Offers contained within this article maybe expired.

Global Entry and TSA Pre-Check programs are great because they allow you to breeze through airports, when you are departing or arriving back in the country (depending on which program you get). These programs do require you to pay high application fees but luckily you can avoid these fees by using the right Amex cards that offer reimbursement credits.

This article will tell you everything you need to know about the American Express Global Entry and TSA Pre-Check credits. I’ll also explain which program might be better for you based on your individual goals and preferences.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

What is the American Express Global Entry/TSA Pre-Check credit?

The American Express Global Entry/TSA Pre-Check credit allows you to receive a statement credit when paying the application fee for either Global Entry or TSA Pre-Check. The statement credit for Global Entry is $100 and the statement credit for TSA Pre-Check is $85. Both of the programs are good for five years.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

How does the Amex credit work?

After you use your eligible Amex card to pay for your application fees, you’ll see a statement credit show up on your account.

It could take up to 8 weeks after the qualifying Global Entry or TSA Pre-Check transaction is charged to the eligible Card account for the statement credit to be posted to the Card account.

If you do not see a credit for a qualifying purchase on your eligible Card after 6-8 weeks, simply call the number on the back of your Card. Card Members are responsible for payment of all application charges until the statement credit posts to the Card account.

What Amex cards are eligible for the credit?

There are several Amex cards that allow you to receive a credit for Global entry and TSA Pre-Check.

- American Express Gold Corporate Card Members

- Consumer Platinum Card® Members

- Corporate Platinum Card Members

- Business Platinum Card Members

- Consumer Centurion® Members

- Corporate Centurion® Members

- Business Centurion® Members

The most common card that most will rely on for their credit is the Amex Platinum Card. This is one of the most valuable premium-level travel rewards credit cards on the market.

Here’s a rundown of some of the major benefits that you’ll get with the Platinum Card:

- 60,000 miles after spending $5,000 within the first 3 months

- $200 Uber credit

- $200 airline credit

- Priority Pass access for you and two guests

- Centurion lounges access for you and two guests

- Delta SkyClub access when flying with Delta

- Hilton Honors Gold elite status

- SPG Gold Preferred elite status (and therefore Marriott Gold and Ritz-Carlton Gold), and rental car status as well

- 5X on airfare and 5X on hotels booked through the Amex Travel portal

- TSA Pre-Check/Global Entry $100 credit

You can add up to 3 authorized users for $175 and each of these authorized users will also get up to a $100 Global Entry or Pre-Check statement credit. Thus, it can be very worthwhile to add several authorized users since you can up to $300 worth of credit with them alone.

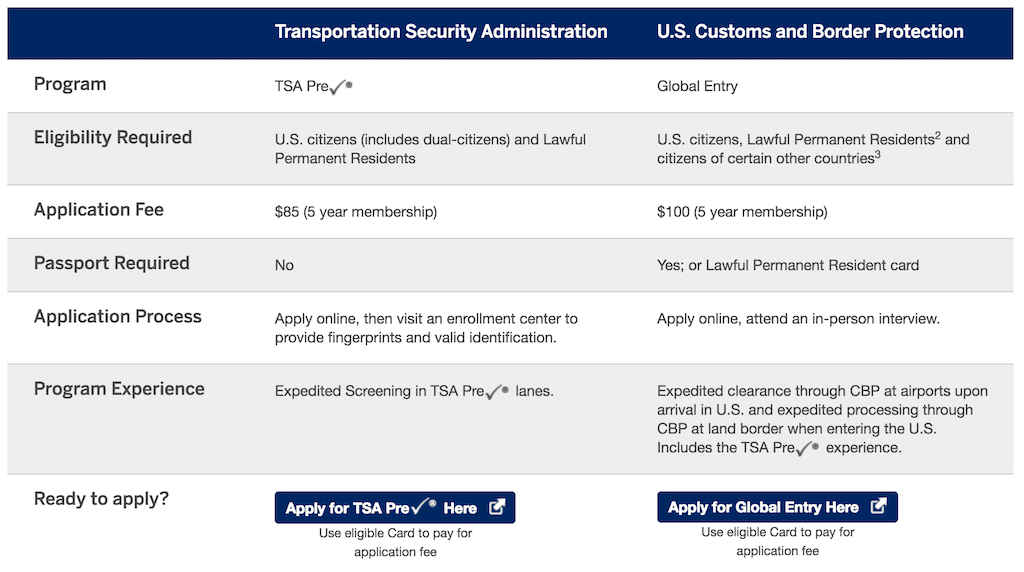

Global Entry

Global Entry is a program that allows you expedited entry back into the US when traveling internationally. It allows you to breeze through US immigration by entering through a shorter line and scanning your passport at a kiosk. You’re then able to go through a separate US Customs line for your baggage. By skipping two potentially long lines, you can save tons of time when entering the US.

Global Entry also comes with TSA Pre-Check. So if you get approved for Global Entry, you’ll be issued a Known Traveler Number and be able to to use TSA Pre-Check.

The process for getting Global Entry can take a bit of time. First, you’ll need to pay the $100 application fee and be conditionally approved. After that, you’ll need to schedule an interview or simply do a walk-in interview at certain locations. The Global Entry interview process is not very intensive. As long as you don’t have a criminal history and don’t have questionable travel patterns, you shouldn’t run into any issue with getting approved. (Just remember to bring your required docs.)

Once you’ve been approved the program, you’ll be granted a PASS ID which will be automatically linked to your passport number you applied with. You won’t have to carry around a card and all you’ll have to do is scan your passport when you arrive through the airport. Your membership will be good for five years.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

TSA Pre-Check?

TSA Pre-Check allows you to go through a priority security line which is often much shorter than the standard security line (though not always, unfortunately).

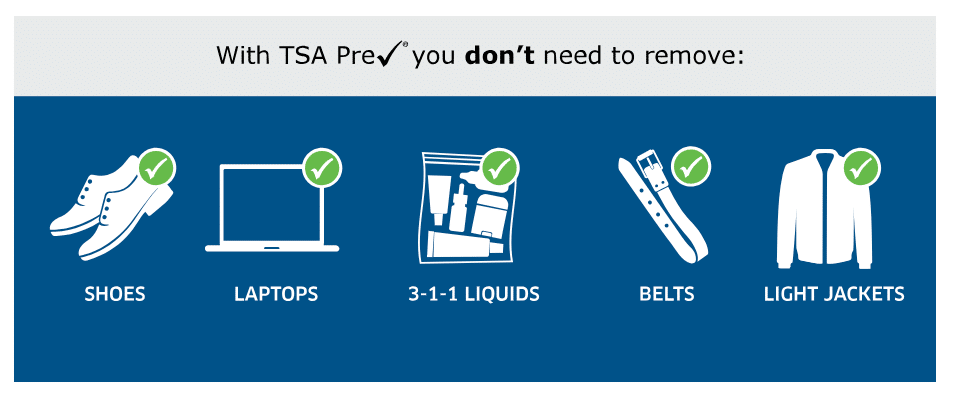

You’ll also be able to go through a less restrictive and invasive screening process. You often only have to pass through a traditional metal detector (as opposed to the full-body scanners) and you also get to enjoy the following benefits:

- Shoes can stay on

- Belt can stay on

- Light jackets can stay on

- Laptops allowed to stay in bag

- Liquids (3-1-1) can stay in bag

This program costs $85 to enroll for five years and it does not require the extensive interview process that Global Entry requires. You still have to visit an enrollment center, but it’s just to offer your fingerprints and to verify your identity.

Once you are approved for the program you’ll get a Known Traveler Number which you’ll need to input into your frequent flyer profiles with the airlines so that you’ll receive the TSA Pre-Check perks on your boarding pass.

Many airports have TSA Pre-Check stations but not every terminal in those airports have them. Also, sometimes for whatever reason, you might not get issued a boarding pass with TSA Pre-Check and you won’t be able to take advantage of the perks even though you are enrolled in the program (this still has not happened to me yet).

Global Entry or TSA Pre-Check?

A lot of people wonder whether or not they should choose TSA Pre-Check or Global Entry.

The answer to this question depends a lot on your personal preferences.

If you are only going to be traveling within the US then your need for Global Entry will be nearly zero. In that case, getting TSA Pre-Check should be just fine. Also, if you don’t think that you can pass the Global Entry interview and background check because of past criminal issues (many times even DWIs can be an issue), then you might want to settle for Pre-Check until more time passes since your latest criminal offense.

On the other hand, if you’re going to be traveling internationally then you might want to think about Global Entry since it will save you a lot of time getting back into the country. Even if you only have one international trip a year, Global Entry can be worth it if you get caught with some ridiculous lines back through immigration and customs.

American Express Global Entry FAQ

You should be able to use your statement credit on a card that is in your name for a Global Entry application that is in someone else’s name.

However, note that when paying for TSA Pre-Check at an enrollment center, you will usually be required to have a credit card in that person’s name or at least to be present when using your card, so “lending” a card to someone else is not a good idea for TSA Pre-Check.

Card Members are eligible to receive statement credit every 4 years for the application fee for either Global Entry or TSA Pre-Check when charged to an eligible Card.

Card Members will receive a statement credit for the first program (either Global Entry or TSA Pre-Check ) to which they apply and pay for with their eligible Card regardless of whether they are approved for Global Entry or TSA Pre-Check.

No, using an Amex card for your application fee has no bearing on your approval.

No, if you get denied for Global Entry or TSA Pre-Check you will not get your credit refunded. You will have to wait four years until you can utilize the credit again, though you can attempt to re-apply anytime you wish (without the credit).

No, Amex does not have access to any information provided to the government by the Card Member or by the government to the Card Member.

No, the credit will not work with other program applications such as NEXUS, SENTRI, and Privium.

Final word

If you do any type of air travel, it’s really a no-brainer that you should use your Amex statement credit to enroll in one of these programs. Membership lasts for five years and it’s free with your credit so any inconvenience with attending interviews or enrollment centers is well worth it in my opinion.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.