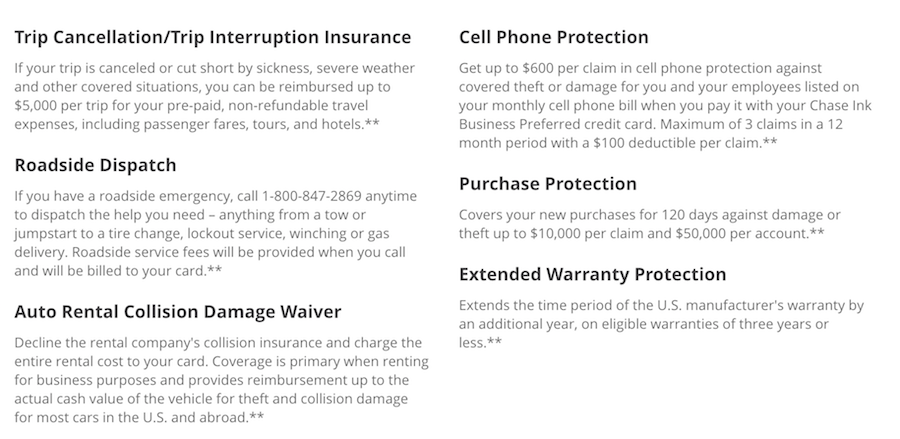

The Chase Ink Business Preferred is arguably the most valuable business credit card.

It’s one of the best business credit cards for entrepreneurs with it bonus categories on advertising and travel but it’s also a great card to pay your cell phone bill with.

Here’s the ultimate guide to the Chase Ink Preferred cell phone protection (insurance).

What is the Chase Ink Business Preferred Cell Phone Protection?

The Chase Ink Business Preferred cell phone protection will protect you against damage, theft, or involuntary and accidental parting of your cell phone when you use your Chase Ink Preferred to pay your phone bill.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

What does “involuntary and accidental parting” mean?

Involuntary and accidental parting with property means “the unintended separation from an item of personal property in which the item’s location is known but recovery is impractical to complete.”

So for example if you unintentionally drop your phone in the ocean then you might have grounds for coverage since you know it’s in the ocean but draining the ocean and/or going on a scuba mission to recover your phone is pretty impractical.

However, if you just left your phone sitting out somewhere but can’t remember, your phone could be anywhere so you can’t argue that you know its location.

So the take-a-way is that lost phones are not covered. I think there’s definitely some grey area in the language regarding practical recovery and some benefit services love to fall back on grey areas in their terms to deny coverage.

Thus, be prepared to plead your case if you’re going to argue recovery of your phone is “impractical.”

$100 deductible

The protection requires a $100 deductible per claim and allows a maximum of 3 claims per 12 month period. You will receive no more than the purchase price less your $100 deductible. The maximum coverage limit is $600 per claim and $1,800 dollars per 12 month period.

Practically speaking, this means you’re able to get up to $500 worth of free credit towards repairs or replacements per claim and up to $1,500 per year.

The $100 deductible is a bit of a bummer for a couple of reasons. For one, if it’s just your screen that needs fixing, you can often find kiosks in shopping malls or online vendors that can fix it for under $100.

It’s also a bit of a bummer because there are other cards that offer $25 deductibles for similar coverage like the Wells Fargo Cash Wise.

But even with that limitation, the protection can still be very worthwhile.

How the cell phone protection coverage works

To be eligible for the cell phone insurance perk you must charge your monthly cellular wireless telephone bills to your Chase Ink Preferred card.

This is key to remember — just being a Chase Ink Preferred cardmember is not enough to kick in the cell phone protection perk. Also, just because you purchased your phone with the Chase Ink Preferred that does not mean that you’ll get coverage.

When the cell phone protection begins

The cellular telephone protection begins the day following your cellular wireless telephone bill payment and remains in effect until the last day of the calendar month following the payment. Coverage is suspended if no payment is made on your eligible card.

This is another key thing to consider.

The cell phone insurance does not kick in until “the day following your cellular wireless telephone bill payment.” So until you actually make a payment on your cell phone bill, you are not covered by the Chase Ink Preferred.

To illustrate, say you get a new cell phone on March 15, 2019 but you don’t make a payment until March 31, 2019. This means that the protection won’t apply to any damage that occurs in the month of March 2019.

When the cell phone protection ends

Also, if you ever fail to make a payment or switch up your payment then you will eventually lose the protection. In those situations, the coverage would end the last day of the calendar month following the payment.

Coverage is secondary

The cell phone protection is supplemental to cellular wireless telephone insurance programs, homeowner’s, renter’s, automobile, or employer’s insurance policies.

What this means is that if you have cell phone insurance like that offered by Verizon, this benefit only kicks in when that coverage has been exhausted.

What is not covered?

There’s a pretty extensive list of items that are not covered.

But I’ll focus on three areas I think are pretty important.

“Mysteriously disappear”

Phones that are lost or “mysteriously disappear” will not be covered. Mysterious disappearance” means the “vanishing of an item in an unexplained manner where there is absence of evidence of a wrongful act by a person or persons.”

Again, I think there’s a lot of room for interpretation with this provision. I take it to mean that if you claim your phone was stolen from your car but there’s not a police report or any supporting documentation, that probably falls under “mysteriously disappeared.”

Pre-paid phones

You should know that phones that have been rented, leased, borrowed or that are a part of a pre-paid wireless service plan or “pay as you go” type service plan are not eligible.

Phones not purchased from authorized dealers

Cell phones not purchased from a cellular service provider’s retail or Internet store, (for example: Verizon Wireless, Sprint Wireless, etc.) or from an authorized cellular phone retailer are not eligible.

Additional exclusions

The following items are also excluded:

- Phone accessories

- Phones purchased for resale.

- Phones under the care and control of a common carrier

- Phones stolen from baggage unless hand-carried and under your supervision

- Cosmetic damage to the phone that does not impact the functionalities of the phone.

- Damage or theft resulting from abuse, intentional acts, fraud, illegal activities, etc.

- Damage or theft resulting from mis-delivery or voluntary parting with the cellular wireless telephone.

You can look more into the terms and conditions here.

How do I file a claim?

It’s really important to contact the Benefit Administrator at 888-320-9956 within 60 days of damage, theft or involuntary and accidental parting. If you wait any longer than that, your claim may be denied.

The Benefit Administrator representative will ask you some preliminary questions and send you a claim form or you can file your claim online.

I recommend filing a claim online because it’ usually much easier. You’ll go to the Card Benefit Services website to file online.

This claim form must be completed, signed, and returned with all the requested documentation within 90 days from the date of the incident, or your claim might be denied.

The process for filing online is very similar to filing an extended warranty claim for cell phone protection which you can read about here.

What do I need to submit with my claim?

Just like with any other credit card protection, you need to do your best to keep records of every document related to the benefit you’re seeking.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Standard documents needed

The documents that you’ll need to submit a claim may include:

- Your completed and signed claim form.

- Copies of your card statement showing the entire monthly cell phone payment(s) preceding the date of damage, theft or involuntary and accidental parting.

- A copy of your cell phone bill that corresponds with the above card statement.

- A copy of your cell phone provider’s wireless device page or other sufficient proof, as determined in the Benefit Administrator’s sole discretion, of the cellular wireless telephone model currently linked to Your cellular wireless telephone account.

- If the claim is due to theft or criminal action, a copy of the police report or incident report filed within 48 hours of the occurrence.

If the claim is due to damage, a copy of an insurance claim or other report as the Benefit Administrator, in its sole discretion, deems necessary to determine eligibility for coverage.

Additional possible documents needed

In addition the Benefit Administrator may in its sole discretion require:

- (a) An itemized estimate of repair from an authorized repair facility

- (b) The cell phone in question

- (c) an itemized store receipt for the replacement cell phones showing the purchase was made at an authorized cellular service provider’s retail or Internet store.

As you can see, the Benefit Administrator is going to want to see documents to back up everything. It shouldn’t be difficult for you to retrieve most of these items online but when it comes to itemized receipts or even the cell phone itself, you need to make sure you’re prepared to hand those over if needed.

How will I be reimbursed if my claim is approved?

Depending on the nature and circumstances of the incident, the Benefit Administrator, at its sole discretion, may choose to repair or replace the cellular wireless telephone or reimburse the Cardholder for the lesser of:

- a) $600 dollars excess of the $100.00 deductible; or

- b) the current suggested retail price of a replacement cellular wireless telephone of like kind and quality, excluding taxes, delivery and transportation charges, and any fees associated with the cellular wireless telephone service provider, less the $100.00 deductible.

Under normal circumstances, reimbursement will take place within ten (10) business days of receipt and approval of claim form and all required documents.

Additional Provisions for Cellular Telephone Protection:

This protection provides benefits that only apply to the cardholder and eligible lines listed on the most recent cellular provider’s monthly billing statement for the billing cycle prior to when the incident occurred.

Many state that the protections only apply to employees on the monthly billing statement but the terms and conditions don’t clarify that.

Here are some additional restrictions:

- If You make any claim knowing it to be false or fraudulent in any respect including, but not limited to, the cost of repair services, no coverage shall exist for such claim and the Cellular Telephone Protection benefit may be canceled.

- Once you report an occurrence of the incident, a claim file will be opened and shall remain open for six months from the date of the incident. No payment will be made on a claim that is not completely substantiated in the manner required by the Benefit Administrator within six months of the date of the incident.

Other cards that provide cell phone insurance

There are a few other credit cards that provide this benefit but they are personal credit cards.

Wells Fargo credit cards

Wells Fargo has some great rewards credit cards that I think a lot of people sleep on. Several of these cards like the Well Fargo Propel and the Cash Wise card come with cell phone protection up to a maximum benefit limit of $600 per claim and $1,200 per 12 month period.

But what makes them stand out is that the deductible is only $25.

Barclays Uber

The Barclays Uber card is one of the best cash back credit cards and arguably the best card for dining since it earns a whopping 4% back!

Other cards

A few other cards also offer cell phone protection including the Absolute Rewards card from First National Bank of Omaha and the Platinum Visa from U.S. Bank.

Chase Ink Cell Phone Protection FAQ

The deductible is $100 per claim.

You can file a maximum of three claims per 12 month period.

The maximum coverage limit is $600 per claim and $1,800 dollars per 12 month period.

You can trigger coverage by paying your cell phone bill with your Chase Ink Business Preferred.

Phones that have been rented, leased, borrowed or that are a part of a pre-paid wireless service plan or “pay as you go” type service plan are not eligible.

The Chase Ink Cash is a great card but unfortunately it does not provide cell phone protection. Also, the Chase Sapphire Preferred (full card review) and the Chase Sapphire Reserve also do not provide these benefits.

No, you only need to pay your cell phone bill with the Chase Ink Preferred in order for the benefit to kick in.

Final word

The Chase Ink Preferred cell phone protection benefit is a great perk but it does have its limitations compared to other cards. The most important thing is to know is that you must pay your cell phone bill with the Ink Preferred in order for coverage to kick in and that you need to document everything as best you can so that you can smoothly process your claim.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Do I need to pay the entire cell phone bill on my ink card or can I do a partial payment, in order to be eligible for insurance coverage?

I received a $150 verizon gift card after I purchased a new phone. Another phone on my bill needs to be repaired (maybe replaced). Last month I applied the $150 gift card to my account and the Chase Ink Business Preferred paid the balance. Is this still covered since I didn’t pay the entire amount with the credit card? thank you