When you’re trying to build up your credit score, you’ll often find yourself struggling to get approved for credit cards. This is a bit of a catch 22 because credit cards can help rebuild your credit but you need decent credit to get approved for certain credit cards. The good news is that there are still plenty of options for people looking for low credit score credit cards.

What is the best low credit score credit card?

The best credit card for people with bad credit a lot of times is whatever card you can get approved for so long as it reports to the credit bureaus and doesn’t come with ridiculous fees.

When your credit score is not good and you’re sitting at or below 600, it’s not the time to be picky.

Instead, your primary objective is to just open up a card that will report to the credit bureaus and establish yourself some payment history for your credit report. So in that regard, it’s important to not be “too choosey.”

Most of the time secured credit cards will be your best bet. These cards require you to put down a deposit and that deposit is typically the credit line offered to you.

These cards can differ greatly in their annual fees, rewards, interest rates, and how they report to the credit bureaus. So while you don’t want to be too picky, it’s a good idea to at least be aware of the key features of different cards before you apply.

Credit card options for bad credit

Below is a list of low credit score credit cards that you can consider for helping to build up your credit. This is not an exhaustive list by any means but these cards should be easy to get approved for and should help you get on your way to building up credit.

OpenSky® Secured Visa® Credit Card

- $35 annual fee

- No credit check necessary to apply

- The refundable deposit you provide becomes your credit line limit on your Visa card. Choose it yourself, from as low as $200.

- OpenSky reports to all 3 major credit bureaus.

- 99% of customers who started without a credit score earned a credit score record with the credit bureaus in as little as 6 months.

The OpenSky® Secured Visa® Credit Card is a nice option for people with literally no credit or very bad credit scores. You also don’t need a bank account to open up a credit card with them. These two factors make this secured credit card ideal for many people who are truly starting from the bottom. Although there is a small annual fee, I think the annual fee is well worth your money since this allows you to build up your credit profile from nothing.

Discover it® Secured Credit Card

- No annual fee

- Minimum deposit is $200

- No late fee on first payment and paying late wont increase APR

- Rewards (see below)

- Reports to all three credit bureaus

- Free FICO score

If you’re planning on getting into the rewards game, this is a great way to break into it, as it’s rare for a secured credit card to offer rewards (and good ones at that). This card earns 2% cash back at restaurants & gas stations on up to $1,000 in combined purchases each quarter and 1% cash back on all other purchases. At the end of your first year (as a new cardmember) Discover doubles all the cash back you’ve earned, too!

Another thing that’s great about this card is that after 12 months you Discover will evaluate whether or not to approve you for additional credit and if you’re approved they’ll transition you into the standard Discover It. The drawback to this card is that it does have a high APR at a variable 23.24. But you should not be carrying a balance when you’re trying to rebuild or repair your credit.

Capital One® Secured MasterCard®

- No annual fee

- Minimum deposit is $49, $99, $200

- Variable APR 24.99%

- Credit line increase possible

- No foreign transaction fees

- Reports to all three credit bureaus

This is one of the most popular secured credit cards out there on the market. It reports to all three credit bureaus so it’s a great way to build your credit profile and there’s no processing fees to go along with no annual fee and no foreign transaction fees. Furthermore, depending on your credit worthiness, it’s possible that you may only have to deposit as little as $49!

Capital One® Platinum Credit Card

- No annual fee

- Get access to a higher credit line after making your first 5 monthly payments on time

- Fraud coverage if your card is lost or stolen

This card is not a secured credit card but instead is more of a sub-prime credit card. It won’t require you to put down a deposit but will instead just limit your credit line to a low amount. After you make five on-time payments, however, you should see an increase in your credit limit. It’s true that this card won’t give you the biggest credit limit out there but if you just need a card to build up some credit history then this can be a solid option.

nRewards® Secured Credit Card – Navy Federal Credit Union

- No annual fee

- Minimum deposit $500

- APR 9.24% to 18.0%

- No foreign transaction fees

- Reports to all 3 credit bureaus

- Rewards

This is one of the best secured credit cards for people looking for a low credit credit card but the problem is that you need some form of military connection in order to be eligible. With its potential for a low APR, it can be a great asset for those consumers who think they might carry a balance from time to time. It also has a decent rewards system where you earn 1 point per dollar spent.

Here are some examples of how you can utilize the rewards:

- 3,500 points for $25 gift card from Applebee’s® or Outback Steakhouse®

- 5,000 points for $50 gift card from Best Buy® or Macy’s®

- 7,500 points for $75 Navy Federal Visa® Awards Card or The Home Depot® gift card (That’s a one cent per point redemption for Visa gift cards — not bad for a secured credit card).

USAA Secured Credit Card (Visa and Amex)

This card is currently being updated and not available.

- Annual Fee $35

- $250 minimum deposit (accrues interest)

- Variable APR 10.15% to 20.15% APR

- No foreign transaction fee

- Reports to all 3 credit bureaus

This is one card that I believe is great for getting yourself out of a credit bind when you have a host of negative remarks. I know first-hand of individuals who were approved for this card, despite having several major negative marks and scores down in the lower 500s. That’s not to say you’re guaranteed approval of course.

The $35 annual fee is a bit of a drag and I’d personally go for the nRewards® Secured Credit Card first but this isn’t a bad option. And as always, USAA has renown customer service so if you value that, you can’t go wrong with this card. But again you need to prove some sort of connection to the US Military to get approved for this card.

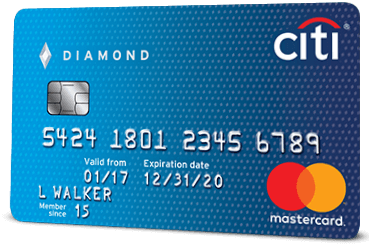

Citi® Secured Mastercard®

- No Annual Fee

- Reports to all 3 credit bureaus

- Minimum security deposit of $200 (maximum deposit $2,500)

The Citi Secured Mastercard is a very straightforward secured credit card. It doesn’t come with any rewards, no annual fee, reports to all three bureaus, and can be had with a minimum deposit of only $200. So if you’re only concerns is getting a low credit score credit card that will build up your credit history this can be a decent option.

The one knock against this card is that you could run into difficulties of getting approved if you have major negative marks on your credit report, such as bankruptcies in the past two years. However, if you have no credit history, this card could be a decent option to rebuilding your credit.

Alternative options

If for some reason you’re not able to get approved for these low credit score credit cards or you simply don’t want to try to go for a secured credit card then you can look into merchant retailer credit cards.

These are those store credit cards offered by places like Zales, WalMart, Macy’s, etc. These are usually pretty easy to get approved for even with limited credit history. Your credit limit will probably be very low to begin with but again it’s all about building credit history at this point.

You can also try the shopping cart trick which can allow you to get approved for select store credit cards without incurring a hard pull. Read more about that method here.

Final word

Secured credit cards are definitely the way to go when trying to establish your credit profile. It’s not a lot of fun to have to put down a deposit and to have a low credit line but patience is key at this point. If you can remain patient and make your payments each month on time, then 6 to 12 months down the line, you’ll have an improved credit score and be in a much better position to start shopping around for more lucrative credit cards.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.