Are you interested in metal credit cards? Now-a-days, there are a lot of metal credit cards to choose from but they are not all created equally…. These cards come in various weights and materials and some have absurd annual fees while some even have no annual fee.

But the most important thing to note is that they come with vastly different benefits.

This article will show you 17 of the best metal credit cards and give you an idea of which metal cards are worth it and which ones you might want to pass on. I’ll also show you how to get custom metal cards and how to properly destroy your metal cards when you no longer have use for them.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Table of Contents

What are metal credit cards?

Metal credit cards are credit cards that come with some form of metal which could include brass, copper, brushed stainless steel, titanium, gold, and even rare palladium.

Some are 100% metal while others come with metal sandwiched between layers of plastic. Metal cards have been around for a while but it’s only recently in the last couple of years that they’ve gotten very popular and we’ve seen various issuers switch to metal, even for non-premium cards.

Why are some credit cards metal?

I’d have to chalk up metal credit cards to a marketing ploy.

I think there’s an association between heavy credit cards and prestige — almost like the heavier the credit card, the more exclusive it is, the bigger the credit limit, the “more important” you are, etc. (it’s very much a status symbol).

Metal can make your credit card more durable so there is a degree of practicality with metal cards, but I think banks are using these cards as a way to generate interest and intrigue for their products — especially from people who like to feel a little special when they swipe or split a bill with friends, colleagues, homies, etc…

List of metal credit cards

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Amazon Prime

- Marriott Rewards

- Marriott Bonvoy Brilliant

- Ritz-Carlton Rewards

- Chase United MileagePlus Club Card

- JP Morgan Reserve

- Capital One Venture Rewards Credit Card

- Citi Prestige

- Amex Gold Card

- Platinum Card from American Express

- Business Platinum Card from American Express

- Amex Centurion Card

- Black Card

- Gold Card

- US Bank Altitude Reserve

- Apple Card

There are a couple of others like the HSBC Premier World Elite Mastercard and the City National Bank (CNB) Crystal Visa Infinite Credit Card but I’m focusing (mostly) on cards available to the masses.

How to get a metal credit card

As you can see there are many different types of metal credit cards out on the market.

As you’d probably expect, most of these require good to excellent credit scores, so if you want a metal card it will be much easier to get if you have a great credit score. That said, some cards like the Amazon Prime card, are easier to get so you don’t necessarily need a fantastic credit score.

The best metal credit cards

Below are the best metal credit cards that you can get right now.

Chase metal cards

Chase Sapphire Preferred

- 2X on dining and travel

- Redeem points at 1.25 cents per point through Chase Travel Portal

- Primary rental car insurance

- Annual fee: $95 (waived first year)

For a while, the Chase Sapphire Preferred was one of the only metal credit cards available to the masses. I used to get reactions when using it but when metal credit cards became more mainstream, those reactions became less common.

The Sapphire Preferred is a strong travel rewards credit card with 2X on dining and travel along with primary rental car insurance.

I usually recommend people to go with the Sapphire Reserve but not everybody is fine with paying such a large annual fee of $550 so it’s often the case that people want to stick with the Sapphire Preferred, with its low $95 annual fee (that’s waived the first year).

Chase Sapphire Reserve

- 50,000 Ultimate Rewards after spending $4,000 within the first 3 months

- $300 travel credit

- 3X on dining and travel

- Priority Pass with unlimited guests

- Redeem points at 1.5 cents per point through Chase Travel Portal

- TSA Pre-Check/Global Entry $100 credit (read about these programs here)

- Primary rental car insurance

- Annual fee: $550 (not waived first year)

The Chase Sapphire Reserve is the ultimate travel rewards credit card and it’s been a hit since it was launched in 2016. In fact, it was such a hit that Chase actually ran out of metal cards and send out plastic ones.

But the metal status of the Sapphire Reserve is secondary to the fantastic travel benefits and rich rewards offered by the the Reserve. Getting a $300 travel credit that can be used on just about anything travel related is huge and it makes utilizing the travel credit very easy.

Also earning 3X on dining and travel is among the best for any credit cards and then being able to redeem points at 1.5 cents per point through the Chase Travel Portal just adds even more value to the card.

Both the Sapphire Preferred and the Sapphire Reserve are the same weight at about 13g, which puts them is sort of the middle when it comes to the heaviness of their metal.

If there’s one metal card that a serious traveler needs in his or her wallet, it’s this one.

Amazon Prime

- 5% back at Amazon

- 5% back at Whole Food Market

- 2% back at restaurants, gas stations, and drug stores

- No foreign transaction fees

- No annual fee

The Amazon Prime card is one of the only metal credit cards with no annual fee and it also comes with no foreign transaction fees. This is actually a great card for Amazon and Whole Foods shoppers since getting 5% back on a constant basis will certainly add up quickly.

I was surprised to find out that this card is metal but if you’re trying to get a metal card and you’re credit score isn’t very high this might be your best shot.

Marriott Rewards Premier Plus

No longer available.

- 1 Free Night Stay every year after account anniversary (valued up to 35,00 points)

- 6 points for every $1 spent at participating Marriott Rewards and SPG hotels

- 2 points for every $1 you spend on all other purchases and your points don’t expire as long as you make purchases on your credit card every 24 months

- Coming in 2019, Receive 15 Elite Night Credits each calendar year

- Automatic Marriott Silver status

- Marriott Gold status when you spend $35,000 on purchases each account year

The Marriott Rewards Premier Plus is a pretty solid credit card that. It offers a pretty good sign-up bonus and then decent earnings at Marriott properties. The elite credits that will hit in 2019 will be very welcomed though I’m not crazy about the $35,000 spend requirement for Marriott Gold status. Not many hotel co-branded cards are made of metal though so this card is a bit unique.

Marriott Bonvoy Brilliant

- $300 in Marriott statement credits (issued on card anniversary)

- Receive 1 Free Night Award every year for a redemption level at or under 50,000 points.

- Bonus earning:

- 6x at SPG/Marriott properties

- 3x at U.S. restaurants and on flights booked directly with airlines

- 2x on all other purchases

- Complimentary Gold Elite status

- Earn Platinum Elite status after making $75,000 in eligible purchases on your Card in a calendar year.

- Each calendar year you can receive credit for 15 nights towards the next level of Elite status.

- Priority Pass Select membership

- Receive a statement credit every four years after you apply for Global Entry ($100) or TSA Preè ($85) with your Card.

- No foreign transaction fees

- Free, unlimited Boingo Wi-Fi at more than 1,000,000 Boingo hotspots worldwide.

- Receive free in-room, premium Internet access while staying at participating SPG and Marriott Rewards hotels

- Annual fee: $450

The Marriott Bonvoy Brilliant is a premium hotel card that comes in metal and earns a decent return on Marriott purchases. But its key benefits are the free night that can be used at some very expensive properties that cost 50,000 points and the $300 in Marriott statement credits. If you plan on spending a bit at Marriott properties, you can easily offset the value of this annual fee.

Ritz-Carlton Rewards

No longer available.

- 5 points per $1 spent at participating Ritz-Carlton Rewards and SPG hotels.

- Earn 2 points per $1 spent on airline tickets, car rentals, and restaurants

- $300 annual travel credit

- Upgrade to The Ritz-Carlton Club Level 3 times annually on paid stays of up to 7 nights

- Marriott Gold status for one year (need to spend $10,000 each year to retain)

- Saves you $100 on the total cost of between 2 and 5 qualifying round-trip, domestic coach airline tickets purchase

There are metal credit cards and then there are metal credit cards. What I mean by that is that the Ritz-Carlton Rewards Card is very heavy and thick.

When I used this card I would almost always get a “Wow” reaction and many people would even drop the card or fumble around with it since they weren’t expecting such a heavy thing to be going into their hands.

I’d be lying if I said I didn’t enjoy using that card.

The Ritz-Carlton Rewards Card is a strong contender for best metal card for the fact that it’s so heavy and clunky — it’s heavier than the J.P. Morgan Reserve card at 29 grams.

But when it comes to overall travel rewards, it’s sort of an average card.

But if you like to stay at Ritz-Carlton properties this is actually a great card. Two free nights could be worth over $1,000 like when I used those free nights at the Ritz-Carlton Battery Park, New York.

Also, the upgrades to the Ritz-Carlton Club Level on paid stays for up to 7 nights can be an extremely valuable perk since you could get up to 21 nights of that covered which could be worth a ton.

Chase United MileagePlus Club Card

No longer available.

- Access to all United Club locations and participating Star Alliance affiliated lounges worldwide

- Priority check-in, security screening (where available), boarding and baggage handling privileges

- The primary Cardmember and one companion traveling on the same reservation will each receive their first and second standard checked bags free

- World of Hyatt: Discoverist Status (the same status offered by the Hyatt card)

- Hertz President’s Circle® Elite Status

The Chase United MileagePlus Club Card is a premium card ideal for those who frequently fly with United or through airports with United lounges. With this card, you’ll get access to all United Club locations and participating Star Alliance affiliated lounges worldwide.

You’ll also get some key elite-status like benefits, such as priority check-in, boarding, and security screening. They also start you off with Hyatt Discoverist status, although there’s not too much to get excited about when it comes to Discoverist status.

The metal United Club card is one of the lighter metal cards so don’t expect to receive a lot of attention for it.

JP Morgan Reserve

- 3X on dining and travel

- $300 annual travel credit

- Redeem points at 1.5 cents per point through Chase Travel Portal

- Priority Pass with unlimited guests

- TSA Pre-Check/Global Entry $100 credit

- Primary rental car insurance

The J.P. Morgan Reserve, formerly known as the the Chase Palladium Card, is an ultra-premium card that is available by invitation only. The card is virtually identical to the Chase Sapphire Reserve when it comes to perks like bonus spending, the travel credit, and lounge access.

The big difference is that you’ll be required to have a minimum of $10 million in assets managed by J.P. Morgan’s Private Bank (not to be confused with Chase Private Client).

The card comes with a $595 annual fee which isn’t that bad compared to its competitor, the Amex Centurion Card.

This might be the most special metal credit card because it’s made out of brass and palladium, the latter of which is a rare and lustrous silvery-white metal only found in moon rocks (or something like that).

It weighs an impressive 27g, which is on of the heaviest out of any of the metal credit cards.

Tip: Check out the free app WalletFlo so that you can optimize your credit card spend by seeing the best card to use! You can also track credits, annual fees, and get notifications when you’re eligible for the best cards!

Capital One metal cards

Capital One Venture

- Earn 60,000 bonus miles once you spend $3,000 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, every day

- 10X on purchases with Hotels.com (new perk!)

- $0 intro annual fee for the first year, $95 after that

- No foreign transaction fees

The Capital One Venture is one of the most popular travel cards due to its simple rewards structure that earns a straight 2% cash back on all purchases and also because of the Capital One commercials that so frequently grace your TV screen.

This card recently picked up an additional perk that allows you to earn 10X at Hotels.com, which is pretty impressive and now you can also transfer points to travel partners which is pretty amazing.

It seems that not everybody has been given a metal version of the Capital One Venture so this might be something that you’d need to request.

Citibank metal cards

Citi Prestige

- 3X on hotels and airfare

- 2X on entertainment and dining

- 4th night free benefit

- Priority Pass

- $100 Global Entry application fee credit

- $250 Air Travel Credit

The Citi Prestige can be the most valuable credit card if you play your cards correctly. That’s because it earns a 4th night free when you use the Citi booking service. You can use the 4th night free as many times as you’d like so it has the potential to offer you back some serious value.

The $250 air travel credit is not as broad as the Chase Sapphire Reserve but it’s still enough to knock down the annual fee to an effective $200, which is great. All of these other perks like the bonus earning on hotels, airfare, and entertainment and dining are nice but the only perk that makes this card stand out to me is the 4th night free benefit.

The Prestige looks like a fancy black black metal credit card but it actually only weighs about 12g, making it lighter than even the Amazon Prime card!

American Express metal cards

Gold Card

The new Amex Gold Card is a very attractive option. The standard public offer is for 35,000 Membership Rewards but you can sometimes find offers for 60,000 Membership Rewards.

But what really makes this card stand out are the bonus categories which are:

- 3X on airfare

- 4X points at Restaurants

- 4X points at U.S. supermarkets (up to $25,000 in spend per calendar year)

The card also comes with a $120 dining credit, which offers a $10 monthly credit that can be used at Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, and Shake Shack (read more about that credit here). With the addition of a $100 Amex airline credit, it’s very easy knock down the effective annual fee to just $30.

Platinum Card from American Express

Highlights:

- Priority Pass access for you and two guests

- Centurion lounges access for you and two guests

- Delta SkyClub access when flying with Delta

- Hilton Honors Gold elite status

- Marriott Gold

- $179 CLEAR credit

- $200 Hotel credit

- $300 Equinox credit

- $240 Entertainment credit

- 5X on airfare and 5X on hotels booked through the Amex Travel portal

- TSA Pre-Check/Global Entry $100 credit

- Annual fee: $695 (NOT waived first year)

The Platinum Card is my favorite metal credit card because I just love the way it looks and feels. At 18g, it’s much thicker than the Sapphire Preferred and Reserve but not quite as thick as the Ritz-Carlton, so it’s still usually practical to use.

The Platinum Card is just full of benefits, especially when it comes to lounge access. You’ll be able to access Centurion Lounges all around the US, which are some of the nicest lounges around. You’ll also get Priority Pass access and Delta SkyClub access when flying with Delta.

If you spend a lot on airfare the Platinum Card could be the best option for you since it earns 5X on all of those purchases made directly with the airline.

And if you value hotel elite status, then the Platinum Card is great because you’ll get Hilton Honors Gold elite status , SPG Gold Preferred elite status (and therefore Marriott Gold and Ritz-Carlton Gold). These can get you free breakfasts, upgrades, late check-out, and other nice perks.

Business Platinum Card from American Express

- 5X on flights and eligible hotels on amextravel.com

- 1.5X per dollar on each eligible purchase of $5,000+

- Centurion lounge access and Priority Pass for you and two guests.

- Does NOT come with the $200 Uber credit.

- Redeem your Membership Rewards at a rate of 1.54 cents per point with premium cabin flights (and one chosen airline)

- $200 airline incidental credit

- Hilton Gold and SPG Gold

- Global Entry ($100) statement credit or one TSA Pre✓® ($85) statement credit every 4 years

- $595 annual fee

- 10 Gogo wifi passes each year

The Business Platinum is similar to the personal version but it comes with a lower annual fee (although you don’t get the $200 Uber credits). You also can earn 1.5X per dollar on each eligible purchase of $5,000+.

The perk that stands out the most is being able to redeem your Membership Rewards at a rate of 1.54 cents per point with premium cabin flights (and one chosen airline). This allows you to get even better than the Chase Travel Portal (when you have the Sapphire Reserve), so it’s a pretty valuable perk.

Amex Centurion Card

- SPG Gold

- Hilton Diamond

- IHG Priority Club Rewards Platinum Elite

- Delta SkyMiles Platinum Medallion

- Relais & Châteaux

- Amex Fine Hotels & Resorts

- Centurion Hotel Program

- Centurion International Arrival Services

- Boingo

- Centurion Lounge Access

- Priority Pass Select

- Lufthansa First Class Lounges

- $200 Airline Fee Credit

- Global Entry or TSA PreCheck

- International Airline Program

- Car Rental Benefits (primary rental car insurance, Hertz Platinum, and Avis President’s Club)

- Cruise privileges

- Centurion Shopping Program

- Concierge services

The Centurion Card, also known as the Amex Black Card, is one of the most prestigious credit cards. And as you can tell, it comes with a long list of travel benefits.

This card is s made from anodized titanium with laser etched numbers and letters but it’s not easy to get. For the personal version, you’ll likely need to be spending around $250,000 per year on your Amex cards just to get an invitation.

And once you get the card, the initiation fee is $7,500 and the annual fee is $2,500.

Although this card is loaded with travel perks, it’s not the best card to use if you just want to rack up points because it offers no real bonus categories and doesn’t with a welcome offer.

You can read more about the black cards here.

Luxury Card metal cards

Luxury Card has two different types of metal credit cards that it offers.

The Mastercard Black Card

- 2% back when used for airfare

- 1.5% back on all purchases

- Earn one point for every dollar spent

- $100 airline credit

- $100 Global Entry credit

- Priority Pass Select (allows unlimited guests)

- 24/7 complimentary Luxury Card Concierge

- 0% introductory APR for the first fifteen billing cycles following a balance transfer

- Patented card design with a black-PVD-coated stainless steel front and carbon back. Heaviest card in the industry at 22 grams.

- $495 annual fee

- Terms and conditions apply

The MasterCard Black Card is very heavy (22 grams) and comes with patented (46 patents) PVD-coated stainless steel front and carbon back, making for an impressive build.

But it doesn’t offer a whole lot in the points department.

2% back towards airfare is not unique and other premium cards like the Sapphire Reserve earn 3X on travel purchases that can amount to much higher than 2% back. The strength of the Black Card is that you can earn 2% back on airfare and 1.5% back on everyday purchases. (In most cases, you have to pick up an additional card if you want to earn 1.5% back on everyday spend.) You can read more about the MasterCard Black Card here

MasterCard Gold Card

- 2% back when used for airfare

- 2% back on all purchases

- $200 airline credit

- $100 Global Entry credit

- Priority Pass Select (allows unlimited guests)

- 24/7 complimentary Luxury Card Concierge

- 0% introductory APR for the first fifteen billing cycles following a balance transfer

- $995 annual fee

The MasterCard Gold Card is just like the Black Card the only difference is that it offers 2% back on all purchases and has a higher travel credit ($100 more). Just like the Black Card, the strength of the Gold Card is that you can earn 2% back on airfare and 2% back on everyday purchases, so you don’t have to pick up an additional card for everyday spend.

What makes this card so special and unique is that it’s made with 24K gold, which is pretty insane.

But with that gaudy appearance comes a $995 annual fee so you’ll have to pay up for the prestige. Unless you’re one who really likes to be flashy, this premium card isn’t going to be the best fit for someone looking to maximize their rewards in an efficient way while avoiding high fees.

US Bank metal cards

US Bank Altitude Reserve

- 50,000 points (worth $750 in travel) after spending $4,500 within the first 90 days

- $325 travel credit

- 3X on eligible mobile wallet purchases

- 3X on travel booked directly with airlines, hotels, taxis, trains, etc. (but no OTAs)

- Priority Pass (with only 4 entries)

- 12 complimentary GoGo passes each membership year

- TSA Pre-Check/Global Entry $100 credit

- $400 annual fee

The US Bank Altitude Reserve is one of the newer premium cards to come out and hit the market. It’s actually a pretty good card with its 3X on travel and mobile wallet purchases. If you like to use things like Apple Pay and Samsung Pay then this card can be one of the most rewarding cards.

Apple credit card

The new Apple credit card is made of titanium and earns the following rates:

- 3% on Apple purchases

- 2% on Apple Pay purchases

- 1% back on all other purchases

It’s a very sleek looking card and has some cool features for added privacy, security, and budgeting and other convenience-related perks. But ultimately, it’s a fairly average cash back card.

Discover

Discover does not currently offer any metal credit cards.

Maybe it’s only a matter of time?

Custom metal credit cards

You can actually convert plastic credit cards into metal credit cards.

Lion Credit Card

San Jose-based company Lion Credit Card allows you to convert your card into a stainless steel metal credit card.

They allow you to choose three different versions: The Premier, basic or fully custom card.

The Premier Card is the companies own trademark of a black card, while the basic version provides a variety of metal options and different logos to choose from.

The fully custom metal card option comes with the added service of a personal design consultant who will help you to create a design and render a mockup your card.

From what I’ve read you could get this done to any credit card even the lowest, no annual fee credit card on the totem pole….

Metal creditcard.com

Metal-creditcard.com is yet another option where you can convert any plastic card to a metal card. This is definitely one of the more economical options that would only cost you $149.

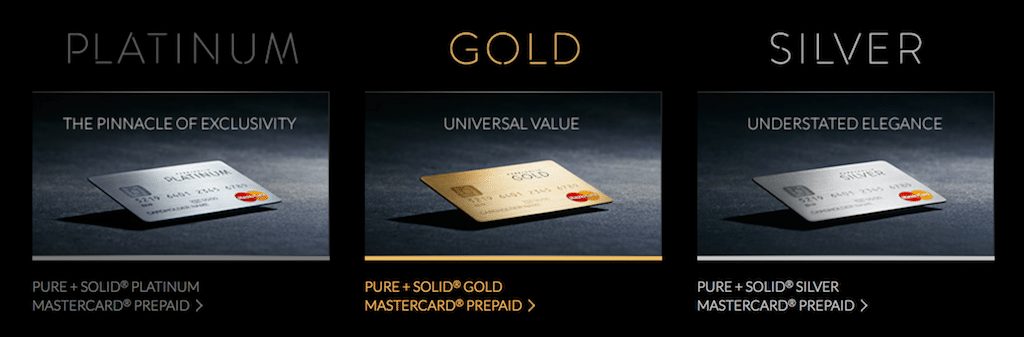

Pure + Solid

Pure + Solid allows you order pre-paid Mastercards made with silver, gold or platinum. But these things aren’t going to be cheap.

A platinum card (yes, made with real platinum) will cost €28,690!

The silver card is much cheaper at €1,490 but that’s still a lot of dough for a pre-paid card.

I guess you could always melt the card in the future and consider it an investment?

Metal credit card problems

I personally love the look and feel of most metal cards but they do cause some issues.

Too thick for machines

These cards can be quite thick and heavy. Sometimes they are too thick to be used in credit card machines or worse — they get stuck!

For this reason, I usually always make sure I have a plastic credit card that earns decent rewards for things like parking garages so that I can always use it if I don’t want to take a chance.

Weighing down your wallet

Since so many issuers offer metal cards now it’s not uncommon for your wallet to get filled with heavy metal credit cards. This can weigh down your wallet a lot and make it uncomfortable to keep in your pocket and difficult to fit additional cards inside.

You might not even be able to get through metal detectors — Okay so maybe that’s a stretch but the point is that metal credit cards can become a hassle to deal with.

Tip: Some issuers might allow you to request a plastic version of their metal card so that’s always something to look into.

How to destroy metal credit cards

Once it’s time to dispose of your metal credit card, you might be wondering how to destroy it?

The first thing to note is to not put the metal credit card in a shredder — that’s not going to end well.

Some people have resorted to things like garden shears and wire cutters to destroy them and have had mixed success. Some banks will provide you with postage so that you can send your cards back in the mail to them for them to handle it. They will pay for the postage so all you have to do is request it.

Other people like to save and store their cards or use them in some sort of arts and crafts project.

Metal credit card holders (wallets)

If you’re trying to up your metal game to its fullest potential, you might want to walk around with your metal credit cards inside of a metal credit card holder.

It might sound a bit ridiculous, but there are some very nice metal credit card holders and cases out there that you can find, many of which come with RFID Blocking Technology.

It might be a bit heavy if it’s loaded up with metal cards but if you just have one or two it shouldn’t be too bad.

You don’t have to spend a lot of money on these to fine a decent one either.

Final word

There are a lot of different metal credit cards and each of them is a little bit different in terms of the composition of the metal. But more importantly, these cards are very different in terms of the real value offered by the cards.

My suggestion would be to try to avoid putting too much stock in the fact that a credit card is made out of steel or brass and just focus on what value you can get from the card.

If your form of value includes being able to flash around a fancy black card there’s nothing wrong with that (to each their own) but you should always be aware of what other types of value you’re leaving on the table.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.