The Disney Premier Visa Card is an extremely popular travel rewards card offered by Chase. I know many Disney-lovers with this card and often come across others who have it or are thinking about picking it up.

But is this card actually a valuable card or is its popularity just the result of great marketing and placement by the Disney media machine?

In this article, I’ll break down the Disney Premier Visa Card and tell you everything you need to know about its benefits and perks. I’ll talk about Disney Rewards, custom card designs, and how things like the airline credits work.

Table of Contents

Welcome bonus

The Disney Premier Visa Card typically comes with a $200 statement credit after spending $500 in the first three months. I have also seen this card offering a welcome bonus worth $250.

Personally, I don’t think that it is necessary to wait for the $250 bonus to come around and jumping on the $200 statement credit is probably decent enough (sometimes the no-fee version even has a $200 offer).

You can find other Chase cards with much more valuable welcome bonuses like the Chase Sapphire Preferred which offers a welcome bonus of 60,000 points after spending $4,000 in the first three months. Those 60,000 points will be worth at least $600 but could easily be worth much more than that for travel expenses.

So for the average Disney fan/tourist, the Disney Premier Visa Card’s bonus can be a nice boost but for someone trying to really maximize their wallet, they would want to go with other cards with more lucrative offers.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Bonus categories

- 2% in Disney Rewards Dollars on card purchases at:

- Gas stations

- Grocery stores

- Restaurants

- Most Disney locations

The eligible Disney locations where you can earn 2% back with this card include locations at:

-

- Walt Disney World® Resort,

- the Disneyland® Resort,

- Disney store locations in the U.S.,

- shopDisney.com,

- Disney Cruise Line,

- Disney Vacation Club® and

- Adventures by Disney®

The big difference between this card and the no annual fee version is that with the Disney Premier Visa Card you can earn 2% on some purchases and the no annual fee version only earns 1% back on all purchases.

If you are serious about maximizing your rewards on spend you can do much better than 2% back on gas, groceries, and restaurants. For example, I earn 4X at restaurants and US supermarkets with the Amex Gold Card and those earnings come out to around 7%, which is way higher (though the annual fee is a lot higher).

If you want to earn more bonus points on your travel purchases on Disney Tickets, consider booking your tickets through Undercover Tourist, which codes Disney bookings as travel. Some cards like the Sapphire Reserve could earn you 3X Ultimate Rewards on those Disney purchases versus the 2% back.

Also, you can use cards like the Chase Ink Business Cash or Chase Freedom to purchase Disney Gift Cards and sometimes earn a whopping 5X Ultimate Rewards which would be like getting close to 10% back depending on your valuations (though you have to deal with gift cards and could lose out on travel protections).

I will say that earning 2% back on all of these categories on one low-annual fee card is not that bad. It’s just worth noting that there are no annual fee options out there that offer 2% back on all purchases and other alternative routes that will be more lucrative.

So if you use the Disney Premier Visa Card for your all or most of your spend, you’re getting decent rewards but just know that you could probably be doing a lot better.

- Related reading: New Disneyland Web Slingers: A Spider-Man Adventure

Rewards

The rewards for the Disney Premier Visa Card are a little confusing to some people but here’s how it works.

First, you will earn 2% back in the form Disney Rewards Dollars with your Disney Premier Visa Card. So it is important to realize that you are not earning “cash back” but instead “Disney Rewards Dollars.” One Disney Rewards Dollar is worth $1 USD.

Once you have earned Disney Rewards Dollars, you can then transfer those points to a Disney Rewards Redemption Card or use them for a statement credit towards airline ticket purchases.

Here is an important thing to note: once Disney Rewards Dollars are transferred onto a Disney Rewards Redemption Card, they cannot be transferred back into your Disney Rewards account. This means once you transfer them, you can no longer use them for a statement credit towards airline ticket purchases.

After linking your Disney Rewards and Chase account, you will need to order a Disney Rewards Redemption Card which you can do by going to the Disney Visa Account page and selecting “Order a new Disney Rewards Redemption Card,” or by calling 1-800-300-8575. I believe you’ll need 20 Disney Rewards to order your Disney Rewards Redemption Card and you are allowed a maximum of two.

It could take two to three weeks for you to receive your card and you’ll need to activate it when it arrives. However, if you are pressed for time there are a few locations at both Disneyland and Walt Disney World where you can pick up a Disney Rewards Redemption Card.

Disney Rewards Redemption Card

There are a lot of places within the Disney Universe where you can use your Disney Rewards Redemption Card. Obviously, many cardholders will want to use their Disney Rewards at the main Disney theme parks but don’t forget about places like Disney Springs, Downtown Disney, Disney Cruises, etc. (You can also use your Disney Rewards for Disney/Pixar/StarWars movies at AMC theaters.)

You can see all the different ways to redeem your Disney Rewards here.

Airline credit

You can use your Disney Rewards Dollars for a statement credit towards airline ticket purchases made with your Disney Premier Visa Credit Card within 60 days after your purchase.

Note that Disney Rewards Dollars cannot be redeemed for an airline statement credit using a Disney Rewards Redemption Card. Also, the no annual fee Disney card does not get this perk.

The airline credit redemptions start at 50 Disney Rewards Dollars for a $50 airline statement credit. One good thing about this credit is that you don’t have to be flying to Disney to use it — you can activate the credits for tickets with any airline to any destination. But keep in mind it doesn’t apply to incidental expenses like baggage fees.

The airline statement credits will post to the card account within five to seven business days of a request to redeem.

Related reading: Southwest Vacations Guide: Does it Really Save you Money?

0% promotional APR

- 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase.

Let’s face it, Disney trips aren’t cheap. In some cases you’ll need to carry a balance to finance your trip. This 0% APR period of six months can help you do that.

It is worth noting that if you’re really trying to avoid interest, you can find other cards offering 0% interest for much longer periods, such as 12, 15, or even 18 months. So if avoiding interest it a top priority, you might want to think about other options with longer promotional APR periods.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Disney Premier Visa Card Benefits

The Disney Premier Visa Card comes with a lot of benefits that can save you money.

Merchandise discount

- 10% off select merchandise purchases of $50 or more at select locations at Disneyland and Disney World

Special photo ops

- Special photo ops with Disney or Star Wars Characters, held in private locations (You also get downloads of your photos.)

Dining discount

- 10% off select dining locations most days at Disneyland and Disney World.

Tours discount

- 15% off the non-discounted price of select guided tours at Disneyland and Disney World.

Shopping discount

- 10% off select purchases at Disney store and shopDisney.com.

Events at Disney Stores

- Access to exclusive Disney Visa Cardmember events at Disney store.

VIP Broadway package

- VIP Package at Disney broadway shows like The Lion King when you use your Disney Visa Card to purchase premium tickets.

Something that I should point out is that you can get most of these benefits with the Disney debit card for free and also on the no-annual fee Disney credit card. Check out that article for more on how all of the discounts work and all of the terms and conditions.

And remember to always carry your Disney card with you just in case you need it for the perks!

Travel and purchase protections

With the Disney Premier Visa Credit Card, you can get some decent travel and purchase protections that come with the card.

Baggage Delay Insurance

Baggage delay will reimburse you for essential purchases like toiletries and clothing for baggage delays over six hours up to $100 a day for three days. It’s nice that it kicks in after six hours and usually you’ll always have your bags by three days, so this is a good perk for a low annual fee card.

Purchase Protection

Purchase protection covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account. The $500 is very low compared to premium cards like the Chase Sapphire Reserve that have a $10,000 limit! If you really want solid purchase protection, you should consider putting your purchase on a card like the Chase Sapphire Reserve.

Extended Warranty Protection

This will extend the time period of the U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less. Again, this is a great perk for a low annual fee card though better warranties can be had with Amex cards that add time to warranties up to five years.

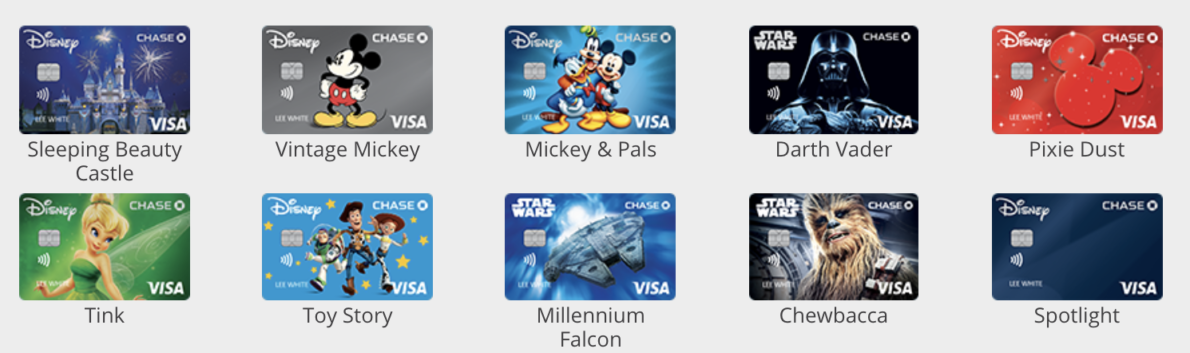

Disney Premier Visa Card card designs

One thing that many people love about the Disney Premier Visa Card is that you can choose from one of many different credit card designs. Although design has no bearing on the benefits, for Disney and Star Wars fans, it’s fun to whip out a Chewbacca credit card (much like it can be for the Marvel cards).

Chase will let you change your design as much as you’d like for no additional charge. Furthermore, each authorized user can choose a unique card design.

Here are some of the designs available in the fall of 2019, but I believe that some of these do change on a semi-regular basis.

These are different from the debit cards designs, so it’s possible that you could have two different Disney designs on your cards if you bank with Chase.

Annual fee

- $49

The Disney Premier Visa Credit Card has a low annual fee of only $49, making it very appealing to the masses.

Final word

The Disney Premier Visa Card has a semi-complicated reward structure but overall decent earning rates of 2% across many categories to go along with a low annual fee.

I like that it has some additional benefits like a 0% APR intro period, travel and purchase protections, and a lot of ways to save with Disney (although you can get those discounts with a debit card). And you can’t forget about the custom designs which are great for Disney fans.

Overall, I think the Disney Premier Visa Card is a decent credit card for Disney fans but if you’re really trying to maximize the value out of credit card travel rewards, you want to at least pick up an additional card or two.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

i like this card i wont it