Capital One Improves Savor Cards

Capital One just upgraded the bonus earning rates for two of us most popular cards. Capital One Savor The Capital One Savor Cash Rewards Credit Card previously earned: 4% on dining

Capital One just upgraded the bonus earning rates for two of us most popular cards. Capital One Savor The Capital One Savor Cash Rewards Credit Card previously earned: 4% on dining

American Express just came out with some increased welcome bonus offers for some Hilton cards. These are interesting offers because these are very high offers (up to 180K)! Also, to

The Apple Card from Goldman Sachs is one of the most popular credit cards on the market and is also extremely popular with WalletFlo users. I’ve been a fan of

Capital One is currently offering a pretty strong 100K offer for the Capital One Venture. With thew new offer you can earn: 50,000 miles if you spend $3,000 on purchases

The Capital One Venture is back with another exciting 100K offer. The offer Earn 50,000 miles if you spend $3,000 on purchases in the first 3 months Earn another 50,000

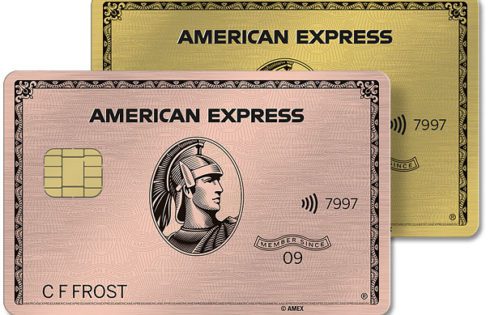

Offers contained within this article maybe expired. Today is the last day to sign up for one of the best ever offers for the Amex Business Gold Card. If you

Offers contained within this article maybe expired. One of the best credit card offers that we have seen (ever) is the 75,000 point (+$200 statement credit) offer for the Amex

For a while now, IHG has remained one of my secondary hotel reward programs (below the big three: Hyatt, Hilton, and Marriott). I’ve never been a huge IHG fan for

The Sapphire Preferred and the Sapphire Reserve are two of the most valuable travel rewards credit cards. The Sapphire Preferred is a favorite right now because you can get an

Offers contained within this article maybe expired. The Amex Marriott Brilliant is now offering one of the most lucrative offers we’ve ever seen for the card. It’s a welcome bonus

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |