There are a hand full of options that come to mind when I think of the best gas credit cards for small businesses. You’ve got a lot of things to consider like: the type of rewards you want to earn (cash back vs transferrable currency) and also things like annual fees, foreign transaction fees, and of course the most important thing: the bonus spend categories.

In this article I’m going to cover eight small business credit cards that could be utilized to cash in on rewards for gas purchases. You’ll see credit cards with different bonus earning rates ranging from 1% to over 5% back on gas purchases and many of them will have bonus earnings on other categories.

Update: Some offers are no longer available — click here for the latest deals!

My #1 gas credit card

If you don’t have the time to go through this entire 3,000 word article and read up on your options, my #1 gas credit card is the newly revamped American Express Business Gold for the following reasons:

- Ability to earn 4X Membership Rewards on gas (terms apply)

- Ability to earn 4X Membership Rewards on an additional category

- Points transfer to some of the best transfer partners

- Up to 1 year of ZipRecruiter

- Charge card with potential for high credit limit

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Are you new to small business credit cards?

If you’re looking for the best gas cards for small businesses but you’re new to small business credit cards there are some things you should know.

First, you will be personally liable for all of the charges put on the credit card. Your initial credit card application will be based primarily if not entirely on your personal credit report since you haven’t established credit for your business.

So as long as you have a decent credit score with some credit history, you’ll probably be in good shape to give your application a shot. But I highly suggest that you read my article on how to get small business credit cards because there are some tips and tricks in there that could help you increase your approval odds if you’re worried about getting rejected.

How much do you spend on fuel?

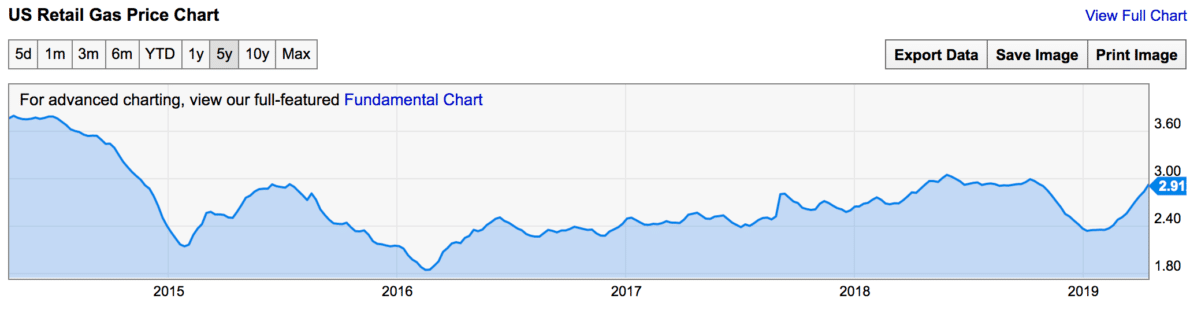

The price of gas is on the rise again as shown by ycharts.com below:

This means that it’s going to be more important than it’s been in a while to ensure that you’re getting the most back in gas rewards.

If you spend a significant amount on fuel, it could make sense to go for a credit card to use solely on your gas purchases even if that credit card comes with an annual fee.

But to figure that out you first need to breakdown your expenses.

Try to map out how much you spend on gas so that you can make the most informed decision as possible when choosing a credit card. Also note that many of the best gas cards for small businesses also earn bonus rates for other categories that can be very lucrative like travel, office supply stores, and advertising.

For the best results that will maximize your cash back earnings you should audit your expenses so that you have a thorough breakdown of the different categories that you primarily spend in.

The 8 Best Gas Cards for Small Businesses

Chase Ink Cash

The Chase Ink Cash is one of my favorite business credit cards for a few reasons. It comes with no annual fee yet you still get some killer cash back rates.

The Chase Ink Cash earns 5% cash back on the first $25,000 spent in combined purchases each account anniversary year at:

- Internet

- cable

- and phone services

- Office supply stores

It’s very easy to spend a big chunk on fixed expenses of internet, cable, and phone services. These expenses that you are going to making regardless and they are easy to make via credit cards online so there’s really no reason to not be cashing on these bonus categories.

Earn 2% cash back on the first $25,000 spent in combined purchases each account anniversary year at:

- Gas stations

- Restaurants

Getting 2% back on gas and dining is decent but it’s not industry leading.

I probably wouldn’t seek out the Ink Cash just for gas. But if you have to pay internet, cable, and phon bills then you should consider this card. Even if you were paying $400 a month on those expenses, that’s still $20 back in your pocket each month, or $240 back each year which is nice.

Also, if you have a premium Chase card like the Sapphire Reserve that 2X on gas becomes 3% back through the Chase travel portal at a redemption rate of 1.5 cents per point, so the Ink Cash becomes much more competitive in that scenario.

Rental car perks

One additional reason why the Chase Ink Cash is such a great option for someone who spends a lot on gas for work is that they might also be renting a lot of vehicles when they travel. If that’s the case a significant perk of the Ink Cash is that it offers primary rental car coverage (when renting for business purposes) and provides reimbursement up to the actual cash value of the vehicle.

This is something very rare to find offered by a credit card with no annual fee and could end up saving you a lot. By having primary coverage, you won’t have to file a claim with your insurance company which means that your monthly premium won’t rise and you’ll probably be able avoid some fees. So don’t undervalue this perk if you regularly rent vehicles.

SimplyCash Plus Business Credit Card from American Express

Update: this card is no longer available:

The SimplyCash Plus Business Credit Card from American Express is a very popular business credit card and for good reason. What makes the card such a valuable product is that it comes with some fantastic bonus categories.

With the SimplyCash Plus Business Credit Card you’ll earn 5% cash back at U.S. office supply stores and on wireless telephone services purchased directly from U.S. service providers.

You’ll also earn 3% cash back on the category of your choice from a list of eight categories:

- Airfare purchased directly from airlines

- Hotel rooms purchased directly from hotels

- Car rentals purchased from select car rental companies

- U.S. gas stations

- U.S. restaurants

- U.S. purchases for advertising in select media

- U.S. purchases for shipping

- U.S. computer hardware, software, and cloud computing purchases made directly from select providers

5% and 3% apply to the first $50,000 in purchases per calendar year, then 1% applies thereafter.

One thing to keep in mind about this credit card is that it does come with foreign transaction fees. So if a lot of your spending on fuel comes on international trips then you’ll get hit with those foreign transaction fees. Also, you won’t even be earning bonus points on fuel expenses since it only earns a bonus rate on US gas stations.

Another great feature about this card is that you can spend above your credit limit when needed, though that limit will be adjusted based on your payment history, credit record, financial resources known to Amex.

Chase Ink Preferred

Earn 3 points per $1 on the first $150,000 spent in combined purchases each account anniversary year on:

- Travel, including airfare, hotels, rental cars, train tickets and taxis

- Shipping purchases

- Advertising purchases made with social media sites and search engines

- Internet, cable and phone services

The Chase Ink Preferred doesn’t offer a bonus category on gas but it could still be great for people who spend a lot on fuel. The reason is that it comes with a high sign-up bonus of 100,000 Ultimate Rewards after you spend $15,000 in the first three months, which is worth at least $800 in cash back.

If you spent $26,666 on gas on a 3% cash back card you’d earn $800 worth of rewards so the fact that you could earn that much with only $5,000 is fantastic for the short-haul. But if you’re thinking about long-term earnings then you would want to eventually get a card that earns a bonus rate on fuel.

It should be noted that valuing 100,000 Ultimate Rewards at $800 cash back is actually very low. That’s because you could redeem those points through the Chase Travel Portal for more or you could transfer those Ultimate Rewards out to some fantastic travel partners.

The Ink Preferred also comes with cell phone insurance which will protect your phone for damage up to $600 against damage or theft, 3 times per 12-month period so long as you pay your cell phone with this credit card. (You do have to pay a $100 deductible.)

And finally, Chase offers some of the highest referrals for the Chase Ink Preferred so you could earn up to 20,000 Ultimate Rewards per approval up to a maximum of 100,000 points per calendar year. This means that you could earn $200+ back when each time you successfully refer someone.

American Express Business Gold

The American Express Business Gold is the newly revamped gold card from American Express. It stands out with its bonus earning potential, which covers a lot of categories that businesses will need to make purchases in.

With this card, you earn 4X Membership Rewards points on the 2 categories where your business spent the most each billing cycle from the list below:

- Airfare purchased directly from airlines

- U.S. purchases for advertising in select media (online, TV, radio)

- U.S. purchases made directly from select technology providers of computer hardware, software, and cloud solutions

- U.S. purchases at gas stations

- U.S. purchases at restaurants

- U.S. purchases for shipping

So this can be another great card for those to spend a lot on gas. But if you also need to spend a lot on software or cloud storage or advertising this can be a great card for those categories. And for those who run businesses where they need to ship a lot of products this is another solid option.

4X points applies to the first $150,000 in combined purchases from these 2 categories each calendar year then earn 1 point per dollar.

Here are a couple of the additional features of the card:

- Get 25% points back, after you book a flight using Pay with Points (up to 250K points back)

- $295 Annual Fee

The big thing to note about this card is that earns Membership Rewards and not just straight cash back. This means that your points will be better used on some of the Amex travel partners like Delta, ANA, Aeroplan, or others.

Another feature to note about this card is that it is a charge card and not a traditional credit card. This means that the balance must be paid off each month and that you don’t have a set credit limit (although that doesn’t mean that it’s unlimited). This is why it’s a great business card for those who need high credit limits.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Amex Blue Business Plus

The Amex Blue Business Plus is another one of my favorite small business credits.

It doesn’t earn bonus points on a special fuel rewards bonus category but earns 2% back on all purchases up to $50,000 per year. But the card also comes with no annual fee and a 0% intro APR period of 12 months. So if you need to make a large purchase in any category this is a great option, since you could put the charge on the card and earn 2% back and then pay off your balance before that 0% intro period is over with.

Since the Amex Blue Business Plus is a credit card and the Business Gold Rewards Card is a charge card you can actually apply for both of these at the same time. Together, the two would give you very well-rounded bonus earning potential with 2X on all purchases and up to 3X on gas or other categories. You can read more about the Amex application rules here.

There have been welcome offers for this card at 25,000 before but those offers have been pretty rare and usually disappear really quickly. Because of the 2X Membership Rewards, this card is worth considering even when it doesn’t have a welcome bonus because it has potential for some exceptional long-term earnings.

Capital One Spark Cash for Business

The Capital One Spark earns an unlimited 2% cash back on all purchases. It’s a very straight forward credit card with no special bonus categories. So if you don’t need a card that focuses on the gas category alone then you could use this card to earn 2% back all across the board.

The Spark comes with a $0 intro annual fee for the first year, and it’s $95 after that. It also comes with a great early spend bonus of $500 when you spend $4,500 on purchases within the first 3 months from account opening. And finally, the card comes with no foreign transaction fees so it’s great for travelers.

One thing to note about the Capital One Spark is that it will usually report to your personal credit report. So if you’re trying to stay under 5/24 so you can apply for Chase cards, you might want to consider one of the other options listed in this article.

Amex Hilton Honors American Express Business Card

The Amex Hilton Honors American Express Business Card can earn you bonus rate on your fuel purchases. The card earns 12X on Hilton purchases and 6X on select business and air travel purchases which include:

- U.S. gas stations

- Wireless telephone services purchases directly from U.S. service providers

- U.S. purchases for shipping

Getting 6X on Hilton points on gas stations is like getting a little bit less than 3% based on a point valuation of just under .5 cents per Hilton Honors point. That’s not a horrible return but obviously you need to have a plan or desire to use your earnings at Hilton properties if you go with this card.

The Hilton business card grants you automatic Hilton Honors Gold Status and allows you to upgrade to Diamond Status by spending $40,000 on eligible purchases on your Card in a calendar year. If you spend $15,000 in a year, you’ll earn a free weekend night which can be used on even the most expensive properties like the Conrad. And finally, the card comes with no foreign transactions and the annual fee is $95 and is not waved.

Sometimes the only reason you need a small business credit card is to segregate your personal expenses from your business credit card. If that’s the case then there may be no difference between using a personal card versus a business card to segregate your expenses (just remember that some business credit card protections only apply to business-related activities — check with the respective bank for details).

If the above applies to you then you might to think about going for a personal credit card to maximize your gas rewards.

Amex Blue Cash Preferred

I think that the Amex Blue Cash Preferred is one of the best cash back credit cards on the market. It earns 6% back at US supermarkets, on up to $6,000 per year in purchases (then 1%). It also earns 3% cash back at US gas stations and select US department stores.

If you’d rather earn Membership Rewards then you might want to look in to the Amex EveryDay and Amex EveryDay Preferred. Those cards offer great bonus earning categories but only the Amex EveryDay Preferred earns bonus on gas (up to 3X). You can read my comparison of these cards here.

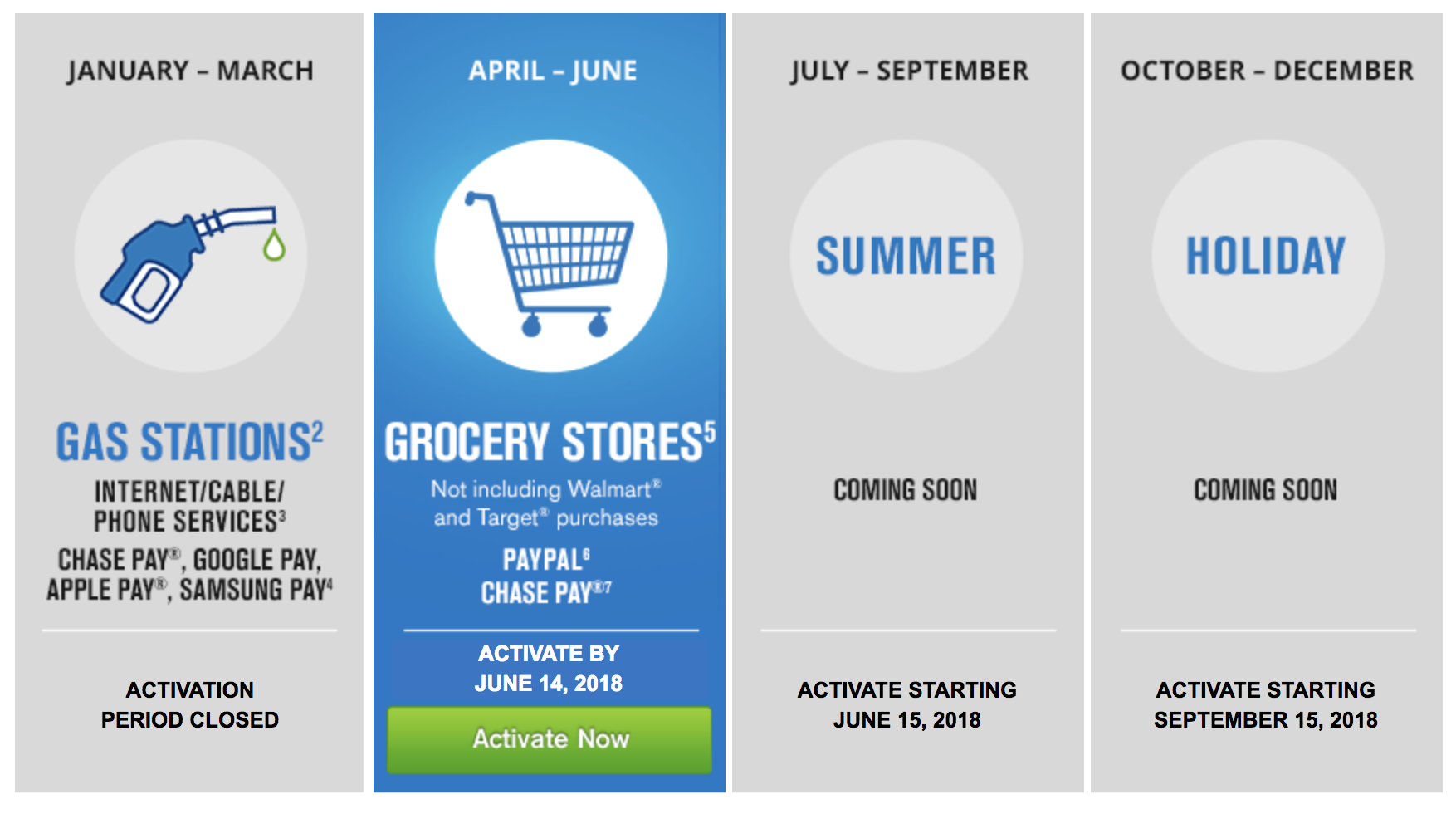

Rotating Quarterly Categories

If you’re considering personal cards then you also have to entertain the idea of going with a card that offers rotating 5% back on gas.

My top option for such a card would be the Chase Freedom. These cards limit you to $1,500 worth of bonus spend per quarter on that category so the maximum that you’d be able to earn in cash back is $75 but that’s a great return. You can learn more about the Chase Freedom here.

And finally there are a lot of obscure credit cards that offer high returns on gas and you can read about those credit cards here.

Final word

These are all some of best gas cards for small businesses that you might want to go with. I would personally try to earn a minimum of 3% back or 3X in Membership Rewards, although getting 2X in Ultimate Rewards is like getting 3% back in travel if you can use the Reserve to redeem points at 1.5 cents per point.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

One comment

Comments are closed.