How to Get The Chase Ink Preferred 100K Offer (In-Branch, Matches) [2019]

The Chase Ink Preferred 100k offer is one of the hottest credit card offers up there with the elusive Sapphire Reserve 100K offer. But where can you find this offer?

The Chase Ink Preferred 100k offer is one of the hottest credit card offers up there with the elusive Sapphire Reserve 100K offer. But where can you find this offer?

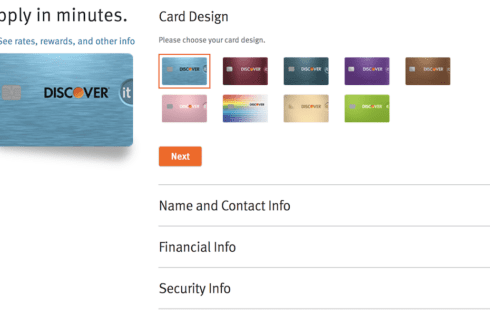

Some credit card issuers allow you to benefit whenever you can successfully refer other people to their credit cards. Discover is one of these banks and they actually have a

Citi pre-qualify offers can provide you with some extra assurance and better interest rates when applying for Citi cards. But how exactly do you get these offers and what do

The Chase Slate is one of the top balance transfer credit cards on the market and it can save you lots of money in interest. But what credit score is

Have you ever paid for an item or service with your credit card only to be severely disappointed with the quality of the product or service? Or have you ever

Chase has some increasingly strict rules and restrictions for applying for their credit cards. There’s the Chase 5/24 rule and there’s also the Chase 30 day rule (2/30 rule). I’m

If you think you are ready to apply for an American Express Card, I highly suggest that you take a look at this article. There are a lot things you

Getting approved for a small business credit card is not nearly as difficult as many think. As long as you have a decent credit score and some form of a

Offers contained within this article maybe expired. American Express offers credit cards that provide you with bonus points for spend at select US department stores. A common question is what

Some credit card issuers, such as American Express will limit you to a specific number of credit cards that you can have. Meanwhile other banks don’t have a firm cut-off.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |