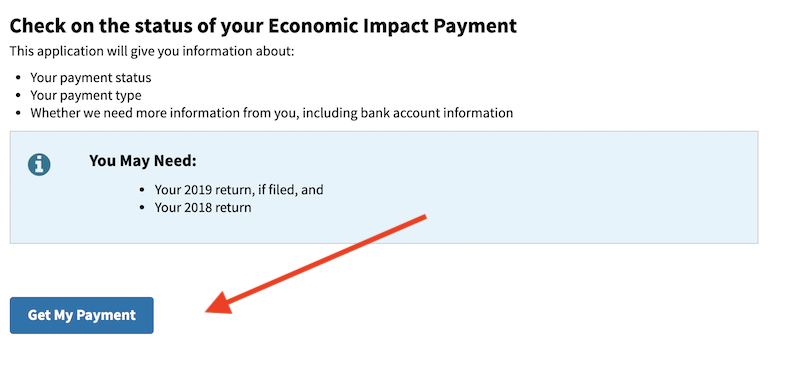

The IRS is issuing out stimulus checks to eligible Americans and we’ve been waiting a long time for the IRS to launch the ability to sign up for direct deposit online but it is finally here!

You can now sign up for direct deposit and also check the status of your payment. If you are not sure if you are receiving direct deposit or a check, you can also check on the status of that. (Note: It’s not showing status for most people it seems).

You will need to have your bank details ready such as your account number and routing number. You can find these numbers on a personal check or perhaps log into your bank account online and you might be able to use those numbers there as well.

You also may need to have your tax returns from 2018 or 2019 on hand.

Remember, if you already provided direct deposit information when you filed your taxes you will not have to sign up for direct deposit now and your funds will be automatically deposited.

My advice would be to do this as soon as possible to try to get in front of the line. Also, it is possible that the site could go down when it gets very busy and there could be a long backlog of applications.

You can find the link to sign up for direct deposit here.

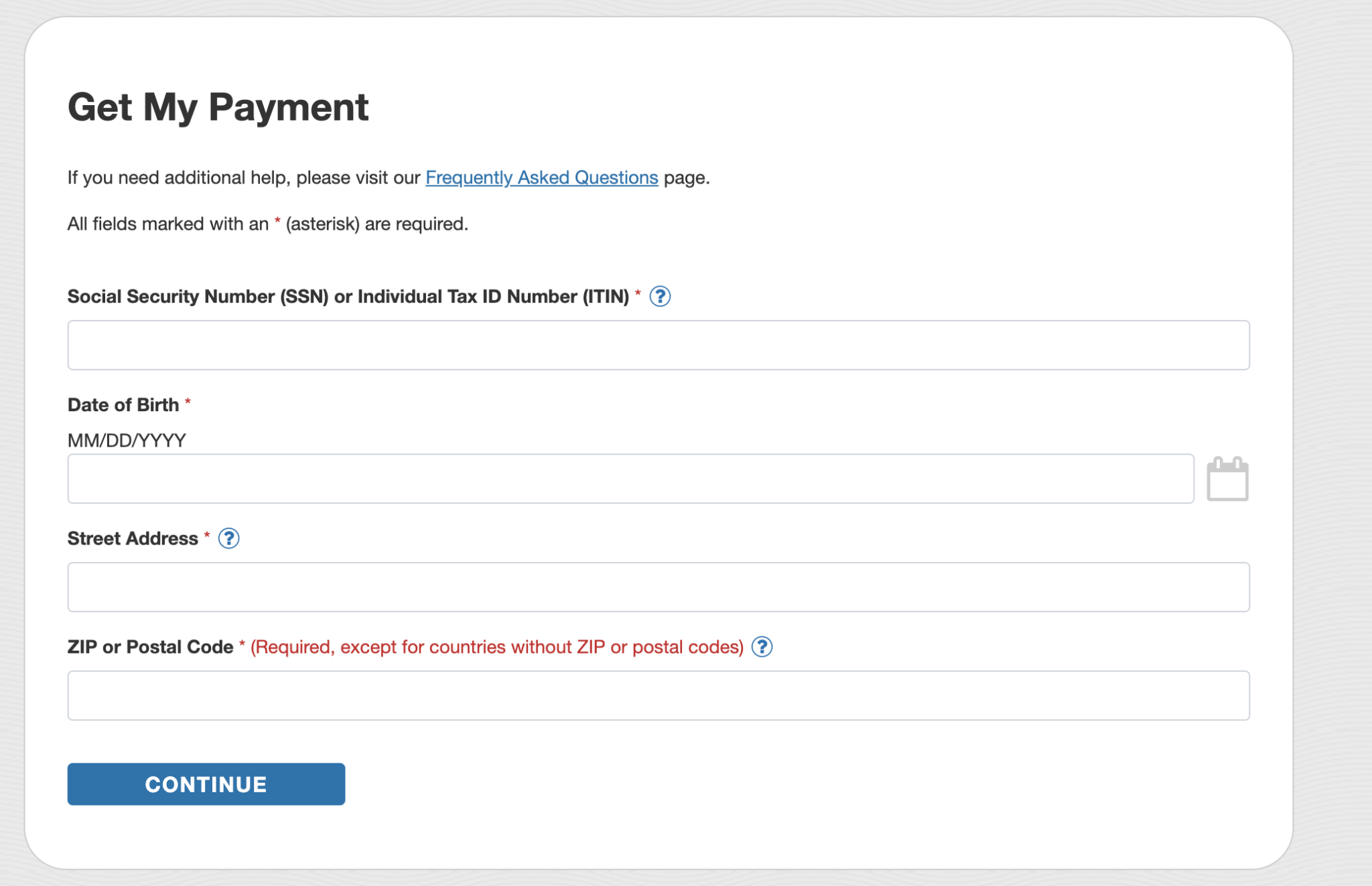

Click on “Get my payment.”

Then enter in your personal information and you will see if you are eligible.

Right now, some people are getting status not available like:

“According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

If you get a message like that, then I would just check back later to see if it changes. This just went live this morning so it’s possible that they are still working out some glitches.

If you successfully check your status or sign up for direct deposit, please let me know in the comments below!

Also list the year you filed for taxes – 2018 or 2019.

Not every American will be eligible for these checks. In fact, many people will be excluded for a variety of reasons and if you want to read about who will not receive a stimulus check click here.

It’s still not clear exactly how long it will take to receive your funds but my guess is a few weeks.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I got the status not available!!! I was wondering why!!

Yeah we are trying to figure out if it’s a glitch right now or not. Still not sure.

Got the same message

I also got the “Payment Status Not Available” message. I am definitely eligible-100%. And have a current bank account on file for direct deposit. I am in Connecticut… I haven’t filed 2019 taxes yet, but 2018 were filed –not sure if these two factors have anything to do with it? I talked to a friend in NY who has filed 2019 already and got hers this morning.

I got same message. I also hope it is only a glitch.

My concern is that i live in a rural area, i use a PO BOX. So i dont know why they ask for that info on main page to identify me. I have had trouble getting online with other government websites (Dpt of Education; Student Aide .gov) because the “address” must match exactly (capitals, spacing, abbreviation etc). It should be enough to take our social and date of birth. Now i am worried that if i enter the address and it doesnt match 100% it will not allow me to access the information. As far as my street address, i have no mailbox here at this street address and do not want them to think this is where they are going to mail me any documents or letters (or check if they dont have or get my DD info).

I will try accessing again tomorrow since i also got message that i had reached my limit and must wait 24 hours to try again. (But will have same concern about that po box…PO BOX, P.O. Box, P.O. BOX, etc not matching 100%)

yeah my wife and i filed jointly our taxes were already accepted by the IRS back in the beginning of march .We too are receiving According to information that we have on file, we cannot determine your eligibility for a payment at this time. would really like to know whats going on all the ppl we know have already got theirs.Why are we receiving this message?I dont get why ppl that are making far more then we were got there stimulus and we The struggling ones are trying to stay afloat but continue to sink. Last i read it was supposed to be lower income families first.

According to information that we have on file, we cannot determine your eligibility for a payment at this time this is what i got as well

That is what I received also. Cannot determine eligibility at this time.

Same here – can not determine eligibility

Same here. We get SS and have direct deposit and same banking info for both of us. Getting same info.

Same here

I got the same message. What does that mean?

I heard it could be in the street address. If on your return your address ended in “Road”,”Street”, etc. spelled out, do not abbreviate with “Rd” or “St”.

I keep getting the 24hour lock out and i dont understand all my information should be correct it has now been 24hour and still lock out

The first time I went to get my payment, it worked fine and told me I was eligible and even allowed me to go in and add my direct deposit information. After a few hours I went back and checked it again and it told me and I was eligible and as soon as they had the date I would receive payment they would update so I could access the I fo. The next day I checked again and it said the tax info I had entered did not match their records or I had accesses the system the maximum number of times already and to try again in 24 hours. This is the second day in a row it has said that. I have done nothing different. I think I am doomed to just wait and hope it works out but I wish you good luck and if I ever find any answers I will try to update everyone I can with similar problem.

How long did you have to wait to get back in? its been two days for me.

I had originally signed up thru the emerald card. I didn’t receive a return because it all went to back child support. As of now I still owe around $500 in CS, so I’m not sure how that will work out on when I’ll receive the difference (1200-500). Also I have heard from a number of sources that I would not receive the stimulus on my emerald card so I changed my direct deposit (rounting# & acct. #) to my PayPal Debit card which has all my info up to date. Not sure I did that right thing or not..?

I should receive a stimulas check! I draw social security benefits! I was wrongfully used as a dependant on their taxes this year! By no means was it legal! I have no clue how to fix this!

What about people that have identity theft and need to go in to an office to show I am who I am. My family is struggling and I’m a taxpayer ..Or what about people that get Calfresh food stamps or Calworks the dont get any assistance during COVID-19 .21 dollars payment isnt helping ..

I finally got a you are getting a check and it will be deposit to my account. Listed my last four account numbers. This was 3 days ago.Today it said the The date I would be getting it, buy it had a wrong account info different from the previews statement 3 days ago. And different from what account info was filed with.

I got the following message

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

I got the same damn thing. My wife and I qualify 100%. So sick of this bullshit. Haven’t been able to get unemployment and now this!

got that message too and I can’t find any answers.

Same error message as the rest of you. Hopefully this gets fixed soon.

For unemployment I saw on the news this morning for free use the app in the app store or Google play called donotpay to apply for unemployment. Its absolutely free and has greatreviews. The woman on the news got her unemployment within 1 week.

Same

Glad to see that I was not the only one.

I thought I was the only one and got really upset

Same and it 100% sucks but somehow knowing others in same boat with 0$ unemployment for me for weeks now, then this message from IRS, just helped….thanks all. I hope we all recieve

I was “retired,” not by my choice just as the Covid crisi got bad and need the assistance. Hopefully this gets worked out soon.

i got this status as I checked it at about 5 am CST. I was pissed.

Thanks for the quick info. For one of us the payment status was shown, was accurate, and the funds already deposited in to the account. Checked for 2 others in the family and got the message of “not able to determine eligibility.” Hoping it is a glitch that will be fixed soon. We know they are both eligible, so that isn’t the problem.

They told me that I had to add my DD information when I’ve already entered it in the non filers tool and then it froze. Does anyone knows what this means?

If you filed a tax return you were not supposed to use the non-filers tool. That created a zero income 2019 return for you. Now a return for 2019 will be rejected unless you file an amended return. Should not have done that.

So what if you use the nonfilers tool, then file 2019? Thats what i did. Its saying it cant determine payment eligibility.

You filed a zero income return for 2019. You F’d yourself. Now if you do a 2019 return it has to be an admendment. You cannot exepct an instant result. That other site just files returns for people with no income. Takes time to be processed. Jeez what people do the F up the system.

I input the wrong info, locked out for 24 hours. 24 hours passed and still locked out with the same message, very frustrating.

At first I got the same message that u said was a glitch but now I’m getting this one.

Note: I have wanted 24 hours and all my info is def correct.

(The tax return information you entered does not match our records; or

You have already accessed the system the maximum number of times today.)

Exact same thing happening to me. The fist day it was up it worked and allowed me to add my DD info and afterwards it said when they had the date I would be paid they would update so I would know. Even worked a few times more throughout the day as I showed a few others what to do and expect. Next day I got that exact wrong info or accessed too many times message and still keep getting it though 24 hours has passed and done nothing different. I know my info is correct.

I dont know mines just said that to. I think might do that when u start checkin on it too much idk I think everybody gon get theirs soon just makes u wonder when u get any kind of error message

I got the status unavailable too..

Thanks for the datapoint!

I also got the “Payment Status Not Available” message, and we should qualify too. Frustrating…

Get My Payment . I did not get my stimulus check yet. For a week I was eligible waiting for a date then all of a sudden it changed and said Status Not Available. It said it was mailed March 12. I Realized it’s not talking about my Stimulus check but my income tax check that I Filed in February. It said I was Eligible. I know I am as a single mom who works Full time at minimum wage. I don’t make too much not to. It won’t let me check and see if my bank info. I put in is correct just address, birthdate and SS number.

Received my normal social security check but no stimulus check.

Came up status not available. Did file income taxes in 2018.

Status not available at this time.

Same thing here.

Same message here and still waiting on my unemployment claim to be processed after 4 weeks. Technology and the government making life easier! 🙄

Same message. Wishing they would hurry up and correct the problem. For many this is the only income they may be receiving.

I received the status not available as well.

I also got “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

Looks like it doesn’t work.

Same here! I am sure I am eligible.

It says it will deposit on 4/15, but the account it has listed is closed. I didnt see an option to enter new account info.

We are in the same situation. Was hoping we could update bank information.

I am getting this message ” ” According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

But I know 3 people that got their deposits last night.

I didn’t file 2019 taxes yet…so I dont know if that’s the old up, I also usually owe taxes every year, but according to the IRS that wasn’t going to matter.

so I’m not sure if I am getting a stimulus check or not, Im definitely eligible.

No the stimulus check is for people that don’t work who already get a check every month From the government Hardworking people that have lost there job looks like don’t get fucken money I’m over this shit

That is wrong. Read something. Anything.

LOL!!!!

Same thing here:

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

I got the message “According to information that we have on file, we cannot determine your eligibility for a payment at this time”

BUT

My wife was able to get on and go through the process of adding her direct deposit information. She needed to have her AGI from her 2019 taxes, whether she owed or received a refund and what that amount was. She provided her account information and received acceptance. She exited the system and when she logged back in, received this message:

You are eligible for the payment. Once we have your payment date, we will update this page.

We will deposit your payment to the bank account below.

Bank Account Number: ************XXXX

Updates to your payment are made no more than once a day. We will mail you a letter with additional information on this payment.

SO, she got on to add her DD info using the Get My Payment tool or another way? We get the same error for both me and my hubby.

She was able to add the bank info using the new get my payment tool. I kept checking and apparently you can only do so a number of times each day before it locks you out for 24 hours. Stay tuned for me for tomorrow morning I guess?!?

mine says it will update me with a payment date but when is that??? i filled my 2018 and 2019 taxes and it also shows my correct deposit information guess the people still working don’t need a check

are we able to update our bank acct info. if the old account we used is closed is my main question

Same!! Used my chase acct that I closed months ago.

I had the same thing haplen to me I got a acceptance but not a payment date yet so I tryed checking for a update several times today and now its saying iv reached my maximum log ins for today and gotta wait 24 hours so Idk

I received the same comment, last week and still says the same thing. I need my money, rent is due way over due with late fee.

one more for:

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

I received:

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

Both when we tried my husband and mine. 2018 filed, 2019 not yet.

I added my account information easily and quickly. I didn’t bother trying to check the status. Basically because I already know it. It will show up in a few days I’m sure. Not going to stress it. Or the new portal that’s already being over loaded as it is.

How could you add the account info but not check the status there is not two separate portals you have to check the status to get to the point if adding the bank info. You just posting this message because you a trump ball licker and trying to make another one of his blunders look good is my assumption.

I too Recieved the same message about not being able to determine eligibility..l filed in 2018 but am now on SSDI so ldk if that will hold it up or not but will keep checking!

Another for :

“According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

I got the message “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

I’m kinda nervous

Gkt same thing but it could be thatthe site had just popped up to but don’t know.

I also am getting the message : Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

There’s no where I can report this glitch too unfortunately they probably are not aware

I got a message saying, ”According to information that we have on file, we cannot determine your eligibility for a payment at this time.” I keep checking too; nothing changes. Nothing was deposited in my account either. I owed on state and federal taxes in 2018 and 2019, but that is not supposed to matter. So many people I have talked too got a stimulus check. I definitely qualify for the entire check!

Same here. I owed a little bit (less than $500) on this years file. But, as stated, that shouldn’t matter.

Now I’m concerned and so unsure of what I should do.

We owed the last two years as well, but not much more than you paid. We made less than the amount it states and says we should get a check. I tried y

Using the check stays and go the same as everyone else about can not be determined at this time. This shit sucks.

And now both my partner and I got locked out for 24 hours. The message said ….

Please Try Again Later

We are unable to provide you with the status of your payment or perform the action requested because:

The tax return information you entered does not match our records; or

You have already accessed the system the maximum number of times today.

Please come back after 24 hours and try again.

If you need additional help, please visit our Frequently Asked Questions page.

What is the maximum number of times?!

I believe you get locked out after 5 or 6. Now you have to wait 24 hours. Don’t try again as every attempt during the lockout period will result the 24 hour wait.

It tells me the information i put in does not match what they have on record. I am putting the info in directly from my 2019 tax return. Which had a turbo tax direct deposit account attached to it so i was expecting it there in the first place. But once i signed into get my payment tool it said we need uldated direct deposit info and then at that point i got the error message about the info from my taxes being incorrect and got locked out.wth do i do now

This is the message i got..According to information that we have on file, we cannot determine your eligibility for a payment at this time.

Why are some people getting dates and some of us are getting this message?

Mine and my grandmas both said the same error. My mother’s worked fine and supposed to have hers today so idk?

Getting the same error message that everyone else is getting. Come on man!

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

Is what I got – seems like they didn’t test this tool before launching it.

Same message for me, which is BS. I filed taxes in 2019, 2018 , and every other damn year.

I’m also receiving the same error message like others in this comment section:

“According to information that we have on file, we cannot determine your eligibility for a payment at this time. . .”

I filed my 2018 tax return (not filed 2029, yet) and owed money. However, my 2018 income did not preclude me from the stimulus income threshold.

still not fixed at almost 8:00 am ? just got the same message and i called the treasury department and the lady confirmed a check was never sent to me great!

What number did you call?

Yes what number please?

We REALLY need a car

What phone number did you call?

*2019 sorry. lol.

I recieved mine just an hour ago but doesn’t reflect my claimed and qualifying dependents. What do I do looked everywhere for help.

I got the same message “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

I only filed for 2019 (never filed for 2018 because I was dependent) for the first time as head of household. I’m currently unemployed with a disabled daughte that receives SSI so I’m unsure if I will be able to qualify. hopefully

I received the same message. I filed my taxes later. 3/25. I’m wondering if that has anything to do with it. I am set up for DD. I did receive my tax refund already.

same here

I, too, received “According to information that we have on file, we cannot determine your eligibility for a payment at this time.“

It seems like people who have only filed 2018 taxes are getting the error message.

I only filed for 2019-

no true; I wasnt required to file 2018 and I stil recd this msg

“Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

Now it’s telling me to come back in 24 hours because I have tried more than three times. I keep getting the above message like everyone else so I kept trying. Just ridiculous. Bl

I filed 2018 and 2019 still getting crap message

I can get the the page and enter the bank details. After that it says “Technical Difficulty”

Same thing as everyone else. “Can not determine eligability at this time” Ugh so frustrating but makes me feel better it is not just me and must be a system error.

Same here

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

This is the message I am getting “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

This whole thing is a disaster. That what you get when you elect an imbecile to run the country.

Yes..because he coded the IRS website. Seriously?!?! It’s going to be a long next 4 years for you. I advise getting a comfy chair.

Fuck You Bob

You obviously don’t remember the ObamaCare completely crashing the first day it came out.

You do understand, he’s the only reason we have a stimulus package at all…He doesn’t control the websites and distribution. He has done an amazing job with extremely difficult circumstances that he did not chose. My kids all got much needed checks , my husband and I still patiently and gratefully wait.

He is not the reason. He just happened to be the guy who was president at the time. Senate passed the bill Trump was only needed to sign it into law. What would have happened if he didn’t? He would have probably been roasted on the White House lawn. But he likes it when people give him credit for anything good that happens for the country. Then wants to sign all the checks which would then make them worthless. He still gets to worm his name on the memo line on the checks though. Just so people will say it’s because of him we got these checks. Let’s vote for him again. I’m a Trump supporter but even I know better than to think he’s the only reason we get this check. We get it because of all the people who make up Trump’s government who had the good sense to up the amount of money on an act that existed before Trump then put it in front of his face and told him to sign it and all the people who work their asses off to survive and keep this country functioning and pay their taxes. He’s only doing what’s best for him. Believe me, he’s not paying this money out of his own pocket.

EAT SHIT BOB!

Victor you are a pig. Eat your own shit MFer.

just got that message that says “we cannot determine your eligibility” i filed my taxes in jan and i dont make over 75k

I only applied for 2019 as I was a dependent on 2018. Like the article states: it could be very possible that the website is working out it’s kinks. There might be new updates later on today

Same! Filed 2019

I got the same message “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

I only filed for 2019 (never filed for 2018 because I was dependent) for the first time as head of household. I’m currently unemployed with a disabled daughte that receives SSI so I’m unsure if I will be able to qualify. hopefully we can all get our checks

It makes me feel better too. I’m sure the problem will be worked out shortly

I got the same message. Only filed for 2019 plus i became a SSDI recipient so I’m not sure if that’s the hold up but I DEFINITELY qualify.

I was receiving the same “cannot determine eligibility” message so I kept checking (maybe 6x?), but now the message is that Ive exceeded the maximum allowable attempts and to try again in 24 hours. ??!!

Wow, that’s good to know

Lol…. Me too.. But I feel better knowing I’m not alone in this mess.

Lol. I did the same thing.

I’m getting the same message:

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

We have not filed for 2019 yet, but did for 2018. Hubby is self employed so we always have to pay and we don’t even have the money to pay the accountant now. I put in my 25 year old son’s info and his is supposed to be deposited today. I hope it’s just a glitch, because we are trying to pay bills with just an NC teacher’s income.

I also got this message. There’s no reason why I wouldn’t qualify. I filed both 2018 and 2019. I don’t owe taxes. I am owed child support.

At first I was getting

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

Now I got this!!

Please Try Again Later

We are unable to provide you with the status of your payment or perform the action because

The tax return information you entered does not match our records; or

You have already accessed the system the maximum number of times today.

Please come back after 24 hours and try again.

If you need additional help, please visit our Frequently Asked Questions page.

So frustrated.. I’m going back to sleep 😡

Same message. After few attempts I’m blocked for 24 hours

I got the same thing

Another one for “Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time” I filed in 2018 and owed money due to 2nd job not withholding. I have not yet filed in 2019. My husband and I file separately and he has already received his check (filed in 2018 and received a refund has not filed in 2019) and my adult daughter has also received her check (filed in 2018 and 2019 and received a refund both years)

Same exact situation as me! I am on a payment plan for owing 2018 and have not filed yet for 2019…I am thinking the delay could be that they do not have my direct deposit info??? My fiancé claimed kids in 2018, hasn’t filed in 2019 and received his in our acct today.

Same thing with me. Have yet to file for 2019. My brother/roommates all got theirs a few hours ago. However none of them owed.

I got my $2200 I got my unemployment on time and the extra $600 for unemployment .

I only filed a 2019 tax return since I used to be a stay at home mom I started working again last year glad I did.

Yes! I just checked same message as others. I am on a payment plan and they automatically take the money out of my account. They sure did for this month. Really need this money. 🙁

I’m on a payment plan too for back taxes. They sure aren’t having any trouble taking that money out of my account every month. I wish they’d suspend THOSE payments until they “allow us” to roam freely again. I’m getting the “not available” status as well on the IRS site.

“Existing Installment Agreements –For taxpayers under an existing Installment Agreement, payments due between April 1 and July 15, 2020 are suspended. Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement, including a Direct Debit Installment Agreement, may suspend payments during this period if they prefer. Furthermore, the IRS will not default any Installment Agreements during this period. By law, interest will continue to accrue on any unpaid balances.”

https://www.irs.gov/newsroom/irs-unveils-new-people-first-initiative-covid-19-effort-temporarily-adjusts-suspends-key-compliance-program

Throwing in mine as well! Got the error, haven’t filed for 2019 and filed married jointly in 2018 with far below 150k. Super frustrating.

Checked at 8:15 and my status says, “According to information that we have on file, we cannot determine your eligibility for payment at this time.” Filed in 2018 and owed taxes. We haven’t filed for 2019 yet.

Filed for 2019 like 3 weeks ago – even though I didn’t need to…

And now it’s having the same issue with everyone else on here 🙁

I filled both in 2018 and 2019, making less then 30k each year. Havent been a dependent in 3 years and it still tells me that “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

Got the error as well. On SSI and also filled out a simple tax return about a week ago.

Has anyone been able to reach the IRS by phone? I’ve tried and they kept saying they are low-staffed.

“According to information that we have on file, we cannot determine your eligibility for payment at this time.” Filed

I continued to try again and again and now im getting

We are unable to provide you with the status of your payment or perform the action because

The tax return information you entered does not match our records; or

You have already accessed the system the maximum number of times today.

Please come back after 24 hours and try again.

If you need additional help, please visit our Frequently Asked Questions page.

I have to wait 24 hours because I did it too many times I guess. It’s crazy how the government tells us for certain that we will be receiving funds during this pandemic but now you aren’t sure if we’re eligible or not? Come on now. I think at a time like this we shouldn’t be asking who is or who isn’t eligible. Just send the funds direct deposit or by check. We don’t have time to play these games with our government.

I also received the same error. So many people have received their checks already, and I haven’t, but I definitely qualified.

“According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

I filed taxes for 2019. But I know a few others that the website has worked for but gave incorrect banking information and they weren’t able to change it.

I filed in 2018 and have not filed in 2019 yet: Same message…

“Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.“

Both my kids got their money today. One filed both 18 and 19, the other only filed 19.

My husband and i have not gotten any money and the site is giving us the notice: Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

He filed both years i only filed 19. Our filing for 19 was just completed when they announced the stimulus.

Kinda sucks. We need to pay the bills.

I filed 2018 and 2019. Paid my owed taxes for 2019 and still showing unable to determine eligibility

MY HUSBANDS A DISABLED VETERAN WE ARE FIXED INCOME AND IT SUCKS AND ITS WAYYYYY BELOW REQUIRED BUT WIRST IS ITS JUST ENOUGH SO WE GET NO FOOD STAMPS IN KANSAS DO NOT QUALIFY I USED TO SUPPLEMENT OUR INCOME BY DRIVING FOR LYHT AND UBER AND SELLING ONLINE I QUIT ALL THAT SHIT BECAUSE I CANT GET MY HUSBAND SICK WITH COVID IT WOULD KILL HIM I CAN NOT BELIEVE THIS AND GOD MUST HATE ME I GIVE UP

I tired this morning for my wife and i . Our income was significantly under the threshold in 2018 for married couples and we actually owed. We have not filed 2019 yet. I was getting really nervous however seeing multiple others with this issue has at least put my mind at ease that it is an error and not a disqualification.

I’d everyone on the tax return don’t have ssn then you won’t get stimulus payment. E.g spouse or kids have itin. Is this true?

Oh joy, same message: According to information that we have on file, we cannot determine your eligibility for a payment at this time

Payment eligibility not available at this time.

Same message. Not available. But funny that payment was available. Ive paid what I owed from last year and now owe nothing. I make less than $99k. I’m a ya paying citizen who owes no back child support. I’m due this money. The IRS is not taking live calls. Bullshhh

Got the same message as the rest of you, and I got my 2019 tax refund just this past Monday, having filed on 04/04. I’m definitely qualified to receive it.

My GF got hers today, and I checked with her info just to see and all that was correct showing a deposit for today.

Just got this message: Due to high demand, you may have to wait longer than usual to access this site. We appreciate your patience.

I got the same message, I know I am eligible

I did receive mine this morning and while checking for my mom(who got the payment status unavailable). Out of curiosity I checked my own despite already having gotten the deposit this morning:

We scheduled your payment to be deposited on April 15, 2020 to the bank account below.

Bank Account Number: ——————

If you don’t see your payment credited to your account, check with your bank to verify they received it. We will mail you a letter with additional information on this payment.

If you need additional help or do not receive your payment, please visit our Frequently Asked Questions page.

I filed in 2018

Same

What do you get if you filed married separately?

So my husbands shows that his was scheduled to be deposited (we did receive his). But mine shows the “we cannot determine your eligibility for a payment at this time.”

We filed 2019 married but separately. We both used the same checking account as well.

Please Try Again Later

We are unable to provide you with the status of your payment or perform the action requested because:

The tax return information you entered does not match our records; or

You have already accessed the system the maximum number of times today.

Please come back after 24 hours and try again.

If you need additional help, please visit our Frequently Asked Questions page.

This is fucking bullshit. I hope our government rots in hell

Agreed! You’d think they would let allow people to try as many times as possible…irs for you.

When we need our money, we sit and wait. But when they need their money, it’s hurry up and pay or we’ll penalize the crap out of you. Ugh

You are absolutely right. They better be glad I got my refund. I told someone yesterday that today maybe chaotic and I was right.

I think.they limit you because of the fear of a website crash. Remember, the officials rely on web engineers. In sure they would love to see everyone get the money immediately.

(Look at this Crap) Just Gewat. BEWARE!!!

Please Try Again Later

We are unable to provide you with the status of your payment or perform the action requested because:

The tax return information you entered does not match our records; or

You have already accessed the system the maximum number of times today.

Please come back after 24 hours and try again.

If you need additional help, please visit our Frequently Asked Questions page.

Tried everyone in our family. Same message, cannot determine eligibility at this time. GRRRRRRR

Same error as everyone else:

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

I am self-employed and filed taxes for 2018, but not 2019 yet. definitely below the eligibility income level. Thought they would have my bank account stuff as I had to do a direct pay thing with them in 2018 to pay extra taxes that I owed.

Hope its just a glitch.

Seems like their is a correlation between people who haven’t filed their 2019 taxes this year getting the dreaded “According to information that we have on file, we cannot determine your eligibility for a payment at this time”. My in laws are getting this message too and they have only filed their 2018 taxes last year. Me and a friend that filed our 2019 taxes when it first opened at the end of Jan 2020 got ours yesterday and today. They said it would be staggering. Hopefully all people with direct deposit info have it by Friday.

I filed 2019 electronically on 3/26 and i still receive this same error.

There is no such correlation.

I got the same message about “payment status not available“, etc. I was hoping to put in direct deposit information because they did not have that since usually I owe. I am well under the threshold of income and have filed for 2018 and 2019. I hope this is just some sort of glitch. Speaking of glitches, when I tried to check additional times, it was telling me that I was putting my birthday info in wrong (I was NOT…the date and the format was correct) but when I used their little calendar pop up tool it went through to do the search (still got message status not available).

Same error… its not cool but it feels good t know its not just me… they need to fix the tool

“According to information that we have on file, we cannot determine your eligibility for a payment at this time”

I’am happy to find this website, please keep updating the info, thanks !!

If you get “The tax return information you entered does not match our records” play with the street number abbreviations. Mine did this too. Had to be st not street on my address. Check the address you submitted on your last taxes and type it identically.

My parents got the same message they just filed there 2019 taxes on.the 6th of this month. Don’t know if that.matters.

Da5hiz:

Those who filed for 2019 most likely have the DD information on the return already.

Our unintelligent accountant did not include our DD on our 2018 return, or we more than likely would’ve received our payment already. I am only attempting to access the site to input my DD information, which I’m guessing is what all the others are attempting to do as well. 😊

Or maybe not. It is 9:15 EST, come on IRS pull it together.

Still getting this error, its actually starting to p*iss me off

I also received the message that they couldn’t determine my eligibility. My sister got right through and was able to submit her direct deposit information.

Same message here

I am thinking its only showing status for those who filed 2019 returns and received a refund. My sister has filed 2019 and got a refund the app shows she will get her stimulus on Friday 4/17. I haven’t filed 2019 yet and owed in 2018, same with my parents and some friends. We are all getting the message in the post.

I’m getting the same message.

Since the govt is trying to rob us I can rob them too.

I filed for food stamps, unemployment and social security benefits.

I’m getting money from you one way or the other

Same issue as everyone else.

Same here. Got the cannot determine eligibility message. Filed both 2018 and 2019 taxes. Both were accepted. This is BS. They better get this sorted out quickly. Going to be many angry people.

Same message for me, filed in 2018 have yet to file for 2019

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

For more information on the eligibility rules, see our Frequently Asked Questions page.

I efilee 2019, got my refund already dd, 100% qualify but have yet to get any of this money…

Same thing… Can’t determine eligibility. Filed 2019, but it’s still processing. My adult son got the same message and his 2019 return is still processing. A friend of mine received a 2019 refund and still got the same message… Can’t determine eligibility at this time. None of us received the stimulus. This is ridiculous. What’s the sense in having this assistance if we can’t access it

Same here, both for me and my wife. I have to say I am a bit relieved that so many people got the same message as me. Obviously it is a glitch. I would be a lot more nervous if we were the only ones. Both our sons got theirs.

Our taxes for 2019 were filed over a week ago, online. 2018 was online as well.

My accountant got the same message. He thinks perhaps they are doing single filers first, and then joint filers, but he doesn’t know for sure.

Nah my mother inlaw got hers an she files jointly just another fuck up with irs like usual

Same error for me. Filed jointly with wife in 2018 and got this dreaded message as well.

Same!

Same message for me! “ Payment Status Not Available- According to information that we have on file, we cannot determine your eligibility for a payment at this time.” I filed for 2018, but haven’t yet for 2019- I’m in the process of getting them finished. Based on who is eligible, I meet every criteria. Thankful that there is an actual website that is reporting on this situation.

I received the same message. Checked under my husband as he is listed first and also checked under myself – same message for both. Relieved to see we are not the only ones getting this message.

We just tried and received the same message. We are under the $150,000 window and should be receiving the check. We did have to pay taxes for the last 2 years so I am sure the IRS does not have our bank info. I was hoping to get that added.

However

Both my kids got their check today……go figure lol

I owed in 2018 and haven’t filed for 2019. IRS didn’t have my bank info. I added here about an hour ago and got email info wd. Hoping this will speed things up!

https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

Wait, this link is for non-filers. Did you create a non filer account?

Have not received my stimulus check yet. I filed 2018 and 2019 taxes. Just got my 2019 tax refund on 3/14 with my new checking account. Now I get the error: Payment Status Not Available; “according to information that we have on file, we cannot determine your eligibility for a payment at this time”. I’m 100% certain that I’m eligible for it I made way below $75K. Does anyone else have PenFed and didn’t get their checks yet?

I’m on a payment plan with the IRS, and my payments are automatically pulled out of my bank account. Because of the payment plan, I do not receive refunds from my taxes. Does anyone know if they will consider my bank account which they pull my payments from as a direct deposit bank account? I’m getting the error message too, so I can’t see if they acknowledge my banking information.

Same boat as you Jenny. Hopefully we will find out soon.

hmmm…good question as my irs payment was deducted today from my acct but no stimulus check. I just went on and entered my bank info here…..got an email an hour later it was accepted.

worth a try

https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

Interesting…I thought that was for just non-filers for tax years 2018/2019.

Keep us posted if your status changes and I will follow suite….

But, when you go to this website it makes you create an account for FreeFile, then it makes you fill out a 1040 and file your taxes? Where are you JUST entering your DD info?

Yes, that link is for people that have not filed tax returns. It will create a zero income return for 2019 to update their information. If someone has already filed 2019 or needs to file a 2019 and uses the link for non-filers it will seriously screw them up when they return gets refused as a zero income return was already filed.

Thank you for this website. I checked myself this morning and received the same notice that most people commenting have received. I went to google and typed in the IRS error message and came up with your website. Thank you again. I will check back later.

Thanks for getting everyone hyped up about payments being available today Gov. thousands of people getting the message: “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

Sham on me for even waking up

My 25 year old son already did his 2019 taxes. His Stimulus Check was in the bank overnight last night (15th). His father and I made $30,000 together last year and we got the message : According to information that we have on file, we cannot determine your eligibility for a payment at this time.

I got the same message (9:40 a.m. on Wed., April 15, 2020).

Figured it out?!$!$!

If you read the directions under the “Get My Payment” it says the following. This defeats the whole purpose of providing a button to update your direct deposit information. It says if you filed in 2019 you cannot update your payment information. It says if you filed in 2018 you must file 2019 electronically to update your payment information. Defeats the entire purpose of the app. (SEE BELOW)

If we don’t have your direct deposit information from 2018 or 2019 return – and we haven’t yet sent your payment – use the Get My Payment application to let us know where to send your direct deposit.

2019 Filers: We will send your payment using the information you provided with your 2019 tax return. You will not be able to change it.

2018 Filers: If you need to change your account information or mailing address, file your 2019 taxes electronically as soon as possible. That is the only way to let us know your new information.

So I’m guessing that means if your accountant decided to not even bother including your direct deposit info on your 2019 return and instead chose check by mail, we will receive the stimulus by mail too?

That makes no sense, they give us until July to file but then say you have to file to get your stimulus? A lot of tax offices and accounts are closed. What if we owe? Pay money to get money? While we are not working. That’s ridiculous!

The tool unfortunately only facilitates providing the IRS with your direct deposit information, if they don’t have it already. That message applies if they already have direct deposit information for your account, but you need to change it. It does not apply if you filed in 2018 and they don’t have your direct deposit information.

Not true. I filed both 2018 and 2019 and the IRS does not have my direct deposit info. That is why I came to the website to provide it to them. Like most government crap the website has been poorly programmed and/or they are having database connection issues.

The government couldn’t run a hot dog without messing it up.

Same here:

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

Question: Do you have to do this separately if you are married filing jointly? Not specific about that either! Ugh frustrating

Same message for me…ugh

Most of us have to wait 24 hours not because we tried too many times. That isn’t fair if you ask me. Knowing that they have a flaw in their system. Maybe they would let us have another go at it later today and if not we just have to wait til tomorrow or Friday 🤦🏾♂️ this is a disgrace.

*Most of us have to wait 24 hours because we tried too many times.*

Yes sucks. I got locked out too. I am eligible. Why it cannot determine my status is beyond me. Typical government incompetence.

Same message as the 100’s of others have said, really it is a sign of relief, as I thought I was being single handedly screwed over. ‘Payment Status Not Available-According to information that we have on file, we cannot determine your eligibility for a payment at this time’.

I did not file taxes for 2018, but filed for 2019 on 4/2, even though I made nothing, but won $20 on a scratcher .. so I reported that as my earnings, and allowed me to efile.

Looking forward to having a little bit of money for once in a very long while, just before I finally get to return to the workforce after long sustained injuries.

Also the FREE TIGER KING JOE!

May I ask if your return is under review? My AGI was $1 and on Where’s my refund I’ve lost all bars and it just says processing. I was thinking maybe that’s why I haven’t received payment.

Free Joe lol!

Got the same message as everyone here. Government at it’s finest here folks.

I filed my 2019 taxes April 4, 2020. I did not filed 2018 returns, due to be unemployed the whole year. When I went on the irs site, get my payment, status refund. It says, Payment status not available. According to information that we have on file, we can not determine your eligibility for payment at this time. What? I worked for 3 months last year, make under $75,000, Christmas help I qualify. I am glad I am not the only one. What information they have on fug file, other than my 2019 tax refund that’s recorded, that they should be going, by?

“According to information that we have on file, we cannot determine your eligibility for a payment at this time”

Got this message for both my husband and myself. Beyond frustrating!

I am seeing a common pattern here. Many people filed in 2018 but may have owed money. And it seems these people have filed their 2019 taxes within the last week to a month, and they are getting this error. At least this is my situation. Wonder if this error has anything to do with when you filed your 2019 taxes?

Falling under the category filed 2019 within a month – getting the same error message.

ALSO , I don’t think the website might be busy but definitely not down at all – because for my friend who has received the money, his status is correctly reflected on the website.

Don’t think so. I owed no money and had no refund for both 2018 and 2019. 2019 filed electronically by TurboTax on March 27, 2019 and was accepted with hours. There is no reason it should say cannot determine my eligibility. So frustrating.

I meant 2019 files March 27, 2020. Typo.

Filed m 2019 taxes. First came up According to information that we have on file, we cannot determine your eligibility for a payment at this time – then after 3rd time it came up and I was able to put bank info in.

But my son’s (he filed 2019, too) is still coming up that they can’t find him!! Very frustrating.

As I was saying, maybe if you filed within the last month or so, it kicks out this error?

I have an awesome CPA who explained that the message simply means the site is down right now. It has nothing to do with eligibility. If you were already set up to receive an e-refund, your payment will come faster because it’s already in the pipeline.

That is great. I was really worried until i saw everyones responses. Typical crap . Thanks for sharing with us .

Does he work for the IRS? If not, how would he know?

Lol… exactly there are people who got in successfully and got the status of their bbn payment. After, that message, theirs a link below that tells you, who qualifies, when you click on it. So, I took it as I did not qualify, and how so? When I knew, i did. Unless, they have wrong information on file. They need to do something about this.

I was able to provide bank info this morning and I’ve only filed for 2018. My daughter is getting same message as the rest of you and filed 2019.

I got the message Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

but I checked a family members and Got the message payment set to direct deposit April 15, 2020… they filed 2018 and 2019 taxes

My significant other successfully signed up for direct deposit!

I got the “cannot determine your eligibility for a payment at this time” message, but probably because I’m not included in the income bracket.

Just to add on, she already filed her 2019 tax return, so that’s the information she entered on the site

I’m getting same message: “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

I’ve tried a couple of times over the past 2 hours. Tried my SS as well as my wifes, as we file joint.

Have NOT filed my 2019 taxes as yet.

I did file my 2018 taxes, but owed money, and do not think therefore I provided bank account info on the return. No need to provide deposit info when I owed money.

Perhaps that is triggering the message? If so, I still have not seen where someone who filed 2018 or 2019 tax returns, owed money, and therefore did NOT provide bank info, can go into this tool or any other tool, and now add.

My sister did owe for 2018 & 2019 and she was able to put in her DD info this morning. She had to provide her AGI for 2019 and how much tax she owed for that year. She went into the system the same time that I did and she was able to get her info submitted. I wasn’t so lucky. I have filed 2018 return and owed but have not filed 2019 return yet.

ROSE – if the site is simply down, why ban us from checking our status for 24 hours if we checked too much? Doesn’t make sense to me.

It’s not down, it’s just not working properly. After all it is the government’s site and they don’t have a great track record with this type of procedure.

Or, it’s possible your not eligible to receive funds, and, thought you were.

Then why does it say “we cannot determine at this time”. That’s the same as saying “we don’t know”. Wouldn’t it instead say something like “you are not eligible”? I believe it would.

Also I make less than $75000 per year, I filed my 2019 tax return and I don’t owe taxes or child support. It’s a pretty low threshold.

This is exactly what happened on the first day of the Obamacare App going live. So there is no reason to expect anything different this time. Don’t bother trying for a few days- its just an exercise in frustration. And no official response from IRS- just crickets. Spend your time wisely- keep looking for toilet paper!

hahaha this made my day

its after 10am its giving me the same message as many have posted here “According to information that we have on file, we cannot determine your eligibility for a payment at this time” hopefully they will fix the problem soon I am definitely eligible for the payment.

Exactly!

Hey guys i saw this on the bottom of the get my payment tool. I am unsure if that was there earlier.

2019 Filers: We will send your payment using the information you provided with your 2019 tax return. You will not be able to change it.

2018 Filers: If you need to change your account information or mailing address, file your 2019 taxes electronically as soon as possible. That is the only way to let us know your new information.

I have not filed 2019 yet ( will owe ) and 2018 was filed and we did owe.

I’m getting the same error message. I recently filed my 2019 on 4/9 and I owe a little over 500$ because I’m self employed. My husband filed his 2019 and he is still showing the same error message as me. This really sucks, I hope it all works out for everyone. We all need help at this point.

We got this message:

Please Try Again Later

We are unable to provide you with the status of your payment or perform the action requested because:

The tax return information you entered does not match our records; or

You have already accessed the system the maximum number of times today.

Please come back after 24 hours and try again.

We filed our 2018 Income Tax but have not filed our 2019. Would that be a problem?

Best regards,

I filed 2018 and 2019 and was due a refund both years. The refund was applied to back taxes I owed from 2013. My banking information was provided in the hopes I would see my refund. My question is, do you think the IRS would keep my banking info on file even though they kept my refund? I got the same info most people here got. “According to information that we have on file, we cannot determine your eligibility for a payment at this time.” Frustrating.

It seems to be giving this message “Cannot determine eligibility” to those that have not filed 2019 yet. I believe that they have not loaded the 2018 return info into the system yet. Would assume that batch will go out at a later date. Perhaps next Wednesday? Can anyone that has filed 2019 taxes verify if they actually got this message? If not, I would assume that its that reason.

Read through the previous threads. Even those who filed 2019 are getting the error.

Still the same message and I’m available for the payment not sure what’s the hold up

My accountant told me he got the same message, and thought perhaps they were doing single people first, and married couples filing jointly after.

I am single and have still received the message

My husband and I file married jointly and have received ours by direct deposit. However, I was reading this article because I had been helping my folks figure out why they haven’t gotten theirs. They are getting the “According to information that we have on file, we cannot determine your eligibility for a payment at this time.” They absolutely should be eligible according to the guidelines and were counting on that money. It’s very frustrating. I imagine it would take forever to get someone on the phone at the IRS.

I got the same message. I am completely eligible to receive the stimulus check according to the guidelines. I hope they fix this soon. I was counting on that money.

For whatever reason, it does appear that they’re still in the process of loading all the data. I’m actually surprised the app was online as scheduled this morning and the website was functional. So far, they’re running rings around the Obamacare rollout.

At least one Reddit user reported receiving the money into their account despite seeing the message.

Thank you for the information! I got the same message about status not available, and there were no posts in the FAQs. So, all in all, you helped me stop worrying about one thing today. Again, thank you.

My adult son and daughter who are both well under the threshold, filed their taxes and received their refunds electronically into their bank accounts received the same message as everyone else here. I am thinking with so many people like this, it’s going to take quite a while to get it all sorted out.

I am getting the same error message as everyone else here. We don’t get refunds, we have to pay. We paid last year electronically from our bank acct. Does that mean they have the number for DD? We also both get social security by DD, so that is two different ways that they should have our bank info. Is there anyone here who did not receive a refund….and whom gets SS via Direct Deposit receive their stimulus payment?

I get social security disability so I should be qualified but I am getting that same message that we cannot determine your eligibility right now, and I know my bank account information is accurate I get my social security DD every month, and so far I have not heard of anyone on social security getting the money yet.

Another one for :

cannot determine eligibility

Got the same message and we totally qualify! It’s damn ridiculous though that they don’t have their act together! It takes them 1 day to pull what you owe out of your account, I’m pretty sure their capable of paying us immediately what they owe us! SICK OF GOVT BULL SH**!

I’m getting the same message . Filed my 2019 taxes on April 4th. Already received my refund so they definitely have my bank account info. And I definitely fall below the $75k. This is really frustrating

I am getting that same error message as well, its kinda frustrating.

I’m starting to think that everyone, myself included, that has gotten this message does not qualify for a stimulus payment. I suspect, the IRS can’t give me my payment status because I don’t have a payment coming. And no money has been direct deposited in my bank account because again I don’t qualify to get one. Sad, but pretty clear at this point.

What is your reason for not qualifying?

Larry, please read above you will see many examples of people whose incomes fall under the income limits, have filed returns in 2018 and 2019, just 2018, just 2019 and are getting the same message. The website is not fully operational. 1/2 the country is getting the same message.

If you meet the criteria for the payment , you will get a payment, that is what is clear at this point.

I hope you’re right.

Mine said that I did qualify and sent me to the next page to enter my banking info but after I hit submit, it said technical difficulties, start over. After about 10 tries, it said I had exceeded the number of times for today and to wait 24 hours and try again. wtf?

If you access the site more than 3-4 times it locks you out. Or it could just be another glitch.

I also got the exceeded limit for the day message and to try 24hrs later.

I think most of us we’ll be getting that at this point of the day or that site will crash.

They apparently have issues due to the volume of people trying to access the site… https://www.cnbc.com/2020/04/15/this-new-government-app-shows-you-the-status-of-your-coronavirus-stimulus-payment.html

The irs not really commenting on anything and not answering any question from people on there pages.Not taking calls.They are ignoring everything.My mother inlaw got there stimulus check an they make far more then me an my wife. we are struggling an from what i understood the first payment were supposed to go to the lower wage families .so how did she recieve hers before us. Nakes bo fucking sense.

My accountant also said they were probably sending out to people with lower incomes first. But my son makes more than I do and he got his. My wife and I filed jointly and electronically for both 2018 and 2019. We even got our (small) 2019 refund last week! But not the stimulus.

All this conjecture is well and good, however the bottom line is I don’t see a $1200 direct deposit in my bank account. Either I’m not one of the millions who will receive their payments by today, or I must have done something incorrectly when I applied (filed 2019 return) for the stimulus.

Well, my son went on today and checked his status to put in info to get the money deposited into his account since he’s always had to pay and they didn’t have bank info on him. He put in his info and the money was deposited in his account in a nanosecond, seriously. So I checked on mine and it said Payment Status Not Available According to information that we have on file, we cannot determine your eligibility for a payment at this time. And I am eligible no doubt about that. Made me really mad.

The IRS reminds me of my old sports bookie i use 2 lay wagers through..Slow to pay but quick to collect…God Damn sons of bitches!!

This was added to the tool after i tried again . When you click on frequently asked questions . None of these apply to me so im even more confused about it . i filed in 2018 and havent completed my 2019 yet . And my married filing jointly income was 117k so well within limits.

In certain cases, the Get My Payment app will be unable to tell you the status of your payment. You may receive this message for one of the following reasons:

If you are not eligible for a payment (see IRS.gov on who is eligible and who is not eligible)

If you are required to file a tax return and have not filed in tax year 2018 or 2019.

If you recently filed your return or provided information through Non-Filers: Enter Your Payment Info on IRS.gov. Your payment status will be updated when processing is completed.

If you are a SSA or RRB Form 1099 recipient, SSI or VA benefit recipient – the IRS is working with your agency to issue your payment; your information is not available in this app yet.

You can check the app again to see whether there has been an update to your information. Get My Payment data is updated once per day, so there’s no need to check back more frequently

The tax return information you entered does not match our records. is anyone getting this

I filed my 2019 return through TurboTax last Saturday and had to pay. I chose direct payment. IRS withdrew my payment yesterday. I’m getting the same message as everyone else. Should we include dashes when entering ss number? What if you live in an apartment. Should the apt number be included in the street address?

Use the address on your 2018 return. Even though you filed your 2019, the have not fully processed that return to use the information for it. Even if you have paid or received a refund off of it, there is a process after that at the IRS that takes a couple of months to finish. So use information from your 2018 tax return. Put the slashes in the date of birth (example: Use 01/29/1903, not 01291903) and don’t put dashes in the social security number.

I submitted my tax return on 4/4 and owed money which I paid through TurboTax. I was finally able to enter my bank info today. So it takes about two weeks to process an electronic return. Now I’m waiting on a payment date.

4/11 not 4/4

I found this. I-Arsh-S tried to explain the tool and the message received. I still have the same message as earlier not sure why I am not eligible?

Link:

https://www.irs.gov/coronavirus/economic-impact-payment-information-center.

Hope this helps.

So I put on my 2019 taxes that someone could claim me, but no one has. Will they check to see if someone has claimed me or will I automatically not get one?

You will not get one unless you file an amended return.

I put in my Direct Deposit information into the website. I filed both a 2018 and 2019 return. My both refunds went on a Serve card, but only my 2019 return had direct deposit information on it. The IRS went off of my 2018 return instead. The portal accepted my direct deposit information, so I am just waiting on my stimulus to be deposited to my bank account.

This is horrible I have been out of work since March 18th and still No unemployment.The IRS still hasn’t received my Tax Refund and it was done by TurboTax Efile 1/31 and still Nothing yet,,The unemployment system in Florida is horrible and I still haven’t received a check for unemployment..Now the IRS sends my stimulus check to the wrong bank account and there is no way you could in put the right bank account when you go to get my payment all the information is there to check your payment not to put the right direct deposit or New information since 2018. This is not 2018 or 2019 that these stimulus checks are being determined this should be for all Americans who lost their jobs who have children to need to feed them This situation is going on in 2020 I don’t understand why the IRS is going upon peoples income Or living status for 2018 and 2019 this is ridiculous people lost their jobs in 2020 Or moved or have different banking info and it doesn’t give you the Tool to change your info!! This is 2020 People’s lives have changed since 2019 and 2018 this is ridiculous.

It is now 3am April 16. IRS website still says “we scheduled your payment to be deposited on April 15, 2020”. The IRS has my correct account number, yet there is no deposit in my Chase bank account. Anyone else have this problem???

I did HNR block got a card this Monday the 13th my tax advisor said the $ would go on the card and I would receive a text anyone else have this issue still no stimulus and I owe $!! I keep trying to even create a account and it says my information is invalid WTF

We are getting the message that our information does not match their records, both yesterday and today. We have our tax forms in front of us and entered the information exactly as it is on our tax forms. We filed at the beginning of March and they had no problems accepting our tax payment! We even tried the 2018 tax forms to see if that is the problem. Same response, and how convenient that there is no one to call as the IRS is not taking any phone calls or appointments.

Anyone who posted here last night that was having problems try again and have better luck today? Not sure when my 24 hour lockout is over so waiting a while longer.

You sure it has been 24 hours since you last checked? I think it might lock you out for a fully 24 hours every time you check and get that message again?

This portal is such a bullshit.

It doesn’t matter what I try it won’t let me pass ‘Information doesn’t match their records’ blah blah

and ‘come back after 24 hours’…

I filed 2018 return and they sure as hell didn’t have problem accepting my tax payment.

And yeah, how convenient there is no way or reaching them.

As usual, our government at their finest !!!

It seems that who has filed with ITIN as dependent are getting the message payment information not available.

ITIN dependent has nothing to do with it. My brother is single and he is getting the same message. He has an SSN.

This is really BS. Waited my 24 hours. Put in info exactly as on my tax return and still get the same message that says “Payment Status Not Available.” I tried with info exactly from both 2019 and 2018 return. I qualify for the payment. I meet all the requirements. Why can’t they get it right or give me a message that has some meaning? Getting very angry and frustrated at this useless government and president moron psycopath idiot.

I waited the 24 hours as well. Same message; same lack of information. I don’t care how long I have to wait as much as I would like to know I will at some point be getting it. I answered everything correctly; my return spells out “Road” at the end of the address line, so I changed from “Rd” to “Road.” Didn’t help.

I think I figured out the problem we are all having. In the FAQ for the stimulus payment web app it says you will get the “Payment Status Not Available” message if you recently filed (or did the non-filers web form) and it has not finished processing yet. I checked my return status and it still shows processing. The average processing time for an e-filed return to be processed after acceptance by the IRS is 21 days. People who got paid or can access this web app are only people that only filed 2018 and did not file 2019 yet or filed 2019 early. In my case the 21 days will be over after April 17th. Once the return is processed the eligibility can be determined. So if any of you filed your 2019 return less than 21 days ago this is likely the reason your status cannot be determined at this time. I will stop trying until the refund status page shows my return has finished processing. Good luck to all.

That isnt the case .I am Married filing jointly . We havent filed 2019 yet but filed for 2018 and owed . My mother is in the same boat as me . No Rhyme or reason for it but we both 100% qualify for the payment. I wish they would just be honest because their examples dont really apply to anyone and they know it.

I like your point MCR, but unfortunately I filed a 2019 tax return 19 days ago and just received my refund back yesterday. So wouldn’t that mean they had already processed my information and have it on file? And yet I still receive the same message in “Get My Payment” as you all. 😕

Well, I got my refund last week, I efiled both 2018 and 2019, and I still get the message. People who just filed 2018 get the message too. My sons both efiled the same day as me (our accountant did) and they got their 1200.

All I can add to this discussion is that I filed my tax return electronically 2 weeks ago, and only 4 days later the tax refund was in my bank account! Today, April 17, my stimulus check returns the following information: ” According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

If “they” (whoever they are) were able to send my 2019 tax refund 4 days after I filed, they should be able to determine my eligibility; I know I am eligible, so there must be a bug in their system. Since they have not provided a website or phone number to follow up on problems, we will just have to wait and see.

Well by the looks of it there doing alot of nothing to fix or help any of us.Its been over 21 days for mine an my wifes tax return and low an behold its still processing.I still revieve same message everyone else is recieving.On top of that all there offices are closed so you cant talk to anyone to get shit fixed.Only thing they ever good for is if you have to pay them.

That isn’t it, either. I filed in 2018. I have not filed 2019 yet because I have to pay so I am taking advantage of the extension to July. I am getting the same message.

I seen on some article it has to do with they are using the JUST the 1040 with DD information not the 9465 form for tax payments!

So these A-holes at the IRS can laboriously use my account to draft payment for back taxes but can’t put $$$$ back in there.

Did you use a tax filing software? I just read an article that if a tax filing software was used then the irs doesnt have the DD info.

Well, I got my refund last week, I efiled both 2018 and 2019, and I still get the message. People who just filed 2018 get the message too. My sons both efiled the same day as me (our accountant did) and they got their 1200.

Yea its getting a lil outta hand now me and my wife are running out of money still get same message.On top of that the unemployment still says pending .Nothing is getting fixed and the people that really need the money arent getting it.unemployment effective days remaining is the only thing changing.still no type of income help though.

ok found out if you are on a payment plan that they take the money out of your checking account they will not use that information. I had to also pay small amount last year and they won’t use that acct (same one) either But can find no way to update the acct information to receive check and wife and I do qualify

Ok so once we us the get my payment tool and update our info any idea on how long it takes from that point to be issued our money? Will they disperse money as people update their info or will it all be sent out at once again to the people who had to update info.

Hey, I know!

Let’s slash funding for agencies like the CDC and the IRS under the guise of an unjustified tax cut, and still expect everything to work!

Day three, and still no money and no change on the message.

Same message for me and my wife!! WTF. We filed taxes every year, and already did this year. However, we relocated in 2019. Do I need to use my old 2018 address when submitting on the “Get my payment” tool for it to work? I tried it, and it still didn’t work, but my old address was an apartment and I’m not sure if I typed in the apartment numbers in the correct format for whatever the stupid website is reading.

If and when this clears up for some of you please post.

Hey Larry! Wanted to update since you asked 🙂 I was getting the same message as you all and even checked this morning and there was no change. I JUST checked recently and it’s switched to say my payment will be deposited on April 22nd. So have hope everyone!!! I’m sure they are working hard trying to get these out to everyone, but I also know how stressed I was about having that “status unavailable” message on the app even after they had already processed my tax refund for this year. I understand you all’s frustration as I was paranoid checking every day. So keep checking and hopefully it will change!

Hi. Thanks. I received mine in my bank account today even though I checked IRS site at 8 last night and received the same status unavailable as before. So it looks like it will eventually work for most people.

Oh great, so happy to hear that!! Yeah it must just be that they aren’t updating the website in time before they deposit for everyone. That’s reassuring to hear you received yours!

I give up

I was finally able to enter my direct deposit info via the get my payment tool but when I tried to check my status today, it told me I have to try again in 24 hours due to accessing too much but I had only tried that one time so I don’t understand!

And let me clarify that I entered my dd info yesterday and then tried to check my status today in which it told me to come back in 24 hours but I had only tried that one time today.

When I was finally able to use the get my payment tool, it told me that I was eligible so then I entered my direct deposit info and everything was submitted with no problem but when I went to use the get my payment tool today, it told me to try again in 24 hours but that is the first and only time I’ve tried to retrieve my status.

Hi Leanne,

Had you originally received the “we can’t determine if you’re eligible” message? I’m wondering if that changed for you.

I’ve been receiving that since Wednesday, but we’re definitely eligible. Stumped and frustrated.

Thanks!

It is happening to millions and millions of people. Give it time. Should get worked out.