircraft I was sad to leave, but I wished them a lovely time in New York City and hoped to see them on another flight.

It’s always nice to see great workers love their company. The crew on this flight were excited as much as I was. I do hope they continue and JAL rewards them for their amazing hard work.

Thank you to the whole flight crew for making this flight fun!

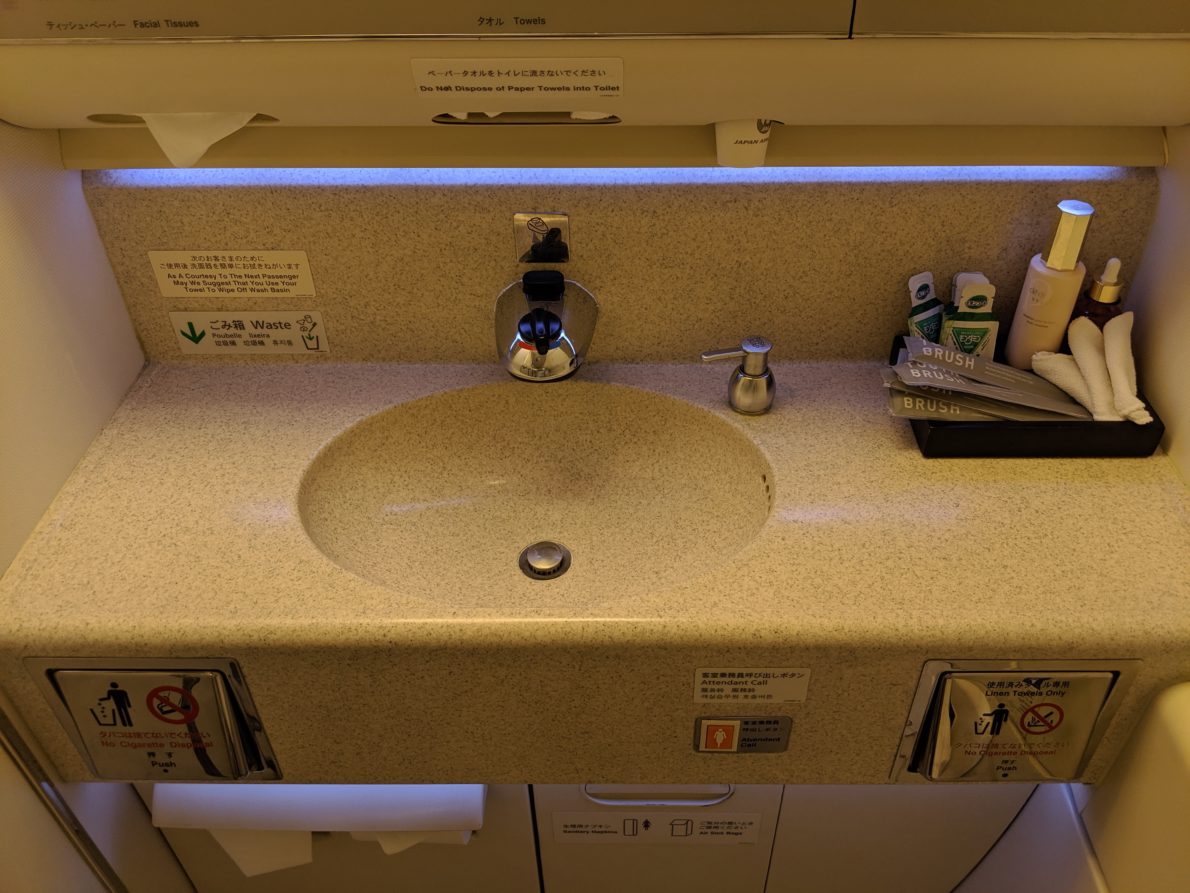

Japan Airlines first class lavatory

JAL has two first class lavatories and one is bigger than the other. While both can be used by the passengers and are well stocked, the smaller one is used by the cabin crew.

Each one offers many different amenities like toothbrush, mouth wash, lotion, and perfume. And like every other Japanese airline, they had a bidet.

Japan Airlines first class bedding

JAL first class bed is wonderful. Would I say it’s as good as Emirates new fully enclosed first class suite bed? No. Would I say it’s better than many first class beds? Yes!!

First of all, JAL gave me another seat for my bed. It was, in fact, my very first time having two seats for myself. It’s not needed, I didn’t ask, but they offered and I was delighted to take them up on their offer. (Another passenger also got the privilege of having a second seat for a bed during this flight.)

The seat in lie-flat mode is fully lie-flat without noticeable differences between different cushions of the seat. It’s wide and long enough for me. When it’s fully in the lie-flat position, you won’t have differences between cushions and it’s comfortable without a mattress pad. Yet, JAL provides a mattress pad and it makes it even better.

The mattress pad adds a layer of comfort that creates a wonderful nights sleep. I slept a good total of eight hours on this flight on my stomach, as I usually do. Definitely a good slumber.

With the rest of the bedding you will find a decent duvet. Not too thick, but not too thin.

The pillows provided are memory foam. I got two pillows and found them to be one of my favorite pillows in the sky.

Landing at JFK

Got some beautiful views of Manhattan during our descent and the Atlantic ocean. You can watch my video here:

[embedyt] https://www.youtube.com/watch?v=XKqXju2805M[/embedyt]

Final word

I don’t know why it took me this long to fly JAL first class. I have flown them in economy and business class numerous times, but never in first class. Now I can say I have flown them and would fly JAL first class again, even if it’s out of my way as their route network is tiny in comparison to ANA.

What makes JAL stand out on this flight has to be the cabin crew for their performance being so friendly and hospitable. It’s not ANA perfection, but JAL first class flight attendants on this flight weren’t robots and felt like I was at home.

I cannot wait for my next JAL first class flight and would definitely go out of my way for their food, service, and seat.

This article was originally published by Steve Smith.