American Express issued two separate gold cards in the past: The Amex Gold Card and the Premier Rewards Gold Card.

The Amex Gold Card is no longer offered to new applicants so now when people refer to Amex Gold Card benefits, they are actually referring to the Premier Rewards Gold Card.

So this article is going to focus on the Amex Premier Rewards Gold Card benefits.

Update: Some offers are no longer available — click here for the latest deals!

Table of Contents

Welcome offer

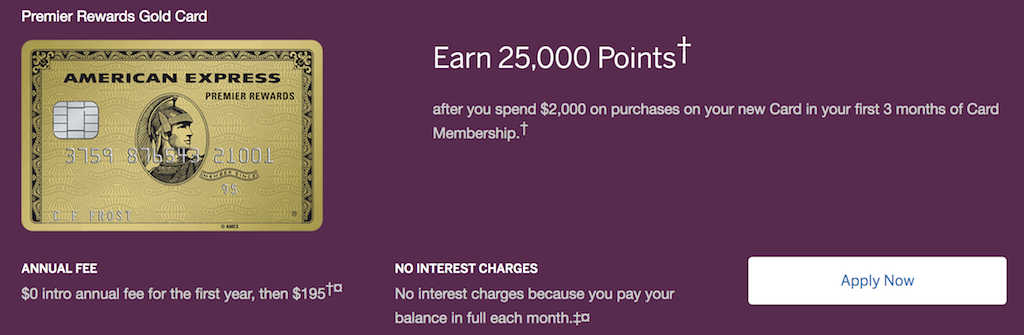

The standard welcome offer for the Premier Rewards Gold Card is 25,000 Membership Reward after you spend $2,000 on purchases on your new Card in your first 3 months of Card Membership.

It’s worth pointing out that sometimes you can receive targeted offers via the mail or Incognito for this card with sign-up bonuses of 50,000 Membership Rewards or more. For that reason a lot of people like to hold out for the higher offers.

But sometimes you’ll never receive those offers so it will just make sent to go for the 25,000 Membership Rewards.

If you’re trying to earn more Membership Rewards in a hurry, then you might want to consider the Amex Platinum Card which comes with a 60,000 Membership Rewards welcome offer after you spend $5,000 or more within the first three months.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Transfer Partners

Once you’ve earned some Membership Rewards, you’ll be able to transfer to some fantastic travel partners.

American Express has arguably better transfer partners than Chase.

With American Express, you can transfer Membership Rewards to airlines like ANA, Aeroplan, Cathay Pacific Asia Miles, British Airways/Iberia, Flying Blue, Delta, Etihad, Emirates, and several others. These programs offer some of the most valuable sweet spots to fly in business class and first class all around the world.

Here’s a list of all of the Amex Membership Rewards partners:

Amex Airline Transfer Partners

- Aeromexico 1:1.6

- Air Canada (Aeroplan) 1:1

- Air France KLM (Flying Blue) 1:1

- Alitalia (Millemiglia) 1:1

- ANA 1:1

- Cathay Pacific (Asia Miles) 1:1

- British Airways 1:1

- Delta Air Lines (SkyMiles) 1:1

- El Al Israel Airlines 1,000: 20

- Emirates 1:1

- Etihad 1:1

- Hawaiian Airlines 1:1

- Iberia Plus 1:1

- JetBlue Airways 250: 200

- Singapore Airlines 1:1

- Virgin Atlantic 1:1

The hotel transfer partners aren’t quite as strong. Here’s a list for the Amex hotel transfer partners:

Amex Hotel Transfer Partners

- Choice Privileges Rewards (1:1)

- Hilton Honors (1:2)

- Starwood SPG (1000:333)

My favorite redemptions

By far one of my favorite ways to use American Express Membership Rewards was to fly first class on Emirates from Milan to JFK on the A380. The service on that flight was incredible as was the on-board bar and shower.

Another one of my favorite redemptions yet was booking business class with SAS on the way to see the northern lights in Tromsø, Norway. On that redemption, I got exceptional value for my points at 14 cents per mile and paid very minimal fees ($12 per person).

For getting to Europe from North American in business, Aeroplan will often be one of your best options.

Other Redemption possibilities

If you don’t decide to transfer your Membership Rewards to other travel partners you can always utilize them for travel redemptions or purchases.

Membership Rewards can be redeemed in the following ways:

- Between .5 and 1.0 cent per point for gift cards

- 0.6 cent per point for a statement credit/charge.

- 1.0 cent per point on airfare

- 0.7 cent per point on hotels, cruises, and vacation packages.

As you can see, a lot of these redemption rates are 1 cent per point or below and for that reason, I don’t usually recommend these redemption possibilities. But it’s still worth noting what’s possible.

Bonus categories

The Premier Rewards Gold Card is known for being one of the highest-earning Amex travel rewards credit cards when it comes to bonus spend.

If offers the following rates:

- 3X on airfare

- 2X at US restaurants

- 2x at US supermarkets

- 2X at US gas stations

You can use this calculator to estimate your point earnings for a year.

Airfare

The Premier Rewards Gold Card will earn you 3X on airfare purchased directly with the airline which is pretty competitive.

Compare this to the 5X on airfare offered by the Platinum Card.

But there is a way to earn more than 3X on airfare with the Premier Rewards Gold Card. If you book your airfare through Amex Travel, you’ll earn an additional 1X Membership Rewards for a total of 4X on airfare, which is great.

Restaurants

The Premier Rewards card earns 2X at US restaurants.

Note that the restaurant has to be located within the US — it can’t just be a US dining establishment (e.g. Hard Rock Café in Paris).

You also will NOT earn additional rewards at nightclubs, convenience stores, grocery stores, or supermarkets (for this restaurant category).

You may not earn additional rewards at a restaurant located within another establishment. An example of this is when a restaurant is inside of a hotel and your purchase codes as a hotel purchase rather than dining.

Supermarkets

The Premier Rewards card earns 2X at US supermarkets

American Express defines a supermarket as follows: “A supermarket offers a wide variety of food and household products such as meat, fresh produce, dairy, canned and packaged goods, household cleaners, pharmacy products and pet supplies.”

The following are explicitly excluded from earning additional rewards.

Specialty food stores, small corner grocery stores, gourmet shops, natural food stores and large superstores including online superstores (e.g. Amazon), warehouses clubs (e.g. BJ’s Club) and big box stores (e.g. Wal-Mart) are examples of merchants that are NOT eligible for additional rewards.

Gas Stations

A gas station is defined by Amex as “a merchant that is in the primary business of selling gasoline to consumers. A gas station may sell other convenience items, but its primary business is selling gasoline.”

Superstores, supermarkets, and warehouse clubs that sell gasoline are not considered gas stations.

Supplement with the Amex EveryDay Preferred

Earning these rewards are very pretty strong but if you want to really capitalize on Membership Rewards in some of these categories like groceries then you need to consider the Amex EveryDay Preferred.

The Amex EveryDay Preferred earns:

- 3x points at US supermarkets (On up to $6,000 in purchases per year)

- 2x points at US gas stations

- 1x points on other purchases

These are decent bonus categories but what really makes this card such a high earner is that when you use your card 30 or more times on purchases in a billing period you get 50% more points on those purchases!

$100 Airline credit

The Premier Rewards Gold Card offers a $100 airline incidental credit.

Before you make any purchase, you need to select the airline that you’ll be making the purchase with. When you receive your card you can go online at www.americanexpress.com/airlinechoice or call the number on the back of your card to select an eligible airline for the credit.

Qualifying airlines include:

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

American Express officially states that the following qualify for the airline credit:

- Checked baggage fees (including overweight/oversize)

- Itinerary change fees

- Phone reservation fees

- Pet flight fees

- Seat assignment fees

- In-flight amenity fees (beverages, food, pillows/blankets, headphones)

- In-flight entertainment fees (excluding wireless internet because it’s not charged by the airline)

- Airport lounge day passes & annual memberships

The following items are explicitly excluded:

- Airline tickets

- Mileage points purchases or mileage points transfer fees

- Gift cards

- Upgrades

- Duty–free purchases

- Award tickets

You can read more about the Amex airline credit here.

Charge card

The new “Amex Gold Card” is a charge card which is different from a traditional credit card.

A charge card is meant to be paid off in full after each month (which is something that you should be doing anyways).

A charge card comes with no pre-set credit limit. This doesn’t mean that you have an unlimited amount of spend that you can put on your card, though.

Usually, Amex will limit your spend to a reasonable amount until you show them that you’re capable of spending money on your card in higher limits and paying off the bill.

This is why I consider this card one of the best for high spenders.

After a while, Amex will likely offer you something called Pay Over Time, which is a feature where they allow you to pay down large charges over time like a normal credit card. Of course, you’ll be paying interest on a monthly basis so this isn’t always a good idea but it’s something that could help you out if you got caught in a bind.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Lounge access?

The Premier Rewards Gold Card does not offer any type of exclusive airport lounge access membership.

But you could potentially use your $100 travel credit towards airport lounge access which could cover about two lounge visits depending on which lounge you visited.

However, if you’re interested in airport lounge access then you should look into the Amex Platinum Card.

With the Platinum Card, you’ll be offered:

- Priority Pass access for you and two guests

- Centurion lounges access for you and two guests

- Delta SkyClub access when flying with Delta

You’ll also get access to a host of additional benefits like hotel status at Hilton and Marriott, a $200 airline credit and a $200 Uber credit.

The Hotel location

With the Premier Rewards Gold Card you can book through the Hotel Collection with American Express Travel and get the following benefits at participating properties when you stay at least two consecutive nights:

- $75 Hotel Credit, to spend on qualifying dining, spa, and resort activities

- Room upgrade upon arrival, if available

- Pay with your eligible Premier Rewards Gold Card from American Express and you get 2X Membership Rewards® points per eligible dollar spent.

You should note that program is different from the Amex Fine Hotels and Resorts program that is offered to cardholders of the Platinum Card.

Protections

This credit card offers some of the best purchase protections along with some decent travel protections.

Purchase Protection

Your eligible purchases can be covered when they’re accidentally damaged, stolen, or lost for up to 90 days from the date of purchase with your Card on up to $10,000 per occurrence (coverage cannot exceed $50,000 per Card Member account per calendar year).

Return Protection

Coverage is limited to 90 days from purchase, up to $300 per item and up to a maximum of $1,000 per Card Member account per calendar year based on the date of purchase.

Shipping and handling costs for the purchase will not be refunded.

Items are eligible if they are in the original purchase condition and if they cannot be returned to the merchant from which they were originally purchased.

Extended Warranty

Extended Warranty can extend the terms of the original manufacturer’s warranty by up to one year on warranties of five years or less.

Specifically, Amex will match the length of the original warranty if the original manufacturer’s warranty is less than one year, and they provide one additional year if the original manufacturer’s warranty is between one year and five years

Amex has a great extended warranty program and getting covered for up to six years is fantastic.

Baggage Insurance Plan

This perk is for eligible lost, damaged, or stolen baggage when you purchase the entire fare for a Common Carrier ticket (e.g. plane, train, ship or bus) on your eligible Card. Coverage can be provided for up to $1,250 for carry-on baggage and up to $500 for checked baggage.

Premium Roadside Assistance

Call 1-800-333-AMEX when you need help arranging towing (up to 10 miles), winching, jump starts, flat tire change when you have a workable spare, lockout service or delivery of up to two gallons of fuel.

This can be a life-saver and it’s one of the more underrated benefits.

Shop Runner

Shop Runner offers free 2-day shipping on eligible items at a growing network of over 140 online stores. You can search for these stores here.

You can actually sign-up for a trial version (3 months) to see if it’s something you’re intersted in.

No foreign transaction fees

There are no foreign transaction fees.

Membership Experiences

This perk will provide you with access to amazing events in music, theater, sports, and more. You can take advantage of presale tickets and special events, experiences, and offers when you purchase tickets with your Card through the Membership Experiences website.

Amex application rules

Amex cards are subject to several specific rules when applying. For example, you can only apply for a specific amount of American express cards within a 90 day period. Another restriction limits you to applying for one individual credit card at a time in the majority of instances.

The good news is that charge cards are subject to less restrictions than credit cards. You can read more about these restrictions here.

Final word

The Premier Rewards Gold Card is a great travel rewards card when it comes to earning valuable Memberships Rewards. It is a really good card when ever you can get the 50,000 point sign-up bonus, but it can still be a worthwhile card for its great bonus categories and other perks like the airline travel credit.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.